What Is a Demo Account in Forex: A Practical Guide for Traders

Author: Jameson Richman Expert

Published On: 2025-10-28

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

What is a demo account in forex? In short, a demo account is a risk-free practice environment that allows traders — beginners and experienced alike — to learn, test strategies, and become familiar with a broker’s platform using virtual funds. This comprehensive guide explains how demo accounts work, their benefits and limitations, step-by-step instructions to get the most value from them, and actionable advice for transitioning to a live forex account.

Table of contents

- Definition and purpose

- How demo accounts work

- Key benefits of demo trading

- Limitations and differences vs live accounts

- How to use a demo account effectively (step-by-step)

- Real examples: strategy testing in a demo

- Bridging the psychology gap

- When and how to transition to a live account

- Recommended platforms and registration links

- FAQ

- Further reading and resources

What is a demo account in forex — definition and purpose

A forex demo account, sometimes called a practice account or paper trading account, is a simulated trading environment provided by brokers. It mirrors the broker’s live trading platform and market quotes but uses virtual capital instead of real money. The primary purposes are:

- To teach beginners how forex trading works (order types, leverage, spreads).

- To allow traders to test strategies under live market conditions without financial risk.

- To evaluate a broker’s platform, execution speed, and available tools.

- To fine-tune risk management and position sizing methods before risking real capital.

Demo accounts replicate the foreign exchange market (FX) as realistically as possible. For an overview of how the forex market operates, see the Wikipedia page on Foreign Exchange Market or Investopedia’s detailed articles on forex basics.

How demo accounts work — mechanics and setup

When you register for a demo account, the broker assigns you a virtual balance (commonly $10,000–$100,000) that you can use to place market or limit orders. The platform streams live or slightly delayed market data, and your virtual trades are executed under simulated conditions that aim to mimic live pricing and spreads.

Key components

- Virtual balance: Pre-funded with simulated capital.

- Live market data: Price feeds from the broker or liquidity providers; may be delayed depending on account terms.

- Order types: Market, limit, stop-loss, take-profit, and advanced order types like trailing stop.

- Leverage and margin: Demo accounts allow setting leverage identical to live accounts for accurate testing.

- Platform tools: Charts, indicators, automated strategies (EAs on MT4/MT5), backtesting environments.

Key benefits of using a demo account

Demo accounts are powerful learning and development tools. The main advantages include:

1. Risk-free learning

Beginners can learn how forex trading works — placing orders, using stop-loss/take-profit, managing leverage — without risking capital.

2. Strategy testing and refinement

Traders can test trading strategies under real-time market conditions. Demo testing helps evaluate profitability, risk, and robustness before implementing strategies live.

3. Platform familiarization

Testing with a demo account helps you become comfortable with the broker’s interface, charting tools, and order execution process.

4. Risk management practice

Experiment with position sizing, risk-per-trade rules, and margin calculations to develop consistent risk control habits.

5. Confidence building for beginners

Repeated successful practice trades build the discipline and confidence needed to handle live-market pressure more effectively.

Limitations and critical differences between demo and live accounts

While demo accounts are useful, they aren’t perfect replicas of live trading. Knowing their limitations prevents false expectations.

1. Emotional and psychological differences

Trading with virtual funds doesn’t trigger the same emotional responses as real-money trading. Fear and greed can affect decision-making dramatically when personal capital is at risk.

2. Execution differences and slippage

Demo executions may not always reflect the same latency, slippage, or order rejections you might face with a live broker, especially during high-volatility or low-liquidity events.

3. Real liquidity vs simulated fills

Demo platforms can provide fills that are more favorable than live market fills. In thin markets and during major news events, live fills can vary widely.

4. Data accuracy and spreads

Some demo accounts may use slightly different data feeds or fixed spreads. Always confirm whether your demo environment reproduces variable spreads and commissions like the live account.

5. Overfitting and survival bias

Backtested and demo-optimized strategies may look great on paper but fail in live markets due to conditions not modeled in simulation (e.g., market microstructure, slippage).

How to use a demo account effectively — step-by-step

To gain real value from a demo account, follow a structured approach similar to live trading. Treat your demo account as if real money is on the line.

- Set clear learning objectives: Define what you want to achieve — learn platform basics, test a specific strategy, practice risk management, etc.

- Choose realistic starting capital and leverage: Set your demo balance and leverage to levels you plan to use in a live account. This produces realistic margin requirements and trade sizing.

