Binance Trading Course Book PDF: Complete Guide to Mastering Binance

Author: Jameson Richman Expert

Published On: 2025-11-05

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Binance trading course book pdf is the ideal starting point for traders who want a structured, portable, and practical learning resource for trading on Binance. This article explains what a Binance trading course book PDF should contain, how to use it effectively, where to find legitimate downloads, and actionable study plans to turn knowledge into profitable trading habits. You’ll also find trusted resources, recommended readings, platform signup links, and advanced tips on applying course learnings with signal services and AI tools.

Why a Binance Trading Course Book PDF Is Valuable

PDF course books are portable, searchable, and easy to annotate. A high-quality binance trading course book pdf will combine theory (market structure, order types, indicators) with Binance-specific walkthroughs (spot, margin, futures, staking, and safety). PDFs let you study offline, revisit chapters quickly, and follow a step-by-step curriculum that integrates platform features and risk management best practices.

Benefits at a glance

- Portable learning: study on phone, tablet, or laptop.

- Searchable content: find concepts and strategies quickly.

- Printable worksheets and checklists for trade journaling.

- Binance-specific screenshots and how-to steps for faster execution.

- Long-term reference for evolving trading strategies.

What to Expect in a Quality Binance Trading Course Book PDF

Not all PDFs are equal. Look for a resource that balances foundational theory, practical steps, and tools you can use on Binance right away.

Essential sections

- Introduction to Crypto Markets — Basics of blockchain, Bitcoin, altcoins, and market cycles. (See high-authority resources like Bitcoin — Wikipedia for background.)

- Understanding Binance — Account setup, verification (KYC), security settings, API keys, and user interface walkthroughs specific to Binance.

- Order Types and Execution — Market, limit, stop-limit, OCO (One Cancels the Other), margin and futures mechanics.

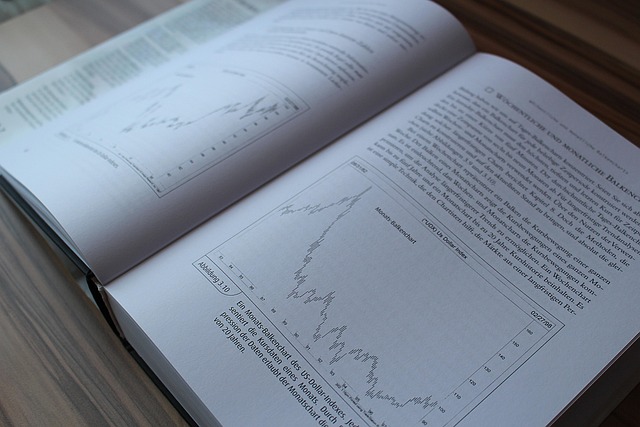

- Technical Analysis (TA) — Price action, candlesticks, support/resistance, moving averages, RSI, MACD. (See foundational TA concepts on Investopedia.)

- Risk Management — Position sizing, stop-loss placement, risk/reward ratios, diversification.

- Trading Psychology — Biases, journaling, emotional control, and routine building.

- Strategy Examples — Sample spot trades, swing trades, scalping approaches, and futures risk controls.

- Advanced Features — Binance Earn, staking, liquidity pools, launchpad, and cross-chain transfers.

- Checklists & Worksheets — Pre-trade checklist, trade log templates, and post-trade review forms.

How to Verify and Safely Download a Binance Trading Course Book PDF

Free PDFs pop up everywhere; verifying legitimacy is crucial to avoid outdated or malicious material.

- Check the author/source. Look for reputable educators, established crypto analysts, or recognized platforms.

- Verify publication date. Crypto changes fast — ensure the PDF is updated in the last 12–24 months.

- Scan for external references and citations. A good book lists sources and gives links to official docs.

- Prefer official or partnered resources. Platform guides from Binance Academy or official partners reduce risk of errors.

- Use antivirus/antimalware scanning before opening downloaded files.

To get started with Binance itself, you can register safely using this official referral link: Register on Binance.

Recommended Curriculum — 12-Week Study Plan Using a Binance Trading Course Book PDF

Below is a structured plan to convert the PDF into a practical program. The schedule assumes 6–10 hours per week and progresses from basics to intermediate trading skills.

Weeks 1–2: Foundations

- Read chapters on blockchain and market structure.

- Set up a Binance account and secure it (2FA, device whitelisting).

- Complete a KYC and practice navigating Binance UI in non-live mode.

Weeks 3–4: Basic Technical Analysis

- Study candle patterns, support/resistance, and trendlines.

- Practice drawing zones on historical charts.

