How Is Trading Volume Measured in 2025: Complete Guide

Author: Jameson Richman Expert

Published On: 2025-11-01

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

How is trading volume measured is a common question for traders, investors, and analysts trying to understand market activity, liquidity, and price conviction. This guide explains precisely what trading volume represents, the different ways it’s measured across asset classes (stocks, futures, crypto), common pitfalls like wash trading, useful volume-based indicators, and actionable steps you can use to measure and interpret volume effectively in 2025.

What is trading volume?

Trading volume is the total quantity of an asset that changes hands during a given period. For stocks it’s usually shares traded, for futures it’s contracts traded, and for cryptocurrencies it can be measured as coins/tokens transferred or the notional (USD) value of trades executed on exchanges. Volume is a primary measure of market participation and a leading indicator of liquidity, momentum, and potential price confirmation.

High volume typically means strong interest, better liquidity (narrower spreads), and a higher probability that price movements are sustainable. Low volume may indicate weak conviction or limited market depth, making price moves more easily manipulated.

Fundamental ways trading volume is measured

Measurement methods vary by market and platform. Here are the principal approaches:

- Exchange Reported Volume (Trade Count or Quantity) — For many centralized exchanges (stock exchanges, crypto spot venues), volume is the sum of quantities executed in the order book during a period (e.g., 1 minute, 1 day).

- Notional Volume — The dollar (or other fiat) value of trades: quantity × price. This provides a unit-consistent measure across instruments with different nominal sizes.

- Contract Volume — For derivatives, volume is often recorded in contracts traded, which may need to be converted to notional value for economic comparison.

- On‑chain Volume — In crypto, on-chain volume measures the number/amount of tokens moved between addresses on the blockchain (independent of exchange reporting). It can be tracked by blockchain explorers or analytics providers.

- Tick Volume — Common in retail forex and some charting platforms: counts the number of price updates (ticks) in a period. It’s a proxy for activity when real volumes aren’t available.

Example: Simple volume calculation

Imagine a crypto spot market over one hour with three trades:

- Trade A: 10 BTC at $70,000 → 10 BTC (quantity), $700,000 notional

- Trade B: 5 BTC at $69,800 → 5 BTC, $349,000 notional

- Trade C: 2 BTC at $70,200 → 2 BTC, $140,400 notional

Spot volume (quantity) = 10 + 5 + 2 = 17 BTC. Notional volume = $700,000 + $349,000 + $140,400 = $1,189,400.

Volume on Crypto vs Traditional Markets

Understanding how volume is measured in crypto requires paying attention to unique factors:

- Multiple venues and aggregation — Crypto trades happen across many exchanges and OTC desks. Aggregated volume (market-level) sums reported exchange volumes; however, reliability varies by venue.

- On-chain vs off-chain — On-chain transfer volume shows token movements on the blockchain, but not every on-chain transfer equals a trade (e.g., wallet transfers, staking, liquidity pool adjustments). Conversely, many trades are off-chain within exchange ledgers and only appear on-chain when withdrawals/deposits occur.

- Wash trading and fake volume — Regulatory oversight differs; some exchanges have historically reported inflated volumes using wash trades. Use trusted data sources and adjusted-volume datasets when possible.

For more about lists of crypto trading platforms (including regional options like India), see this curated resource: list of crypto trading platforms in India — top picks.

Common volume metrics and indicators

Traders use several standard indicators built from volume. Knowing how they’re calculated helps interpret signals correctly.

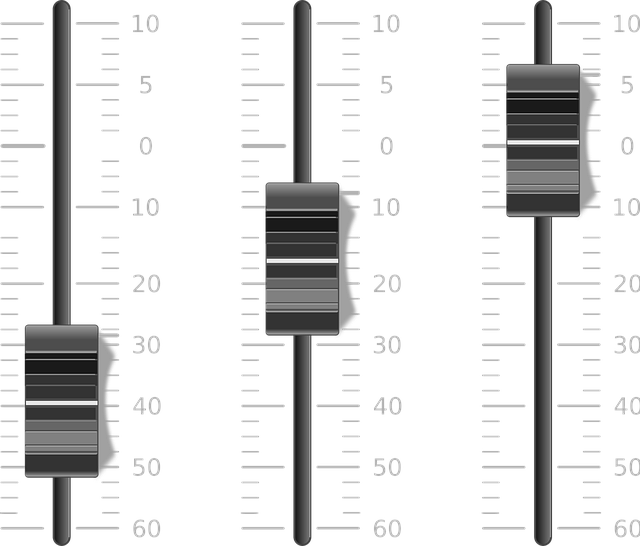

Volume Bars

Simple volume bars on charts show aggregate quantity (or notional) per candle (minute, hour, day). Look at candle color and volume together: rising price with rising volume indicates bullish conviction; falling price with rising volume suggests strong selling pressure.

