Signallab Forex and Crypto Trading Signal Flutter App in 2025: An In-Depth Analysis

Author: Jameson Richman Expert

Published On: 2025-07-26

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Discover how the Signallab Forex and crypto trading signal Flutter app can revolutionize your cryptocurrency trading journey in 2025. As an industry insider with extensive experience in crypto markets spanning over a decade, I understand that navigating the volatile landscape of cryptocurrencies requires more than just luck — it demands robust tools, real-time data, and strategic insights. Over the years, I have encountered numerous pitfalls and breakthroughs, which have underscored the significance of accurate signals and intuitive applications. In this comprehensive article, I will delve into the evolution of crypto trading signals, detailed features of Signallab, and actionable strategies to maximize your trading success in 2025. This is essential knowledge for traders aiming to stay ahead in a rapidly transforming market.

The Evolution of Crypto Trading and the Rise of Signal Applications

The cryptocurrency trading landscape has undergone profound transformation since its inception in 2009 with Bitcoin’s launch. Early traders relied solely on manual analysis—studying basic chart patterns, historical data, and gut instincts—methods that often resulted in inconsistent outcomes and emotional trading pitfalls. As markets matured, the need for automation, precision, and data-driven decision-making became apparent. This led to the emergence of crypto trading signals and automated trading platforms, integrating sophisticated algorithms, artificial intelligence (AI), and big data analytics. These innovations enabled traders to execute disciplined strategies, minimize emotional bias, and capitalize on fleeting market opportunities with greater confidence.

Today, the market is saturated with various signal providers—ranging from manual analysts offering curated insights to fully automated AI-driven systems that process terabytes of data in real-time. The challenge for traders is discerning reliable sources from unreliable ones. High-quality signals incorporate multi-layered technical analysis, sentiment metrics derived from social media and news feeds, macroeconomic indicators, and order book data to deliver timely alerts. As technological advancements continue, apps like Signallab leverage machine learning models that adapt dynamically to changing market conditions, providing traders with a significant competitive edge.

Understanding the Mechanics of Crypto Trading Signals

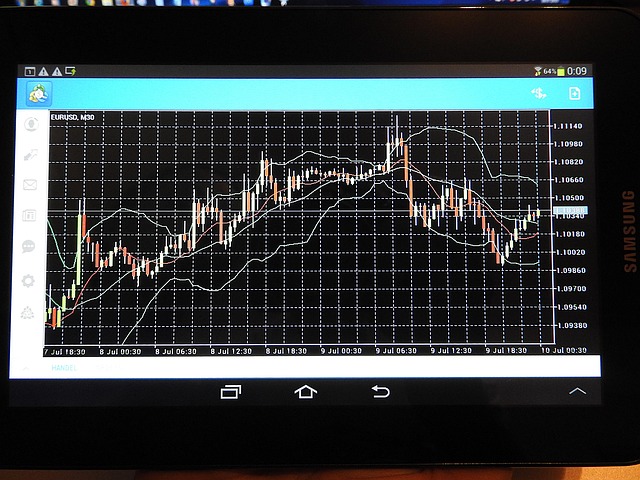

Crypto trading signals are sophisticated, data-driven notifications indicating potential trading opportunities—either buy or sell signals—based on comprehensive analysis of multiple data sources. These signals often incorporate technical indicators such as Moving Averages (MA), Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Fibonacci retracements, and order book depth data. Furthermore, sentiment analysis derived from social media platforms like Twitter, Reddit, and news aggregators can significantly influence signal accuracy, especially during market-moving events.

For example, a typical buy signal might occur when the MACD crosses above its signal line in conjunction with RSI entering oversold territory, suggesting a bullish reversal. Conversely, a sell signal might be triggered by bearish divergence or when key resistance levels are tested without follow-through. Modern applications like Signallab integrate these multiple indicators into cohesive alerts, reducing false positives and enabling traders to act swiftly in volatile environments. Additionally, some signals incorporate on-chain analytics, such as wallet activity or transaction volume spikes, which can serve as early indicators of market shifts. This multi-faceted approach, combining technical, sentiment, and on-chain data, enhances signal robustness, predictive accuracy, and helps traders better anticipate market turns.

