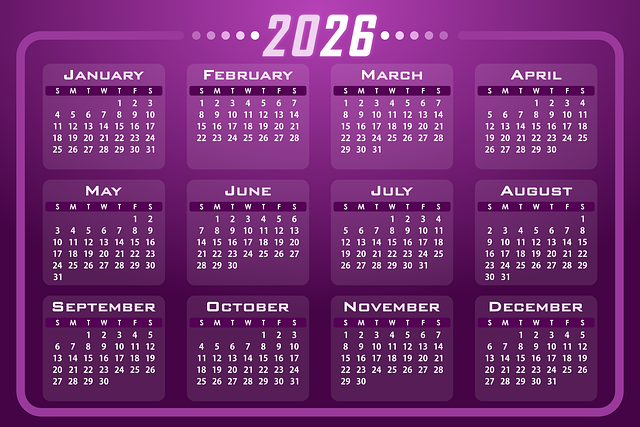

Ethereum Price Prediction 2026 in INR: A Comprehensive Analysis

Author: Jameson Richman Expert

Published On: 2025-08-10

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

The trajectory of Ethereum price prediction 2026 in INR (Indian Rupees) has become a focal point of interest for a broad spectrum of stakeholders, including retail investors, institutional players, blockchain developers, and financial analysts. As the second-largest cryptocurrency by market capitalization after Bitcoin, Ethereum has established itself as a pivotal platform within the decentralized finance (DeFi) ecosystem, enabling smart contracts, decentralized applications (dApps), and tokenization. The rapid technological evolution, expanding global and domestic ecosystem, and surging adoption rates have fueled speculation about Ethereum’s long-term valuation, especially within the context of India’s rapidly digitizing economy, tech-savvy population, and evolving regulatory landscape. This comprehensive analysis aims to explore the fundamental, technical, macroeconomic, and regulatory factors shaping Ethereum’s future in India and project its potential valuation by 2026 with in-depth insights.

Current State of Ethereum and Its Growth Drivers

Ethereum’s present position in the cryptocurrency landscape is underpinned by multiple robust growth drivers that collectively enhance its long-term valuation prospects:

- Technological Upgrades and Ecosystem Maturation: The transition to Ethereum 2.0 (also known as Serenity) marks a significant evolutionary step addressing critical issues such as scalability, energy consumption, and network security. This upgrade replaces the energy-intensive proof-of-work (PoW) consensus with proof-of-stake (PoS), drastically reducing energy usage—addressing environmental concerns—and lowering operational costs. The implementation of sharding techniques allows the network to process multiple transactions in parallel, exponentially increasing throughput and reducing latency, thus enabling Ethereum to handle millions of transactions per second in future iterations. The introduction of eWASM (Ethereum WebAssembly) is poised to optimize smart contract execution speed and efficiency. These innovations are designed to support mass adoption and enterprise-grade applications, positioning Ethereum as a scalable, sustainable blockchain solution.

- Decentralized Finance (DeFi) Ecosystem Expansion: Ethereum remains the backbone for the DeFi revolution, hosting a majority of dApps involved in lending, borrowing, asset management, yield farming, and decentralized exchanges. The exponential growth of DeFi protocols fuels demand for ETH as a utility token used for transaction fees, staking, and governance. In India, with a large underbanked population and increasing smartphone penetration, DeFi solutions could bridge financial gaps, promoting inclusion and boosting demand for ETH-based platforms. The proliferation of user-friendly DeFi interfaces and Layer 2 solutions further enhances accessibility and scalability, fostering greater adoption.

- NFT and Digital Ownership Market: The boom in Non-Fungible Tokens (NFTs), built upon Ethereum’s ERC-721 and ERC-1155 standards, has created a new paradigm in digital ownership, art, collectibles, and virtual assets. This surge in NFT trading increases transaction volume on Ethereum, raising gas fee revenues and reinforcing ETH’s utility as a transactional medium. Given India’s growing creative economy—comprising artists, musicians, and virtual entrepreneurs—the tokenization of assets and digital rights management via Ethereum could generate substantial new revenue streams and increase on-chain activity, thus positively influencing valuation.

- Institutional and Corporate Adoption: Major corporations, financial institutions, and governments are increasingly exploring Ethereum’s platform for developing private blockchains, supply chain solutions, identity management, and enterprise applications. This institutional confidence can lead to larger transaction volumes, strategic partnerships, and enterprise-level deployments, providing a significant uplift in Ethereum’s on-chain utility and, consequently, its price in INR.

Factors Influencing Ethereum’s Future Price in INR

Regulatory Environment in India

The Indian regulatory landscape has historically been cautious, with a mix of bans, restrictions, and ongoing discussions. Initial prohibitions and uncertainty caused short-term market disruptions, but recent signals indicate a shift towards a more balanced approach. The government is actively engaging in consultations to develop a clear, comprehensive framework for digital assets—potentially including recognition of cryptocurrencies as legal assets, taxation policies, and licensing procedures. The establishment of a regulatory sandbox for blockchain innovation and potential approval of crypto exchanges operating under compliance could boost institutional participation and investor confidence. A supportive regulatory environment reduces volatility, mitigates risks, and creates a fertile ground for Ethereum’s sustained growth in INR terms.

Macroeconomic and Market Trends

India’s macroeconomic trajectory—characterized by a rapidly expanding digital economy, increasing digital literacy, and a push towards a cashless society—creates a conducive environment for blockchain adoption. Factors such as high inflation, currency devaluation, and the need for secure cross-border transactions drive interest in cryptocurrencies as alternative assets and hedges. Additionally, rising FDI in fintech, remittances, and digital infrastructure projects under government initiatives like Digital India amplify blockchain relevance. Globally, monetary tightening, geopolitical tensions, and technological breakthroughs influence investor sentiment, impacting capital flows into cryptocurrencies like Ethereum. The interplay of these macro trends underscores the potential for Ethereum’s valuation to benefit from India’s economic shift toward digital and decentralized solutions.