Volume Weighted Average Price (VWAP)

VWAP is used to assess the average price at which an asset traded throughout the day, weighted by volume. Institutional traders use VWAP as a benchmark for execution performance.

VWAP (for a trading session) = cumulative(price × volume) / cumulative(volume).

On Balance Volume (OBV)

OBV is a cumulative indicator that adds daily volume when price closes up and subtracts volume when price closes down. It helps show if volume supports a trend.

Money Flow Index (MFI)

MFI combines price and volume to measure buying and selling pressure. Values near 100 indicate strong buying pressure; values near 0 indicate strong selling.

Accumulation/Distribution

This indicator weights volume by the relative position of the close in the candle. It attempts to quantify whether money is flowing into (accumulating) or out of (distributing) an asset.

How is trading volume measured on different platforms and tools?

Measurement details matter depending on where you get your charts and data:

- Centralized exchanges (CEX) — Volume typically reported per trading pair. Confirm whether the exchange reports trades on order execution or internal ledger transfers.

- Decentralized exchanges (DEX) — Volume often measured by on-chain token transfers and liquidity pool swaps; on-chain analytics tools aggregate these events into volume numbers.

- Aggregators and data providers — Sites like CoinMarketCap, CoinGecko, and Glassnode aggregate volumes across sources and often provide “adjusted volume” metrics to exclude suspicious activity. Refer to their methodology pages to understand adjustments.

- Charting platforms — TradingView and similar platforms visualize exchange-reported volume or aggregated feeds. If volumes aren’t displaying correctly, troubleshooting guides can help—see this article on resolving TradingView chart not displaying issues.

Practical pitfalls & accuracy issues

Simply relying on raw reported volume can mislead. Be aware of these common issues:

- Wash trading — Self-trading or collusive trades can inflate reported volume. Prefer exchanges with strong compliance and transparent order books.

- Reporting inconsistencies — Some exchanges report volume as quantity, some as notional, and some mix spot + derivatives volume. Check the metric definition.

- Latency and tick aggregation — Tick volume can over- or under-represent true liquidity on fast-moving instruments.

- On-chain noise — Large transfers between wallets (e.g., exchange custody movements) inflate on-chain volume without reflecting trading activity.

- Time zone and session definitions — Day-based metrics depend on which rollover/time zone an exchange uses.

For accuracy concerns about price and forecast data, see a detailed discussion on how accurate coin price forecasts are in 2025.

How to measure trading volume correctly — step-by-step

Follow this step-by-step checklist to measure and interpret volume with greater confidence:

- Define your unit of measure: Decide whether you’ll use quantity (units/contracts) or notional (USD). For cross-asset comparison, use notional.

- Choose reliable data sources: Use reputable exchanges or aggregated data providers that publish methodologies. Check for adjusted volume metrics. High-authority sources like Wikipedia and Investopedia provide foundational definitions and methods.

- Aggregate correctly: If you’re combining venue volumes, ensure you’re not double-counting cross-listed trades or including derivatives if you only want spot volume.

- Filter noise: Exclude internal transfers, known exchange internalizations, and suspicious trades if your data provider offers flags or adjusted datasets.

- Normalize when necessary: When comparing assets, normalize by market cap, circulating supply, or use notional values to get meaningful comparisons.

- Use indicators thoughtfully: Combine volume analysis with price action and volatility measures. Volume alone rarely gives a complete signal.

- Backtest: Validate volume-based strategies on historical data and check performance across different market regimes.

Example: Determining if a breakout is valid

Scenario: Bitcoin breaks above a resistance level on a daily candle.

Step-by-step:

- Check daily volume bars — is the breakout accompanied by above-average volume? If yes, higher probability of sustained move.

