Understanding XRP Approval Time in 2025: What to Expect

Author: Jameson Richman Expert

Published On: 2025-11-02

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

The phrase "xrp approval time" is used by traders, investors, and institutions to ask one question: how long before XRP is cleared for a particular use — whether that's regulatory acceptance, exchange listing, or institutional onboarding. This article breaks down every meaning of "xrp approval time," explains the factors that determine how long approvals take, and gives practical guidance for traders and institutions in 2025. You'll learn realistic timelines, monitoring methods, and actionable steps to prepare — including recommended exchanges and signal tools to use while you wait.

What “xrp approval time” Can Mean

"xrp approval time" is not a single fixed interval. Context matters. Common interpretations include:

- Regulatory approval — time until a regulator (e.g., the SEC in the U.S. or other national regulators) clarifies whether XRP is treated as a security, or issues licenses that affect its sale and custody.

- Exchange listing approval — the internal review and compliance process an exchange follows before listing or relisting XRP, including KYC/AML integration and liquidity checks.

- Institutional custody/onboarding approval — time for custodians, banks, or payment providers to complete due diligence to offer XRP custody or settlement services.

- Transaction settlement time — the network-level time it takes for an XRP transfer to settle (often seconds) — which is different from regulatory and compliance approvals.

XRP Transaction Time vs. XRP Approval Time

Many people confuse transaction settlement speed with approval processes. XRP’s native ledger — the XRP Ledger (XRPL) — is designed for fast settlement. Typical on-ledger transfers finalize in roughly 3–5 seconds, making XRP one of the fastest major cryptocurrencies for peer-to-peer settlement. For technical background, consult the XRPL documentation and general technical overviews such as the XRP Wikipedia entry (XRP (cryptocurrency)).

But remember: near-instant settlement on the ledger does not replace regulatory, exchange, or institutional approvals. Even if network transfers are fast, you may experience delays when moving funds into or out of exchanges, custodians, or fiat rails because of KYC/AML reviews and banking processes.

Regulatory Approval: The Longest and Most Uncertain Timeline

When most people ask about "xrp approval time," they mean regulatory clarity — especially in jurisdictions where legal status affects trading, listing, or custody. Regulatory approval timelines are the hardest to predict because they depend on:

- Legal outcomes (court rulings, consent decrees)

- Regulatory guidance or rulemaking (which can take months to years)

- Political priorities and enforcement capacity in a jurisdiction

- Precedent set by similar cases or regulations in other countries

For example, U.S. market participants often look to the U.S. Securities and Exchange Commission (SEC) for clarity. You can monitor official filings and guidance at the SEC’s site (sec.gov). For historical and summary information about the case and related events, the public encyclopedia entry for the SEC v. Ripple and the XRP page on Wikipedia are useful references.

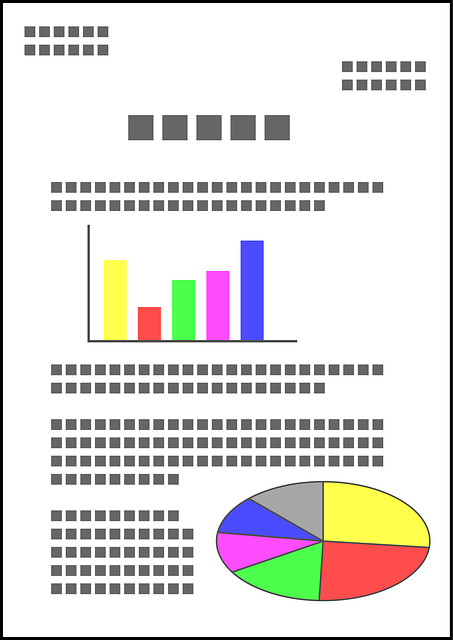

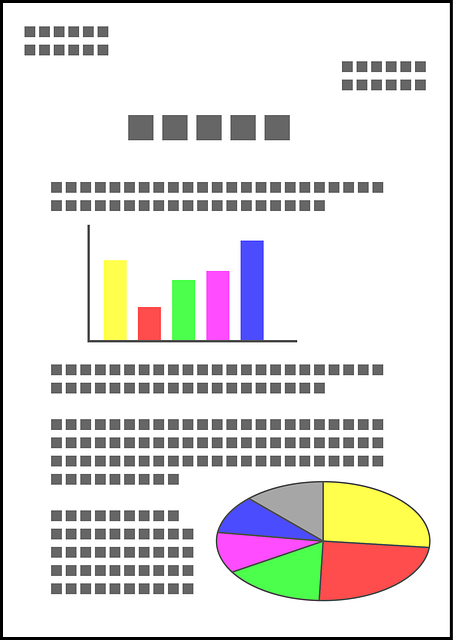

Typical Regulatory Timelines

While every jurisdiction is different, here are rough scenarios:

- Fast scenario (weeks–months): Regulators issue clear guidance or a settlement that resolves major uncertainties. This is rare for complex matters.

- Medium scenario (months–1–2 years): Regulators release targeted guidance, or courts rule in portions that materially reduce uncertainty, allowing exchanges and custodians to act.

