Free App for Demo Trading in 2025: My Journey and Insights

Author: Jameson Richman Expert

Published On: 2025-08-10

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

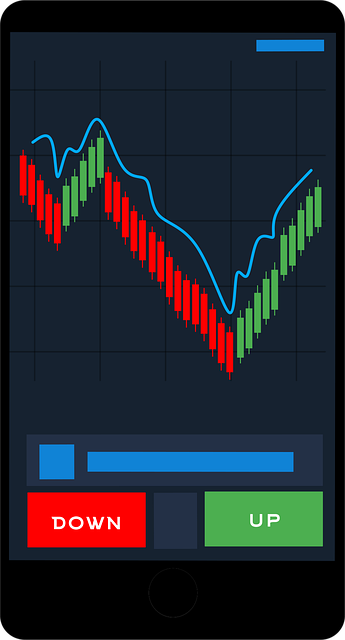

Discovering a reliable free app for demo trading in 2025 marked a pivotal turning point in my trading journey. Over the years, I meticulously explored a multitude of platforms, each promising innovative features, seamless interfaces, and realistic trading conditions. Yet, only a handful of these platforms truly delivered the fidelity, reliability, and educational value necessary to develop trading skills without risking real capital. My extensive testing involved evaluating data accuracy, execution speed, UI/UX design, and the depth of trading tools. Through hands-on experience and detailed analysis, I gained deep insights into what makes an effective demo environment, including the importance of realistic market simulation, comprehensive order types, and integrated risk management. In this comprehensive article, I will share my personal experiences, delve into critical features that distinguish top-tier demo platforms, and highlight some of the most reputable free demo apps available in 2025. Whether you are a beginner or a seasoned trader, this guide aims to help you optimize practice sessions, develop robust strategies, and prepare confidently for live trading.

Why a Free Demo Trading App is Essential for Every Trader

In the rapidly evolving landscape of modern financial markets—spanning forex, cryptocurrencies, stocks, commodities, and derivatives—the importance of a high-quality demo trading app cannot be overstated. For newcomers, entering these markets without prior preparation often results in costly mistakes, emotional trading, and diminished confidence. A free demo trading app provides a risk-free environment where traders can familiarize themselves with market mechanics, test hypotheses, and hone strategies without financial loss. Beyond basic practice, demo accounts facilitate psychological resilience, helping traders manage stress and avoid impulsive decisions during live trades. Furthermore, experienced traders leverage these platforms to experiment with innovative strategies, evaluate new tools, and understand how specific order types or leverage levels impact their positions. Ultimately, a well-designed demo platform bridges the gap between theoretical knowledge and real-world execution, significantly increasing the chances of success when transitioning to live trading.

My Trials with Various Demo Trading Platforms

My initial foray into demo trading involved trial-and-error with numerous platforms, each with distinct strengths and limitations. Early on, I encountered common issues such as delayed data feeds, which impaired strategy testing, and poorly optimized UI/UX, which hampered user experience. Some platforms oversimplified market conditions, failing to replicate the volatility and execution nuances of live trading, leading to false confidence. For example, I tested a prominent app that boasted extensive asset coverage but suffered from latency issues, making real-time decision-making unreliable. These experiences underscored the critical importance of data accuracy, execution speed, and intuitive interface design. Over time, I prioritized platforms offering customizable advanced charting tools, real-time market data, and robust order execution capabilities—features essential for realistic simulations. Additionally, I assessed educational resources, community forums, and the ability to simulate complex trading techniques such as leverage, short-selling, and multi-position management. Rigorous testing allowed me to identify platforms that not only mimicked live environments but also provided meaningful practice aligned with real trading conditions.

Top Free Demo Trading Apps in 2025

1. Binance

Binance remains a dominant force in the cryptocurrency trading arena. Its demo trading environment is a standout, offering a fully functional simulation that mirrors its live interface. Users can practice trading hundreds of cryptocurrencies with virtual funds, gaining exposure to real-time market data, advanced charting, and technical analysis tools. The demo supports complex order types such as limit, market, stop-limit, and OCO (One-Cancels-the-Other), enabling traders to simulate nuanced trading scenarios. The onboarding process is simplified—register through this link—and the platform’s comprehensive educational resources demystify cryptocurrency market dynamics, technical analysis, and risk management. For digital asset traders, Binance’s demo app provides an authentic, risk-free environment to refine strategies, understand market signals, and build confidence before transitioning to live trading. Its versatility makes it suitable for both novice crypto traders and seasoned professionals seeking to test high-stakes strategies.

2. MEXC

MEXC has garnered recognition for its extensive asset coverage, including a wide array of tokens—from established coins to emerging altcoins—and its user-focused design. Its demo trading platform delivers a seamless experience with real-time price movements, order execution, and margin trading functionalities. The environment allows traders to experiment with leverage, set stop-loss and take-profit orders, and practice executing high-volatility trades safely. I explored their demo via this referral link, discovering a platform that emphasizes both simplicity and depth. MEXC provides comprehensive educational content—tutorials on trading fundamentals, technical analysis, and risk management—ensuring beginners develop well-rounded skills. Its realistic simulation of volatile conditions and extensive asset options make MEXC a preferred choice for traders aiming to understand high-stakes crypto trading without exposure to real risk.

3. Bitget

Bitget distinguishes itself with a focus on derivatives and futures trading. Its demo platform offers an advanced yet user-friendly simulation of derivatives trading, including perpetual swaps, quarterly contracts, and adaptive margin features. The interface is clean but packed with powerful tools that enable practice in executing hedging, scalping, and arbitrage strategies. Access the demo via this link. The environment allows traders to understand the implications of leverage, manage risk ratios, and experience the impact of high volatility in a controlled setting. Bitget’s demo is especially valuable for those interested in mastering derivatives, providing an authentic, risk-free space to develop confidence before moving to live positions involving significant leverage and margin considerations.

4. Bybit

Bybit has established itself as a leader in crypto derivatives and futures trading. Its demo platform faithfully replicates the live trading environment, supporting perpetual contracts with real-time data feeds, advanced order types such as stop-limit, take-profit, and trailing stops. The interface is optimized for both novice and advanced traders, featuring customizable charts, in-depth analytics, and risk management tools. Practicing on Bybit’s demo enhanced my ability to execute trades under pressure, interpret complex signals, and manage leverage effectively. Sign up through this referral link to access the demo. Bybit’s environment facilitates testing of sophisticated strategies in a risk-free setting, making it ideal for traders looking to sharpen their skills with perpetual contracts and high-leverage trading.

Integrating Education and Practice for Better Results

While hands-on practice on demo apps is vital, pairing this with ongoing education accelerates learning and improves trading outcomes. I regularly leverage detailed guides, tutorials, and analytical resources. For example, resources like "What platform do you trade forex on" provide foundational knowledge on platform selection, features, and trading environments. Advanced chart analysis tutorials such as "How to open multiple charts in TradingView" enhance technical skills, pattern recognition, and strategic timing. Incorporating webinars, trading courses, and community forums further deepens understanding of market psychology, risk management techniques, and emerging trends. Remember, no demo app can substitute for structured learning—yet, when integrated effectively, they form a powerful foundation for long-term trading success.

Deep Dive into Trading Costs and Fees

Understanding trading costs is crucial when moving from demo to live trading, as real trades involve spreads, commissions, overnight financing, and other fees that impact profitability. I recommend reviewing "Binance trading fees vs Coinbase", which offers a detailed comparison of fee structures across major exchanges. Recognizing how these costs influence net gains—especially in high-frequency or scalping strategies—is essential for effective planning. Through my experience, I learned that even minor differences in trading fees can erode margins over time. Therefore, understanding fee models allows traders to select platforms with competitive rates, optimize order placement, and develop strategies that remain profitable after costs are accounted for. This knowledge ensures that traders are well-prepared for the realities of live trading and can adapt their approaches accordingly. Additionally, being aware of fee structures helps in calculating breakeven points and profit margins more accurately, a critical step for professional trading. It also encourages traders to refine their execution techniques—such as batching orders or choosing optimal times for trading—to minimize costs.

Final Thoughts

My journey with free demo trading apps in 2025 has been profoundly educational and confidence-boosting. They are invaluable tools for gaining practical experience, testing innovative strategies, and understanding market behavior—without risking real capital. After initial trial-and-error, I identified platforms that aligned with my trading style, educational needs, and risk appetite. The key to successful trading lies in consistent practice, continuous learning, and staying informed about market trends and platform updates. Use these free demo environments as your stepping stones, refining your skills and strategies until you’re ready for live trading. Remember, each experience—whether a gain or a setback—adds to your trading wisdom and prepares you for the unpredictable realities of live markets. The combination of realistic simulation, educational resources, and disciplined practice creates a resilient foundation for trading success.

For further insights into trading platforms, technical analysis, and fee optimization, explore these resources:

- What platform do you trade forex on

- How to open multiple charts in TradingView

- Binance trading fees vs Coinbase

Embark on your trading journey with confidence—practice diligently, continue learning, and adapt to market dynamics. The right combination of demo practice and education will set you on the path to sustained trading success in 2025 and beyond.