- Compare notional volume to previous weeks — a 30–50% increase vs average suggests conviction.

- Check on-chain metrics (exchange inflows/outflows) — is there net outflow from exchanges (bullish) or inflow (bearish)? See live market indications and context from real-time Bitcoin price data.

- Validate with VWAP — price staying above intraday VWAP supports strength for intraday traders.

Using on-chain volume as a complement

On-chain metrics are increasingly essential in crypto analysis. On-chain volume shows the movement of tokens between addresses and contracts. While not a one-to-one substitute for exchange volume, it provides context:

- Exchange inflows/outflows: Large inflows to exchanges might precede selling pressure; large outflows can indicate accumulation (or consolidation into cold storage).

- DeFi activity: DEX swap volume and liquidity pool activity indicate usage and real economic activity in the token’s ecosystem.

- Network health: Transaction counts and average transferred amount can indicate network adoption and attention.

Analytics providers like Glassnode, Nansen, and on-chain explorers document these metrics. Use them in tandem with exchange-reported volumes for a fuller picture.

Indicators and practical strategies using volume

Volume should be part of a broader toolkit. Here are tested ways traders use volume:

Confirming breakouts

Rule of thumb: a genuine breakout out of consolidation should occur with above-average volume. Use session-based VWAP or day-over-day volume comparisons to quantify “above-average.”

Spotting reversals

Climactic volume spikes on extended trends often precede reversals or consolidation. Look for price rejection at extremes (wicks) alongside surge in volume.

Volume divergence

When price makes a higher high but volume decreases, momentum may be weakening — a bearish divergence. Conversely, higher volume with lower lows on price can indicate increased selling pressure and continuation.

Liquidity management for large orders

Institutional traders slice large orders using algorithms (TWAP, VWAP) to minimize market impact. VWAP tracks execution vs the volume-weighted market price to measure cost efficiency.

Tools and platforms to measure and visualize volume

Use robust charting platforms that offer accurate volume feeds and customizable indicators. TradingView is a popular choice — if you run into chart display issues, consult a guide on resolving TradingView chart not displaying issues.

If you trade via MetaTrader or other execution platforms and want to integrate advanced charting, there are step-by-step guides for connecting MT4 to TradingView to bridge visual analytics and execution workflows in 2025.

For real-time price and volume context for major assets like Bitcoin, refer to live insights and trading guides, which combine volume analysis with price action perspectives.

Best exchanges and how their volume reporting differs

Choose exchanges with transparent order books, good liquidity, and strong regulatory posture to reduce the risk of misleading volume figures. If you’re choosing a venue, consider regional recommendations and platform comparisons — for example, a list of crypto trading platforms in India highlights different options and their characteristics.

Below are some widely used global exchanges (affiliate links provided for convenience):

- Binance (register) — large global liquidity and robust API, but volume reports have been scrutinized; use adjusted metrics where possible.

- MEXC (register) — active in certain regions, suitable for altcoin liquidity.

- Bitget (register) — derivatives-first exchange with sizable volumes.

- Bybit (register) — derivatives liquidity, good order-book depth for major crypto pairs.

Before selecting a venue, read exchange fee structures, liquidity by trading pair, and policy on market surveillance. For Indian users or region-specific needs, that curated list mentioned earlier is useful for narrowing options.

Regulation, transparency, and red flags

Volume manipulation is a real risk. Regulators and industry analysts recommend looking for these red flags:

- Abnormally high volume on illiquid pairs

- Frequent repetitive trades between the same counterparties

- Large discrepancy between reported exchange volume and on-chain flows

- Sudden, unexplained surges in reported volume without a news catalyst

The U.S. Securities and Exchange Commission (SEC) provides resources on market manipulation to help investors understand and spot suspicious activity.

Advanced topic: Measuring active liquidity using market depth

Volume tells you how much traded, but order book depth tells you how much you can trade without moving the price. Use these metrics together:

- Order book depth at X%: Sum of bids/asks within ±1% or ±2% of mid-price to estimate immediate liquidity.

- Average true range (ATR) and slippage modeling: Combine typical price movement with average depth to estimate slippage for large orders.

- Volume profile: Visualizes traded volume at different price levels to identify high-volume nodes (support/resistance).

