Is Margin Trading Haram? An Islamic Finance Guide for Traders

Author: Jameson Richman Expert

Published On: 2025-11-10

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

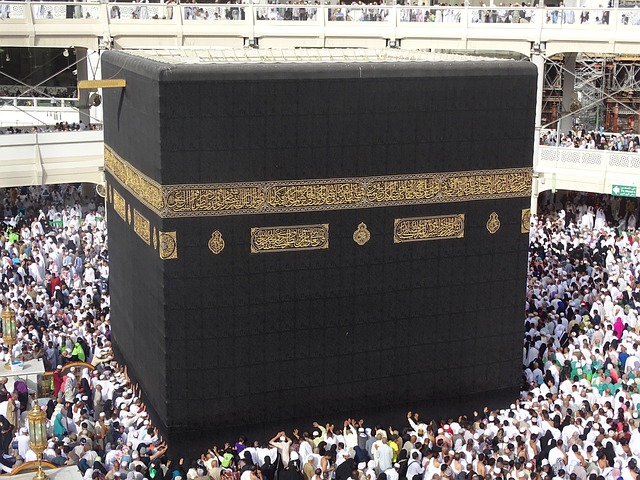

Is margin trading haram is a common and important question for Muslim investors exploring cryptocurrency and traditional markets. This comprehensive guide examines the Shariah issues surrounding margin and leveraged trading, explains the underlying concepts (riba, gharar, and maisir), presents scholarly opinions, and offers practical, actionable guidance and halal alternatives for ethical trading. Whether you trade spot, margin, or use automated tools, this article helps you make informed, faith-consistent decisions.

What is margin trading? A clear, practical definition

Margin trading allows traders to borrow funds from a broker or exchange to increase their market exposure. By using leverage (for example, 2x, 5x, 100x), traders can control positions much larger than their account balance. While leverage amplifies potential profits, it also magnifies losses and introduces financing costs such as overnight or funding fees.

For an authoritative overview of margin concepts and mechanics, see Investopedia’s guide to margin trading: Investopedia — Margin. You can also read a general description on Wikipedia: Wikipedia — Margin (finance).

Core Shariah concerns: Riba, gharar, and maisir

When answering "is margin trading haram," Islamic jurists evaluate whether the activity violates core prohibitions:

- Riba (usury/interest): Any guaranteed interest or unjustified increment on loans is prohibited. Margin positions often incur financing fees or interest charges on borrowed funds.

- Gharar (excessive uncertainty): Contracts with excessive ambiguity or speculative elements may be void. Highly leveraged trading can be extremely uncertain.

- Maisir (gambling/speculation): Transactions that primarily rely on chance or pure speculation are forbidden.

These three concepts form the primary framework for Shariah assessments of margin trading.

How margin trading can involve riba

Most margin platforms charge financing costs for borrowed capital. For crypto perpetual swaps and futures, exchanges apply funding rates, which can be positive or negative; for spot margin, brokers charge interest. When such fees are fixed and guaranteed, many scholars consider them to fall under riba. Key indicators:

- Is the borrower required to pay a predetermined interest regardless of outcome?

- Is the fee imposed as a condition of borrowing to increase trading capacity?

If yes, that element resembles riba and is generally considered impermissible by mainstream scholars.

How margin trading can involve gharar and maisir

High leverage magnifies uncertainty: a small market move can wipe out equity. Short selling, derivatives, and complex leveraged instruments can have speculative features akin to gambling (maisir). Contracts lacking clear terms or featuring extreme uncertainty fall into gharar territory.

Therefore, even when direct interest is absent, the speculative nature of leveraged trades can still render margin trading impermissible to some scholars.

Scholarly opinions: No unanimous verdict

There is no single consensus; Islamic jurists differ based on contract details and market practices. Common positions include:

- Many scholars argue margin trading is haram when it involves guaranteed interest (riba) or mimics gambling through excessive speculation.

- Some scholars permit limited forms of leverage if the contract is structured without interest, with clear terms and proportionate risk-sharing or profit-and-loss sharing (e.g., mudarabah-like structures).

- Other scholars emphasize the underlying asset: trading actual ownership (spot) is generally permissible, while trading derivatives/CFDs (where no true ownership exists) is more likely to be prohibited.

Islamic finance boards such as AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) provide standards that many institutions follow; however, their standards are mostly applied to conventional financial institutions rather than retail crypto exchanges. Visit AAOIFI for institutional guidance: AAOIFI.

Margin trading in crypto: additional complexities

Cryptocurrency adds technical and legal complexities:

- Some platforms lend stablecoins or crypto for margin, creating lending arrangements that may carry interest-like returns.