Why Signallab Forex and Crypto Trading Signal Flutter App Stands Out in 2025

The Signallab app exemplifies the convergence of cutting-edge technology and user-centric design, making it an indispensable tool for traders in 2025. Its seamless integration of forex and cryptocurrency signals within a mobile-friendly, cross-platform framework ensures that traders can access critical market insights anytime, anywhere. Built with Flutter—Google’s UI toolkit—the app guarantees high-performance, smooth animations, and a consistent experience across iOS and Android devices, reducing development costs and boosting user engagement.

What truly sets Signallab apart is its unwavering commitment to accuracy, speed, and customization. Unlike generic signal providers, Signallab employs advanced AI algorithms that continuously learn from vast datasets, including historical price action, macroeconomic trends, and social sentiment, to reduce false alerts and improve predictive capabilities. Its intuitive interface allows traders to tailor notifications based on risk tolerance, asset preferences, and trading styles—whether scalping, swing trading, or long-term investing—making it adaptable for both novices and seasoned professionals.

Key Features that Make Signallab a Market Leader

- Real-Time, High-Frequency Alerts: Instant notifications ensure traders never miss critical opportunities, especially vital in high-volatility markets like crypto and forex. The app’s low-latency architecture minimizes delays, which is crucial for executing timely trades during market surges or crashes. This feature is supported by high-speed data feeds and optimized backend infrastructure that process and deliver alerts within milliseconds.

- Multi-Asset Coverage: Support for a broad spectrum of assets—including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and major forex pairs like EUR/USD, GBP/JPY—facilitates diversified trading strategies. The platform’s ability to handle diverse asset classes provides traders with flexibility to adapt to various market conditions, enabling cross-asset arbitrage and hedging strategies.

- Advanced Customization: Users can set personalized risk parameters, define preferred assets, and select alert types such as volume spikes, trend reversals, or breakout signals, optimizing their trading workflows. Custom filters enable traders to focus on signals aligned with their specific strategies and risk appetite, enhancing efficiency and reducing information overload.

- Deep Learning Algorithms: Continuous learning from market patterns and trader behavior enhances signal reliability over time, allowing the system to adapt to new market dynamics and reduce false positives. These AI models incorporate reinforcement learning techniques to refine their predictions based on historical performance, thereby increasing accuracy in volatile environments.

- Educational Modules: Built-in tutorials, comprehensive market analysis guides, and active community forums empower traders to deepen their understanding and refine strategies. Education is a core component, ensuring traders can interpret signals correctly, manage risk effectively, and improve decision-making skills.

- Security and Privacy: Robust encryption and privacy controls ensure that user data and trading activities remain protected, building trust and compliance with regulations like GDPR. The platform’s security architecture follows best practices, including multi-factor authentication, end-to-end encryption, and regular security audits.

My Personal Journey with Crypto Signal Applications

Having experimented extensively with various signal providers—from basic newsletter alerts to sophisticated AI-powered platforms—I have firsthand insight into their impact on trading outcomes. Early in my trading career, I relied heavily on manual analysis, which often led to missed opportunities or costly errors due to emotional decision-making. Transitioning to apps like Signallab marked a pivotal shift. The real-time, high-accuracy signals significantly reduced emotional biases and improved my timing for entries and exits.

However, I emphasize that no signal app guarantees success—markets are inherently unpredictable and influenced by countless external factors. Combining signals with fundamental analysis, macroeconomic news, on-chain metrics, and sentiment data creates a holistic trading approach. Discipline in risk management, continuous learning, and adapting strategies are essential for sustainable growth. Over time, I observed my portfolio's stability improve, especially when leveraging AI-powered signals for high-frequency trading, scalping, and arbitrage strategies. Consistent evaluation and backtesting of signals against historical data further enhance confidence in deployment.

