What Platforms Allow Forex Trading in 2025 — Top Picks

Author: Jameson Richman Expert

Published On: 2025-11-04

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

What platforms allow forex trading is a common question for new and experienced traders alike. This guide explains the full range of platforms (retail brokers, ECNs, banks, multi-asset apps, and crypto exchanges offering margin/futures) that allow forex trading in 2025, how they differ, which features matter, and step-by-step advice to choose and start trading on the best platform for your needs.

Overview: Types of platforms that allow forex trading

Forex trading is accessible through different kinds of platforms. Each has trade-offs in execution quality, fees, regulatory protections, and available instruments. Below is a practical breakdown of the main categories:

- Retail Forex Brokers (MT4/MT5/cTrader) — Classic providers that offer currency pairs (majors, minors, exotics), CFDs, leverage, and dedicated trading platforms like MetaTrader 4/5 or cTrader.

- Electronic Communication Networks (ECNs) & Institutional Liquidity Providers — For professional traders; direct market access, raw spreads, and lower latency execution.

- Banks and Institutional Dealers — Offer interbank FX trading (primarily for corporate or high-net-worth clients).

- Multi-asset Trading Platforms / Brokers — Provide forex alongside stocks, commodities, ETFs, and crypto in one account (useful for portfolio traders).

- CFD & Spread Betting Platforms — Allow forex CFDs (contracts for difference) in regulated jurisdictions where available.

- Crypto Exchanges & Derivatives Platforms — Some crypto platforms offer margin and perpetual futures that behave like leveraged currency trades or offer fiat currency pairs; see the caveats below.

- Social / Copy Trading Platforms — Platforms that let you follow or copy experienced traders’ forex strategies (e.g., ZuluTrade, eToro for CFDs).

Leading platforms and software used in 2025

Most traders choose platforms based on their needs: low-cost execution, advanced charting, automation, or regulatory safeguards. Popular choices in 2025 include:

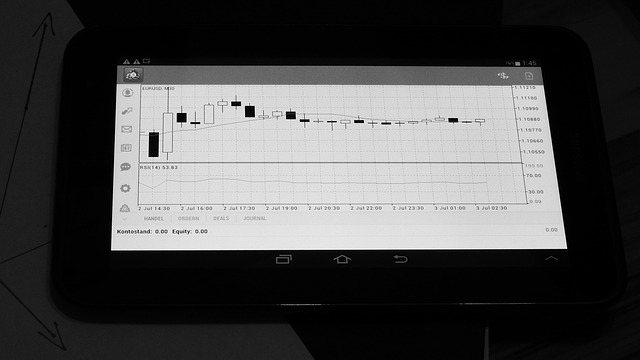

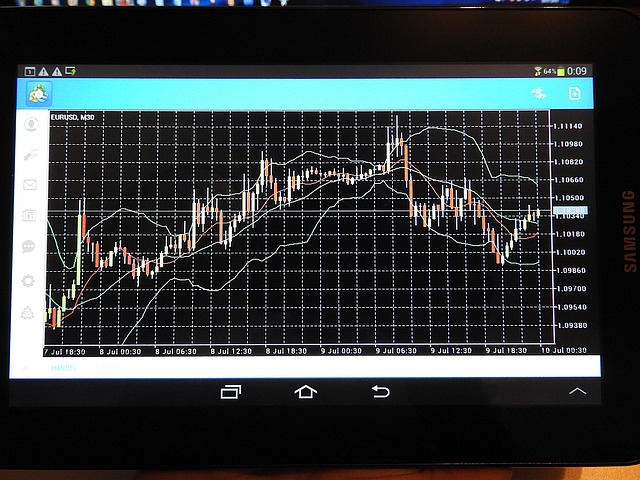

- MetaTrader 4 (MT4) / MetaTrader 5 (MT5) — Widely supported, supports Expert Advisors (EAs) for automated trading, robust backtesting.

- cTrader — Known for transparent ECN-style pricing and modern UI; preferred by many active traders.

- TradingView — Leading charting platform used across brokers; supports scripting (Pine Script) and broker integrations. For developers and brokers, see a complete integration reference: TradingView Data Feed API integration guide.

