The Evolution of DeFi Trading Bots: Revolutionizing the Cryptocurrency Market

Author: Jameson Richman Expert

Published On: 2024-10-26

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

In the rapidly advancing world of cryptocurrency, decentralized finance (DeFi) is taking the spotlight. A pivotal component of the DeFi ecosystem is the use of trading bots, which automate trading strategies, improve efficiency, and enhance profitability. This article delves into DeFi trading bots, their functionalities, benefits, and the role they play in transforming trading for individual and institutional investors alike.

What are DeFi Trading Bots?

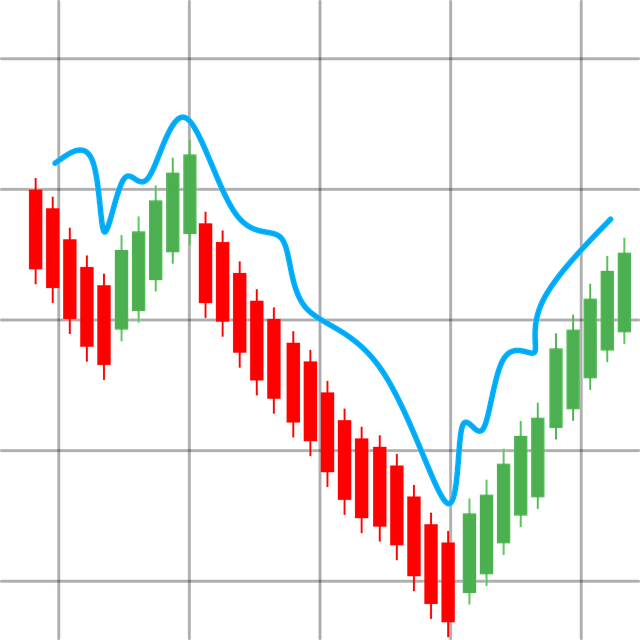

DeFi trading bots are automated software programs that execute buy and sell orders in financial markets on behalf of users, relying on predefined algorithms and strategies. These bots utilize data analysis, market indicators, and various trading strategies to make trades 24/7 with minimal human intervention. With the rise of DeFi platforms, traders can leverage these bots to optimize their strategies and capitalize on market opportunities without constant monitoring.

Key Features of DeFi Trading Bots

- Automation: DeFi trading bots can execute trades automatically based on set parameters, helping traders avoid emotional decision-making.

- Backtesting: Many bots allow users to backtest strategies against historical data to evaluate performance before real-money trading.

- Analytics: Bots often incorporate analytical tools that provide insights, signals, and analyses to optimize trading strategies.

- Adaptability: Bots can quickly adapt to changing market conditions, assisting traders in recalibrating strategies on-the-fly.

The Benefits of Using DeFi Trading Bots

As traders explore automation, the use of DeFi trading bots offers several advantages:

1. Increased Efficiency

One of the primary benefits is efficiency. Trading bots operate 24/7, allowing traders to capitalize on price fluctuations at any time, particularly in a market that never sleeps. This constant vigilance can lead to higher profits and significantly less missed opportunities.

2. Reduced Emotional Impact

Trading decisions are often influenced by emotions, leading to inconsistent performance. Trading bots operate based on data rather than feelings, ensuring that trades are executed according to predetermined strategies, thereby reducing emotional trading decisions.

3. Access to Advanced Strategies

Experienced traders can program complex strategies into bots, utilizing technical analysis and market trends. This advanced approach can improve trading performance and lead to higher returns on investment.

4. Backtesting and Optimization

Many trading bots come with backtesting functionalities, allowing traders to test and optimize their strategies against historical data before risking real money. This feature can significantly enhance performance outcomes by selecting the most effective approach.

Challenges and Risks of DeFi Trading Bots

While the advantages are compelling, it’s crucial to acknowledge the challenges associated with DeFi trading bots:

1. Market Volatility

Market conditions can change rapidly, and trading bots, while sophisticated, are not foolproof. Unanticipated events can lead to significant losses if the bot's algorithm fails to adapt in time.

