bitcoin vs altcoin memefi video code 2025 Guide

Author: Jameson Richman Expert

Published On: 2025-11-04

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Summary: This comprehensive guide explores the topic of bitcoin vs altcoin memefi video code in 2025 — defining terms, comparing fundamentals, showing how to analyze memefi (meme + DeFi) tokens, and providing practical video and code examples to create, track, and present memecoin/DeFi content. You’ll find step-by-step trading and automation resources, demo/practice options, and links to authoritative references and tools so you can research, backtest, and manage risk effectively.

Why "bitcoin vs altcoin memefi video code" matters in 2025

The crypto landscape continues to diversify. While Bitcoin remains the dominant store of value and liquidity hub, altcoins — especially novelty hybrids like memeFi or memefi tokens — drive attention, social media flows, rapid speculation, and sometimes innovation in yield mechanics. Comparing "bitcoin vs altcoin memefi video code" covers three practical needs:

- Understanding how Bitcoin’s fundamentals differ from speculative memefi tokens.

- Learning how to capture and present memefi narratives via video assets and embed code for websites or apps.

- Adopting tools, APIs, and bots to analyze, backtest, and trade with lower friction.

Core definitions: Bitcoin, altcoin, memeFi (memefi), and video code

Bitcoin

Bitcoin is the first cryptocurrency and a high-liquidity asset often treated as digital gold. Its value drivers include scarcity (21M cap), network security, macro adoption, and institutional flows. See the authoritative overview on Wikipedia: Bitcoin.

Altcoin

“Altcoin” refers to any cryptocurrency other than Bitcoin. Altcoins vary widely: platform tokens (Ethereum), stablecoins (USDC), utility tokens, privacy coins, and countless speculative memecoins. The term is broad — treat each altcoin by its specific fundamentals.

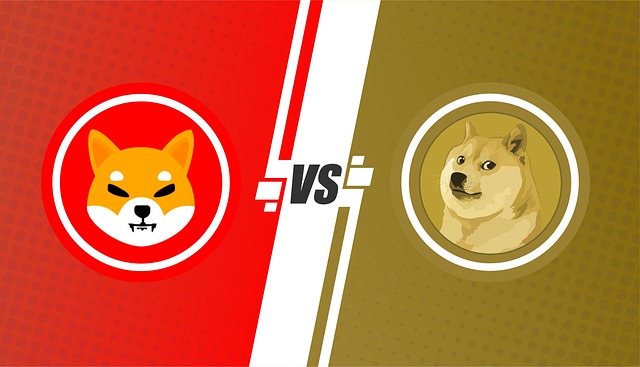

MemeFi / memefi

MemeFi (memefi) blends meme-driven social tokens (memecoins like Dogecoin) with DeFi mechanics (liquidity pools, yield farming, tokenomics that reward holding or staking). Memefi projects rely heavily on community, social video, and narrative-driven growth — so video assets and shareable code (widgets, embeds) become central to adoption.

Video code

In this context, video code refers to HTML/JS snippets, embed players, and API integrations that host or annotate video content about a token (price overlays, live charts, interactive CTAs). Video plus embedded price/transaction data creates a high-conversion content format for memefi marketing and analysis.

Bitcoin vs altcoin memefi video code — key comparison points

When framing "bitcoin vs altcoin memefi video code", look at these axes:

- Fundamentals: Bitcoin’s consensus security and store-of-value narrative vs memefi tokens’ community-driven incentives and tokenomics.

- Volatility & liquidity: Bitcoin is generally less volatile and more liquid than memefi tokens which can move 50–500% on social catalysts.

- Regulatory risk: MemeFi projects often face higher regulatory uncertainty (token classifications, promotions). See SEC guidance on token offerings for reference: SEC ICO Spotlight.

- Technical integration: For video content, Bitcoin-focused pieces may highlight macro charts, while memefi video must include live price feeds, token contract verification, and liquidity metrics via code embeds.

How to analyze memefi projects — practical checklist

Memefi due diligence differs from blue-chip altcoins. Use this checklist before you consider any exposure:

- Contract verification: Check token contract on explorer (Etherscan, BscScan). Verify ownership and minting functions.

- Liquidity and rug risk: Confirm locked liquidity or verified liquidity locking mechanisms.

- Holders and distribution: Look at concentration of token holders; very centralized holdings are high risk.