- Proprietary Broker Platforms — Many regulated brokers provide their own web and mobile apps with integrated research and order management.

Example regulated broker names commonly used by retail traders (for context): OANDA, IG, FOREX.com (Gain Capital), Saxo Bank, and Interactive Brokers. These names are representative of platform categories: regulated, feature-rich, and suitable for most traders’ needs.

Forex on crypto exchanges — what to expect

Several large crypto exchanges offer margin trading, futures, and leverage that may feel similar to forex trading (currency vs currency). Examples include Binance, Bybit, Bitget, and MEXC. These platforms are primarily crypto-focused but can be used by traders who want high leverage and 24/7 markets.

Important notes:

- Crypto exchanges typically offer crypto/fiat and crypto/crypto pairs rather than classic FX pairs like EUR/USD, GBP/USD, etc. They do, however, offer synthetic fiat pairs and margin products that behave like leveraged currency trades.

- Regulatory oversight differs from traditional forex brokers — check local laws, KYC, and custody rules carefully.

If you’d like to try these platforms, here are registration links (useful for quick access): Register on Binance, Register on MEXC, Register on Bitget, and Register on Bybit.

For traders interested in automation and trading bots on crypto exchanges, see the practical guide to free Binance trading bots: Binance trading bot free download 2025 guide.

How to choose the best platform: a practical checklist

Choosing a forex trading platform is a decision that should be based on clear criteria aligned with your trading style. Use this checklist to compare platforms:

- Regulation & Safety — Is the broker regulated by a reputable authority (FCA, ASIC, NFA, CySEC, FINRA)? Check the regulator’s register.

- Execution Model — Market maker vs ECN vs STP. For scalpers and high-frequency traders, ECN/STP with low latency is usually better.

- Spreads & Fees — Compare spreads, commissions, overnight swap fees, and deposit/withdrawal charges.

- Available Instruments — Do they offer the currency pairs and cross rates you need? Any CFDs on indices/commodities you want to trade?

- Leverage & Margin — What leverage is offered, and what are the margin requirements? Higher leverage increases risk.

- Platform Features — Charting tools, backtesting, automated trading (EAs / APIs), social trading, alerts, and order types (limit, stop, OCO).

- Liquidity & Price Transparency — How deep is liquidity at peak times? Is there slippage or re-quotes?

- Funding Options — Supported deposit/withdrawal methods and processing times.

- Customer Support — Live chat, phone, multilingual support quality and hours.

- Educational Resources — Does the platform offer tutorials, webinars, and research?

Regulation and why it matters

Regulation protects traders via capital requirements, segregation of client funds, dispute resolution procedures, and audited operations. Check regulator websites for registration and disciplinary history — for example, see the authoritative overview of the foreign exchange market on Wikipedia’s FX article and Investopedia’s explanation on how retail forex works: Investopedia — Forex Market.

Costs explained: spreads, commissions, and overnight fees

Costs directly impact profitability. Understand the three main cost types:

- Spreads — The difference between the bid and ask price. Retail brokers often include the cost in the spread; ECNs may charge raw spreads plus a commission.

- Commissions — Per-lot commission (common with ECN accounts) may be lower overall than wide spreads depending on trade frequency.

- Swap/Overnight Fees — Fees or credits applied for holding positions overnight (rollover). These can be significant for carry trades.

Tip: for active intraday traders, prioritize low spreads and low slippage over other features. For swing traders, overnight and inactivity fees matter more.

Platforms for automation and signals

Algorithmic trading and signal services are an important part of modern FX trading. Two complementary options:

- Automated trading (EAs, APIs) — MT4/MT5 Expert Advisors, cTrader Automate, broker REST/WebSocket APIs, and TradingView scripts can power automated strategies. For developers integrating TradingView with broker feeds, see this TradingView Data Feed API guide.

- Signal services and copy trading — Use vetted providers or platforms that allow copying. When choosing a signal provider, evaluate performance transparency, risk management, and track record. A useful review on choosing signal services is available here: How to choose the right signal provider.

If you want to experiment with bots on crypto exchanges (which may complement forex strategies for some traders), see this guide to Binance trading bots: Binance trading bot free download 2025 guide.

