How to Know Forex Signals: Practical Guide

Author: Jameson Richman Expert

Published On: 2025-11-05

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

How to know forex signals is a common question for traders who want to follow market opportunities without reinventing analysis every day. This comprehensive guide explains what forex signals are, how to evaluate their quality, where signals come from, practical methods to verify and backtest them, and a step‑by‑step checklist you can use before risking real capital. The article also points to tools, trusted resources, and red flags to avoid so you can make more confident, data‑driven decisions.

What are forex signals and why they matter

Forex signals are trade suggestions that specify an entry price, stop‑loss, take‑profit (or target), and often a timeframe. They can be produced by:

- Human analysts (manual signals)

- Algorithmic strategies, such as Expert Advisors (EAs) on MetaTrader

- Copy‑trading platforms or social trading services

- Hybrid services that combine algorithmic filters with human oversight

Signals matter because they convert market analysis into executable steps — saving time, teaching traders about trade structure, and enabling scaled trading (copying multiple strategies). But not all signals are equal; knowing how to know forex signals means evaluating credibility, performance, risk controls, and alignment with your trading style.

Types of forex signals

- Technical signals: Based on indicators (moving averages, RSI, MACD), chart patterns, or price action setups.

- Fundamental signals: Triggered by macro events, news releases, or interest rate differentials.

- Algorithmic/high‑frequency signals: Generated by models that scan many instruments for short‑term opportunities.

- Sentiment signals: Derived from order flow, positioning data, or retail trader sentiment.

- Hybrid signals: Combine technical and fundamental filters.

How to know forex signals: step‑by‑step process

To reliably know whether a forex signal is worth following, use this step‑by‑step framework:

- Identify the source and transparency

- Evaluate historical performance metrics

- Check risk management details

- Validate in demo/paper trading

- Confirm live execution and slippage expectations

- Monitor and audit ongoing results

1. Identify the source and transparency

Ask: Who is providing the signal? Are they a verified trader, a regulated firm, or an anonymous Telegram channel? Transparency matters. A reliable provider will disclose:

- Trade history (audit or verified account where possible)

- Win rate, average return, drawdown, and sample size

- Exact rules for entries and exits

- Risk settings (position sizing, stop loss, max concurrent trades)

Look for public track records on platforms that verify performance. If a provider uses screenshots only, be skeptical. For a primer on what signals are and basic definitions, Investopedia’s overview is useful: Investopedia — Forex Signal.

2. Evaluate historical performance metrics

Key metrics you should see include:

- Sample size: Minimum hundreds of trades preferred for short‑term strategies; months/years of history for longer horizons.

- Win rate: The percentage of profitable trades. Alone it’s misleading — combine it with risk‑reward ratio.

- Average risk‑reward (R): Average reward relative to risk (e.g., 1:2 means potential profit twice the risk).

- Sharpe / Sortino ratios: Risk‑adjusted performance metrics.

- Maximum drawdown: Largest peak‑to‑trough decline experienced.

Example: A signal service with a 60% win rate and a 1:1 risk‑reward is less attractive than a 45% win rate with 1:2 risk‑reward if drawdown and volatility are lower for the latter.

3. Check risk management details

A trustworthy signal will specify stop loss levels, position size rules (or a suggested % of equity per trade), and guidance on when to close early. Avoid signals that only give entry points without exits or risk guidance. Good signals also provide contingency guidelines for volatile news or outages.

4. Validate in demo/paper trading

Before using real funds, forward test signals in a demo account for several months. This helps you assess execution differences (slippage, spread), psychological comfort, and whether the stated performance holds up. Most brokers offer demo accounts; open one with a regulated broker or use institutional simulation tools.

5. Confirm live execution and slippage expectations

Real market conditions introduce slippage, partial fills, and higher spreads. Ask the provider for realistic slippage figures and test a small live allocation to measure real performance and order execution quality.

6. Monitor and audit ongoing results

Keep a journal and audit the signals monthly. Compare actual trades executed vs. signals and compute your own realized performance. If a service’s realized outcomes deviate markedly from advertised results, it’s a warning sign.

Tools and platforms for receiving and verifying forex signals

Most traders combine multiple tools to receive, verify and trade signals:

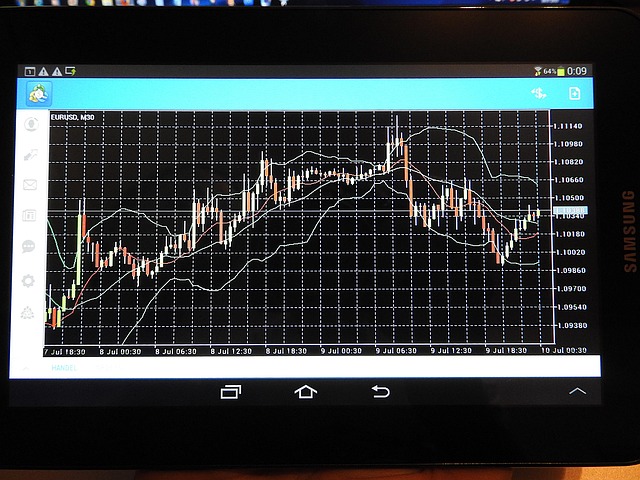

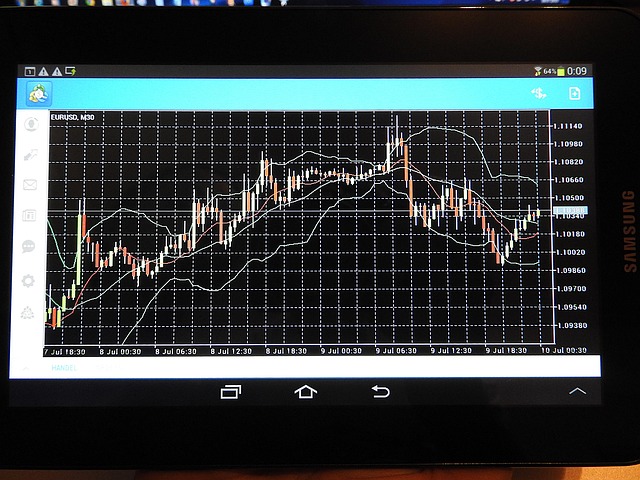

- Charting platforms: TradingView, MetaTrader 4/5 (MT4/MT5). For issues with alerts on TradingView, consult the TradingView alerts quick fixes.

- Execution platforms: MT4/MT5, cTrader, broker web terminals.

- Communication channels: Telegram, Signal, email, or API integrations.

- Backtesting tools: Strategy testers in MT4/MT5, TradingView Pine Script backtesting, or dedicated platforms.

- Order routers / PAMM / copy trading: For auto‑copying a signal provider to your account.

How to know forex signals — practical criteria checklist

Use this checklist before you subscribe or follow any signal provider:

- Is the provider transparent with audited or platform‑verified results?

- Does the performance sample size meet your minimum (e.g., 200+ trades or 12+ months)?

- Are entries, exits, and stop loss clearly stated?

- Is the risk per trade specified (e.g., 1% of equity)?

- Do you understand the underlying strategy (trend‑following, mean‑reversion, news‑driven)?

- Have you forward‑tested on demo for a minimum period (e.g., 3 months)?

- Does the provider disclose maximum historical drawdown?

- Are customer reviews consistent with claimed results (watch for fake reviews)?

Examples: Interpreting two sample signals

Example A (technical breakout):

- Pair: EUR/USD

- Entry: 1.0880 on 4‑hour close above resistance

- Stop loss: 1.0820 (60 pips)

- Take profit: 1.1000 (120 pips)

- Risk‑reward: 1:2

- Action: Position size = 1% of capital → calculate lots based on pip value

Example B (news‑driven swing):

- Pair: USD/JPY

- Trigger: BoJ surprise policy statement

- Entry: Market price after 30 minutes of volatility (avoid immediate knee‑jerk moves)

- Stop loss: 100 pips from entry

- Take profit: Trailing stop after 200 pips or key support/resistance

These examples show why clear stops and risk allocation matter. Always compute position size from risk amount and pip distance. For formulas and pip calculators, trusted educational resources like Wikipedia’s page on the foreign exchange market can help with context: Foreign Exchange Market — Wikipedia.

Validating signal quality: metrics that matter

When you analyze a signal provider, focus on these quantitative metrics:

- Profit factor: Gross profits divided by gross losses (greater than 1.5 is reasonable for many strategies).

- Expectancy: (Average win × win rate) – (Average loss × loss rate) — this shows average return per trade.

- Sharpe ratio: Annualized return divided by volatility; higher is better.

- Max drawdown: Lower is preferable for psychological resilience.

- Consistency across market regimes: Does the strategy perform in trending and ranging markets?

How to implement signals safely

Adopt these best practices:

- Use small allocations initially: Start with 1–5% of capital allocated to a new signal provider and increase only after satisfactory live results.

- Diversify across strategies: Combine uncorrelated signal strategies to reduce portfolio drawdown.

- Set maximum daily/weekly loss limits: Stop following signals for the day/week if losses surpass a pre‑set limit.

- Keep a trading journal: Document each signal, timing, slippage, and outcome for objective review.

- Use limit orders where applicable: To control entry price and slippage, though market orders may be necessary during high‑volatility news.

Common sources of forex signals and how to vet them

Common sources include subscription services, social trading platforms, broker signals, free Telegram/Discord channels, and independent analysts. Vet each type:

- Subscription services: Expect track record, trial periods, and refund policies.

- Social/copy trading: Check the trader’s historical stats on the platform and their consistency over different timeframes.

- Broker signals: Often convenient but may have conflicts of interest. Verify their neutrality.

- Free channels: Useful for learning, but be wary — many free groups act as funnels to paid services or signal scams.

Behavioral and psychological factors when following signals

Even high‑quality signals require trader discipline. Common psychological pitfalls:

- Overtrading when signals come fast — set max concurrent trades.