Case study: Using volume to refine a trading plan

Trader scenario: You scalp BTC futures intraday and want to avoid false breakouts.

Rules implemented:

- Only trade breakouts accompanied by a volume increase of at least 20% above 20-period average volume (notional basis).

- Confirm on-chain exchange outflows for higher time-frame confirmation (look for sustained net outflows over 6–24 hours).

- Use VWAP as an intraday liquidity benchmark for entry/exit sizing.

- Cap position sizing relative to measured instantaneous liquidity (max 1–2% of depth within 0.5% price move).

This rule set blends volume visualization, on-chain analysis, and order-book liquidity to reduce exposure to false signals and slippage.

Frequently asked questions (FAQ)

Q: Are volume numbers trustworthy for all exchanges?

A: No. Some exchanges have previously reported inflated numbers via wash trading or internal accounting. Prefer exchanges with transparent order-books and third-party audits; use adjusted-volume datasets if available.

Q: What’s better — tick volume or real volume?

A: Real volume (quantity or notional) is superior when available. Tick volume can be a useful proxy when real volume is inaccessible (e.g., some forex feeds), but it can mislead in very noisy markets.

Q: How do on-chain and exchange volumes differ?

A: On-chain shows token movements; exchange volume reflects executed trades. Many trades are off-chain within exchange ledgers, and large custody movements can inflate on-chain volume without trading activity.

Q: Can volume help predict price direction?

A: Volume is confirmatory. Rising price on rising volume is bullish; rising price on decreasing volume may indicate weakening momentum. Combine volume with price action, volatility, and order-book data for better predictions.

Tools and further reading

Reliable resources to expand your understanding:

- Trading volume — Wikipedia (definition and background)

- Volume — Investopedia (indicators and calculations)

- SEC — Market Manipulation (regulatory guidance)

- Trading platform troubleshooting: resolve TradingView chart not displaying issues

- Bridge execution & analytics: how to connect MT4 to TradingView in 2025 — step-by-step guide

- Platform selection: list of crypto trading platforms in India — top picks

- Real-time asset context: Bitcoin live price now — real-time insights and trading guide

- Model caution: how accurate is coin price forecast in 2025 — realistic expectations

Actionable checklist: How to measure volume for your strategy

Use this checklist to implement reliable volume measurement into your trading routine:

- Decide on a unit: notional vs quantity.

- Select trusted data sources and verify methodology.

- Cross-check exchange volume with on-chain flows (for crypto).

- Use adjusted-volume datasets when available to exclude suspicious trades.

- Apply VWAP, OBV, and volume-profile to confirm trades.

- Always control position size relative to order-book depth to manage slippage.

- Backtest volume rules across bull, bear, and sideways markets.

Conclusion

Understanding how is trading volume measured is essential to measuring market participation, confirming price moves, and managing execution risk. In 2025, traders should combine exchange-reported volume, on-chain metrics, order-book depth, and robust indicators (VWAP, OBV, MFI) to make informed decisions. Always cross-verify data sources, be mindful of wash trading and reporting differences, and use volume alongside price action and liquidity metrics for the highest-confidence signals.

For troubleshooting charts or linking execution platforms with advanced visualization, consult practical guides on resolving TradingView issues and connecting MT4 to TradingView in 2025. If you want to explore top platforms by region, review curated lists of crypto trading platforms in India. For live asset context, check up-to-date Bitcoin price guides and keep realistic expectations about forecasting accuracy in 2025.

If you’re ready to trade and want to evaluate liquidity and volume on major exchanges, consider the following platforms (affiliate links): Binance, MEXC, Bitget, and Bybit. Use these platforms with caution and always perform due diligence on fees, order-book depth, and regulatory status before trading.

Further reading and resources referenced in this guide:

- Resolve TradingView chart not displaying issues

- How to connect MT4 to TradingView in 2025 — step-by-step guide

- List of crypto trading platforms in India — top picks

- Bitcoin live price now — real-time insights and trading guide

- How accurate is coin price forecast in 2025 — realistic expectations

Mastering volume measurement takes time, but integrating the principles above will improve your market reads, trade selection, and risk control. If you’d like, I can provide a downloadable checklist, sample backtest code, or a tailored volume-based trade filter for your preferred market or timeframe.