Practical steps: open an account and start trading

Follow these steps to open an account and reduce errors at the start:

- Research and shortlist — Use the checklist above to pick 2–3 platforms that match your trading needs.

- Open a demo account — Test execution, platform features, and strategies in a risk-free environment.

- Verify regulation and reputation — Confirm the broker’s registration on the regulator’s site (FCA, ASIC, NFA, etc.).

- Complete KYC & fund account — Submit ID, proof of address, and deposit via supported methods.

- Start small — Use a small live size initially to validate execution and withdraw experience.

- Implement risk management — Limit risk per trade (commonly 1–2% of capital), set stop losses, and diversify exposure.

Example: quick start on a mainstream platform

1) Choose a regulated broker and download MT5 or log in to the broker’s web app. 2) Open a demo and try placing market, limit, and stop orders. 3) Backtest a simple moving average crossover on historical EUR/USD. 4) If results are satisfactory, open a small live position with strict stops and observe slippage and spreads in real market conditions.

Special considerations for crypto exchanges and hybrid platforms

Crypto platforms can be tempting due to deep liquidity in crypto futures and 24/7 trading. If you use a crypto exchange for FX-like trading:

- Verify whether the platform offers fiat pairs or synthetic FX instruments.

- Understand leverage rules, liquidation mechanisms, and funding rates (perpetual contracts).

- Consider custody risks — crypto exchanges often custody assets differently than retail FX brokers custody fiat funds.

Market news and macro drivers influence both FX and crypto. Keep up with macro calendars and risk events. For a view on market sentiment and price outlooks, you can consult analyses such as a live expert outlook for Bitcoin (useful when building cross-asset perspectives): Bitcoin price prediction and market outlook.

Advanced tools and integrations

Traders increasingly use a mix of charting, analytics, and API integrations:

- TradingView — Use for charts, alerts, and strategy development; many brokers allow TradingView to execute trades directly.

- Broker APIs — For execution automation, researchers use REST or WebSocket APIs to place orders, stream prices, and manage accounts.

- VPS & Latency Optimization — For automated strategies requiring low latency, use a Virtual Private Server (VPS) located near broker servers.

- Third-party platforms — Tools like MultiCharts, NinjaTrader, and QuantConnect for advanced testing and strategy deployment.

Integrating charting and live data reliably is crucial for algorithmic trading — that’s why developer guides and API documentation (for TradingView, broker data feeds, and exchange APIs) are essential resources.

Choosing between MT4/MT5, cTrader, and broker web apps

Which platform is best depends on your priorities:

- MT4 — Very widespread, many EAs, but older tech. Good for forex specialists using many legacy tools.

- MT5 — Newer, multi-asset, better order types, improved testing.

- cTrader — Transparent pricing and modern automation (cAlgo/cTrader Automate).

- Broker Web Apps — Often the easiest for beginners, integrated research, and a single environment for multiple asset classes.

Common mistakes traders make when picking platforms

- Prioritizing bonuses over regulation and execution quality.

- Overlooking actual live spreads and slippage — demo accounts can lag real market conditions.

- Using excessive leverage without understanding margin calls and liquidation.

- Failing to test automated strategies on a live account with small sizes before scaling.

- Assuming crypto exchanges are regulated like traditional forex brokers — they often are not.

Risk management best practices

Good risk management separates successful traders from others. Key practices:

- Limit risk per trade (1–2% of account balance is common).

- Use stop-loss orders and never trade without a plan.

- Diversify exposures across pairs and uncorrelated instruments.

- Keep leverage modest until you thoroughly understand its impact.

- Maintain an emergency reserve and avoid margining essential living funds.

Where to find additional authoritative information

Further reading and regulatory resources:

- Foreign exchange market — Wikipedia

- Investopedia — Forex basics

- Check national regulators’ registers (FCA for the UK, ASIC for Australia, NFA/CFTC for the USA, CySEC for Cyprus) for broker licensing verification.

Using signals, copy trading, and paid services — how to evaluate providers

Signal services and paid providers can be useful if chosen carefully. Here are selection criteria:

- Verified track record — Look for audited performance, preferably with third-party verification.

