2025 Best Free Trading Signals Forex Crypto Guide

Author: Jameson Richman Expert

Published On: 2025-10-30

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Looking for the best free trading signals forex crypto in 2025? This comprehensive guide explains how to find, evaluate, and use free forex and crypto signals safely and profitably. You’ll learn how signals are generated, which free sources to trust, how to backtest and manage risk, and practical examples that show step-by-step placement and sizing. Links to trusted resources, exchange sign-ups, and further reading are included so you can act immediately.

What are trading signals and why free signals matter

Trading signals are trade ideas that specify entry, stop-loss and target levels, or indicate a directional bias and timeframe. They can be generated by human analysts, algorithmic systems, or community-driven signals (e.g., Telegram groups). Free signals are important because they lower the barrier to entry for new traders and allow experienced traders to test providers before committing to paid services.

Signals fall into several types:

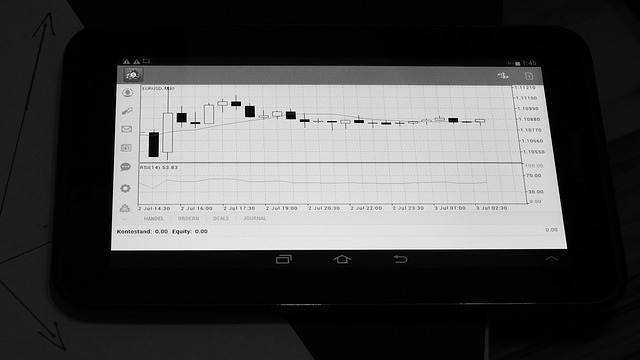

- Technical signals — based on price action, indicators (RSI, MACD, moving averages), pattern recognition.

- Fundamental signals — informed by macro events, earnings, regulatory news or on-chain metrics for crypto.

- Algorithmic signals — quantitative or AI-driven models that scan markets programmatically.

- Sentiment signals — derived from order flow, social media, or derivatives positioning.

How to evaluate the best free trading signals forex crypto providers

Not all free signals are equal. Use this checklist to evaluate providers before you risk capital:

1. Transparency and verifiable performance

Reliable providers publish historical trades and clear performance metrics. Look for verified track records (e.g., on Myfxbook for forex or public trade histories for crypto). Beware of cherry-picked screenshots without timestamps.

2. Clear risk management rules

A good signal includes recommended stop-loss and position sizing rules or at least risk-per-trade guidance. If a provider cannot articulate risk management, this is a red flag.

3. Source and methodology

Trust providers that explain their methodology—technical indicators, timeframes, and data sources. If a signal is purely "pump" driven or vague, avoid it.

4. Community feedback and moderation

Check reviews from independent sources (forums, Reddit, TradingView comments). Active moderation in signal channels may indicate responsible behavior.

5. Latency and execution practicality

Some signals are meant for rapid execution (scalping) while others are longer-term. Ensure the signal’s timeframe matches your account (retail or margin) and latency capability.

Where to find the best free trading signals forex crypto in 2025

Below are reliable places to source free signals. Always cross-check signals on your charts before execution.

- Exchange market analysis pages — Leading exchanges publish market updates and educational signals. For example, Binance and Bybit publish analyses; you can register at Binance here: Binance registration and Bybit here: Bybit invite.

- TradingView public ideas — Real-time charts and published trade ideas, with author histories.

- Telegram and Discord groups — Many reputable groups provide free signals (typically to funnel users to paid tiers). Validate by sampling and seeing if trades are time-stamped and rational.

- Broker/Exchange social features — Copy-trading platforms and leaderboards on MEXC (MEXC signup) and Bitget (Bitget signup) can surface top performers.

- Open-source algorithm libraries — GitHub projects and quant forums publish free signal algorithms you can run locally.

Trusted reading and specialized reports

Use high-quality analysis to complement signals. For example, consider institutional-style write-ups about assets you trade. If you trade crypto, these deep dives can add context:

- XRP market dynamics and future outlook — great for XRP traders wanting fundamental & technical synthesis.

- Ethereum live prices and smart trading strategies — useful when receiving ETH/altcoin signals.

- Bitcoin 2025 expert forecasts — helps calibrate macro bias for BTC signals.

- Bitget trade history and optimization — a practical read if using Bitget trade history to evaluate signals.