- Slow scenario (multiple years): Cases proceed through appeals, or regulators opt for long-form rulemaking and formal procedures. This is common for regulatory rule changes that affect many market participants.

Exchange Listing and Delisting Approval Time

Exchanges often maintain discretion over listings based on compliance, liquidity, and legal risk. Their approval time for adding or relisting XRP depends on:

- Legal risk assessment in the exchange’s operating jurisdictions

- Liquidity provisioning and market-making readiness

- Technical integration and wallet security audits

- Internal compliance and KYC processes

Some exchanges can add tokens rapidly (days to a few weeks) if risk assessments are favorable. Others pause listings until regulatory clarity returns, which may take months. If you’re comparing exchanges, check their public policies and fee structures; articles such as a Bybit vs Binance trading fees comparison can be useful when choosing where to trade. For quick mobile trading and monitoring, resources like the TradingView mobile app guide help you stay ready while waiting for approvals.

Actionable Steps When an Exchange Delays or Relists

- Open accounts on multiple reputable exchanges to spread counterparty risk — share your funds across regulated platforms. Consider using Binance (register link), Bybit (invite link), MEXC (invite link), and Bitget (referral link) to maintain access to markets if one exchange delists temporarily.

- Keep small balances on exchanges for active trading; store the bulk in secure wallets or institutional custody providers if you’re long-term.

- Monitor exchange announcements and legal filings. Exchanges often publish rationale and timelines for delisting or relisting.

Institutional Custody and Onboarding: Days to Months

For banks, custodians, and payments firms to offer XRP custody, they must complete:

- Legal review (is XRP treated as a security or commodity in the relevant jurisdiction?)

- Operational integration (wallets, keys, insurance)

- Compliance checks (KYC, AML, transaction monitoring)

- Counterparty agreements and bank relationships for fiat on/off ramps

Institutional onboarding can take anywhere from a few weeks to several months depending on the complexity and the service provider’s risk appetite. For institutions evaluating trading tools and automation during onboarding, guides to automated strategies and bots (for example, ETH trading bot guides) and lists of reliable signal websites can accelerate strategy implementation once custody is established.

Practical Timeline Scenarios for "xrp approval time"

Below are sample timelines phrased as practical scenarios so you can estimate planning horizons.

Scenario 1 — Quick Market Clearance (Weeks to Months)

- Regulatory authority issues a concise ruling or guidance clarifying that XRP is not a security for specific institutional uses.

- Major exchanges resume full listings within weeks after legal teams clear the path.

- Institutional custodians update policies and begin onboarding within months; traders can expect improved liquidity and product offerings.

Scenario 2 — Partial Clarity (Months to a Year)

- Court rulings or guidance resolve some issues but leave other aspects unresolved (e.g., programmatic sales vs. institutional sales).

- Exchanges and custodians make nuanced decisions — some services return quickly while others remain limited.

- Market volatility may spike around major legal milestones; active risk management is required.

Scenario 3 — Prolonged Uncertainty (1+ Years)

- Appeals and regulatory processes extend the final resolution timeline.

- Some exchanges avoid relisting in high-risk jurisdictions, while convertible services operate in supportive regions.

- Long-term holders and institutions wait for definitive rulings or market consensus.

How to Monitor and Verify XRP Approval Status

Use a combination of legal, on-chain, and exchange sources:

- Official regulator portals and filings — U.S. SEC filings can be found at sec.gov and EDGAR. Watch for decisions, enforcement releases, and guidance documents.

- Court dockets and public legal analysis — follow major filings in high-profile cases on legal databases and credible news outlets.

- Exchange announcements — check official exchange blogs and support pages for relisting or delisting notices.

- Blockchain explorers and XRPL resources — technical confirmations and ledger activity are visible on XRPL explorers and the official documentation at xrpl.org.

- Industry analysis and signal sites — reputable signal sites and trading tools provide market-ready alerts and educational content. For curated resources, see free crypto signal aggregators and guides to reliable sites.

What Traders Should Do While Waiting

If you're waiting for "xrp approval time" to elapse before taking major positions, here are practical steps to remain prepared and limit downside:

- Build diversified access: Open and verify accounts on multiple reputable exchanges to preserve trading flexibility. Useful links: register on Binance, MEXC, Bitget, and Bybit.

- Use paper trading and demo systems: Practice strategies using demo accounts or simulated trades (TradingView and many exchanges offer this).

- Set risk controls: Use stop-losses, position-sizing rules, and avoid overleveraging while legal uncertainty persists.

- Stay informed: Subscribe to official exchange and regulator updates and follow legal coverage.

- Use automation wisely: Explore trading automation and bot strategies for other correlated assets (for example, ETH trading bots) to maintain market exposure while reducing manual workload.

- Monitor technical indicators: Use charting platforms and mobile tools to receive alerts across devices — guides exist to optimize mobile trading setups.