- Risk disclosures — Providers should disclose maximum drawdown and risk settings used in their strategies.

- Transparency — Clear details on trade size, stop losses, and trade frequency.

- Compatibility — Ensure signals can be consumed by your platform (e.g., compatible with MT4/MT5, TradingView alerts, or broker API).

Read a practical guide on choosing and evaluating signal providers here: How to choose the right signal provider.

Example platform comparison (features to weigh)

Below is an illustrative, non-exhaustive feature comparison framework that you can apply when comparing two platforms:

- Regulator — FCA (UK) vs CySEC (Cyprus) vs unregulated.

- Cost — Average EUR/USD spread during London session, commission per lot.

- Execution — Market execution latency, slippage frequency.

- Order types — Market, limit, stop, trailing stop, OCO.

- Automation — MT4/MT5/EAs, broker API, TradingView integration.

- Account types — Demo, standard, ECN/Raw, institutional.

- Funding — Wire transfer, card, e-wallets, crypto.

Case study: Starting FX trading with a multi-asset broker

Imagine you’re a beginner who also wants occasional stock and crypto exposure. A multi-asset broker that supports MT5 or a quality web app might be best:

- Open a demo account and test EUR/USD and GBP/USD during major sessions.

- Assess the spread during London and New York overlaps, check for slippage on news releases.

- Test funding methods and withdrawal speed with a small deposit.

- If you want automated alerts tied to TradingView charts, confirm the broker supports TradingView or an API integrated workflow (TradingView integration guide).

Frequently Asked Questions (FAQ)

Q: Can I trade forex on crypto exchanges?

A: Some crypto exchanges provide margin, futures, and perpetual contracts that let you take leveraged positions. These instruments are not identical to traditional FX pairs, and regulation/custody differences apply. Always confirm instruments and rules before trading on a crypto platform.

Q: Which platform is best for scalping?

A: Scalpers should seek low spreads, fast execution, and a platform that permits high-frequency order placement (ECN/STP brokers with MT4/MT5 or cTrader are common choices).

Q: Are demo accounts reliable?

A: Demo accounts are valuable for learning platform features and strategy logic, but they sometimes understate slippage and latency found in live markets. Always test strategies with small live sizes before scaling.

Q: Is MT4 still relevant in 2025?

A: Yes. MT4 remains widely used, especially for classic forex EAs. However, MT5 and cTrader have modern features that many traders prefer for multi-asset trading and advanced order types.

Actionable next steps

Follow these practical steps to move from research to trading:

- Decide on your target instruments (major forex pairs, cross rates, or crypto margin products).

- Shortlist 2–3 platforms from different categories (one regulated retail broker, one multi-asset broker, and one crypto exchange if you want crypto exposure).

- Open demo accounts and test for at least two market weeks covering news events.

- Compare live spreads and execution under real market conditions with small deposits.

- If automation interests you, test API or EA functionality on the demo and then on a low-size live account.

Resources and further reading

Developer-oriented and market resources referenced in this article:

- TradingView Data Feed API complete integration guide — technical integration reference.

- How to choose the right signal provider — guide to evaluating signals and copy trading services.

- Binance trading bot free download 2025 guide — automation guide for crypto markets.

- Bitcoin price prediction and market outlook — cross-asset perspective useful for macro traders.

Conclusion

In 2025, a wide range of platforms allow forex trading — from classic regulated retail brokers (MT4/MT5/cTrader) to institutional ECNs and even crypto exchanges offering margin/futures. Your choice should align with regulation, execution needs, costs, automation requirements, and the instruments you intend to trade. Use demo accounts, verify regulation, monitor live spreads, and start small with robust risk management.

If you want to experiment with crypto-margin platforms in addition to traditional FX brokers, you can quickly open accounts here: Binance registration, MEXC registration, Bitget registration, and Bybit registration. Remember to evaluate regulatory protections and product specifications before trading.

Start by choosing two platforms (one regulated forex broker and one multi-asset or crypto platform if desired), run parallel demo tests for at least two weeks, and compare execution, spreads, and platform reliability. That process will answer the question “what platforms allow forex trading” not only in theory, but practically for your goals and trading style.