Practical Guide to fees for professional fees

Author: Jameson Richman Expert

Published On: 2025-10-28

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Fees for professional fees can be confusing, variable, and consequential to both personal and business finances. This guide summarizes how professionals set their charges, the most common billing models, practical negotiation and documentation tactics, tax treatment, alternatives (including crypto payments), and how to compare and challenge fees fairly. Whether you’re hiring a lawyer, accountant, consultant, or creative professional, understanding the mechanics behind fees will help you make smarter decisions, reduce surprises, and protect your budget.

Why clear fees for professional fees matter

Transparent pricing establishes trust, reduces disputes, and enables effective budgeting. For firms and freelancers, defining fees clearly protects profitability and clarifies scope. For clients, clarity prevents scope creep, unexpected invoices, and costly misunderstandings.

- Budgeting: Accurate cost expectations allow individuals and businesses to plan cash flows, allocate resources, and set ROI targets.

- Accountability: Clear fees reduce disputes and provide benchmarks for performance and value delivered.

- Comparability: Understanding fee structures enables apples-to-apples comparison of providers.

Common billing models and how they affect effective cost

Professionals use a range of models. The same engagement can cost very differently depending on the structure — so when comparing bids, normalize them into an effective total cost.

Hourly rates

Most common for lawyers, consultants, and some accountants. The provider bills by the hour, often in increments (e.g., six-minute or 15-minute blocks).

- Pros: Flexible, easy to start.

- Cons: Incentivizes time over efficiency; final cost uncertain.

Flat (fixed) fees

Best for well-defined tasks (tax returns, routine contracts, simple website builds). The provider quotes a lump sum for the entire scope.

- Pros: Predictability, alignment on scope.

- Cons: Scope creep risk — requires precise engagement terms.

Retainers

Clients pay an upfront amount to secure capacity. The retainer may be drawn down or considered prepaid work.

- Pros: Ensures availability; stabilizes cash flow for the provider.

- Cons: May lead to unused hours if not managed; requires clear reporting.

Contingency fees

Often used in litigation or recovery work where the professional receives a percentage of the recovered amount.

- Pros: Low upfront cost for client; incentives aligned.

- Cons: Can be expensive if recovery is large; not suitable for all cases.

Value-based and performance fees

Fees tied to outcomes, KPIs, or the value delivered (e.g., revenue uplift, cost savings).

- Pros: Aligns incentives, can generate higher ROI.

- Cons: Measuring value requires agreed metrics and transparency.

Blended and tiered pricing

Firms sometimes combine models — e.g., flat fee for discovery plus hourly for ongoing work, or tiered subscription pricing for services.

How fees are calculated — components to watch

Understand what goes into a professional’s price so you can evaluate fairness:

- Base rate or hourly rate: The published charge per hour per role (partner, senior associate, junior).

- Time estimates: How long tasks are expected to take; compare quoted hours across providers.

- Overhead allocation: Office costs, technology, insurance, continuing education — often built into rates.

- Risk premium: Contingency cases or tight deadlines often carry higher rates.

- Administrative fees: Billing, copying, courier, and other pass-through costs.

- Taxes and statutory surcharges: Sales tax or VAT on services depending on jurisdiction.

Effective rate vs. headline rate

The headline rate (e.g., $300/hour) is less useful than the effective rate (total fees divided by total hours). Junior staff may bill less but require partner supervision, raising the effective rate. Always ask for historical averages or sample billing summaries.

Practical examples: How different structures impact cost

Here are simplified examples to illustrate how billing choices influence final cost.

Legal matter — hourly vs. flat

Scenario: Contract drafting and negotiation estimated at 20–30 hours.

- Hourly: 25 hours × $300/hour = $7,500 (variable; could be 20–30+ hours).

- Flat: Fixed fee quoted at $6,500 for the complete service (scope defined: one round of negotiation).

Trade-off: Flat offers predictability; hourly protects the lawyer from underestimation.

Accounting engagement — retainer vs. subscription

Scenario: Monthly bookkeeping and tax filing.

- Retainer: $2,000/month retainer covering up to a set number of hours; overages billed hourly.

- Subscription: $1,200/month fixed subscription for defined services with add-on fees for exceptional work.

Subscription often suits predictable recurring tasks, while retainers help firms manage peak demand.

How to compare and benchmark fees for professional fees

Comparing proposals requires conversion to common metrics and careful evaluation beyond price.

- Normalize to total cost: Ask providers to estimate total fee ranges for the full scope.

- Request a price breakdown: Hours, roles, disbursements, and assumptions.

- Calculate effective hourly rates: Total estimated fee divided by estimated hours.

- Evaluate scope and deliverables: Lower price may omit critical steps — compare apples to apples.

