What is Trading Software and How Will It Evolve by 2025

Author: Jameson Richman Expert

Published On: 2025-09-07

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

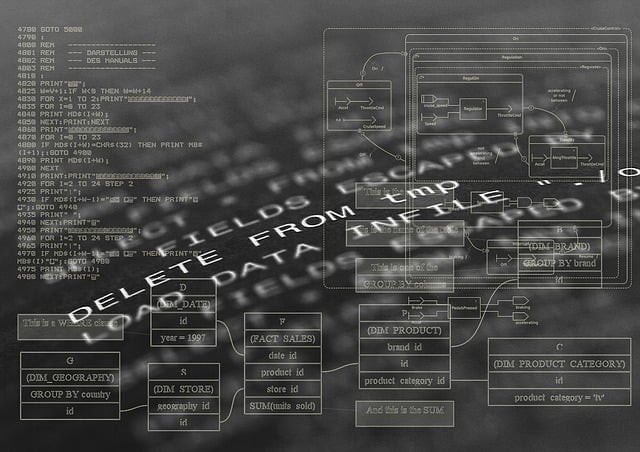

Trading software constitutes the vital digital infrastructure that underpins modern financial markets, transforming how traders and institutions interact with a multitude of asset classes. These advanced platforms have revolutionized trading and investment activities by enabling rapid, precise, and automated transactions across stocks, forex, cryptocurrencies, commodities, and derivatives. Beyond mere order execution, trading software provides a comprehensive environment for in-depth data analysis, development of trading strategies, risk management, and portfolio optimization. As technology advances at an unprecedented pace, understanding the sophisticated capabilities, evolving features, and future trends of trading software is crucial for traders and investors aiming to sustain a competitive advantage in an increasingly digitized, globalized, and interconnected financial landscape. Mastery of these tools not only facilitates strategic decision-making and mitigates risks but also unlocks new avenues for profit maximization across traditional and emergent markets.

Understanding Trading Software: Definition and Core Functions

At its core, trading software encompasses specialized computer programs designed to facilitate the buying, selling, and management of financial instruments such as stocks, forex, cryptocurrencies, commodities, and derivatives. These platforms serve as critical interfaces between traders and global financial markets, integrating multiple functionalities to streamline operations and enhance analytical prowess. Fundamental objectives include reducing trading latency, automating routine tasks, increasing accuracy in data interpretation, and optimizing trading performance through automation and high-speed data processing.

Leading industry analysts emphasize that effective trading software integrates features such as real-time market data feeds, sophisticated technical analysis tools, customizable charting systems, and comprehensive risk management modules. Seamless connectivity with brokerage APIs, liquidity providers, and data vendors is essential to ensure rapid order execution—particularly in volatile markets like cryptocurrencies, forex, and commodities. Modern platforms increasingly harness artificial intelligence (AI), natural language processing (NLP), and machine learning (ML) algorithms to interpret news sentiment, macroeconomic indicators, and social media trends. This integration offers traders predictive insights and strategic advantages, enabling proactive decision-making and more nuanced market analysis. The evolution of trading software thus reflects a shift towards more intelligent, data-driven, and automated trading ecosystems.

The Evolution of Trading Software: From Manual to Automated Trading

The trajectory of trading technology illustrates a profound shift from manual, human-dependent processes to highly sophisticated, automated, algorithm-driven systems. Early trading relied heavily on manual order submissions via telephone, handwritten logs, and human judgment—which constrained speed, scalability, and objectivity. The late 20th century marked a pivotal milestone with the advent of electronic trading platforms like the NASDAQ’s launch, which democratized access, reduced transaction times from minutes to milliseconds, and minimized human intervention in order execution.

Subsequent technological innovations led to development of complex platforms integrating real-time data streams, technical analysis tools, and automated risk controls. Today, the landscape is dominated by high-frequency trading (HFT) and algorithmic trading systems that utilize immense computational power, ultra-low latency networks, and sophisticated algorithms to execute thousands of trades within microseconds. These systems analyze market microstructure—such as order book dynamics and price micro-movements—and identify arbitrage opportunities or patterns invisible to human traders. Many of these algorithms are based on machine learning models that adapt over time, improving performance with exposure to more data inputs.

Looking towards 2025, trading software is poised to incorporate AI-driven adaptive algorithms capable of autonomous learning and real-time strategy evolution. Reinforcement learning techniques will allow systems to optimize decision parameters dynamically, adjusting strategies without human intervention as market conditions shift. Furthermore, sentiment analysis tools that scrape social media, news outlets, and macroeconomic reports will become more integrated within trading platforms, providing traders with a full-spectrum view of market sentiment and potential shifts—thus enabling more responsive, data-driven trades. This convergence of AI, big data analytics, and automation signifies a future where trading platforms not only execute strategies but also continuously learn and adapt to complex and volatile markets.

Types of Trading Software and Their Key Features

1. Retail Trading Platforms

Retail trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, Thinkorswim, and NinjaTrader are designed primarily for individual traders and smaller investors. These platforms feature intuitive user interfaces, extensive technical analysis libraries, and support for automated trading via Expert Advisors (EAs), scripts, and custom algorithms. They facilitate access to multiple asset classes—including forex, CFDs, cryptocurrencies, and commodities—within an integrated environment.

Cutting-edge features include multi-timeframe chart analysis, real-time news feeds, social trading functionalities, and direct API integration for third-party indicators and trading bots. Recent technological enhancements have introduced cloud-based AI tools that assist in trade setup optimization, backtesting, strategy development, and automated trade management. These innovations lower barriers to entry for novice traders while providing experienced traders with advanced analytical and automation tools, fostering increased efficiency and strategic depth.

