Unlocking the Secrets of Crypto Trading Signals on Telegram: A Comprehensive Guide to Oxford Crypto Signals

Author: Jameson Richman Expert

Published On: 2024-12-30

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

The world of cryptocurrency trading has significantly expanded, introducing numerous platforms, tools, and strategies for traders to maximize their returns. Among these tools, trading signals have emerged as crucial resources for making informed decisions. In this article, we will delve into the dynamics of crypto trading signals on Telegram, specifically focusing on **Oxford Crypto Signals**, while providing insights into the broader landscape of Telegram crypto signals.

The Rise of Telegram as a Trading Signal Platform

Telegram has gained notable traction among crypto traders due to its fast communication capabilities and the ability to create private groups. This platform allows traders to receive real-time signals and analyses from experts, enabling them to react quickly to market changes. Its privacy features and user-friendly interface make it a favorite for both novice and expert traders alike.

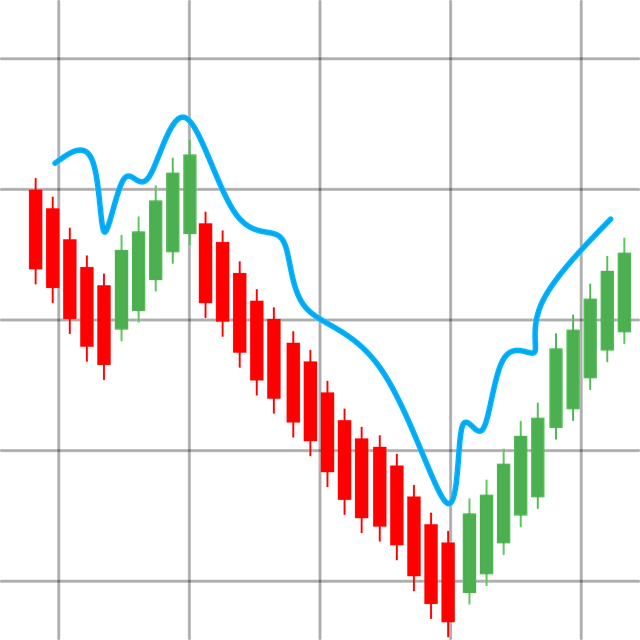

What Are Crypto Trading Signals?

Crypto trading signals are indicators that suggest when to buy or sell a cryptocurrency. These signals typically include details like entry points, exit points, and stop-loss levels, aiming to empower traders to make informed decisions in a volatile market. Understanding these signals can significantly demystify the trading process.

Key Elements of Trading Signals

- Entry Point: The price level at which a trader considers opening a position.

- Exit Point: The price level at which the position should be closed to secure profits.

- Stop-Loss: A tool to prevent excessive losses and manage risk effectively.

Exploring Oxford Crypto Signals

Among the many crypto signal providers, **Oxford Crypto Signals** stands out for its commitment to delivering reliable trading signals. This service is known for its in-depth market analysis and educational resources, making it beneficial for both novice and experienced traders. Key features include:

In-Depth Market Analysis

The team conducts extensive research, analyzing market trends, historical performance, and potential catalysts before sending out signals. This allows traders to make educated decisions rather than relying solely on instinct.

Educational Resources

Oxford Crypto Signals emphasizes education by sharing tips, tutorials, and insights that explain the rationale behind their signals. This not only aids new traders but also enhances overall trading knowledge.

Community Engagement

The service promotes a collaborative environment where subscribers can share feedback and experiences, leading to improved accuracy and satisfaction within the community.

Benefits of Using Telegram for Trading Signals

- Real-Time Updates: Instantaneous sharing of signals enables traders to capitalize on market opportunities quickly.

- Accessibility: Traders can access signals from anywhere on their mobile devices, allowing for flexible trading.

- Anonymity and Privacy: Telegram offers a level of privacy for those who prefer to keep their trading habits confidential.

Navigating the World of Telegram Crypto Signals

As you explore different Telegram channels, consider the following elements to maximize your trading strategy:

Transparency and Credibility

Choose channels that are transparent about their performance metrics. Look for providers that offer a historical track record, showcasing accountability in their recommendations.

Choose the Right Niche

Some channels specialize in specific cryptocurrencies, while others cover a wider range. Align your choice with your investment goals for the best results.

Consider Subscription Models

While some Telegram signal channels are free, others require a subscription fee. Evaluate whether the cost aligns with the potential returns, and consider trial periods to assess effectiveness.

Common Pitfalls to Avoid with Crypto Trading Signals

While Telegram channels provide valuable information, traders should remain vigilant about potential pitfalls:

Blindly Following Signals

One of the biggest mistakes is to follow signals without conducting personal research. Always analyze market conditions to understand why a signal was generated.

Overtrading

Traders can easily fall into the trap of overtrading due to the fast pace of signals. Stick to a well-defined trading plan and avoid impulsive reactions to every signal.

Ignoring Stop-Loss Orders

Protecting your capital should always come first. Establish risk-to-reward ratios and leverage stop-loss orders to manage risk effectively.

Conclusion: Making the Most of Telegram Crypto Signals

In conclusion, trading signals on platforms like Telegram offer traders a powerful means to access critical market insights. With services like **Oxford Crypto Signals** leading the way, traders can significantly enhance their strategies. However, it's vital to combine these insights with personal analysis and maintain disciplined trading practices for long-term success.

For further learning and valuable resources, consider visiting: