Top Apps to Buy Crypto in Canada: Fees, Security, Picks

Author: Jameson Richman Expert

Published On: 2025-10-26

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Apps to buy crypto in Canada are numerous and varied — from Canadian-regulated platforms focused on simplicity and fiat rails, to global exchanges with deeper liquidity and advanced features. This article compares the best mobile apps and exchanges available to Canadians, explains payment methods, fees, security and regulatory considerations, and offers actionable steps to pick the right app and buy your first crypto safely.

Why the right app matters

Choosing the right app affects cost, speed, security, and user experience. Some apps prioritize low spreads and advanced order types (limit, stop-limit), while others focus on beginner-friendly UX and fast fiat deposits via Interac e-Transfer. For Canadians, additional factors include CRA tax reporting, compliance with FINTRAC/OSC, and availability of Canadian dollar (CAD) pairs and withdrawal options.

Who this guide is for

- Canadian beginners wondering where to buy Bitcoin or Ethereum.

- Experienced traders comparing fees, deposit methods, and security.

- Investors looking to move funds between apps or withdraw to Canadian banks.

Top apps to buy crypto in Canada — quick list

Below are widely used apps and platforms that support Canadian users. This list includes Canadian-based services, as well as reputable global exchanges that accept Canadian customers.

- Shakepay — simple UX, Interac e-Transfer, no trading fees but spreads apply.

- Newton — zero-fee model with spreads, fast Interac deposits, offers many coins.

- Bitbuy — Canadian exchange with Express Trade and Pro Trade, competitive fees, good reputation.

- Wealthsimple Crypto — best for beginners and integration with wealth accounts, limited crypto selection.

- Coinsquare — one of Canada’s established exchanges with fiat on-ramps.

- Kraken — global, strong security, advanced tools, supports CAD funding in some cases.

- Coinbase — beginner-friendly, strong compliance, supports Canadian users.

- Binance, Bybit, Bitget, MEXC — global exchanges with deep liquidity and advanced features; Canadians often use them but should check local access and KYC requirements.

To register on some global platforms quickly, use the following links (validate T&Cs and availability in your province): Binance registration, MEXC invite, Bitget referral, Bybit invite.

How Canadian regulation affects crypto apps

Canada applies AML/KYC rules via FINTRAC — many Canadian exchanges are registered as money services businesses and follow identity verification procedures. Provincial regulators like the Ontario Securities Commission (OSC) may impose additional requirements. Always confirm whether an app is registered and complies with FINTRAC and your provincial rules.

For tax obligations, the Canada Revenue Agency (CRA) treats cryptocurrency transactions as either income or capital gains depending on activity. Keep records of all trades, deposits and withdrawals for reporting. See the official CRA guidance for crypto taxation for details: Canada Revenue Agency: Cryptocurrency.

Key factors to compare when choosing an app

When selecting among apps to buy crypto in Canada, evaluate these dimensions:

- Fees and spreads — trading fees, deposit/withdrawal fees, and spread (price markup).

- Payment methods — Interac e-Transfer, bank wire, credit/debit card, and whether CAD trading pairs are available.

- Security — cold storage policies, insurance, 2FA, withdrawal whitelist, and past security record.

- Regulation and compliance — FINTRAC registration and local licensing if applicable.

- User experience — mobile app reliability, speed of verification, customer support.

- Coin selection — does the app support Bitcoin, Ethereum, and the altcoins you want?

- Advanced features — staking, lending, margin, advanced order types, API access.

Detailed comparison: popular Canadian apps and exchanges

The following sections break down costs, features and ideal users for each app.

Shakepay

Shakepay is a popular Canadian app known for simplicity and fast Interac e-Transfer deposits. It offers Bitcoin and Ethereum, instantaneous CAD deposits and withdrawals, and a social-style interface.

- Fees: No explicit trading fee, but spreads exist; interac deposits often instant and free.

- Best for: Beginners and those who want instant fiat on-ramps.

- Security: 2FA, custodial wallet; keep small amounts for active trading and use hardware wallets for larger holdings.

Newton

Newton offers zero-fee trading with revenue from spreads and fiat withdrawal fees. Supports many altcoins and Interac e-Transfer for deposits.

- Fees: No trading fee; watch the spread and withdrawal fees for different coins.

- Best for: Cost-conscious buyers who still want a wide coin selection.

- Security: Standard 2FA, custodial storage; consider moving assets to a hardware wallet for long-term storage.

Bitbuy

Bitbuy is a Canadian exchange that provides both an easy Express Trade and more advanced Pro Trade. It is known for competitive spreads and a transparent fee schedule.

- Fees: Express Trade higher spreads; Pro Trade has maker/taker fees (typically competitive).

- Best for: Users who want a regulated Canadian exchange with advanced order types.

- Security: Strong reputation, insurance policies, regulatory compliance.

Wealthsimple Crypto

Wealthsimple Crypto is integrated with Wealthsimple Cash and Wealthsimple Trade services — a good choice if you already use their ecosystem. It’s beginner-friendly but offers a limited set of coins and restricted withdrawal options (historically).

- Fees: Spread and platform fee; check current pricing.

- Best for: New investors who want a simple, integrated experience.

- Security: Regulated broker features and industry-standard protections.

Coinsquare

Coinsquare is an established Canadian exchange supporting CAD pairs, offering both retail and OTC services for larger trades.

Kraken

Kraken is a global exchange with a long track record for security and USD/EUR/CAD support in some regions. It offers more advanced trading features and staking.

Coinbase

Coinbase provides strong compliance, insurance on hot wallets, and a friendly mobile app. It’s a straightforward option for Canadians who prefer a familiar global brand.

Global advanced exchanges: Binance, Bybit, Bitget, MEXC

Global platforms offer deep liquidity, derivatives, margin, and a vast altcoin selection. Canadians use these platforms for advanced trading, but must ensure local accessibility and compliance. If you want to try them, you can register via these links (verify region availability first): Binance sign up, MEXC registration, Bitget referral, Bybit invite.

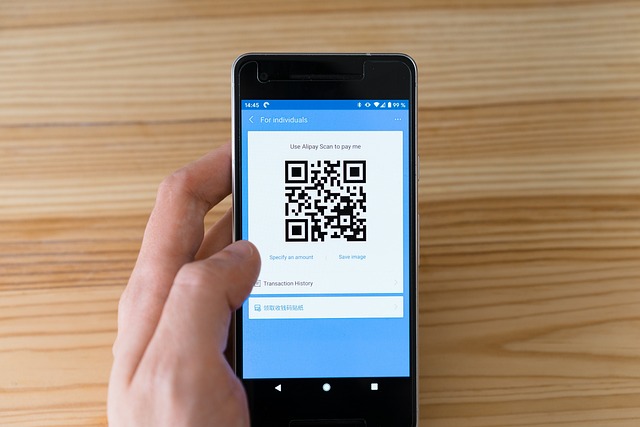

Payment methods explained

Understanding CAD deposit options helps minimize costs and delays:

- Interac e-Transfer — fastest and most popular for small/medium deposits; many Canadian platforms support it with near-instant settlement.

- Bank wire (EFT/ABM) — suited to larger transfers, usually with fees and slower processing.

- Credit/debit card — convenient but often carries high fees and chargeback risk (less commonly accepted for CAD purchases).

- Bank debit/Direct debit — available on some platforms.

- Crypto transfers — move crypto between wallets/exchanges — minimal platform fees but network transaction fees apply.

Fee transparency: examples and what to watch for

Fee structures vary. Here are typical fee elements to watch:

- Spread — the mark-up between buy and sell price. Even “zero-fee” platforms usually include a spread.

- Trading fee — maker/taker fees on orderbook platforms (e.g., 0.10% to 0.50%).

- Deposit/withdrawal fees — banks and exchanges may charge for CAD wires or crypto withdrawals.

- Conversion fees — if platform converts CAD to USD behind the scenes.

Example: A platform advertising “no commission” might still charge a 0.75% spread. A maker/taker model might cost 0.20% maker / 0.30% taker for active traders. Always check the platform’s fee page and run a sample calculation for your typical trade size.

Security checklist before buying crypto

Security is paramount. Use this checklist before funding accounts:

- Enable two-factor authentication (2FA) — use an authenticator app (Google Authenticator, Authy) rather than SMS when possible.

- Use strong, unique passwords and a password manager.

- Confirm platform reputation — track record, audits, and any insurance coverage.

- Enable withdrawal whitelist where available.

- Consider a hardware wallet (Ledger, Trezor) for long-term storage of large balances.

- Be wary of phishing — verify URLs and enable bookmarks for login pages.

How to buy crypto in Canada — step-by-step

Here’s a simple walk-through to buy Bitcoin (BTC) or Ethereum (ETH) using a Canadian app like Shakepay, Newton or Bitbuy.

- Choose an app that supports CAD deposits and the coin you want. Check fees and KYC requirements.

- Create an account and complete identity verification (photo ID, proof of address). Verification speed varies from minutes to days.

- Secure your account — set strong password and enable 2FA immediately.

- Deposit CAD — use Interac e-Transfer for speed or bank wire for larger amounts.

- Place an order — market order for instant fill or limit order to set a target price. Check the price spread and total cost before confirming.

- Withdraw to a personal wallet if you plan to hold long-term. For large holdings, transfer to a hardware wallet and verify the receiving address thoroughly.

- Keep records of your transactions for CRA reporting.

Tracking prices and using tools effectively

After you buy, you’ll likely want to track prices in CAD and apply forecasts or strategies. Real-time CAD tracking and technical tools help you monitor positions. For live BTC price tracking in Canadian dollars and recommended tools and strategies, see this resource: BTC live price CAD — real-time tracking tools & strategies.

Be cautious with price predictions. Forecasts can help frame scenarios but are not guarantees. For a useful discussion on forecast accuracy and realistic expectations, read: How accurate is coin price forecast in 2025 — realistic expectations. For a deep dive into Bitcoin's long-term outlook, see this analysis: Bitcoin price prediction chart 2025 — in-depth analysis.

Tax implications and record keeping

The CRA treats cryptocurrency depending on your activity:

- As capital gains when you hold crypto as an investment and sell later (capital gains taxable at 50% inclusion).

