Which Apps Are Good for Forex Trading

Author: Jameson Richman Expert

Published On: 2025-08-03

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Finding the optimal forex trading app can be a complex task given the proliferation of platforms, each with unique features, user interfaces, security protocols, and integration capabilities. As an experienced trader with years of hands-on exposure, I understand that selecting the right app is pivotal to achieving consistent success in the dynamic forex market. Over the years, I’ve tested numerous applications, faced various setbacks such as technical glitches and limited functionalities, and gained invaluable insights into what makes a trading app truly effective. This comprehensive guide aims to deepen your understanding of the most reliable and feature-rich forex trading apps, backed by detailed personal experiences, critical analysis of their functionalities, strategic tips, and considerations for integrating with reputable brokers to maximize your trading potential.

Understanding the Importance of the Right Forex Trading App

The foundation of successful forex trading is built upon the platform you choose. A high-quality trading app should seamlessly blend an intuitive user interface with powerful analytical tools, ensuring traders can execute timely decisions amidst volatile markets. Beyond basic functionalities, security features like end-to-end encryption, two-factor authentication (2FA), biometric login, and compliance with financial regulations such as FCA (Financial Conduct Authority), ASIC (Australian Securities and Investments Commission), or CySEC (Cyprus Securities and Exchange Commission) are essential to safeguard your capital and personal data. A good app also provides access to a broad spectrum of currency pairs, leverage options, real-time news feeds, economic calendars, and educational resources—elements crucial for both beginners and advanced traders.

My initial experiences with poorly supported or unstable apps underscored the importance of platform stability, quick order execution, and comprehensive features, which ultimately can significantly enhance trading efficiency, reduce errors, and improve profitability. Additionally, mobile responsiveness and cross-platform synchronization ensure you can monitor and execute trades from anywhere, an indispensable feature in today's fast-paced markets. Moreover, integration with third-party analytical tools, custom indicator support, and automated trading capabilities often distinguish top-tier platforms from less robust alternatives.

Top Forex Trading Apps Based on Experience and Features

MetaTrader 4 and MetaTrader 5

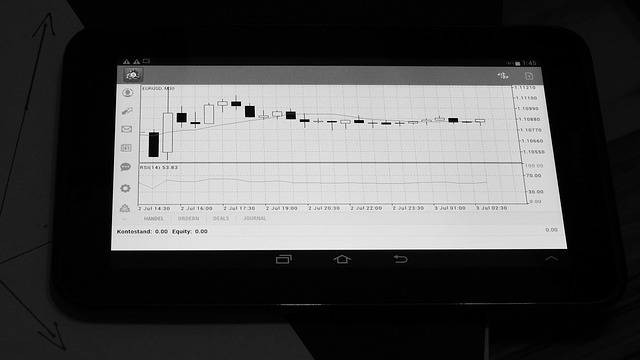

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are industry benchmarks in forex trading platforms, renowned for their robustness, extensive feature sets, and widespread broker support. Launched in 2005, MT4 remains favored among retail traders for its simplicity, stability, and an extensive ecosystem of custom indicators, scripts, and Expert Advisors (EAs). Its scripting language, MQL4, allows for automation of trading strategies, which is vital for executing emotion-free, disciplined trades. MT5, introduced in 2010, builds upon this foundation with support for multiple asset classes—forex, commodities, indices, and cryptocurrencies—and offers more advanced order types, depth of market (DOM) views, and improved back-testing and optimization tools via MQL5.

From my experience, MT4 is ideal for traders seeking a straightforward, reliable environment, while MT5 caters to more experienced traders requiring sophisticated analytical capabilities and multi-asset trading. Both support multi-language interfaces, customizable dashboards, and active community forums, which facilitate continuous learning and strategy development. Their mobile apps are equally feature-rich, allowing traders to manage positions on the go with minimal latency. Additionally, the platforms support automated trading through custom scripts and EAs, which can be optimized for different market conditions to enhance trading efficiency.

Thinkorswim by TD Ameritrade

Thinkorswim (TOS) is a professional-grade trading platform known for its comprehensive analytical suite and customization options. Although primarily popular among US-based traders, its international availability and rich feature set make it a versatile choice. TOS offers advanced charting tools, real-time economic calendars, news feeds, and paper trading environments for strategy testing—crucial for refining trading techniques without risking real money. Its robust risk management tools include various order types like stop-loss, take-profit, and complex OCO (One Cancels the Other). Integration with TD Ameritrade accounts ensures seamless trade execution and account management, while its extensive educational resources support traders at all skill levels.

During my trials, I appreciated the platform’s intuitive layout, the depth of analysis tools, and the ability to customize layouts for specific trading styles. Its multi-platform support (desktop, web, and mobile) ensures flexibility and constant connectivity, essential for responding swiftly to market movements. The platform’s scripting language, thinkScript, allows for creating custom indicators and alerts, providing a tailored trading experience that can adapt to individual strategies.

TradingView

TradingView revolutionizes technical analysis and social trading with its cloud-based platform, intuitive interface, and vibrant community. It offers a comprehensive library of over 100 indicators, drawing tools, and scripting capabilities via Pine Script—enabling traders to create custom indicators and automated alerts. Its extensive integration with brokers like OANDA, FXCM, and others allows users to perform analysis within TradingView and execute trades directly through connected broker accounts, streamlining workflows.

