The Future of Crypto Trading: A Guide to Bots and Automation

Author: Jameson Richman Expert

Published On: 2024-11-05

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

In the rapidly evolving world of cryptocurrency, traders are constantly seeking tools and techniques to enhance their trading efficiency and profitability. With the advent of advanced technology, automated trading bots have emerged as a game-changer for many investors. This article aims to provide an in-depth exploration of crypto trading bots, specifically focusing on how they can be applied to popular platforms like Coinbase, the development of bots in Golang, and a look at the best free crypto trading bots available. Additionally, we will touch upon related topics such as understanding the potential of automated trading and a comprehensive guide to developing your own crypto trading bot.

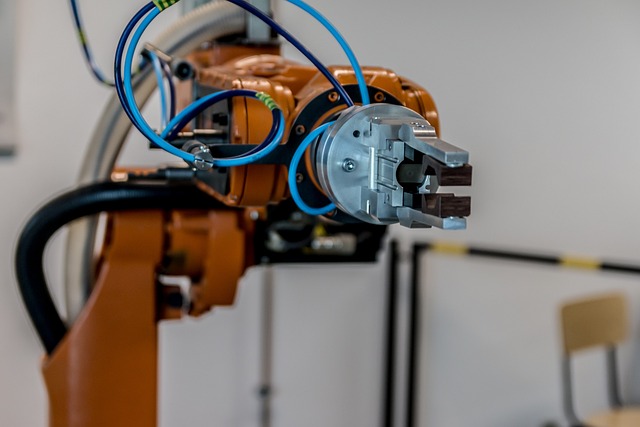

Understanding Buying Bots

The cryptocurrency market operates 24/7, which means that trading opportunities exist at all hours. Many traders find it challenging to keep track of market trends and make timely decisions, particularly those who may have other commitments during the day. This is where buy bots come into play. These bots are designed to automate the buying process, executing trades based on predetermined criteria.

When utilizing a buy bot, traders set specific parameters such as price thresholds, trading volumes, and other indicators that suggest a good moment to buy. The bot then monitors the market continuously, executing trades on behalf of the user when conditions are met.

Benefits of Using Buy Bots

- Speed and Efficiency: Bots can react to market changes in milliseconds, enabling them to capitalize on price fluctuations that human traders might miss.

- Emotionless Trading: Bots execute trades based on data and algorithms, removing the emotional elements that often interfere with human trading decisions.

- 24/7 Monitoring: Unlike human traders, bots can operate around the clock, allowing traders to take advantage of opportunities at any time.

In my opinion, the integration of buy bots into trading strategies could significantly enhance trading discipline and consistency. The human element in trading can lead to impulsive decisions which could be avoided through automation.

Crypto Exchanges with Bots

Various crypto exchanges support the use of trading bots, with some platforms even offering integrated solutions. One prominent example is Coinbase, a popular choice among traders due to its intuitive user interface and wide range of supported cryptocurrencies. The combination of Coinbase with trading bots opens new avenues for traders looking to automate their strategies.

Trading Bots on Coinbase

Coinbase permits the use of third-party trading bots, which means users can leverage various automation tools to optimize their trading strategies. Bots can access the Coinbase API, enabling them to perform trades, analyze market trends, and even conduct backtesting of strategies before deploying them live.

For those interested in building automatic strategies, programmers can also develop bots in programming languages like Golang, which is known for its efficiency and speed. Golang crypto trading bots are now becoming increasingly popular due to their robust performance and concurrency capabilities.

Advantages of Golang for Trading Bots

- Performance: Golang is known for its high performance, which is crucial for trading bots that need to make real-time decisions.

- Concurrency: Golang supports concurrent programming, which allows multiple trading strategies to be executed simultaneously without compromising on speed.

- Easy Integration: Its simplicity and ease of integration with APIs make it a great choice for developers looking to create custom trading solutions.

In the context of creating your own trading bot, if you wish to delve deeper, you might consider checking out a resource like Developing Your Own Crypto Trading Bot: A Comprehensive Guide. This guide provides step-by-step instructions tailored for both beginners and experienced programmers, detailing how to conceptualize and build a trading bot.

Best Crypto Trading Bots for Coinbase

When it comes to identifying the best crypto trading bot for Coinbase, several options stand out. These bots vary in terms of features, pricing, and user experience. Below is a brief overview of a few popular trading bots that can be integrated with Coinbase:

1. 3Commas

3Commas is a widely used trading bot that allows users to automate their trading strategies on various exchanges, including Coinbase. It offers features such as Smart Trading, DCA bots, and copy trading, giving users a significant amount of flexibility in managing their portfolios.

2. Coinbase Pro Bot

Coinbase Pro is geared for more advanced users and offers a robust API that allows traders to create custom bots to manage trades effectively. Utilizing a Coinbase Pro bot can help traders take advantage of lower fees and more features that pleasingly cater to experienced traders.

3. Cryptohopper

Cryptohopper is another popular trading bot that functions well with Coinbase. It offers a user-friendly interface and a cloud-based service, allowing users to trade from anywhere. With features like strategy design and backtesting, Cryptohopper is particularly appealing for those who want to craft their unique trading strategies.

Free Crypto Trading Bots

For those just starting, finding a best crypto trading bot for free can be highly advantageous. Several platforms offer free versions with limited features. One of the notable mentions is:

1. Zignaly

Zignaly offers a free tier that is highly functional for beginners looking to get their feet wet in automated trading. It supports copy trading, allowing inexperienced traders to mirror the strategies of successful traders.

My opinion is that while free bots are excellent for practicing, users should be aware of limitations regarding functionalities. To consistently achieve optimal trading results, investing in a premium bot version can provide additional features that enhance trading effectiveness.

The Rise of Automated Trading

Over recent years, there has been a noteworthy shift towards automated trading across various financial markets. Innovations in technology have enabled traders to execute complex trading strategies effortlessly. The increased popularity of automated trading signifies a notable evolution in how financial markets operate.

For those interested in understanding the broader implications of this trend, exploring the article titled The Rise of Automated Trading: Transforming Financial Markets could shed light on the current landscape, exploring how automated trading significantly alters market dynamics, reduces transaction latency, and enhances liquidity.

The Impact of Trading Bots on the Market

As more traders lean towards automation, the internal dynamics of cryptocurrency exchanges are changing. Bots that employ quantitative strategies can help maintain market efficiency by enabling continuous trading, ensuring that prices accurately reflect available information. However, there is a flip side; the proliferation of trading bots can also lead to increased market volatility and flash crashes.

Moreover, platforms that promote automated trading tools are positioned to attract more users. This shift has led to the emergence of community resources and discussions surrounding the ethics and regulations needed in trading. These are crucial considerations for new entrants into the trading world.

Exploring New Technologies

As technology advances, it's also essential to keep an eye on The Rise of Bit GPT: A Revolutionary Tool in Quantitative Trading. This article explores the intersection of artificial intelligence and quant trading, showcasing how new algorithms and tools could further revolutionize automated trading strategies.

The integration of AI and machine learning is enabling traders to analyze large volumes of data more effectively, predicting market trends and making data-driven decisions. These technologies are not just limited to algorithmic trading but have far-reaching implications across various sectors of the financial market.

In conclusion, the surge of trading bots in the cryptocurrency market marks a significant milestone in trading methodologies. Automated trading presents numerous benefits, including efficiency, emotionless decision-making, and 24/7 market participation. However, it is essential to approach this dynamic with a critical mindset and recognize the potential challenges that come with it.

As we embrace this technological evolution, staying informed and understanding the tools at our disposal will be vital for any trader looking to thrive in the new digital economy.