- Social sentiment: Track Twitter, Telegram, Discord, Reddit for engagement quality vs hype bots.

- On-chain metrics: Volume, active addresses, and swap flows. Use reputable data sources.

- Tokenomics: Inflation schedule, transaction taxes, and reward structures.

Data sources and automation: incorporate APIs and bots

To operationalize the "video code" part of memefi content, you will want live price feeds, chart embeds, and automation. Key tools:

- TradingView widgets and APIs for charts and signals — see a practical guide to free TradingView API integration.

- Trading bots for executing rules-based strategies — learn what they do and how to use them: What trading bots do — complete guide.

- Demo and paper trading apps to practice strategy and risk-free learning — use a guided demo app: Mastering a demo share trading app.

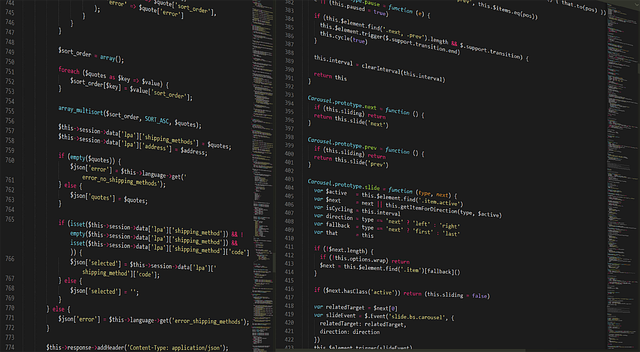

Example: embed a memefi video with live price overlay (HTML + JS)

Below is a simple example pattern that shows how creators can embed a memefi explainer video and overlay a live price feed using a public API (CoinGecko is used here as a free example). This snippet is for educational use and may require API keys or CORS handling in production.

<div id="memefi-video-card">

<video id="memefi-video" width="720" controls>

<source src="memefi-explainer.mp4" type="video/mp4">

Your browser does not support the video tag.

</video>

<div id="price-overlay">Loading price...</div>

</div>

<style>

#memefi-video-card { position: relative; display: inline-block; }

#price-overlay {

position: absolute;

top: 12px;

left: 12px;

background: rgba(0,0,0,0.6);

color: #fff;

padding: 6px 10px;

border-radius: 6px;

font-family: Arial, sans-serif;

}

</style>

<script>

async function fetchPrice() {

try {

const res = await fetch('https://api.coingecko.com/api/v3/simple/price?ids=dogecoin,shiba-inu&vs_currencies=usd');

const data = await res.json();

// Replace "dogecoin" with your memefi token ID if available

const price = data.dogecoin.usd;

document.getElementById('price-overlay').innerText = 'DOGE $' + price.toFixed(4);

} catch (e) {

document.getElementById('price-overlay').innerText = 'Price unavailable';

}

}

setInterval(fetchPrice, 5000);

fetchPrice();

</script>Notes: Replace the video source and API token IDs to match your memefi token. For higher fidelity charts, use a TradingView widget (see the TradingView integration link above).

Using TradingView widgets for embedded charts

TradingView widgets provide polished, interactive charts that can be embedded with a short code snippet. For custom indicators, signals, or alerts, you’ll want to combine TradingView with a backend that handles alerts and order execution. See the free TradingView integration guide: TradingView API free integration guide.

Backtesting and demo trading

Before trading memefi tokens live, backtest strategies and practice in demo/paper trading environments. Good demos let you test entries, exits, position sizing, and slippage assumptions without real capital. For a practical walkthrough, refer to the demo share trading app guide: Mastering a demo share trading app.

Automation and trading bots

Many traders combine strategy signals with bots for execution (market orders, limit ladders, or grid trades). Trading bots can help enforce rules and remove emotional mistakes, but they must be carefully configured and monitored. If you’re new, read the complete guide on what trading bots do: What trading bots do — complete guide.

Practical bot setup checklist

- Define the exact signal (e.g., TradingView alert with RSI + volume sweep).

- Backtest the signal over historical memefi volatility.

- Set conservative position sizing and max daily trade limits.

- Monitor connectivity to exchanges and fail-safe order cancellations.

- Use testnet/demo accounts first (see demo app link above).

Real-world examples: memefi video use cases

Memefi projects often rely on short-form video for virality. Here are use-case examples:

- Explainer videos: Explain why this memefi token has novel staking rewards; embed live price and liquidity stats in the video overlay.

