Understanding Binance Trading Chart Live and Its Significance

Author: Jameson Richman Expert

Published On: 2025-08-20

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

The Binance trading chart live feature stands as a fundamental pillar for cryptocurrency traders aiming to gain a comprehensive and instantaneous view of market movements. In an environment characterized by rapid fluctuations, high volatility, and vast data streams, real-time charting becomes indispensable for making informed trading decisions. Binance’s sophisticated charting system integrates a broad spectrum of analytical tools, customizable interfaces, and dynamic visualization options, thereby empowering traders—from novices to professional strategists—to interpret complex market signals with clarity and precision. As one of the world’s largest and most reputable crypto exchanges, Binance uniquely combines deep liquidity, robust security protocols, and advanced technical features, facilitating swift responses to market opportunities while effectively managing risk.

Beyond mere price tracking, Binance’s live trading charts function as an interconnected analytical ecosystem. They enable in-depth assessments of trading volumes, recognition of emerging trend patterns, technical formations, and momentum shifts. These insights are critical for developing and executing resilient trading strategies. In the volatile landscape of cryptocurrencies such as Bitcoin, Ethereum, and a multitude of altcoins—where price swings can be sudden and severe—the ability to accurately interpret live chart data offers traders a decisive edge. Such analytical acuity supports not only profit maximization but also prudent risk mitigation by signaling potential reversals, breakouts, or breakdowns well in advance, allowing traders to act proactively rather than reactively.

What Is a Binance Trading Chart Live?

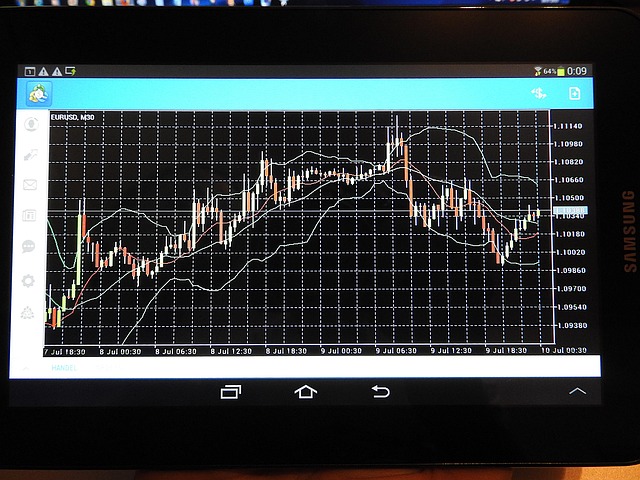

A Binance trading chart live is a real-time, visual representation of the current state of cryptocurrency markets displayed directly on the Binance platform. This dynamic chart continuously updates with each new trade, providing traders with an immediate snapshot of price levels, bid-ask spreads, trading volumes, and market depth. The charts support various visualization styles—such as candlestick, line, bar, and Heikin-Ashi—each suited to different analytical preferences and strategic approaches. For instance, candlestick charts are particularly appreciated for their detailed depiction of open, high, low, and close prices within specific timeframes, facilitating trend analysis, pattern recognition, and signal validation.

Complementing these visual styles is an extensive arsenal of technical indicators including Moving Averages (MA), Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands, Fibonacci retracements, and volume profile analyses. These tools enable traders to dissect market momentum, identify overbought or oversold conditions, and pinpoint key support and resistance levels—crucial for timing entries and exits. The fusion of real-time data and analytical overlays creates a nuanced understanding of market dynamics, helping traders execute strategies with greater confidence and accuracy.

Binance’s charting system is highly customizable—traders can select from various timeframes ranging from ultra-short 1-minute charts ideal for scalping, to weekly or monthly views suited for long-term trend analysis. Overlaying multiple indicators and annotations, such as trend lines, Fibonacci levels, or pattern markers, enhances technical analysis precision. These features facilitate meticulous trade planning, disciplined decision-making, and adaptability across different trading styles and market conditions.

Why Is a Live Trading Chart Important for Cryptocurrency Trading?

Timing is arguably the most critical factor in successful cryptocurrency trading, and live charts serve as the primary source of real-time market intelligence. They allow traders to react promptly to sudden price movements, geopolitical developments, macroeconomic shifts, or breaking news that can dramatically influence digital asset prices within seconds. For day traders and scalpers, immediate access to current data is essential for executing timely entries, exits, and adjustments to risk management orders like stop-loss and take-profit levels. The real-time nature of these charts minimizes slippage and reaction lag, ensuring that trades are based on the most accurate and current information available.

Furthermore, live trading charts are invaluable for confirming technical signals. For example, a breakout pattern accompanied by increased trading volume and a bullish candlestick formation provides stronger validation for initiating a buy order. Similarly, divergence signs between price action and momentum indicators such as RSI or MACD can serve as early warnings of potential reversals, prompting traders to tighten stops or exit positions proactively. When integrated with fundamental analysis—such as news releases, regulatory updates, or macroeconomic reports—these charts offer a comprehensive picture of market sentiment, enabling traders to adapt strategies with higher precision and confidence.

