Is Binance Trading Real: Truths, Risks, Proofs

Author: Jameson Richman Expert

Published On: 2025-11-04

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Is Binance trading real? This article answers that question in depth: we examine how Binance operates, present evidence that trades executed there are genuine, explain common concerns (security, wash trading, hacks), and give actionable steps you can take to verify trades and trade safely. Whether you’re a beginner wondering if the platform is legitimate or an experienced trader assessing risk, this guide covers mechanics, proofs, regulatory context, tools, strategies, and alternatives — all optimized for clarity and practical decision-making.

Quick answer: is binance trading real?

Yes — Binance trading is real in the sense that it is a functioning cryptocurrency exchange where users place orders, orders are matched, and transactions settle either on-chain (for withdrawals/deposits) or within the exchange’s internal ledger (for trades). Binance is one of the highest-volume crypto exchanges globally and provides real-time order books, trade histories, and liquidity. That said, “real” doesn’t mean “risk-free.” There are legitimate concerns (regulatory scrutiny, past security incidents, and allegations of misconduct) that every trader should understand.

How Binance works — the mechanics behind “real” trades

Understanding the infrastructure helps clarify why trades are real:

- Order matching engine: Binance uses a centralized matching engine that pairs buyer and seller orders on spot markets and derivatives. When a buy and sell order match, the exchange updates accounts in its ledger.

- Internal ledger vs. on-chain settlement: Most trades on an exchange are internal ledger updates (user A’s balance decreases, user B’s increases). Only deposits and withdrawals interact with public blockchains.

- Market data: Binance publishes live order books and trade history. Third-party aggregators (CoinMarketCap, CoinGecko) ingest this data to display prices and volumes.

- Order types: Spot, limit, market, stop-limit, and derivatives (perpetual futures with funding rates) — each follows established exchange workflow.

To try Binance yourself, use the official registration page: Binance registration. Always verify the URL and enable security features like 2FA before depositing funds.

Evidence that Binance trading is real

Here are practical sources of verification you can use to confirm that trades executed on Binance reflect real market activity:

- Order books and trade feed: You can view live order books and trade feeds on Binance’s API and UI. These show matched trades and remaining liquidity. Third-party aggregators like CoinMarketCap mirror this data, providing independent confirmation.

- On-chain withdrawal and deposit records: Withdrawals and deposits are public on their respective blockchains. You can verify a withdrawal transaction hash produced by Binance on the relevant blockchain explorer.

- Exchange transparency reports and audits: While cryptocurrency exchanges vary in audit practices, Binance has published various transparency materials. For background about Binance and its public profile, see the Binance Wikipedia entry for a consolidated overview: Binance — Wikipedia.

- Real-world liquidity and arbitrage: High-volume exchanges like Binance make arbitrage between platforms possible. If Binance prices persistently diverged from other major markets, arbitrageurs would trade to correct them — and such activity is observable.

Common concerns: scams, wash trading, and hacks

Legitimacy does not remove all risk. Here are common issues raised by users and regulators, with balanced context.

Wash trading and market manipulation

Wash trading involves the same entity or colluding parties creating artificial volume by simultaneously buying and selling to themselves. Regulators have investigated such practices industry-wide. While Binance has faced scrutiny and allegations, proving wash trading across exchanges requires detailed forensic analysis. Use third-party liquidity metrics and on-chain analysis from independent firms (for example, research published by blockchain analytics companies) to evaluate market integrity.

Security breaches and user protection

Binance has experienced notable incidents in the past, including a high-profile hack in 2019 when attackers stole funds. Binance used its Safu fund to cover losses at that time. Security has generally improved, but no centralized platform is immune to risk. Key protections for users include:

- Strong passwords and two-factor authentication (2FA).

- Withdrawal address whitelisting.

- Cold storage for exchange reserves (operational best practice).

Regulatory actions

Multiple jurisdictions have applied regulatory pressure on Binance, leading to changes in region-specific services and compliance practices. Regulatory scrutiny can cause service restrictions or changes (e.g., product delistings in certain countries).

For detailed analysis of jurisdictional rules, see this guide to crypto trading regulations in the UK: Guide to crypto trading laws — UK 2025.

How to verify trades yourself — step-by-step

Here’s a practical checklist to confirm that trading activity on Binance is real and to verify that your orders are being executed as shown:

- Place a small test trade: Execute a low-value market order to confirm the UI and ledger update.

- Check your trade history: Review the timestamp, executed price, and fees in your account trade history.

- Monitor order book movement: Watch the order book before and after your trade. A trade will typically remove liquidity at the displayed price levels.

- Withdraw a small amount: Withdraw a small on-chain amount and verify the transaction hash on a blockchain explorer (e.g., Etherscan for ERC-20).