- Bybit platform guide 2025 — helps execute signals effectively on Bybit.

How to verify free signal performance — a step-by-step process

- Collect signal history: Save announced entry, stop and target levels with timestamps.

- Reconstruct trades: Use historical price data (e.g., from exchange CSVs or TradingView) to replicate trades and record outcomes.

- Calculate performance metrics: Compute win rate, average reward-to-risk (R), maximum drawdown, and expectancy. Expectancy = (win rate * average win) - (loss rate * average loss).

- Assess sample size: At least 50–100 trades are needed to judge a strategy’s consistency; smaller samples are noisy.

- Look for survivorship and selection bias: Confirm provider isn’t only publishing winning trades.

Quick example: measuring expectancy

Suppose a signal provider issues 100 trades. 55 wins with average +1.8R and 45 losses with -1R. Expectancy = 0.55*1.8 - 0.45*1 = 0.99 - 0.45 = 0.54R per trade. That is an excellent edge. But remember, 100 trades over several years vs 100 trades in weeks might mean different risk exposures.

Practical trade example: following a free crypto signal

Here’s a step-by-step example of following a hypothetical signal for BTC on a 4-hour timeframe:

- Signal: Buy BTC at 62,000; Stop-loss 60,800 (-1.94%); Target 66,000 (+6.45%).

- Risk per trade: 1% of account equity. Account equity = $10,000. Risk = $100.

- Position size calculation: Risk per BTC = entry - stop = 1,200. Contract size = $100 / 1,200 = 0.0833 BTC.

- If target reached: profit = 0.0833 * (66,000 - 62,000) = $333.3 -> Reward-to-risk = $333.3/$100 = 3.33R.

- Execute the trade, set a stop-loss order and a take-profit order or manage manually with trailing stops.

This illustrates disciplined sizing and how the same signal will have different dollar outcomes for different account sizes.

Free vs paid signals — when to upgrade

Free signals are great for learning and initial testing. Consider upgrading if:

- You need lower-latency execution for high-frequency strategies.

- Verified and consistent positive expectancy with a proven audit trail.

- Access to tools that automate execution (copy-trade, APIs) and reduce manual latency.

- Paid tier includes detailed risk management and live analyst support that generates measurable improvement.

Many traders use a hybrid approach: start with free signals to learn, then allocate a small portion of capital to paid providers with a strong, verified edge.

Risks, scams, and red flags in free signal services

Be cautious of the following:

- Guaranteed returns — No legitimate signal can promise fixed returns.

- Unverified screenshots — Screenshots without timestamps or platform links are suspect.

- Pressure to upgrade — Hard-sell tactics to push users to expensive subscriptions or funnels.

- Shared account trades — Some services ask for account control (copy trading with withdrawal rights). Never grant withdrawal permissions.

- Overleverage encouragement — If signals encourage unsustainable leverage, avoid them.

Risk management best practices when using free signals

Signal quality is only one piece. How you size, diversify, and manage trades determines long-term outcomes. Key rules:

- Risk no more than 1–2% of capital per trade (or less for volatile crypto strategies).

- Define position sizing by volatility (ATR-based) for consistent risk.

- Use stops; signals without stop guidance warrant extra caution.

- Limit correlated exposure across signals — avoid stacking many long BTC trades at once.

- Monitor maximum drawdown and stop trading if drawdown exceeds your pre-defined threshold.

Using exchanges and tools to execute signals efficiently

Many traders pair signal services with fast execution platforms and tools. Popular exchanges and tools for crypto and forex trading include:

- Binance — deep liquidity for spot and derivatives. Register here: Binance.

- MEXC — supports copy trading and derivatives. Register here: MEXC.

- Bitget — copy trading and trade history tools (see Bitget trade history analysis linked above). Sign up: Bitget.

- Bybit — strong derivatives offering and platform features (read the 2025 Bybit guide above). Join Bybit: Bybit.

Use exchange APIs and trading bots to automate signal-following, but thoroughly backtest automation and restrict API permissions (e.g., disable withdrawals).

Backtesting free signals — a practical workflow

Backtesting a signal provider involves re-creating each signal in historical data and measuring outcomes. Here’s a practical workflow:

- Collect all signal entries/stops/targets and timestamps into a spreadsheet.