I rely heavily on TradingView for its powerful charting, real-time data, and social features—such as idea sharing, market sentiment discussions, and strategy collaborations—that foster continuous learning. Additionally, the platform's multi-device support ensures you can monitor markets from desktop, tablet, or smartphone. Its social feed helps traders gauge market sentiment and learn from community insights, making it an invaluable resource for both novice and professional traders who prioritize analysis, community engagement, and multi-broker connectivity. The platform also supports automated strategies through Pine Script, enabling semi-automated or fully automated trading workflows when integrated with compatible brokers.

Reliable Forex Brokers and How They Integrate With Apps

The choice of a reputable broker is just as critical as selecting the trading app itself. Trustworthy brokers such as Binance, MEXC, Bitget, and Bybit are renowned for their reliable infrastructure, regulatory compliance, and seamless app integration. For example, Binance offers a versatile platform supporting both crypto and fiat trading, with APIs compatible with MetaTrader and TradingView, enabling streamlined order execution and portfolio management.

MEXC and Bitget are noted for their high liquidity pools, user-friendly interfaces, and competitive spreads, making them suitable for high-frequency and scalping strategies. Bybit, initially a crypto derivatives platform, now offers forex trading with high-speed execution and advanced order types, appealing to professional traders. When selecting a broker, verify their regulatory status, customer support quality, and security measures such as cold storage for funds, SSL encryption, and transparent fee structures. My personal testing confirms that a well-regulated broker minimizes risks of fund misappropriation and ensures fair trading conditions, which are fundamental for long-term success.

My Personal Experience with Forex Trading Apps

In my early days of trading, I faced frequent app crashes and lag during volatile market moments, which resulted in missed opportunities and frustration. These experiences underscored the importance of platform stability, low latency, and reliable support. Over time, I found that pairing MetaTrader (MT4/MT5) for order execution with TradingView for detailed market analysis created a resilient and efficient workflow. Using reputable brokers such as Binance and Bitget, I experienced rapid trade execution, minimal slippage, and consistent connectivity.

I also learned the importance of practicing with demo accounts, which allow you to familiarize yourself with app features, test strategies, and refine risk management without risking real capital. Implementing disciplined routines—like setting predefined stop-loss and take-profit levels—helped me manage losses during unpredictable swings. Regularly reviewing trading journals and analytics helped me identify strengths and weaknesses, leading to progressively better results. These layered approaches, leveraging robust tools, broker reliability, and disciplined execution, have been instrumental in improving my trading consistency and confidence.

Strategies for Success in Forex Trading Using Apps

Achieving success in forex trading relies heavily on the effective use of trading apps aligned with strategic discipline. I recommend starting with demo accounts on platforms like MetaTrader or TradingView to develop and refine your strategies risk-free. Technical analysis techniques such as Fibonacci retracements, Bollinger Bands, MACD, and candlestick patterns are readily available within these apps. Staying informed with real-time economic calendars and news feeds embedded within your platform is critical, as macroeconomic and geopolitical events can cause sudden market shifts.

It is also essential to implement strict risk management rules—using stop-loss and take-profit orders—and maintain a detailed trading journal to evaluate your decisions and adapt strategies over time. Continuous education through webinars, online courses, and active participation in trading communities enhances your market understanding and decision-making skills. Applying disciplined routines and leveraging automation tools like Expert Advisors (EAs) or alerts can help maintain consistency and reduce emotional trading, ultimately leading to better profitability. Additionally, integrating AI-powered analytics and machine learning tools within advanced platforms can provide predictive insights and enhance decision accuracy.

Additional Resources to Enhance Your Forex Trading Skills

Continued education is vital for long-term success. Platforms like CryptoTradeSignals and similar services offer insights into trading apps, automated strategies, and crypto markets, which share analytical tools with forex platforms. Exploring crypto earning strategies, mining bots, and Telegram-based trading groups can diversify income streams and offer alternative trading opportunities.

Participating in webinars, online courses, and active trading forums helps you stay updated on market developments, regulatory changes, and technological advancements. Utilizing resources such as technical analysis courses, risk management workshops, and strategy development webinars can significantly elevate your skills, making you more adaptable to the rapidly evolving digital asset landscape. Many professional traders leverage AI-driven analytics and machine learning tools integrated within advanced platforms to gain a competitive edge, enabling data-driven decision-making and systematic trading approaches.

Conclusion

Selecting the right forex trading app is a fundamental step toward consistent profitability. My extensive experience underscores that pairing robust platforms like MetaTrader (MT4/MT5) with trusted brokers such as Binance, MEXC, Bitget, and Bybit creates a solid foundation for trading success. Remember, the app itself is merely a tool—your discipline, strategic planning, and continuous education are the true drivers of profitability. Take your time exploring different platforms, leverage demo accounts for practice, and stay informed on market news and technological updates. With patience, persistence, and the right combination of tools and knowledge, you can master forex trading and build a sustainable income stream. Happy trading!