Free Forex and Crypto Trading Signals VIP App All In One: Signals, Bots & Copy Trading Guide

Author: Jameson Richman Expert

Published On: 2025-10-22

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

The market moves fast — you need speed, clarity, and reliable data. This guide explores how a free forex and crypto trading signals vip app all in one can give traders of all levels a unified edge: combining real-time signals, copy trading, automated bots, and risk controls in a single platform. You’ll learn what features matter, how to evaluate signal quality, legal and safety considerations, practical setup steps, and advanced tactics — all with actionable examples and trusted references to help you make confident decisions.

Why traders want an all-in-one VIP signals app

Traders increasingly prefer consolidated platforms that bundle forex and crypto signals, order execution, copy trading, and automation. The benefits include:

- Faster decision-making — one dashboard for alerts and execution reduces latency.

- Consistency — uniform risk rules and position sizing across assets.

- Lower friction — fewer APIs, fewer apps to monitor, fewer mistakes.

- Access to VIP signals — professionally curated or algorithmic signals often reserved for paid tiers.

- Automation options — move from manual copying to automated execution with bots or copy-trading integrations.

What “signals” mean: types and anatomy

Trading signals are actionable trade suggestions that typically include:

- Instrument (e.g., EUR/USD, BTC/USDT)

- Entry price

- Stop loss (SL)

- Take profit (TP) or profit targets

- Timeframe (scalp, intraday, swing)

- Confidence score or suggested risk sizing

Signals can be generated by:

- Human analysts (market commentary + entry ideas)

- Rule-based algorithms (technical indicators, pattern recognition)

- Machine learning models (statistical patterns across large datasets)

- Hybrid systems combining human oversight with automation

Key features of a high-quality “free forex and crypto trading signals vip app all in one”

When assessing a platform, prioritize the following capabilities:

- Verified performance history: audited track records, trade logs, Win/Loss ratios, drawdown data.

- Real-time alerts with low latency: immediate push notifications, SMS, or webhook support for execution.

- Multi-asset support: both major forex pairs and major crypto markets (BTC, ETH, altcoins).

- Automated execution options: trading bots, API integrations with brokers/exchanges, MT4/MT5 compatibility.

- Copy trading features: follow/proportionally copy experienced strategies with clear terms.

- Robust risk management tools: per-trade risk sizing, max drawdown limits, account-level stops.

- Backtesting and paper trading: test signals and strategies on historical and simulated markets.

- Security and compliance: encryption, secure API key handling (read-only keys for trading), transparent privacy policy.

- Education and analytics: trade explanations, rationale, chart snapshots and trade performance dashboards.

Evaluating signal quality: metrics and red flags

Not all signals are equal. Use these objective criteria:

- Track record length: preferably 6–12+ months of recorded trades across market cycles.

- Risk-adjusted return: Sharpe ratio, Sortino ratio, and maximum drawdown matter more than raw win rates.

- Trade transparency: timestamps, sizes, and order fills — avoid services with aggregated or anonymized “results.”

- Reproducibility: signals that can be backtested or paper-traded reproducibly are more trustworthy.

- Consistency across markets: a provider that performs only in bull markets may suffer in choppy markets.

- Reasonable promises: avoid services promising guaranteed returns; markets are inherently uncertain.

Red flags:

- Anonymous leaders with no verifiable track record.

- Pressure to deposit on specific exchanges or brokers without valid reason.

- Excessive leverage promotion and “no risk” messaging.

Free vs VIP: what to expect

Many apps offer tiered access: free core signals for new users, with VIP/paid tiers providing higher-frequency, lower-latency, or proprietary signals. Typical differences:

- Free tier: basic alerts, delayed signals, sample strategies, demo access.

- VIP tier: prioritized alerts, exclusive algorithms, direct chat with analysts, custom orders, and lower latency execution.

- All-in-one advantage: even when the app offers free access, combining a VIP option inside the same app reduces integration risk and simplifies scaling up.

How copy trading works and legal considerations

Copy trading lets you automatically replicate the trades of a strategy provider in proportion to your capital. It's convenient but requires governance. For a comprehensive review of legality, regulation, and compliance in copy trading, see this detailed guide on copy-trading legality and regulatory frameworks: Is Copy Trading Legal? Comprehensive Guide to Legality, Regulations and Compliance.

Key compliance points:

- Know-your-customer (KYC) and anti-money-laundering (AML) processes may apply to providers.

- Some jurisdictions treat copy trading as investment advice or portfolio management — meaning licensing may be required.

- Terms and conditions should clearly disclose fees, execution risks, and performance reporting standards.