- Check track record: Experience, references, case studies matter as much as price.

Negotiation tactics that preserve value and relationships

Negotiation should aim to align incentives rather than simply lower price.

- Define clear scope: Limit ambiguity — specify deliverables, timelines, and rounds of revision.

- Use staged pricing: Phase the project with milestones and reassessments.

- Ask for caps or not-to-exceed limits: Keeps upside for the professional while protecting your budget.

- Trade concessions: Offer longer timelines, predictable work, or referrals in exchange for lower fees.

- Negotiate billing increments: Request 15-minute increments instead of six-minute for fewer fractional charges.

- Consider blended teams: Request different staffing mixes (more junior staff under senior supervision) to reduce costs.

Documenting fees: engagement letters and contracts

An engagement letter is the single most important document to control fees and expectations. It should include:

- Scope of services and specific deliverables.

- Fee structure and billing rates for each role.

- Invoicing frequency, payment terms, and late fees.

- Expenses and disbursements policy.

- Termination provisions and fees on termination.

- Dispute resolution mechanism (mediation/arbitration).

Require regular status reporting and timesheet transparency for hourly engagements. This reduces surprises and enables early course corrections.

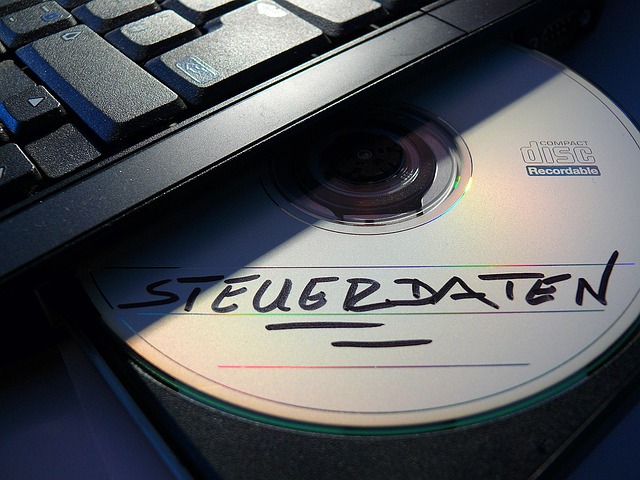

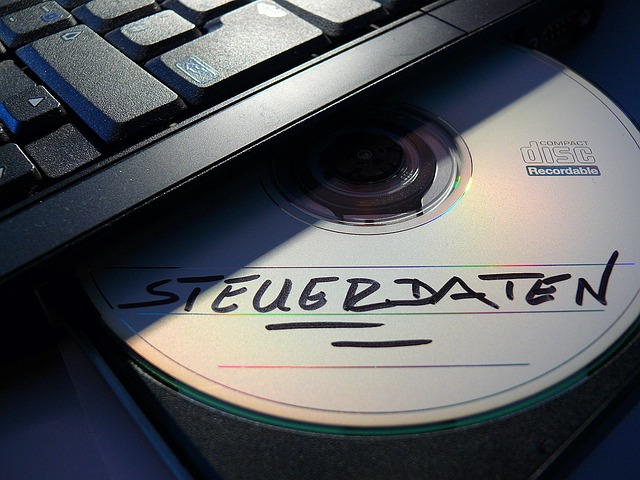

Tax treatment and recordkeeping

Whether professional fees are tax-deductible depends on jurisdiction, the nature of the service, and whether you’re an individual or business. Common rules include:

- Business-related professional fees (legal, accounting, advisory) are often deductible as ordinary business expenses (U.S. taxpayers refer to the IRS). See IRS guidance on business expenses: IRS.gov.

- Personal legal fees may be nondeductible except in specific circumstances (e.g., tax advice or certain discrimination claims).

- Keep invoices, engagement letters, and proof of payment for at least the statutory period required by tax authorities.

For international readers, check local revenue authorities (for example, HM Revenue & Customs in the UK at GOV.UK - HMRC).

Ethics, industry standards, and consumer protections

Professional bodies regulate fee behavior and require transparency in many jurisdictions. For example, lawyers and accountants must follow ethical rules regarding fees and client communication. Consult authoritative resources such as the American Bar Association for legal fee rules: American Bar Association, and the SEC for investment adviser fee rules: SEC - Investor.gov.

Wikipedia has general background on the legal concept of fees and related issues: Fee (law) — Wikipedia.

Disputes over fees: process and remedies

If you believe a bill is incorrect or unreasonable:

- Request a detailed invoice: Ask for time entries and disbursement receipts. Many disputes resolve once line-items are clarified.

- Raise the issue promptly: Don’t let a small concern fester until it becomes a major dispute.

- Negotiate a compromise: Propose reductions, write-offs, or payment plans to preserve the relationship.