- Abandoning stop losses — stick to the plan to prevent large drawdowns.

- Chasing performance after a few wins — use systematic allocation rules.

- Confirmation bias — don’t ignore objective data if the strategy underperforms.

Advanced verification techniques

Advanced traders add layers of verification:

- Correlation analysis: Ensure the signal portfolio isn’t concentrated in highly correlated pairs that increase systemic risk.

- Monte Carlo testing: Simulate different trade sequences to estimate possible future drawdowns.

- Walk‑forward testing: Use out‑of‑sample testing periods to emulate live performance.

Red flags: when to avoid or drop a signal provider

Consider dropping a provider if you observe:

- Lack of verifiable trading records or audited statements.

- Unrealistic claims (e.g., “double your account monthly” without evidence).

- Pressure tactics (limited spots, urgent upsell, no refund).

- Inconsistent or impossible performance metrics (e.g., 99% win rate with high risk‑reward).

- Poor customer support and unclear trade rationale.

Cross‑market considerations: forex vs crypto signals

Signals in forex and crypto share principles, but markets differ. Crypto markets are generally more volatile and trade 24/7. If you follow both, learn how signal guidelines change with asset class. For example, this Bull Crypto Signals review and this Bitcoin signals guide discuss crypto signal specifics that may be instructive for forex traders exploring cross‑market strategies.

For structured learning across markets, a comprehensive strategy guide like the Ultimate Crypto Trading Strategy Book can help adapt analytics and risk methods from crypto to forex and vice versa. Also, staying informed with market guides, such as a market guide, supports macro awareness that impacts FX flows.

Real world testing: sample plan for 3 months

Use this sample plan to test any new signal service over a 3‑month period.

- Open a demo account and replicate signal entries for 1 month while logging every trade.

- Move to a small live account (1–2% of portfolio) for months 2–3 to measure real execution.

- Record metrics weekly: realized P&L, drawdown, win rate, average R, slippage.

- After 3 months, compare realized metrics to advertised stats and decide whether to scale up.

If you need a place to open demo or live accounts, popular exchanges and brokers include Binance, MEXC, Bitget, and Bybit. You can register using these links (affiliate/referral):

Using alerts and technical tools to track signals

Efficient signal following relies on robust alerts and automation. Common practices:

- Set alarms on TradingView for entry triggers and follow the provider’s signal message. If alerts fail or misfire, consult troubleshooting resources like the TradingView alerts quick fixes.

- Use API integrations or bridging software for automated order placement from a signal feed to your broker (ensure permissions and security).

- Log every alert and actual execution price to measure real vs expected slippage.

Legal and regulatory considerations

Some signal providers operate under regulation, others do not. If a provider takes client funds or offers managed accounts, ensure they are licensed in the relevant jurisdiction. For educational or advisory services, check the terms of service and disclaimers. Use regulators’ websites (e.g., the U.S. Securities and Exchange Commission, or your local financial regulator) to verify firm status.

Common FAQs about how to know forex signals

Q: Can I rely entirely on signals to trade?

A: Signals can be a major part of a strategy, but you should not outsource risk management. Combine signals with your own checks, position sizing, and stop loss discipline.

Q: How many signals per week is optimal?

A: It depends on the strategy’s timeframe. Day trading signals may provide many per week; swing strategies may offer a few. Focus on quality, not quantity, and set maximum concurrent trades.

Q: What’s a reasonable performance expectation?

A: Realistic, sustainable monthly returns for many professional strategies range from 1% to 10% depending on risk. Beware of promises of very high returns with little risk.

Q: How do I calculate position size from a signal?

A: Determine your risk per trade (e.g., 1% of account). Convert that to monetary risk, then divide by pip value × pip stop distance to get lot size. Many brokers and online calculators automate this.

Further reading and educational resources

To deepen your understanding, use authoritative resources and advanced strategy books. The following are helpful starting points:

- Foreign exchange market — Wikipedia

- Investopedia — Forex Signal

- Practical strategy books and guides: see resources such as the Ultimate Crypto Trading Strategy Book for cross‑market techniques.

- Crypto signal reviews and guides can also sharpen your verification skills (e.g., Bull Crypto Signals review and Bitcoin signals guide).

Conclusion — practical takeaway on how to know forex signals

Knowing how to know forex signals means combining objectivity, testing, and risk management. Don’t rely on flashy claims; insist on transparency, verify performance in demo and small live tests, measure slippage, and maintain a disciplined allocation plan. Use robust alert systems, backtesting tools, and ongoing audits to ensure that a signal service remains aligned with your goals. Finally, continuously educate yourself and diversify across strategies to reduce the chance that a single underperforming signal source will derail your capital.

If you’re exploring additional markets or troubleshooting technical issues, consult specialized resources: troubleshooting TradingView alerts (quick fixes), market guides (market guide), and practical strategy books (strategy book) to supplement your forex signal process.

Remember: A good signal helps you trade better — but disciplined risk management and independent verification are what keep you in the game long term.