How trading bots integrate with signals in 2025

Trading bots can automate execution of signals, perform order management, and manage risk. For a modern assessment of whether trading bots are effective and how they work in current markets, read this in-depth analysis: Do Crypto Trading Bots Work in 2025? An In-Depth Analysis.

Practical bot integration tips:

- Use read-only API keys where possible; never give withdrawal permissions to third-party systems you don't control.

- Start with paper trading to verify slippage, fills, and execution latency.

- Monitor position sizing logic: ensure it respects account risk parameters (e.g., 1–2% of equity per trade).

- Set automated safety mechanisms: circuit breakers and max daily loss limits.

Market dynamics: BTC, ETH and altcoins — what you must consider

When a combined forex & crypto signals app sends orders across asset classes, you must consider their distinct dynamics. Crypto markets typically have higher volatility, 24/7 trading, and differing liquidity profiles compared to forex. For deeper context on recent Bitcoin and Ethereum moves and their drivers, see this market dynamics analysis: Why Are BTC and ETH Dropping? In-Depth Analysis of Market Dynamics and Future Outlook.

Also, if you need detailed comparative insights between Bitcoin and altcoins when choosing which signals to prioritize, check this comparison: Bitcoin vs Altcoin — An In-Depth Comparison.

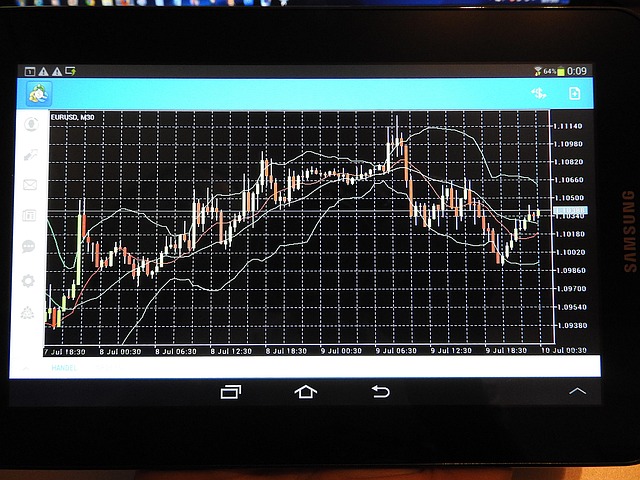

Real-time price and charting integration (example: ETH)

A good app should link signals with live price data and charts. For example, if a VIP ETH signal recommends an entry for ETH/USDT, the trader should see real-time feeds and annotated charts showing support/resistance, moving averages, and trade rationale. For ETH-focused market insights and live-price analysis, you can reference this ETH live price and market analysis resource: ETH Live Price — Binance In-Depth Analysis and Market Insights.

Step-by-step: how to set up a free-to-VIP all-in-one signals app

Follow this practical setup checklist to get started safely and efficiently:

- Create accounts on your selected exchange(s) (e.g., Binance, Kraken) and the signals app.

- Enable 2FA and secure passwords on all accounts. Use a hardware or strong TOTP app.

- Evaluate the app using demo mode or paper trading to confirm signals and execution behaviour.

- Link read-only API keys to the signals app for market data; use execution/API keys only for trusted automated execution and with strict IP whitelisting if supported.

- Set risk parameters (max trade size = 1–2% of account per trade, max daily loss triggers).

- Start with small capital on live trading to validate fills and slippage.

- Monitor performance weekly and keep a trading journal for each signal (entries, SL, TP, and outcomes).

Sample trade example (risk math)

Assume USD account equity = $10,000. Risk per trade = 1% = $100. Signal: entry BTC/USDT @ $60,000, stop loss at $58,500 (1,500 point risk). Contract sizing on spot:

- Per BTC risk = $1,500. To risk $100, buy size = $100 / $1,500 = 0.0667 BTC (~$4,000 notional).

- If it's a leveraged futures trade, calculate notional size so that unrealized P&L at stop does not exceed $100 after fees.

This demonstrates why automatic position-sizing features in VIP apps are valuable; they reduce manual calculation errors.

Backtesting and paper trading: why they matter

Before relying on VIP signals for live capital, perform backtests and paper trading simulations to verify signal performance over different market regimes. Good apps offer:

- Historical replay for the same signal rules

- Walk-forward analysis to check for overfitting

- Performance breakdown by asset, timeframe, and market condition

Document findings: win rate, average win/loss, expectancy per trade. Only proceed if risk-adjusted metrics meet your trading plan.

Security and privacy: best practices

- Use read-only API keys for analytics; only provide trading-enabled keys to trusted automation and avoid withdrawal permissions on third-party services.

- Use 2FA and a password manager for all accounts.

- Confirm provider encryption and data protection policies; review the privacy policy.

- Prefer platforms with SOC 2 or similar security attestations for enterprise-level protection.