- Use formal complaint channels: Professional bodies often have fee dispute mechanisms (e.g., state bar fee arbitration in the U.S.).

- Mediation and arbitration: Cheaper than litigation and often mandated by engagement letters.

Using alternative payment methods — including cryptocurrency

Some professionals now accept alternative forms of payment, including bank transfers, credit cards, payment platforms, and cryptocurrencies. If you and the professional agree to crypto, consider:

- Price volatility: Agree on whether fees are denominated in fiat (e.g., USD) and settled in crypto, or priced in crypto directly.

- Conversion costs: Exchanges and payment processors levy fees and spreads on fiat-crypto conversion.

- Reporting and tax: Crypto payments may trigger tax events; document the fiat-equivalent value at time of payment.

- Regulatory and AML/KYC concerns: Some providers require additional compliance checks before accepting crypto.

If you’re considering crypto for payments or converting assets to meet professional fees, reliable exchange accounts can help. Popular platforms include Binance (register here), MEXC (register here), Bitget (register here), and Bybit (register here). Creating accounts on major exchanges streamlines converting crypto assets into fiat to pay fees or transferring funds to professionals who accept crypto:

For readers looking to understand how crypto markets may affect their ability to pay fees or use crypto as an investment source for covering costs, the following market analysis and strategy resources can be useful:

- XRP price prediction and market forecast — useful if you hold XRP and plan to monetize it for fees.

- Crypto trading strategy for beginners (2025 guide) — a primer on converting crypto holdings efficiently.

- Ethereum price prediction (2025) — relevant if you’re using ETH to pay or liquidate assets for professional fees.

- Crypto IDX signal strategies — tactical information for market timing and liquidity planning.

Example flow: paying professional fees with crypto (practical checklist)

- Confirm the professional accepts crypto and agree on denomination (USD, EUR or crypto token).

- Agree on timing and price reference (e.g., USD equivalent at time of transfer using a named exchange rate).

- Create/verify exchange accounts and KYC to ensure fast conversion: Binance, MEXC, Bitget or Bybit are common options.

- Calculate conversion and network fees; document the exchange rates used.

- Obtain a receipt showing fiat-equivalent value and transaction details for tax and records.

Benchmarks and ballpark ranges (indicative)

Actual fees vary widely by geography, complexity, and professional seniority. These ranges are indicative for planning purposes only:

- Local freelance designer: $30–$150/hour (or $500–$3,000 per project)

- Accountant / bookkeeper: $30–$200/hour depending on qualification; tax preparation $200–$2,500+

- Consultant: $75–$400+/hour; project-based fees can range $5,000–$200,000 depending on scope

- Law firm partners: $300–$1,200+/hour in major cities; associates lower

Remember that cheaper is not always better: evaluate risk, experience, and the cost of poor outcomes.

Checklist before engaging a professional

- Obtain 2–3 proposals and normalize costs.

- Request references and relevant case studies.

- Define success metrics and timelines.

- Agree on billing structure and dispute resolution in writing.

- Clarify administrative charges and third-party expenses.

- Confirm tax treatment and document retention requirements.

- Decide acceptable payment methods and conversion strategies (if using crypto).

Red flags and when to walk away

- Unwillingness to put terms in writing or provide itemized billing.

- Very low prices with high upfront demands and no clear scope.

- Evading questions about staffing, experience, or references.

- Pressure tactics to accept undefined work or to increase retainer quickly.

Final recommendations and action plan

Fees for professional fees should be predictable, justified, and documented. To protect your financial interests:

- Start by defining the problem and outcomes you need — narrower scope reduces costs.

- Request detailed proposals and convert them to total cost and effective rate.

- Negotiate scope, not just price — push for milestone payments and reporting.

- Put an engagement letter in place that spells out billing, deliverables, and dispute procedures.

- Consider alternative payment methods thoughtfully (including crypto) and document conversion rates and receipts.

- Keep records for tax and audit purposes.

Understanding the components and options behind fees gives you leverage to secure better terms and ensures you only pay for value delivered. If you use crypto assets to fund professional engagements, use regulated exchanges to convert and document transactions; for market context and strategy, consult resources like the XRP and Ethereum forecasts above and entry-level trading strategies to plan your funding needs.

Useful authoritative links and further reading

- IRS — official guidance on deductible business expenses

- HMRC — UK tax authority

- American Bar Association — legal ethics and fee guidance

- Fee (law) — background and legal concepts (Wikipedia)

By approaching fees methodically — assessing models, normalizing proposals, negotiating scope, and documenting arrangements — you can control costs while securing the professional expertise you need. If you plan to use or monetize crypto assets to meet fee obligations, open accounts with respected exchanges and consult market analyses to time conversions sensibly.