Features of Binance Trading Chart Live

- Real-Time Data: Ensures continuous, accurate updates reflecting every trade, order book change, and volume shift, providing an immediate snapshot of market conditions.

- Technical Indicators: Extensive suite including MACD, RSI, Bollinger Bands, Ichim-Ashi, Fibonacci retracements, volume profiles, and custom overlays for multifaceted analysis.

- Customizable Timeframes: Ranges from ultra-short 1-minute charts for scalping, to daily, weekly, or monthly charts for macro analysis, allowing traders to adapt to any trading horizon.

- Multiple Chart Types: Supports candlestick, line, bar, and Heikin-Ashi charts—each offering unique insights into trend detection, pattern recognition, and volatility assessment.

- Drawing and Annotation Tools: Features trend lines, support/resistance zones, Fibonacci levels, pattern markers, and other technical drawing tools for detailed analysis and strategic planning.

- Advanced Functionalities: Includes price alerts, multi-indicator overlays, multi-timeframe analysis, strategy backtesting, and automated trading signals to facilitate advanced trading approaches.

How to Use Binance Trading Chart Live Effectively

To maximize the utility of Binance’s live trading charts, traders should adopt disciplined, systematic routines. Begin with mastering core technical analysis patterns such as head and shoulders, double tops/bottoms, ascending or descending triangles, and candlestick formations like doji or engulfing patterns. Recognize how these formations evolve across different timeframes to understand their relevance in various trading contexts and scales.

Incorporate fundamental insights—such as macroeconomic data releases, regulatory developments, or project-specific news—that can significantly influence market sentiment. For example, a major partnership announcement or regulatory approval might trigger bullish candlestick formations confirmed by increased volume and positive momentum indicators on the chart, signaling a strategic point for entry.

Set up automated alerts for key signals—such as moving average crossovers, RSI overbought/oversold thresholds, Fibonacci retracement triggers, or trendline breakouts—to stay alert to market opportunities without the need for constant manual monitoring. These alerts promote disciplined trading, help prevent emotional decisions, and encourage adherence to your trading plan, significantly improving long-term performance and consistency.

Advantages of Using Binance Trading Chart Live

The primary advantage lies in access to precise, real-time market data, critical for executing high-frequency trading, day trading, or scalping strategies. The comprehensive suite of technical tools simplifies complex analysis, making sophisticated strategies accessible even for less experienced traders. Binance’s high liquidity ensures that chart data accurately reflects the true market state, minimizing slippage and enabling efficient order execution.

Additionally, Binance’s user-friendly interface, customizable dashboards, and rich analytical features streamline the trading workflow. Advanced functionalities like multi-chart layouts, backtesting strategies, and custom alerts allow traders to optimize their analysis, manage risks proactively, and enhance profitability. These features foster a learning environment where traders can continuously adapt and refine their strategies in response to evolving market conditions, a necessity in the dynamic crypto landscape.

Comparing Binance Trading Chart Live with Other Platforms

While Binance’s trading charts are renowned for their speed, depth, and user-centric customization, alternatives such as Mexc, Bitget, and Bybit offer distinctive strengths that cater to different trading styles. For example, Bybit specializes in derivatives trading with unique order types, leverage options, and risk management tools, making it appealing for high-leverage traders. Mexc emphasizes community engagement and innovative analytical features, supporting social trading and crowdsourced insights.

However, Binance’s competitive edge stems from its extensive asset coverage, deep liquidity pools, and infrastructure robustness, ensuring that live chart data remains accurate, timely, and reliable across a wide array of tokens and trading pairs. Its intuitive interface combines accessibility for beginners with advanced tools for professionals, making it a versatile choice for traders at all levels.

Getting Started with Binance Trading Chart Live

Getting started on Binance involves creating an account, which requires providing basic personal information and completing identity verification to meet regulatory standards. After registration, navigate to the trading interface and select your preferred trading pairs—such as BTC/USD or ETH/BTC—and access the live charts. Customization options are extensive: choose your preferred chart type, add technical indicators, set price alerts, and organize your workspace for optimized analysis.

For beginners, Binance offers educational resources, tutorials, and demo trading environments to practice without risking real funds. Dedicate time to understanding how to interpret live signals, utilize technical overlays, and incorporate fundamental factors into your analysis. Developing this familiarity is crucial for building confidence and honing your strategic approach over time.

Conclusion

The Binance trading chart live is an indispensable tool for modern cryptocurrency traders, offering real-time market data, versatile analytical features, and extensive customization options. Its precision and immediacy enhance decision-making, risk management, and profitability within the volatile crypto ecosystem. Mastery of Binance’s live charts, combined with disciplined trading practices, fundamental analysis, and continuous learning, positions traders to capitalize on opportunities while effectively managing risks.

Whether you are a beginner seeking to understand fundamental market signals or an experienced trader executing complex strategies, proficiency with Binance’s live trading charts significantly elevates your trading performance and confidence. Embrace this powerful analytical environment to develop a disciplined, informed, and adaptable trading approach aligned with your long-term goals.

Interested traders are encouraged to explore platforms like Binance, Mexc, Bitget, and Bybit to access their advanced charting tools, innovative features, and community support—all designed to support your trading journey and foster sustained success.