Technological and Ecosystem Development

The successful deployment and widespread adoption of Ethereum 2.0, coupled with Layer 2 scaling solutions such as Optimistic Rollups, ZK-Rollups, and Plasma, are pivotal for addressing current scalability bottlenecks and high gas fees. These solutions are designed to significantly reduce transaction costs, increase throughput, and improve user experience, making Ethereum more accessible to mass users—including India’s diverse demographic profile. Cross-chain interoperability solutions such as Polkadot, Cosmos, and LayerZero facilitate seamless integration across different blockchains, expanding Ethereum’s utility beyond its native ecosystem. As these technological advancements mature, they will accelerate adoption within India’s digital sectors, enterprise applications, and individual users, exerting upward pressure on ETH’s INR valuation.

Forecasting Ethereum’s Price in INR for 2026

Forecasting Ethereum’s exact price in 2026 involves a blend of quantitative models, qualitative insights, and macroeconomic considerations, acknowledging inherent uncertainties:

- Quantitative Valuation Models: Techniques like the stock-to-flow (S2F) model, which measures scarcity relative to supply, have been used to project future valuations based on supply dynamics and halving events. Additionally, on-chain analytics—tracking transaction volume, active addresses, and network security metrics—help inform demand projections. Monte Carlo simulations provide probabilistic ranges based on market cycles and adoption trajectories. Analysts suggest that if Ethereum sustains technological upgrades and ecosystem expansion, it could surpass 500,000 INR, with potential for even higher valuations driven by institutional interest and network effects.

- Market Sentiment & Adoption Trajectory: Widespread adoption of Ethereum-based services across Indian fintech, enterprise blockchain projects, and consumer markets could serve as catalysts for price appreciation. As Ethereum becomes integral to India's digital infrastructure—encompassing payments, identity verification, and asset management—its utility and demand are likely to increase substantially, pushing the valuation upward.

- External and Unpredictable Factors: Regulatory shifts, macroeconomic shocks, technological breakthroughs, or geopolitical tensions can cause significant market fluctuations. Unforeseen events—such as security breaches, macroeconomic crises, or regulatory clampdowns—may either accelerate growth or cause setbacks, emphasizing the importance of vigilant risk management.

Potential Price Scenarios

- Optimistic Scenario: Favorable regulations, mass adoption of DeFi and NFTs, technological maturity, and robust institutional backing could propel Ethereum past 500,000 INR, potentially establishing a new valuation benchmark in India and setting the stage for exponential growth.

- Moderate Scenario: Incremental adoption, continuous technological upgrades, and positive regulatory signals may see ETH trading between 300,000 and 400,000 INR, reflecting steady but sustainable growth.

- Pessimistic Scenario: Regulatory restrictions, security vulnerabilities, macroeconomic downturns, or delays in technological upgrades could suppress growth, keeping prices below 200,000 INR and potentially leading to stagnation or retracement.

Strategic Investment Tips for Indian Investors

To maximize gains and mitigate risks in this volatile asset class, investors should adopt a disciplined, informed approach:

- Diversification: Spread investments across various cryptocurrencies, traditional assets, and emerging sectors to hedge volatility and systemic risks.

- Choosing Reliable Platforms: Use reputed exchanges like Binance, MEXC, Bitget, and Bybit, which offer features such as fiat-to-crypto conversions, staking, futures trading, and advanced security protocols. Select platforms compliant with Indian regulations, with strong customer support and transparency.

- Continuous Education & Market Monitoring: Stay updated on regulatory developments, technological advancements, macroeconomic indicators, and market sentiment through credible news sources, community forums, and expert analyses.

- Risk Management Strategies: Employ tools like stop-loss orders, appropriate position sizing, and predefined investment caps. Avoid over-leverage, given the high volatility and sector unpredictability.

In-Depth Analysis of Investment Opportunities in India

India’s legislative and economic environment is witnessing rapid transformation, with recent discussions on comprehensive digital asset regulations, taxation policies, and licensing frameworks. The government’s initiatives—such as Digital India, Make in India, and the push for a cashless economy—are conducive to blockchain adoption. These strategies aim to foster innovation, increase transparency, reduce corruption, and promote financial inclusion, positioning Ethereum as a key infrastructure component for digital transformation.

The demographic dividend—young, tech-literate, and increasingly connected—presents a unique opportunity for Ethereum-based platforms to penetrate retail, enterprise, and government sectors. The rise of blockchain startups, increasing venture capital investments, and collaborations with global giants signal a robust ecosystem growth. Development of local crypto exchanges and payment gateways tailored for Indian consumers could further ease access, stimulate demand, and foster a vibrant, locally anchored blockchain ecosystem.

Conclusion: Outlook for Ethereum in India by 2026

While market unpredictability remains, the long-term prospects for Ethereum in INR terms are promising. Continued technological innovation, expanding adoption across DeFi, NFTs, and enterprise blockchain solutions, coupled with clearer regulatory frameworks, could position Ethereum as a transformative asset within India’s digital economy. Investors should approach this landscape with a disciplined, research-driven mindset—embracing diversification, risk management, and ongoing education. As Ethereum scales, innovates, and increasingly integrates with India’s digital infrastructure, it holds the potential to reach new valuation heights by 2026, transforming from a speculative asset into a cornerstone of India’s blockchain-driven future.