- API cross-check: Use the public API to fetch order history and compare with UI results for consistency.

- Compare across platforms: Check whether price and volume changes are reflected on other major exchanges and price aggregators.

If you want to build advanced verification workflows or use charting to inspect trade execution, this TradingView analysis guide is a good technical resource.

Safety checklist before you trade on Binance

Follow this checklist to minimize risk and ensure that your trading experience aligns with best practices:

- Confirm domain and mobile app legitimacy: Phishing is common. Bookmark the official site and verify app publisher details in app stores.

- Enable 2FA: Use an authenticator app instead of SMS when possible.

- Set up withdrawal whitelists: Restrict withdrawals to known addresses.

- Test with small amounts: Always test deposit/withdrawal workflows with small sums first.

- Understand fees and funding rates: Review maker/taker fees, withdrawal fees, and derivatives funding rates to avoid surprises.

- Keep tax records: Track trades for compliance — regulations vary by country. For specifics in the UK, refer to the earlier linked guide.

Trading strategies and tools for real Binance trading

Binance supports many trading styles. Here are common strategies, tools, and practical tips to use them safely and effectively.

Spot trading

Buy-and-hold or short-term spot strategies rely on order execution and liquidity. For beginners, spot trading reduces the complexity of leverage and funding costs.

Margin and leveraged trading

Margin allows traders to amplify exposure but increases liquidation risk. Understand cross vs isolated margin modes and maintain adequate collateral. Use stop-loss orders to manage downside.

Futures and perpetual contracts

Perpetual futures let you trade with leverage and pay/receive funding rates periodically. Monitor funding rates and use position size limits to control risk.

Bot trading and automation

Algorithmic trading bots can execute faster than humans. If you plan to use bots on Binance, secure your API keys (use read-only keys for data access and restrict withdrawal permissions). For a deep dive into trading apps, strategies, and bots, review this in-depth guide: Trading app, strategy, and bots explained.

Example trading plan

- Objective: Swing trade BTC with 10% target and 5% stop-loss.

- Entry: Confirmed bounce at a key moving average and RSI divergence.

- Position sizing: Risk 1% of portfolio per trade; calculate size accordingly.

- Exit: Partial profit-taking at 5% and remainder at 10% or trailing stop.

If you want a structured strategy template, this free PDF provides frameworks and templates: Bitcoin trading strategy PDF — free download.

Fees, liquidity, and slippage — what “real trading” means for outcomes

Real trades are subject to slippage and fees that affect outcomes:

- Maker/taker fees: Maker (adding liquidity) and taker (removing liquidity) fees differ. Use maker orders to reduce fees when possible.

- Funding rates: For perpetual futures, funding rates periodically transfer value to align contract and spot prices.

- Slippage: Market orders can execute at multiple price levels if liquidity is thin. Check order book depth before large market orders.

- Hidden costs: Spread, withdrawal fees, and conversion fees can reduce net returns.

Always analyze expected market impact before placing large trades, and use limit orders when price certainty matters.

Regulatory landscape and compliance — is Binance safe legally?

Regulation impacts availability, products, and user protections. Binance operates globally but has faced regulatory actions in multiple jurisdictions. Key points:

- Jurisdictional variations: Features available in one country may be restricted in another (e.g., derivatives availability).

- Regulatory actions: Regulators such as the U.S. Department of Justice, Commodity Futures Trading Commission (CFTC), and various European agencies have investigated or taken actions concerning Binance. Always check the current legal status within your country before depositing funds.

- User protections: Some countries provide limited crypto-specific consumer protections; others are more permissive. For official regulatory guidance in the UK, consult the Financial Conduct Authority (FCA): FCA — Financial Conduct Authority.

To understand trading laws and obligations where you live, read jurisdiction-specific guides (for instance, this UK guide linked earlier). For a broader view of platforms in specific markets like India, consider this curated list of exchanges: List of crypto trading platforms in India — top picks.

Alternatives to Binance — comparison and registration links

If you want to diversify or explore other platforms, here are several major exchanges with registration links and a short comparison:

- MEXC — Good for altcoin listings and derivatives. Register: Register at MEXC.

- Bitget — Popular for copy trading and derivatives. Register: Register at Bitget.

- Bybit — Known for derivatives liquidity and competitive fees. Register: Register at Bybit.

- Binance — High liquidity, broad product set. Register: Register at Binance.

Each platform has pros and cons (liquidity, fee structure, regulatory footprint). If you trade in a specific jurisdiction, confirm local compliance and support for fiat on/off ramps.