2. Technological Reliance

Reliance on technology can lead to risks associated with system failures, bugs, or connectivity issues. Bot operators must remain vigilant and ready to intervene when necessary.

3. Dependency on Strategy

The performance of trading bots largely depends on the effectiveness of the strategies programmed into them. An ineffective strategy may lead to losses, making it crucial for users to have a solid understanding of trading principles.

Integrating Trading Bots with Other Platforms

DeFi trading bots excel particularly when integrated with popular cryptocurrency exchanges and APIs. One notable example is the Exploring the Binance API for Trading Bots, which allows developers to interact with the robust features of Binance. This integration opens up avenues for greater customization and execution efficiency, enhancing user experiences. With the Binance API, traders gain access to real-time data feeds and order management functionalities, essential for effective trading.

Moreover, as the landscape of cryptocurrency trading shifts towards automation, it raises critical questions about the overall impact on traders and the market, explored in depth in The Rise of Automated Cryptocurrency Trading: A Game Changer in Finance. The article discusses how automation can democratize trading for everyone, breaking down barriers for individuals who may not have had access to traditional trading strategies or tools.

The Role of Signals and Communication in Crypto Trading

In addition to bots, many traders utilize tools like trading signals to inform their decision-making. Recently, platforms leveraging trading signals, such as Telegram Crypto Trading Signals: A Modern Approach to Crypto Investing, have gained popularity. These signals provide traders with actionable insights and analyses, helping them navigate through volatile markets. By integrating both bots and trading signals, traders can develop robust strategies that incorporate multiple sources of information, thus improving their outcomes.

Understanding Bots Beyond Trading: Discord and Community-Based Approaches

As the cryptocurrency community is profoundly collaborative, especially in decentralized finance, platforms like Discord are pivotal. For instance, understanding how Discord can facilitate trading via marketplaces, as seen in Understanding Binance Discord Bots: A Comprehensive Overview, equips traders with knowledge on utilizing such keeping platforms to enhance communication and trading effectiveness. Discord not only supports trading via bots but also fosters networking among like-minded traders, enhancing learning and collaboration opportunities.

Engaging in Crypto Development

For individuals eager to engage more actively in the crypto space, creating personalized solutions is a popular trend. Resources on how to develop your custom bots, like How to Create Your Own Crypto Trading Bot in 2024, are paving the way for a new generation of traders looking to tailor their experiences to fit unique strategies. This DIY approach can empower users and maximize the effectiveness of their trading operations.

The Future of DeFi Trading Bots

As the cryptocurrency landscape continues to evolve, the introduction of AI-driven approaches is reshaping the market. The emergence of crypto AI robots marks a profound shift in financial technology, as outlined in The Emergence of Crypto AI Robots: A New Era in Financial Technology. These AI-driven bots promise to enhance trading strategies by learning and adapting to market changes over time, making them potentially more successful than their algorithmic predecessors.

Ultimately, the future for DeFi trading bots is bright, suggesting a greater shift towards automated trading. Users must remain informed, adapting to advances in technology and market conditions that can impact their trading strategies. Staying knowledgeable about both tools and the market is crucial for maximizing trading potential.

Conclusion

DeFi trading bots are not merely a trend; they are becoming integral to the trading strategies employed by retail and institutional investors alike. With a blend of efficiency, automation, and advanced functionality, these bots empower traders to navigate the complexities of the cryptocurrency market. Enhanced by effective integration with signal services and community platforms, the potential for profit generation has never been higher. However, as with any investment, understanding the risks and challenges is vital. Staying educated and adaptable will be the key to thriving in the world of DeFi trading.

It is my belief that as automated systems like DeFi trading bots continue to evolve, they will not only democratize trading but also provoke discussions about ethics, control, and the nature of trading itself.