- Use Binance Spot market to place small sample trades (0.5–1% of capital).

Weeks 5–6: Indicators & Strategy Building

- Learn moving averages, RSI, MACD, and ATR for volatility.

- Backtest simple moving average cross strategies on historical data.

- Create a trade plan template and a checklist from the PDF.

Weeks 7–8: Risk Management & Psychology

- Define position sizing rules (e.g., risk 1–2% per trade).

- Implement stop-loss rules and practice simulated trades.

- Start a trade journal and psychological notes after each session.

Weeks 9–10: Advanced Products

- Study margin and futures concepts — margin calls, funding rates, and leverage risk.

- Practice on testnet or with minimal capital while applying strict risk limits.

- Learn about staking and yield options in Binance Earn as passive alternatives.

Weeks 11–12: Strategy Refinement and Automation

- Refine a small set of strategies and backtest them.

- Explore automation via APIs, bots, or copy-trade features after solid live results.

- Integrate signal services or AI tools where appropriate (see recommended signals).

Practical Examples — How Lessons Translate into Real Trades

Concrete examples help bridge theory and practice. Below are two brief walkthroughs you might find in a comprehensive binance trading course book pdf.

Example 1: Simple Swing Trade on BTC/USDT

- Identify trend: BTC in clear uptrend on daily chart (higher highs, higher lows).

- Support zone: Draw daily support at $X (based on PDF guidelines for support detection).

- Entry: Place a limit buy near the support zone after confirmation candle.

- Stop-loss: 2–3% below the support level (calculated by ATR or fixed %).

- Target: 2–3x risk for a favorable risk/reward (set take-profit levels in Binance order panel).

- Position size: Use risk per trade rule (1% of account equity) to determine trade size.

Example 2: Short-Term Scalping on Altcoin

- Timeframe: 5–15 minute charts, high liquidity coin.

- Indicators: EMA 9 & 21, RSI under 70/over 30.

- Execution: Enter when EMA9 crosses above EMA21 and RSI rising from oversold levels.

- Exit: Tight stop (0.5–1%) and small target (1–2%) due to higher frequency.

Advanced Sections to Look for in a PDF

After mastering basics, the best PDFs include advanced insights that reduce common trader mistakes and enhance returns.

- Market Microstructure: How order flow, liquidity, and slippage affect fills.

- Derivatives Risk: Funding rates, contango/backwardation, and perpetual swaps mechanics.

- API and Automation: How to safely use API keys and build simple bot logic.

- Tax and Compliance: General overview of tax reporting and recordkeeping for crypto traders (link to your local tax authority for details).

- Security Best Practices: Cold storage basics, secure backups, and common scams to avoid.

Using Signals and AI with Your Course Learnings

Once you have a foundational strategy from your binance trading course book pdf, validated signals and AI systems can speed research and trade screening. But use them as tools — not replacements — for your strategy and risk controls.

Explore expert guides on top AI crypto trading signals to understand how to integrate them with your plan: Best AI Crypto Trading Signals 2025 — Expert Guide.

Combine signals with your PDF’s checklists: require at least 2–3 confirmation criteria from your strategy before placing a funded trade. Signals should reduce research time but never override your risk rules.

Keep Current: Why Regular Market Analysis Matters

Crypto markets evolve quickly. A static PDF is a foundation — not the entire solution. Regularly reading market analysis keeps your strategies relevant. For instance, keep an eye on Bitcoin price trends and expert scenario analyses: What Could Bitcoin Be Worth 2030 — Realistic Price Scenarios and live market updates: Bitcoin Price — Latest News & Market Analysis.

Where to Find High-Quality Binance Trading Course Book PDFs

Sources worth checking:

- Binance Academy — Official educational content and downloadable guides (search Binance Academy for PDF resources).

- Reputable trading educators — Well-known authors and published traders who provide supporting documentation and verified testimonials.

- Paid courses with PDF supplements — Often updated, include exercises, community support, and direct feedback.

- Books converted to PDF — Author-published guides or eBooks from established crypto authors. Verify rights and authenticity.

Also consider signing up on other exchanges for backup practical experience with these links:

Security Considerations When Using PDFs and Platforms

Security should be a priority every time you load a new PDF or sign up for a platform.

- Only download from trusted sources. Avoid unknown torrent sites and suspicious email attachments.

- Keep your OS and PDF reader updated to prevent vulnerabilities.

- Never share private keys or API keys without restricted permissions. Use read-only keys when connecting third-party tools for analysis.

- Enable 2FA (Google Authenticator or hardware keys) and avoid SMS-based 2FA where possible.