- Perpetual futures and swap mechanisms have funding rates that can act like interest.

- Market volatility, flash crashes, and automatic liquidations increase gharar and may resemble gambling to some jurists.

If you use trading bots or automated systems for leveraged crypto trading, that introduces further layers—algorithmic risk, lack of human oversight, and the possibility of hidden costs. For developers building or using bots, guides such as this expert resource on AI crypto trading bots can be useful: AI crypto trading bot GitHub — expert guide.

Examples: How typical margin scenarios interact with Shariah principles

Example 1: Borrowing USD to buy BTC with interest

A trader borrows $10,000 at a stated annual interest rate to buy BTC. The interest is due regardless of trade outcome. This arrangement contains riba and is widely considered impermissible.

Example 2: Perpetual swaps with variable funding rates

Perpetual contracts use periodic funding payments. These are not classic interest but functionally transfer value between longs and shorts. Some scholars view predictable funding flows that transfer value as problematic, while others see them as a mechanism tied to market balance. Context matters.

Example 3: Low-leverage margin with profit-and-loss sharing structure

If an investment platform pools investor funds and trades on a mudarabah basis (profit share, loss borne by capital owner) rather than lending at interest, some scholars may permit it. Transparency and contractual clarity are essential.

Common related keywords — used naturally

Throughout this article, readers may also search for phrases such as "is margin trading halal," "margin trading shariah," "is leverage trading haram," "Islamic ruling on margin trading," and "crypto margin trading and Islam." We will address these angles below.

What mainstream fatwas and institutions say

Several fatwas and scholarly statements have addressed margin trading, derivatives, and CFD trading. Summaries include:

- CFDs and derivatives are often ruled impermissible because they represent contracts where the seller does not own the underlying asset (lack of tahalul) and often involve interest and speculation.

- Margin trading that requires interest-bearing loans is commonly deemed haram.

- Some scholars have allowed short-term, low-leverage spot margin under tightly controlled conditions and no explicit interest, but this view is less common.

Because rulings depend on details and local Ilm councils, always consult a trusted local scholar or Shariah advisory body before making a judgment for your situation.

Practical checklist: How to evaluate a margin or leveraged offer

Before entering any margin/leveraged trade, use this checklist:

- Does the platform charge interest or guaranteed financing fees? If yes, this leans toward impermissible.

- Is there true ownership transfer of the underlying asset? Spot buying where ownership is transferred is more likely halal than synthetic contracts (CFDs, some futures).

- Are there automatic liquidations without mutual consent? Highly mechanical terms can raise gharar concerns.

- Is the activity speculative or akin to gambling? If the trade is primarily a bet on short-term price moves with leverage, many scholars consider it impermissible.

- Is the contract documented and transparent? Ambiguous or hidden fees increase the risk of non-compliance.

How traders can reduce Shariah risk if they want to stay compliant

If you want to trade while minimizing religious concerns, consider these measures:

- Prefer spot trading with clear ownership transfer and no borrowing.

- Avoid margin borrowing that carries explicit interest or financing charges.

- Use lower leverage (if unavoidable) and avoid instruments that are effectively derivatives without ownership.

- Choose platforms that offer Islamic or swap-free accounts and request contractual clarity. Note: "swap-free" marketing does not automatically mean Shariah-compliant; examine the contract and any hidden fees.

- Consider equity-like products based on profit-and-loss sharing (mudarabah and musharakah structures), if available and certified.

- Document and consult: get formal Shariah certification or a fatwa for the platform’s product whenever possible.

Halal alternatives to margin trading

Several alternatives may allow participation in markets without the Shariah concerns of margin trading:

- Spot trading: Buying and holding assets outright ensures ownership and usually avoids interest and speculative contract issues.

- Profit-and-loss sharing funds: Mudarabah or musharakah-based funds pool capital and share profit/loss rather than lending at interest.

- Staking and participation models: Some forms of staking may be structured as profit-sharing. Be cautious: not all staking is halal—review the token economics and agreement. For background on how automated trading and strategies affect outcomes, see advanced strategy guides like Top TradingView Strategies 2025.

- Halal-focused crypto products: A small but growing number of projects and funds claim Shariah compliance; verify certifications.

If you still choose to use margin: risk management and best practices

If after consultation you decide to use margin trading, take strict precautions:

- Use the lowest acceptable leverage to limit gharar.

- Keep clear records of financing fees and consult a scholar about any interest-like payments—some scholars recommend donating interest received to charity without claiming it as halal.

- Set stop-loss and position-size rules to avoid forced liquidations that might create unethical losses for counter-parties.

- Prefer regulated exchanges and ensure contractual transparency.