- Trade call overlays: Stream a token’s real-time chart with annotated entry/exit points while narrating rationale.

- Educational content: Step-by-step guides on tokenomics, bonding curves, and how to participate in liquidity pools.

Practical example: producing a memefi promotional video with SEO-friendly code

Follow this checklist to maximize discoverability and trust:

- Verify contracts: Include a visible link to the verified contract on block explorer in the video description and overlay (e.g., Etherscan/BscScan).

- Embed live metrics: Use the code snippet above or TradingView widgets to show price and volume directly in the video embed on your site.

- Include timestamps and chapters: Add chapters in the video metadata describing tokenomics, roadmap, and security features.

- Transparent disclaimers: Clearly state risks and that content is not financial advice.

- Structured data: Use schema.org VideoObject markup on your page to improve search visibility.

Regulatory and safety considerations

Memefi projects can face rapid regulatory scrutiny. Always:

- Label promotional content clearly as marketing, and include disclaimers.

- Verify whether a token may be treated as a security in your jurisdiction; consult legal counsel if needed.

- Keep a log of claims made in video content to avoid misleading statements.

For regulatory context, review official agency guidance such as the U.S. Securities and Exchange Commission: SEC ICO information.

Exchanges and liquidity — where to list and test trades

If you’re evaluating memefi tokens or want to trade, you may consider reputable exchanges. For onboarding and account creation, these platforms are commonly used by retail traders (affiliate links provided for convenience):

Tip: Always use small amounts and verify withdrawal paths when testing new memefi tokens.

SEO best practices for memefi video pages

To rank well for "bitcoin vs altcoin memefi video code" and related queries in 2025, focus on the following:

- E-E-A-T: Show experience, expertise, authoritativeness, and trustworthiness: use verified contract links, on-chain stats, and transparent disclosures.

- Structured content: Use headings, timestamps, schema.org VideoObject, and concise meta descriptions.

- Page speed: Host video on fast CDNs, lazy-load heavy scripts, and use efficient embed code.

- User intent alignment: Provide clear answers (how-to, demos, examples) and tools for practice (demo trading links and API guides).

- Backlinks and references: Cite reputable sources (Wikipedia, SEC) and partner tools (TradingView) to signal trust.

Where to learn more — curated resources

Actionable resources to move from research to practice:

- Demo trading and practice: Mastering a demo share trading app — guide

- TradingView integration for charts and alerts: TradingView API free integration guide

- Automation & bots: What trading bots do — complete guide

- Technical reference: DeFi overview on Wikipedia

Sample memefi scenario: from research to a publish-ready video

Example workflow you can replicate:

- Identify token: find memefi candidate and verify contract on Etherscan/BscScan.

- Collect metrics: fetch liquidity, volume, holder concentration, and 24h change via APIs.

- Backtest a trading hypothesis in a demo trading account (see demo guide link above).

- Create a 2–3 minute explainer video highlighting tokenomics, risks, and a live price overlay (use the HTML snippet above or TradingView widgets).

- Publish with full on-page verification links, transcript, schema markup, and clear disclaimers.

- Monitor social sentiment and update the video/card as material events occur.

Common mistakes to avoid

- Relying solely on social hype without on-chain verification.

- Over-automating without human supervision — bots need monitoring for API failures and flash crashes.

- Publishing videos without clear risk disclosures or contract links.

- Embedding heavy unoptimized video players that kill page speed and SEO.

Final thoughts and next steps

The phrase bitcoin vs altcoin memefi video code captures three overlapping worlds: macro store-of-value (Bitcoin), speculative altcoin/memefi mechanics, and the technical production of video + code to present and analyze tokens. In 2025, success requires blending rigorous on-chain due diligence, clear, verifiable video content, and automated tooling for analysis and execution.

Actionable next steps:

- Practice strategies in a demo environment before trading. Start here: demo share trading app guide.

- Integrate interactive charts into your video pages using TradingView — learn how: TradingView API guide.

- If you automate, read best practices for bots and monitoring: trading bots guide.

- Open exchange accounts for liquidity access (small initial deposits recommended): Binance, MEXC, Bitget, Bybit.

Disclaimer: This article is for educational purposes only and does not constitute financial or investment advice. Crypto assets are highly volatile and involve risk of loss. Consult a licensed professional for personalized guidance.