- Create a trading plan: Define markets, timeframes, entry/exit rules, risk per trade, and performance metrics. Document every trade.

- Use realistic position sizing: Apply the same percentage risk rules you would in live trading (e.g., risk 1% of account per trade).

- Trade live market hours: Practice trading during the hours you’ll actually trade live to experience similar volatility and liquidity conditions.

- Record and analyze every trade: Keep a trading journal with screenshots, rationale, outcome, and lessons learned. Review weekly/monthly performance.

- Simulate transaction costs and slippage: Factor in spreads, commissions, and occasional slippage to avoid inflated success rates.

- Practice exits and risk management: Don’t only focus on entries — work on stops, trailing stops, scaling, and trade management rules.

- Transition with a micro-account: When ready, move to a small live account or micro-lot environment to acclimatize to real-money conditions.

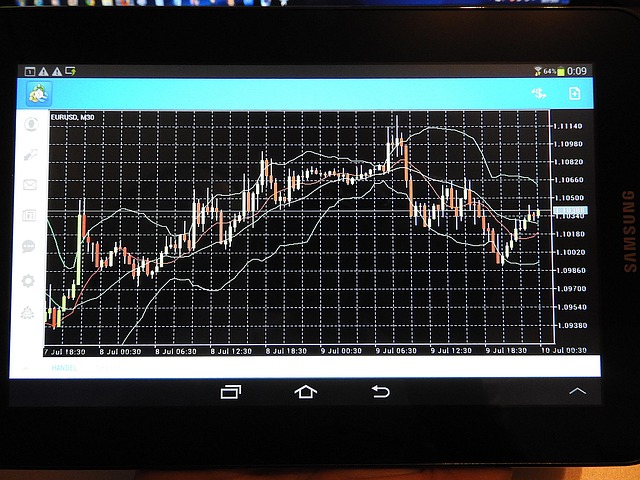

Real examples: testing strategies in a demo account

Below are practical use cases and an example of how to test a moving-average crossover strategy in a demo environment.

Use case 1 — Price action scalping (short timeframes)

- Objective: Test scalp entries and exits on 1-minute and 5-minute charts.

- Demo setup: Use small virtual balance and account sizing equal to planned live micro-lots. Trade during high-liquidity hours (London/New York overlap).

- Metrics to track: Win rate, average win/loss, maximum consecutive losses, and slippage frequency.

Use case 2 — Swing trading with risk management

- Objective: Validate swing trades on 4-hour and daily charts using a trend-following system with stop-loss and take-profit.

- Demo setup: Set leverage moderate (e.g., 10:1), risk per trade 1–2%.

- Metrics to track: Expected return per trade, drawdown, and risk-adjusted return (Sharpe ratio).

Example: Moving-average crossover strategy

Here’s a step-by-step example to test a simple moving-average crossover strategy.

- Define rules: Buy when the 50-period SMA crosses above the 200-period SMA; sell when it crosses below. Use a stop-loss at 1.5x ATR and a take-profit of 2x risk.

- Set demo account: Start with $10,000 virtual balance, leverage 20:1, risk 1% per trade.

- Backtest: Use historical data or the platform’s backtesting tool to test the strategy over multiple market regimes.

- Forward test live (demo): Place trades in real-time demo conditions, document each trade in a journal, and analyze performance over at least 50–100 trades.

- Adjust: If drawdown or win-rate is unacceptable, refine entry/exit rules or risk parameters, then retest.

Addressing the psychology gap: how to simulate real emotions

One of the biggest differences between demo and live trading is psychology. Use these techniques to minimize the emotional gap:

- Set stakes in the demo: Pretend the virtual balance equals your intended live capital and review account statements mentally as if real.

- Create consequences: Keep a public trading log or share progress with a mentor to add accountability.

- Limit demo balance: Don’t use an unrealistically large demo account — it can distort risk behavior.

- Transition gradually: Use a small live account to experience real emotional pressure while keeping losses manageable.

- Practice stress management: Use routines, breaks, and pre-defined rules to avoid emotional decision-making.

When and how to transition from demo to live trading

Transition timing is individual, but consider moving to live trading when you meet objective criteria:

- Your demo strategy produced consistent positive returns over a significant sample size (e.g., 6 months or 100+ trades).

- Maximum drawdowns were within your risk tolerance and you adhered to your trading plan during adversity.

- You can consistently follow risk management rules (position sizing, stop-loss discipline).