- Use strong, unique passwords or a password manager for every exchange account.

How to Convert the PDF Knowledge into Consistent Profitability

Reading a great binance trading course book pdf won’t guarantee profits. You must follow disciplined steps to transform learning into repeatable performance:

- Start Small: Deploy minimal real capital while you validate strategies in live conditions.

- Journal Every Trade: Record rationale, outcome, and lessons. Use PDF worksheets to standardize entries.

- Backtest & Forward Test: Use historical data for backtesting and small-scale forward testing to validate edge.

- Strict Risk Controls: Apply consistent position sizing and stop-loss rules from the PDF.

- Periodic Review: Monthly and quarterly performance reviews to cut or scale strategies.

- Continuous Learning: Update skills with new chapters, market analyses, and peer feedback.

Common Mistakes New Traders Make Despite Having a PDF Course

The presence of a quality course book solves many problems — but not all. Watch out for:

- Overleveraging: Using high leverage without proper risk management.

- Ignoring Slippage and Fees: Small trades may look profitable in theory but fail after fees and slippage.

- Overtrading: Trading beyond the strategy’s signals because of boredom or greed.

- Skipping Post-Trade Reviews: Failing to learn from mistakes by not journaling or analyzing losing trades.

- Blindly Following Signals: Using signal services without validating them against your rules.

How to Combine Official News and Analysis With Your PDF Learnings

Use authoritative market updates and macro context to inform trade selection and risk sizing. For example, broad Bitcoin trend changes can affect altcoin volatility and success rates for certain strategies. Regularly check reputable market analysis and scenario planning resources such as the articles linked earlier for longer-term perspective (2030 Bitcoin scenarios and live Bitcoin market updates).

Checklist: What to Look for Before Downloading Any Binance Trading Course Book PDF

- Is the author credible? (Trading track record, verifiable identity)

- Is the content dated and maintained? (Updated for the latest Binance features)

- Does it include practical exercises and checklists?

- Are there references to official documentation and external authoritative sources?

- Is there a community or support channel for questions?

Further Reading & High-Authority Resources

Deepen your knowledge with these authoritative sites:

- Investopedia — Comprehensive finance and technical analysis articles.

- Cryptocurrency — Wikipedia — Historical and conceptual background.

- Binance Academy — Official, free educational content with updates.

- Your local tax authority site — for regulations and reporting guidance.

FAQs — Quick Answers Traders Look For

Q: Is a free Binance trading course book PDF enough to learn trading?

A: A free PDF can provide solid foundations, but trading mastery requires practice, feedback, and ongoing education. Combine the PDF with demo trading, mentorship, or community feedback for best results.

Q: Can I trade using only what’s in a PDF?

A: You can start with PDF knowledge, but adapt it to live market conditions. Use checklists, small capital, and a journal to bridge the gap between theory and practice.

Q: Are Binance PDFs updated for new features like liquid swaps or staking?

A: Good PDFs are updated periodically. Verify the publication date and version history. Official Binance resources are more likely to reflect the platform’s latest features.

Q: How do I integrate AI or signals safely?

A: Validate signals against your strategy’s rules. Prefer read-only APIs, and avoid giving withdrawal permission to third-party services. Read this expert guide for integrating AI signals responsibly: Best AI Crypto Trading Signals 2025.

Final Action Plan — Start Learning Today

Follow these immediate steps to put a binance trading course book pdf into action:

- Download or purchase a recent PDF from a reputable teacher or Binance Academy.

- Register for an exchange account (start with Binance): Register on Binance.

- Work through the 12-week plan in the PDF and keep a trade journal.

- Validate any signal or AI tool you use with a small test capital and a clear rule set — consider exploring the expert AI guide here: AI Crypto Trading Signals — Expert Guide.

- Monitor long-term market themes via trusted analysis: Bitcoin 2030 scenarios and Bitcoin market updates.

Bonus: Alternate Exchanges for Practice

Having accounts on multiple exchanges can be helpful for liquidity, altcoin access, and comparing fee structures. Consider signing up on these platforms as well:

Conclusion

A binance trading course book pdf is a powerful starting tool for any trader. When chosen carefully and used with discipline, it provides the structure and checklists you need to learn efficiently, avoid beginner mistakes, and grow trading competence. Pair the PDF with practical account experience, strict risk management, and validation of signals or automation before scaling. Regularly consult authoritative market analysis and keep your PDF updated as you progress.

Ready to begin? Register on Binance here to practice the tutorials and exercises from your course material: Register on Binance. For alternative exchange access and liquidity exploration, consider MEXC, Bitget, or Bybit via the links above.