For educational and operational resources you can consult while you wait, see these practical guides and tools:

- TradingView Mobile App — Ultimate Mobile Trading Guide (useful for setting alerts and following price action on the go)

- ETH Trading Bot Telegram Profitable Setup Guide (for automated trade strategies you can adopt or adapt)

- Ultimate Guide to the Best Free Crypto Signal Websites (curated signal resources)

- Bybit vs Binance Trading Fees — Ultimate Comparison 2025 (compare fee structures as you choose exchanges)

- What is Trading Competition? Complete Guide (ideas for honing trading skills while waiting)

Examples: How Approval Timelines Affected Markets in the Past

Historical examples help illustrate the real-world effects of approvals and regulatory clarity:

- Exchange delistings: In prior regulatory events, some exchanges temporarily delisted tokens perceived as legally risky, causing immediate liquidity reduction and price pressure. Relisting often restored liquidity and normalized spreads.

- Court rulings: Partial rulings in cryptocurrency litigation historically produced sharp short-term volatility as markets re-priced assets based on new legal interpretations.

- Fast technical integrations: When regulators or exchanges issue clear guidance quickly, developers and market makers can integrate or re-enable services rapidly, often within weeks.

High-Authority Resources to Follow

When tracking "xrp approval time," rely on primary, authoritative sources:

- Regulators: U.S. Securities and Exchange Commission — https://www.sec.gov/

- Blockchain project documentation: XRP Ledger official docs — https://xrpl.org/

- Encyclopedic and legal summaries: XRP (cryptocurrency) — https://en.wikipedia.org/wiki/XRP_(cryptocurrency)

- Exchange policy pages: Check each exchange’s compliance and listing policy pages directly (Binance, Bybit, Bitget, MEXC).

Recommended Exchanges and How to Stay Ready

To reduce downtime if an approval or relisting occurs, be ready with verified exchange accounts. Below are commonly used exchanges and direct registration/referral links to help you get started quickly:

- Binance — register here: Binance registration

- MEXC — open an account: MEXC invite

- Bitget — referral link: Bitget referral

- Bybit — invite link: Bybit invite

Having verified accounts on multiple platforms reduces the risk that a single exchange’s decision will lock you out of markets during a critical approval window.

Using Signals, Bots, and Competitions to Improve Readiness

Waiting for regulatory or listing approvals is an opportunity to improve your trading process:

- Test automated strategies using bots and demo environments. The ETH trading bot setup guide explains how to implement and monitor a bot strategy safely.

- Follow reliable signal providers (see the free signal website guide) but always backtest signals and verify credibility before committing capital.

- Join trading competitions and educational events (see trading competition guides) to sharpen strategy and risk management under simulated pressure.

Frequently Asked Questions (FAQ)

Q: How long does an XRP transaction take?

A: On the XRP Ledger, transfers usually settle in about 3–5 seconds. This is separate from any approval process required by regulators or exchanges.

Q: How long until regulators approve XRP?

A: There is no single timetable. It can range from weeks to multiple years depending on legal developments, rulemaking timelines, and jurisdiction-specific processes. Monitor official regulator releases and court filings for the most accurate updates.

Q: Will price react to approval news?

A: Yes — regulatory clarity or exchange relistings often produce significant price movements due to changes in market access and perceived legal risk. Expect increased volatility around major announcements and manage position sizes accordingly.

Q: Should I keep XRP on exchanges while waiting for approval?

A: It depends on your risk tolerance. Keeping funds on reputable exchanges can enable fast trading if approvals occur, but it increases counterparty risk. Consider splitting holdings between secure self-custody (or insured custodians) and exchanges.

Checklist: Preparing for Any "xrp approval time" Outcome

- Create and verify accounts on multiple reputable exchanges (links above).

- Set alerts on official regulatory and exchange channels.

- Have a cold-storage plan or institutional custody solution for larger positions.

- Backtest any automated strategies and use demo accounts before deploying capital.

- Maintain a clear risk-management plan: stop-loss rules, position sizing, and liquidity buffers.

Conclusion — Plan for Uncertainty, Act on Readiness

"xrp approval time" is not a single number; it’s a set of timelines determined by legal, regulatory, operational, and technical factors. Network settlement is fast, but approvals for trading, custody, and institutional use vary significantly by jurisdiction and circumstance. The best approach is to prepare proactively: maintain diversified exchange access, use reputable custodians, follow primary regulatory sources, and employ disciplined risk management. Meanwhile, use educational tools, automation guides, and signal services to remain engaged and ready for opportunities once approvals arrive.

Helpful starting resources mentioned in this article:

- TradingView Mobile App — Mobile Trading Guide

- Bybit vs Binance — Trading Fees Comparison 2025

- ETH Trading Bot — Telegram Setup Guide

- Best Free Crypto Signal Websites — Guide

- Trading Competitions — Complete Guide

Register or prepare accounts now so you're ready when approvals change market access: Binance (register), MEXC (invite), Bitget (referral), Bybit (invite).

Stay disciplined, stay informed, and treat "xrp approval time" as a planning parameter — not a binary trigger. That approach will keep you positioned to act efficiently whenever the market’s legal and operational landscape changes.