- You have a realistic understanding of trade execution differences and have tested on a demo account that mimics live spreads/commissions.

Transition steps:

- Open a small live account (micro-lots) with the broker you tested. Keep capital small initially.

- Use the same trading plan and risk rules (don’t increase leverage or risk per trade). Treat the first 20–50 live trades as a continuation of your demo testing.

- Monitor emotional responses and adjust the plan or account size as you gain confidence.

Recommended platforms and broker registration links

Many reputable brokers and crypto exchanges offer demo or testnet environments for practice. Below are popular platforms and registration links you can use to try demo trading or open an account. Note: Some links are for crypto exchanges which also have demo/test environments or educational resources.

- Register with Binance — Binance provides extensive educational materials and testnet resources for crypto trading.

- Register with MEXC — MEXC offers demo/test trading for crypto markets and an intuitive interface.

- Register with Bitget — Bitget supports spot, margin, and derivatives trading with demo and copy-trading features.

- Register with Bybit — Bybit provides testnet access and strong charting tools for practice trading.

If you prefer traditional forex brokers, look for ones that explicitly advertise demo accounts and realistic fee structures. Always check regulated broker listings by authorities such as the UK Financial Conduct Authority (FCA) or the U.S. Securities and Exchange Commission (SEC) for regulatory information.

FAQ — common questions about demo accounts

Is demo trading totally free?

Most brokers offer demo accounts free of charge. They are funded with virtual capital and typically have no expiration or limited time periods (though some brokers limit demo duration).

Can demo accounts be used for algorithmic trading?

Yes. Platforms like MetaTrader 4/5, cTrader, and many brokers provide demo environments supporting expert advisors (EAs) and automated trading systems. Test automated strategies thoroughly on demo before going live.

Will a high win rate on demo ensure success live?

No. Demo performance is informative but not definitive due to differences in execution, psychology, and liquidity. Use demo results as evidence of a strategy’s potential, not a guarantee.

How long should one use a demo account?

There’s no fixed duration. Use it until you achieve consistent results under realistic conditions — often several months and 50–200 trades depending on your strategy’s timeframe.

Further reading and resources

To deepen your knowledge, consult authoritative resources and industry articles:

- Investopedia — Demo Account — A clear overview of demo accounts and purpose.

- Wikipedia — Foreign Exchange Market — Background on the FX market structure and participants.

- Smart Guide: Binance Trading Bot — Withdraw Profit Safely — A practical guide that touches on automation and profit handling for traders engaged in crypto trading.

- Crypto Live Support in 2025 — Insights into customer support and technological trends that affect trading platforms.

- BTC Price Prediction & Trade Plans (2025) — Example of scenario planning and trade strategies in volatile markets.

Common mistakes to avoid with demo accounts

Avoid habits that make demo results misleading:

- Using unrealistic capital/leverage that you won’t use live.

- Ignoring commissions, swaps, or slippage in your calculations.

- Over-optimizing a strategy until it only works in demo (curve-fitting).

- Failing to journal trades and learn from mistakes.

- Delaying the transition to live trading indefinitely out of comfort with no measurable progress.

Checklist before switching to live trading

- Documented trading plan with clear rules and performance metrics.

- Consistent demo results over sufficient trades/time.

- Risk management rules tested and proven (e.g., risk per trade limits).

- Comfort with the broker’s execution, spreads, and fees (confirmed either in demo or small live tests).

- Psychological readiness — ability to follow the plan under pressure.

Conclusion — making the most of your demo account

Understanding what is a demo account in forex is the first step toward disciplined, informed trading. Demo accounts are indispensable tools for learning, testing, and refining strategies without financial risk. However, recognize their limitations — particularly around execution and psychology — and bridge these gaps with realistic settings, disciplined journaling, and a gradual transition to live trading. Use the resources and platform links shared above to test thoroughly, and always prioritize risk management when moving to real capital.

For those exploring automated trading, platform onboarding, or crypto-related trading tools and support, review expert guides and technological updates to stay current. For example, read a practical guide on safely withdrawing profits when using automated trading via Binance here, learn about live support tools shaping trading experiences here, and study scenario-based trade plans like those covering BTC ETF approvals here.

Ready to practice? You can create accounts and test platforms via these links:

- Open an account at Binance

- Open an account at MEXC

- Open an account at Bitget

- Open an account at Bybit

Good luck, and remember: the value of a demo account lies in disciplined, realistic practice and the lessons you carry forward when you begin live trading.