2. Institutional Trading Systems

Institutional-grade platforms are built to meet the rigorous demands of large trading desks, hedge funds, proprietary trading firms, and market makers. They offer ultra-low latency order execution, high throughput capacity, and extensive data integration capabilities to support complex quantitative models and multi-asset strategies. These systems often involve colocated servers within exchange data centers, leveraging hardware accelerators such as FPGAs (Field-Programmable Gate Arrays), GPUs, and bespoke custom hardware to achieve nanosecond-level execution speeds.

They incorporate sophisticated risk management tools, regulatory compliance modules, and real-time analytics dashboards. Features include scenario analysis, stress testing, order routing optimization, and automated compliance reporting—enabling large portfolios to operate at maximum efficiency while adhering to strict risk and regulatory standards. The focus on speed, accuracy, and compliance makes these platforms essential for high-frequency trading, arbitrage, and complex algorithmic strategies.

3. Cryptocurrency Trading Software

The explosive growth of digital assets has spurred the development of specialized cryptocurrency trading platforms such as Binance, MEXC, Bybit, and BitGet. These platforms support spot trading, futures, options, leveraged trading, yield farming, staking, and social trading communities—catering to the highly volatile, 24/7 crypto markets. They feature advanced order types—including stop-loss, take-profit, trailing stops, conditional orders, and layered orders—and integrate robust risk management tools tailored for crypto-specific risks.

Additionally, they often connect with decentralized finance (DeFi) protocols, decentralized exchanges (DEXs), liquidity pools, and yield farming platforms, allowing traders to participate in blockchain-based activities directly from the trading interface. Real-time analytics, on-chain data, and security features—such as multi-signature wallets and biometric authentication—are embedded to protect assets and facilitate informed trading in a rapidly evolving space. Many platforms also offer educational resources, community forums, and AI-driven insights to navigate the complexities of crypto markets efficiently.

Future Trends in Trading Software by 2025

The next few years will witness transformative shifts in trading technology driven by breakthroughs in AI, big data, blockchain, and user-centric design. These emerging trends will dramatically reshape traders’ interactions with markets and their strategic capabilities:

- AI and Machine Learning: Future trading systems will leverage increasingly sophisticated AI models—such as deep neural networks, reinforcement learning, and generative models—that adapt dynamically to market conditions. Such systems will autonomously optimize trading strategies, risk parameters, and position sizing in real-time, reducing reliance on static rules and manual adjustments. This evolution will enable more resilient and predictive trading environments.

- Integration of Big Data and Alternative Data Sources: The ability to analyze vast and diverse datasets—including social sentiment, macroeconomic indicators, satellite imagery, weather patterns, and news analytics—will become a core feature. These alternative data sources will provide traders with richer, more nuanced insights into market drivers, enhancing predictive accuracy and risk assessment.

- Blockchain and DeFi Innovation: Blockchain technology will continue to revolutionize trading via transparent, immutable, and decentralized transactions. Smart contracts will automate trade execution, order settlement, and liquidity provisioning—reducing counterparty risks and operational costs. DeFi protocols will facilitate yield farming, liquidity mining, and cross-chain arbitrage, expanding profit opportunities beyond traditional markets.

- User-Centric Design and Personalization: AI-powered interfaces will tailor dashboards, notifications, and trading strategies to individual risk profiles, experience levels, and objectives. Enhanced customization and intuitive designs will democratize access to sophisticated trading tools, making advanced strategies accessible to novices while providing depth for experts.

- Enhanced Security and Regulatory Compliance: As cyber threats evolve and regulatory requirements tighten across jurisdictions, future platforms will incorporate biometric authentication, blockchain-based identity verification, end-to-end encryption, and automated compliance checks. These features will ensure asset safety, data integrity, and legal adherence, fostering trust in digital trading ecosystems.

How New Traders Can Benefit from Advanced Trading Software

For newcomers entering the trading arena—especially by 2025—leveraging advanced trading software can significantly accelerate learning curves, risk awareness, and profitability. These platforms offer detailed analytics, robust backtesting environments, real-time risk management tools, and AI-driven insights that promote disciplined, data-informed decision-making. Automated trading features reduce emotional biases, ensuring execution aligns with pre-set strategies and risk parameters.

Platforms like Binance, Mexc, BitGet, and Bybit now incorporate AI-driven strategy builders, educational modules, and community insights that empower beginners to develop effective, adaptable trading approaches with minimal exposure to risk. Demo accounts and simulated environments enable novices to practice strategies without financial consequences, fostering confidence and mastery before live trading. Access to comprehensive tutorials, community support, and AI recommendations facilitates a smoother transition into active trading, making sophisticated tools accessible even to those with limited experience.

Conclusion

In conclusion, trading software has undergone a remarkable transformation—from manual, labor-intensive processes to highly intelligent, automated platforms that enhance speed, analytical depth, and user engagement. By 2025, these systems are expected to become more adaptive, personalized, and secure—equipping traders of all levels with unprecedented tools to navigate complex, volatile, and fast-changing markets. Staying abreast of technological innovations and integrating cutting-edge trading platforms into daily routines will be essential for maintaining a competitive edge. Embracing these advancements will enable smarter decision-making, more effective risk management, and the ability to capitalize on emerging opportunities within the rapidly evolving global financial ecosystem.