- Download historical OHLC data for the exact timeframe and instrument from a trusted source (exchange CSV, TradingView, or data providers).

- Simulate trade execution accounting for spreads/slippage—crypto spot has tight spreads, but derivative funding and liquidity issues can affect execution.

- Record trade outcomes, calculate drawdowns and performance metrics (Sharpe ratio, expectancy, max consecutive losses).

- Repeat the process across different market regimes (bull, bear, sideways) to test robustness.

Combining multiple free signal sources — portfolio approach

Rather than following a single provider, treat signals as a portfolio. Advantages:

- Reduces single-provider risk.

- Provides diversified strategy exposures (momentum, mean-reversion, macro-driven).

- Allows ensemble filtering—execute only when multiple independent providers agree.

Example ensemble rule: execute a long only if a technical signal (TradingView idea) and a sentiment signal (derivatives funding negative) both align. This increases probability at the cost of fewer trades.

Regulation, taxes, and legal considerations

Understand jurisdictional rules. Forex signals used via regulated brokers may fall under local financial regulation. Crypto regulations vary widely—check your local tax authority and regulatory guidance. For background information on forex markets see Wikipedia’s foreign exchange page: Foreign exchange market (Wikipedia). For crypto basics, see: Cryptocurrency (Wikipedia).

Advanced tips to get the most from free trading signals

- Use conditional orders: Pre-place stop and take-profit orders to remove emotional interference.

- Time your entry: Confirm signal with a shorter timeframe candle close to reduce false entries.

- Monitor newsfeeds: Avoid trading signals that conflict with imminent macro events (e.g., rate decisions).

- Keep an observation-only period: Follow a provider for several weeks in a demo or small live account before scaling.

- Track metrics constantly: Maintain an automated P&L tracker (Google Sheets or trading journal software) to spot deterioration early.

Signal-following strategies for different trader profiles

Design your approach based on time availability and risk appetite:

1. The beginner (part-time, small capital)

- Use free educational signals with clear stops (demo-trade first).

- Limit exposure to 0.5–1% per trade.

- Focus on longer timeframes (4H, daily) to reduce noise.

2. The systematic trader (quant/intermediate)

- Backtest signal algorithms and implement position sizing via Kelly/Fixed Fraction.

- Use automated execution on exchanges (API keys with trade-only permission).

- Monitor model decay and rebalance strategies.

3. The active trader (full-time)

- Combine multiple free and paid signals with rigorous risk protocols.

- Leverage platforms with high liquidity and low latency (Binance, Bybit, Bitget, MEXC).

- Maintain a robust trade journal and periodic performance audits.

SEO and ongoing learning resources

Keep learning with trusted resources. For signal definitions and trading concepts consider Investopedia’s overview of trading signals: Trading signal definition (Investopedia). For macro and regulatory updates, consult official sources such as the U.S. Securities and Exchange Commission: SEC.

Summary checklist: choosing and executing with the best free trading signals forex crypto

- Verify provider transparency and performance.

- Confirm clear stop-loss and position sizing rules.

- Backtest a representative sample before live allocation.

- Practice strict risk management: typically 1% or less per trade.

- Use reputable exchanges and protect API keys (Binance, Bybit, Bitget, MEXC).

- Diversify across providers and avoid concentrated directional bets.

- Document every trade in a journal and calculate expectancy regularly.

Useful next steps — get started safely

1) Create demo accounts and practice trade signal replication. 2) Open accounts with reputable exchanges to test live execution (register at Binance: Binance, MEXC: MEXC, Bitget: Bitget, Bybit: Bybit). 3) Read focused asset analyses to inform your bias (see the crypto deep dives and platform guides linked above).

Final thoughts

Free trading signals can be a powerful tool when used with discipline, verification, and adequate risk management. The best free trading signals forex crypto in 2025 are those that are transparent, verifiable, and complemented with solid execution and position sizing rules. Use the methods and resources in this guide to vet providers, automate safely, and continuously monitor performance. With patience and process, free signals can become a valuable component of your trading toolkit.

Further reading and analysis: explore the in-depth market pieces cited earlier for asset-specific context — XRP analysis, Ethereum strategies, Bitcoin 2025 forecasts, Bitget trade history optimization, and the 2025 Bybit platform guide — to pair signals with broader market understanding.