Tools and resources to improve your trading

Use the right tools to confirm trades and develop strategies:

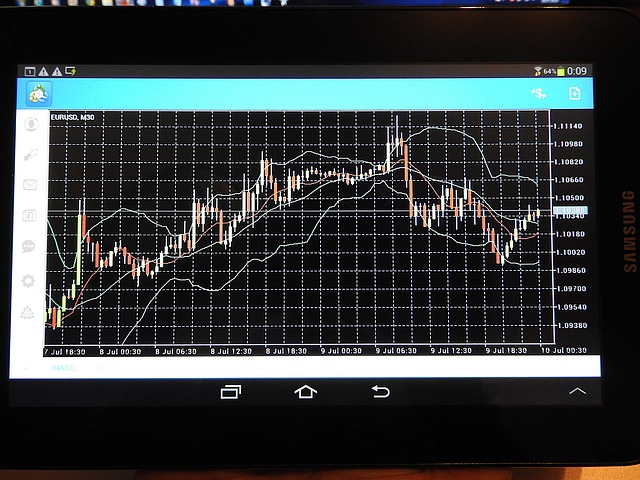

- Charting: TradingView is widely used for technical analysis. Learn chart analysis techniques here: TradingView chart analysis guide.

- Automated strategies: If you use bots, secure API keys and backtest strategies. Review the bots guide mentioned earlier for setup and risk controls.

- Strategy templates: Download strategy PDFs and templates to formalize your approach: Bitcoin trading strategy PDF.

Practical examples: verifying a Binance trade (walkthrough)

Example: You place a 0.01 BTC market buy using USDT on Binance. How to verify the trade was real:

- Submit the order and capture the trade ID and timestamp from your account trade history.

- Check the order book at the trade time — the trade should have consumed liquidity at one or more price levels shown by the order book.

- Confirm the executed price and quantity match your trade history and fee deduction.

- If you withdraw, verify the blockchain transaction hash generated by Binance on the destination chain explorer.

- Cross-verify price on CoinMarketCap or CoinGecko for the same timestamp to ensure consistency across markets.

Following these steps proves the trade occurred and helps you audit your own results.

Frequently asked questions (FAQ)

Q: Is Binance trading fully transparent?

A: Binance provides public order book and trade data, but as a centralized exchange its internal ledger operations are not on-chain. Transparency varies compared to on-chain decentralized exchanges. Use public APIs and third-party analytics for independent data.

Q: Can trades be faked on Binance?

A: Faking trades on a centralized exchange would require either platform-level manipulation or collusion. While allegations of wash trading exist across the industry, reputable exchanges provide APIs, external price feeds, and are subject to regulatory scrutiny. Use multiple data sources and on-chain verification (for withdrawals) to increase assurance.

Q: What protections exist if Binance is hacked?

A: Exchanges may cover losses through insurance funds or reserve funds (e.g., Binance’s SAFU historically). However, user protections are limited compared to insured bank deposits. Minimize custodial risk by holding significant funds in personal wallets (cold wallets).

Q: How do I choose between Binance and other exchanges?

A: Compare liquidity, fee structure, supported assets, regulatory status in your country, and security track record. The exchange list and jurisdiction guides linked above can help determine the best fit.

Additional reading and high-authority references

To understand the broader context and verify facts independently, consult high-authority sources like regulatory sites and mainstream publications:

- Binance overview and history: Binance — Wikipedia

- Regulatory guidance and consumer alerts: check your local regulator (e.g., UK Financial Conduct Authority or U.S. SEC).

- Market data aggregators: CoinMarketCap, CoinGecko.

- Independent research and blockchain forensics: publications by major analytics firms provide in-depth market integrity reports.

Recommended next steps

If you’re ready to evaluate Binance with confidence, follow this prioritized plan:

- Open a verified account through the official registration link: Binance registration.

- Enable 2FA and security measures immediately.

- Place small test trades and withdraw a small amount to verify blockchain settlement.

- Use charting and strategy resources — the TradingView guide and strategy PDF linked above are practical starting points: TradingView guide, Strategy PDF.

- If you plan to automate, read the bots and strategies guide: Bots guide.

For traders in India or those researching local platforms, consult the curated list here: Top crypto platforms in India.

Conclusion

So, is Binance trading real? Yes — trades executed on Binance are real market actions reflected in order books and trade histories, and withdrawals settle on public blockchains. However, “real” does not equal “risk-free.” Traders must perform due diligence: verify trades with small amounts, enable strong security, understand fees and slippage, and keep abreast of regulatory developments. Use the guides and resources linked above to strengthen your strategy and verification process, and consider alternatives like MEXC, Bitget, or Bybit depending on your needs.

Further reading: For in-depth coverage of bots, strategies, and regulatory guides used by active traders, see the following resources — Trading app & bot guide: Trading app & bot guide; Trading strategy templates: Strategy PDF; TradingView analysis: TradingView guide; India platforms list: India exchange list; UK laws guide: UK crypto trading laws.