Strategies to Maximize Crypto Trading in 2025 Using Signallab

To excel in crypto trading in 2025, integrating Signallab into your trading arsenal is crucial. Here are detailed, actionable strategies:

- Diversify Assets: Use Signallab to monitor multiple assets—Bitcoin, Ethereum, Ripple, DeFi tokens like Uniswap (UNI), and forex pairs—to optimize risk-adjusted returns. Diversification helps mitigate the impact of sudden market shocks on individual assets. Regularly reassess asset correlations, volatility patterns, and sector-specific trends to adjust your portfolio accordingly, ensuring resilience in turbulent markets.

- Combine Technical and Sentiment Analysis: Cross-verify signals with macroeconomic news, social media sentiment, and on-chain data to increase accuracy. For instance, a positive tweet from a major influencer or whale activity can validate a technical buy signal. Incorporate sentiment analysis tools that quantify social media buzz and news impact to refine decision-making, especially during news-driven market moves.

- Implement Disciplined Risk Management: Use stop-loss and take-profit orders based on signal strength, volatility levels, and recent price action. Applying position sizing, leverage, and hedging techniques carefully reduces potential losses during unpredictable swings. Regularly review risk parameters and adjust them as market conditions evolve to maintain optimal risk-reward ratios.

- Leverage Platform Integrations: Connect Signallab with leading trading platforms like Binance, MEXC, Bitget, and Bybit to automate trades, reduce latency, and execute complex strategies such as grid trading, scalping, or arbitrage. Automating trades based on signals minimizes emotional interference, enhances execution precision, and frees up time for strategic planning.

- Participate in Referral and Affiliate Programs: Earn passive income by leveraging platform referral programs, which can supplement trading capital and reduce overall risk exposure. For example, earning commissions from Binance or Bybit referrals can be reinvested into trading activities. Many programs offer tiered rewards, incentivizing ongoing promotion and community engagement.

For instance, registering with Binance through this referral link not only grants access to a wide range of cryptocurrencies but also offers trading fee discounts, bonuses, and priority customer support—further enhancing overall profitability. Staying informed about platform-specific features, updates, and community feedback is vital to optimizing your trading infrastructure and capitalizing on new opportunities.

Emerging Trends in Crypto Trading Signals and Future Outlook

Looking toward 2025, the future of crypto trading signals is poised to be shaped by continued innovations such as advanced artificial intelligence, machine learning, and big data analytics. Expect highly personalized, predictive alerts tailored to individual trading styles, risk tolerance, and market conditions. Integration with decentralized finance (DeFi) platforms and blockchain-based signal providers promises increased transparency, decentralization, and security, disrupting traditional centralized models.

AI-driven predictive analytics will enable traders to anticipate market movements with greater precision, increasing profitability and reducing losses. Multi-modal platforms combining visual dashboards, textual insights, voice alerts, and real-time notifications will enhance accessibility and user engagement across diverse devices. Additionally, social trading and community-driven signal sharing on platforms like Telegram, Reddit, and Discord will democratize access to high-quality signals, fostering collaborative trading environments and knowledge sharing.

Staying ahead requires continuous education, active participation in communities, and leveraging the latest technological advancements. Resources such as Understanding crypto trading bot price and its impact on your investment strategy provide insights into deploying automated solutions effectively and cost-efficiently, ensuring you remain competitive in this fast-evolving space.

Conclusion: Embracing Innovation for Trading Success

My extensive experience underscores that success in cryptocurrency trading hinges on leveraging reliable tools, ongoing education, disciplined execution, and continuous adaptation to market dynamics. The Signallab Forex and crypto trading signal Flutter app exemplifies how advanced technology can empower traders in 2025, delivering timely insights and smarter, data-driven trades. When combined with strategic platform choices, active community engagement, and rigorous risk management, these tools can significantly elevate your trading performance. Remember, flexibility, informed decision-making, and embracing innovation are your best assets in the unpredictable crypto markets. Stay curious, keep learning, and trade smart—your journey toward sustained financial growth begins now.