- As business income if you trade frequently or operate a business (taxed fully as income).

- When using crypto for purchases, it’s a disposition that can trigger capital gains/losses.

Maintain detailed records: dates, amounts in CAD at the time of transactions, wallet addresses, fees paid, and receipts. For official guidance, consult the CRA’s SME and cryptocurrency page: CRA cryptocurrency guidance.

Advanced features some apps offer

If you want more than buy/sell, look for these features:

- Staking and yield — earn rewards on supported proof-of-stake coins (know lock-up terms and counterparty risk).

- Margin and derivatives — available on advanced global exchanges but come with high risk.

- OTC desks — for large trades to reduce slippage.

- APIs — for algorithmic trading and portfolio automation.

- Recurring buys — dollar-cost averaging (DCA) features to buy regularly.

Common mistakes to avoid

- Leaving large balances on custodial exchanges without insurance — move long-term holdings to hardware wallets.

- Ignoring fee structure — small spreads add up over time.

- Using credit cards irresponsibly — high fees and debt risk.

- Not verifying deposit/withdrawal addresses — crypto transfers are irreversible.

- Failing to keep tax records — CRA audits can request transaction histories.

Which app is best for you?

Your choice depends on the combination of ease, cost, coin selection, and security you need:

- Choose Shakepay or Newton for fast, simple CAD on-ramps and a mobile-first experience.

- Choose Bitbuy or Coinsquare for a regulated Canadian exchange with transparency and advanced order options.

- Choose Kraken or Coinbase for stronger global features, security history and staking options.

- Choose Binance, Bybit, Bitget or MEXC if you need deep liquidity, low trading fees and advanced derivatives — but confirm Canadian availability and compliance.

Example scenario: moving CAD to crypto and to cold storage

Below is a practical example showing typical steps and timing.

- Open a verified account on Bitbuy (or Shakepay for instant deposits).

- Deposit CAD via Interac e-Transfer — typically instant to a few minutes on Shakepay/Newton; Bitbuy may take a few hours depending on bank processing.

- Buy BTC using a market or limit order. Confirm the total CAD cost including fees/spread.

- Purchase a hardware wallet (Ledger or Trezor) and set it up following the manufacturer's guide.

- Withdraw BTC from the exchange to your hardware wallet address. Allow sufficient network confirmations before marking the transfer complete.

- Store your recovery phrase offline and securely.

Using market signals carefully

Price signals and predictions can be useful, but avoid relying solely on forecasts. Use a combination of:

- Real-time price tracking and alerts

- Technical and fundamental analysis

- Risk management rules (position sizing, stop-loss limits)

For tools and methodologies on tracking BTC in CAD and strategy ideas, the guide linked above on live CAD tracking is helpful: BTC live price CAD tools & strategies. To understand forecast limitations, review forecast accuracy discussions: forecast accuracy in 2025, and deeper Bitcoin outlooks: Bitcoin 2025 analysis.

Frequently asked questions (FAQ)

Are global exchanges safe for Canadians?

Many global exchanges are reputable, but Canadians should confirm whether the platform allows accounts from their province and whether local banking integrations are supported. Always complete KYC and check platform security measures.

Can I use my Canadian bank card to buy crypto?

Some platforms accept credit/debit card purchases, but fees are often higher. Card purchases may be limited or blocked by some Canadian banks. Interac e-Transfer is typically the preferred CAD deposit method.

Do I need to report crypto to the CRA?

Yes. Trades, sales, income from staking or mining, and crypto used for purchases can create taxable events. Keep transaction records and consult tax guidance from the CRA or a tax professional: CRA cryptocurrency guidance.

What if my province has specific rules?

Some provinces may have additional registration or consumer protections. Check provincial securities regulators (e.g., Ontario Securities Commission) and the platform’s terms for province-level access rules.

Final checklist — before you buy

- Verify the app supports CAD and your intended coins.

- Compare total costs (fees + spread) for the trade size you’ll use.

- Complete KYC and secure your account with 2FA.

- Decide whether you’ll hold on the exchange or withdraw to a private wallet.

- Document transactions for tax reporting.

Conclusion

There are many solid apps to buy crypto in Canada — from beginner-friendly platforms like Shakepay and Newton, to regulated Canadian exchanges such as Bitbuy and Coinsquare, to global exchanges that offer advanced features. Choose based on fees, payment methods (Interac is a major advantage), security posture, and regulatory compliance. Use hardware wallets for long-term storage, keep accurate records for CRA reporting, and combine price-tracking tools and critical thinking when using forecasts or strategy signals.

For real-time CAD price tools and strategy ideas, forecasts and analyses that can inform your timing and risk management, explore the guides linked above: BTC live price CAD, forecast accuracy 2025, and Bitcoin 2025 prediction.

Ready to explore exchanges? If you prefer global platforms, consider registering via these links (check regional availability and terms): Binance, MEXC, Bitget, Bybit.

If you’d like, tell me your priorities (lowest fees, easiest deposits, best security, or advanced trading) and I’ll recommend the top 2–3 apps tailored to your needs.