For traders who automate execution, learn the system thoroughly. Practical bot and exchange guides can help you understand risk timing and mechanics. For instance, read this Bybit automation walkthrough: How Bybit trading bot works — step-by-step, and this Bitget challenge strategies guide: Bitget trading challenge strategies.

Regulatory and tax considerations

Even if a particular form of trading is deemed halal, you must still comply with local financial regulations and tax laws. Trading platforms, leverage limits, and legal definitions vary by country. Consult financial and legal advisors in your jurisdiction. For general context on Islamic finance and regulation, Wikipedia offers an overview: Islamic finance — Wikipedia.

Case studies and emerging practices

Some fintech companies and exchanges are experimenting with Shariah-compliant crypto products and accounts that avoid explicit interest and structure fees differently. These models sometimes mimic profit-and-loss sharing or charge fixed service fees for platform access rather than interest on loans. Always verify third-party Shariah board approvals and read terms carefully.

For traders using advanced strategies and algorithmic systems, communities and resources provide strategy libraries and code. Before applying them to leveraged accounts, review ethical and contract implications. See practical developer resources like the AI crypto trading bot guide (GitHub-focused): AI crypto trading bot GitHub guide.

Quick FAQ — concise answers to common questions

Q: Is margin trading haram in all cases?

A: Not necessarily in all cases, but many forms of margin trading are considered haram because of riba, gharar, or maisir. The exact ruling depends on contract details, fees, and the nature of the instrument.

Q: Are perpetual futures haram?

A: Perpetuals often involve funding mechanisms and do not transfer asset ownership; many scholars find them problematic. Opinions differ, so consult a qualified scholar.

Q: Can I use a "swap-free" account to trade margin ethically?

A: Swap-free accounts remove overnight interest but may introduce other fees. Swap-free doesn’t automatically equal Shariah-compliant—examine the fee structure and contractual terms or seek certification.

Q: What should I do if I already paid interest on margin trades?

A: Common scholarly advice is to assess the amount and, if deemed illicit gain (riba), donate equivalent amounts to charity without claiming it as zakat or halal income. Consult a local scholar for guidance.

Actionable next steps for Muslim traders

- Stop and review: If you currently use margin, pause and review your contracts for financing fees and unclear terms.

- Consult: Speak with a qualified Shariah scholar or advisory board, ideally one experienced in modern financial instruments and crypto.

- Choose halal pathways: Favor spot trading, verified Shariah-compliant funds, or profit-and-loss sharing products.

- Document and correct: If past transactions included riba, follow scholarly guidance on expiation (often donation to charity).

If you decide to trade (platforms and resources)

If, after due diligence and consultation, you choose to trade (especially spot trading or ethically structured products), consider regulated platforms and always prioritize transparency. Some popular exchanges that many traders use (for registering accounts) are listed below — note these are standard referral links, and using regulated, transparent platforms remains your responsibility:

- Open a Binance account (referral)

- Register at MEXC (referral)

- Sign up for Bitget (referral)

- Join Bybit (referral)

For strategy development and testing on those platforms, guides like the Bitget strategies article and Bybit bot walkthrough can help you understand mechanics before applying any leverage: Bitget Trading Challenge Strategies and How Bybit Trading Bot Works. If you build algorithmic tools, this comprehensive bot development guide is valuable: AI crypto trading bot GitHub guide.

Conclusion — balanced, practical guidance on "is margin trading haram"

To answer "is margin trading haram": there is no universal yes or no. Many forms of margin trading—especially those involving explicit interest, opaque fees, derivative-only contracts, or high speculation—are considered haram by mainstream scholars. However, nuanced situations exist where structured, transparent, profit-and-loss sharing arrangements or fully Shariah-compliant products may be permissible.

The best path is to analyze the contract, avoid guaranteed interest, minimize speculative leverage, and consult qualified Shariah scholars. Where uncertainty remains, prioritize safer halal alternatives like spot trading or certified Shariah-compliant investment vehicles. For traders who automate strategies, ensure your tools and platform terms align with your ethical and religious obligations—use developer and strategy resources for due diligence, such as the TradingView strategy guide linked here: Top TradingView Strategies 2025.

Further reading and authoritative resources

- Riba — Wikipedia (overview of Islamic prohibition of interest)

- Islamic finance — Wikipedia (general principles and contracts)

- Investopedia — Margin (practical finance overview)

- AAOIFI (standards for Islamic financial institutions)

If you want, I can prepare a tailored checklist to evaluate a specific exchange’s margin terms, review contractual clauses you provide, or draft a set of questions to take to your local Shariah scholar. Would you like help reviewing a particular platform or contract?