Regulatory and tax considerations

Regulations vary by jurisdiction. Crypto signals, trading bots, and copy trading may trigger differing regulatory obligations. Always:

- Comply with local tax reporting rules — track realized P&L and provide transaction histories to your accountant.

- Check if the platform has obligations under securities or advisory laws where you reside.

- Refer to authoritative resources like financial regulators (for US: CFTC, SEC) or your local regulator for guidance.

How to spot scams and avoid them

Scammers often use glossy marketing promising outsized returns. Defend yourself by looking for:

- Proof of verifiable, timestamped trade history hosted on third-party trackers — not self-reported screenshots.

- Realistic performance metrics — extremely high win rates with low drawdowns usually indicate cherry-picked data.

- Clear refund and subscription terms. Avoid platforms that lock you into non-transparent recurring fees without trial options.

- Community feedback — search trading forums and verified reviews rather than testimonials posted only on the vendor's site.

Combining forex and crypto signals strategically

Combining signals across asset classes can diversify your strategy but requires prudence:

- Correlation awareness: some crypto and forex pairs may exhibit correlations during macro events — avoid unintentional directional concentration.

- Allocate by volatility: allocate smaller notional amounts to higher-volatility crypto signals and larger to stable forex pairs to balance risk.

- Timeframe alignment: ensure your portfolio blends short-term crypto scalp signals with longer-term forex or swing trades to reduce stress on execution systems.

Analytics and performance tracking

Vital metrics to monitor in your all-in-one app:

- Cumulative returns vs. benchmark

- Win rate and average win/loss ratio

- Maximum drawdown and recovery period

- Sharpe/Sortino ratios

- Execution metrics: average slippage and fill rate

Use CSV export and independent trackers to validate reporting — vendor dashboards can be helpful but should be audited.

Case study: using an all-in-one app to combine VIP crypto signals and forex hedges

Scenario: You receive a VIP signal recommending a short BTC position due to a macro risk-off event. Simultaneously, forex signals suggest a long JPY trade (safe-haven flows). An all-in-one app can:

- Send simultaneous alerts for BTC short and JPY long.

- Execute the BTC short via a futures bot with a 1% stop-loss and open a spot JPY long on a connected forex broker.

- Monitor portfolio-level exposure and reduce net USD risk by adjusting sizes automatically.

Outcome: faster, coordinated execution and a clearer view of correlated market exposure than juggling separate platforms.

Recommended additional reading and authoritative resources

To deepen your understanding of market fundamentals and trading tools, consult these trusted sources:

- Foreign exchange market — Wikipedia (overview of forex mechanics)

- Bitcoin — Wikipedia (history and fundamentals of BTC)

- Trading signals — Investopedia (definitions and examples)

- CFTC consumer protection — U.S. derivatives regulator (regulatory guidance)

Checklist: selecting the best free forex and crypto trading signals VIP app all in one

Before committing, run through this checklist:

- Is there a verifiable track record with third-party audit or tracker?

- Does the app provide both free trial access and clear VIP upgrade benefits?

- Are the API and automation integrations secure and compatible with your broker/exchange?

- Can you backtest signals and paper trade inside the app?

- Is the pricing transparent and are refund terms reasonable?

- Does the app clearly document compliance and regulatory stance?

- Are risk management controls available and easy to configure?

Conclusion — how to proceed prudently

An effective free forex and crypto trading signals vip app all in one can be a force multiplier for traders, reducing friction and enabling coordinated strategies across markets. However, success depends on rigorous evaluation: verify track records, test via paper trading, secure your accounts, and apply strict risk management. Use the resources and links above — including in-depth analyses on bitcoin vs altcoins, ETH market insights, copy trading legality, BTC/ETH market dynamics, and the role of trading bots — to vet providers and make informed choices:

- Bitcoin vs altcoin comparison: Bitcoin vs Altcoin — An In-Depth Comparison

- Copy trading legality and compliance: Is Copy Trading Legal? A Comprehensive Guide

- Why BTC and ETH are moving: Why Are BTC and ETH Dropping — Market Dynamics & Outlook

- ETH live price and analysis: ETH Live Price — Binance Analysis

- Trading bots in 2025: Do Crypto Trading Bots Work in 2025?

Start conservatively with a trusted provider, confirm reproducibility with paper trading, and scale only when live results match expectations and risk tolerance. With the right combination of technology, disciplined risk rules, and ongoing evaluation, an all-in-one VIP signals app can help streamline execution and improve trade consistency.

If you’d like, I can help you compare 3–5 specific platforms, create a personalized checklist based on your account size and risk tolerance, or draft a step-by-step test plan for paper trading a VIP signal strategy. Which would you prefer?