My Journey with Crypto Trading: A Deep Dive into Strategies, Security, and Market Evolution

Author: Jameson Richman Expert

Published On: 2025-07-15

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Embarking on a journey into the dynamic world of cryptocurrencies can be both exhilarating and challenging. When I first delved into crypto coins, exchanges, and blockchain technology, I was overwhelmed by the sheer volume of information, technical complexities, and the market’s notorious volatility. My initial attempts were marred by mistakes, losses, and moments of doubt, but these setbacks became invaluable learning opportunities. Over time, I developed a structured approach that combined technical analysis, fundamental understanding, and risk management—paving the way for consistent growth. For anyone considering entering crypto trading, a comprehensive grasp of wallet security, trading signals, earning strategies, and technological tools is crucial for increasing your chances of success. This in-depth guide aims to share my experiences, insights, and detailed strategies to help you navigate the crypto landscape more effectively, with added insights into market analysis, security practices, and future trends.

Choosing the Right Crypto Exchange: In-Depth Considerations

Selecting the optimal trading platform was a pivotal step in my crypto journey. The landscape is populated with numerous exchanges, each offering different features, security standards, and fee structures. To make an informed choice, I analyzed critical factors beyond basic features:

- Security Measures: Prioritize exchanges with industry-standard security protocols such as two-factor authentication (2FA), biometric verification, cold storage of assets, anti-phishing measures, and insurance coverage for stored funds. For instance, Binance and Coinbase Pro have dedicated security teams and insurance policies that protect user funds against hacking.

- Fee Structures: Understand both trading and non-trading fees. Some platforms offer tiered fee discounts based on trading volume or native token holdings, which can significantly affect profitability.

- Liquidity & Trading Volume: High liquidity minimizes slippage and enables executing large trades without significantly affecting market price. For example, Binance and Kraken typically feature higher trading volumes, making them preferable for substantial trades.

- Asset Support & Market Access: Confirm that the exchange supports a broad array of cryptocurrencies, including emerging tokens and DeFi assets. This flexibility allows for diversified investment strategies.

- Regulatory Compliance & Legal Standing: Opt for exchanges compliant with local and international regulations, reducing the risk of account freezes or legal issues. For example, Coinbase is regulated in the US, offering a degree of legal security.

- Additional Features & Integrations: Advanced trading tools such as margin trading, futures, staking, API access for automation, and integrated analytics platforms can enhance trading efficiency and strategies.

To streamline your decision-making process, I recommend consulting comprehensive comparison articles such as this detailed guide. Understanding each platform’s strengths and limitations allows you to tailor your choice to your trading style and risk appetite.

Understanding Crypto Wallets and Enhancing Security Protocols

Storing your digital assets securely is fundamental. Initially, I relied on hot wallets—software wallets connected to the internet—for ease of access. However, I soon recognized the increased vulnerability to hacking, phishing, and malware attacks. Transitioning to hardware wallets such as Ledger Nano S/X and Trezor significantly improved security by keeping private keys offline. Besides hardware wallets, other cold storage options include:

- Paper Wallets: Physical printouts of private keys or seed phrases, suitable for long-term holding without internet access.

- Cold Storage Devices: Dedicated hardware or air-gapped computers that remain disconnected from the internet, providing a high level of security.

- Multisignature Wallets: Require multiple private keys to authorize transactions, distributing control and reducing single-point failure risks.

Private key management is critical; always store seed phrases offline in secure, fireproof safes or safety deposit boxes. Avoid digital copies susceptible to hacking. Regularly update device firmware and security patches. Enabling two-factor authentication (2FA) on all exchange and wallet accounts adds an extra layer of security. Be vigilant against phishing scams: never share private keys or seed phrases, and always verify website URLs. For an expanded understanding, explore this comprehensive article on wallets. Staying informed about the latest security threats and mitigation techniques is essential for safeguarding your assets.

Mastering Trading Signals, Technical & Fundamental Analysis

Effective trading hinges on analyzing market signals accurately. My initial reliance on third-party signals often led to losses due to insufficient understanding. Over time, I learned to develop my analytical skills, combining:

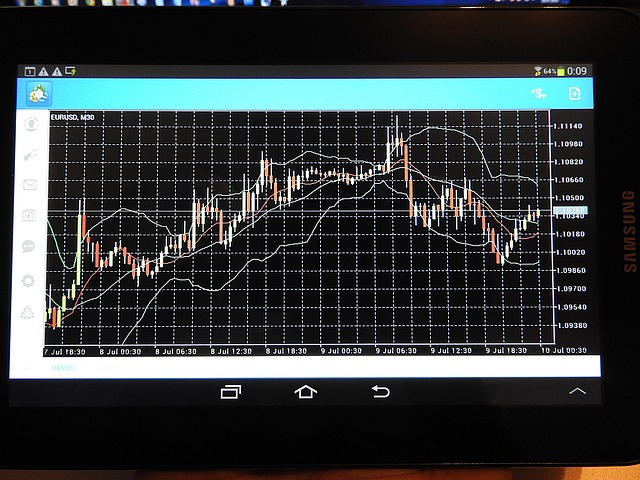

- Technical Analysis: Using indicators such as Moving Averages (MA), Relative Strength Index (RSI), MACD, Bollinger Bands, Fibonacci retracement, and volume analysis to identify optimal entry and exit points. Chart pattern recognition—like head and shoulders, double bottoms, and triangles—also proved invaluable.

- Fundamental Analysis: Assessing project fundamentals, including whitepaper quality, team credibility, technological innovation, partnerships, regulatory developments, and macroeconomic factors influencing crypto prices.

- Sentiment & On-Chain Metrics: Monitoring social media sentiment, news cycles, and on-chain data like transaction volume, active addresses, and network hash rates to gauge market mood and potential reversals.

Risk management strategies such as setting stop-loss and take-profit orders are essential to protect profits and limit losses. I also experimented with automated trading using crypto bots—software executing predefined strategies. Proper configuration, backtesting, and understanding their limitations can optimize trading performance. For a deeper dive into crypto bots, review this article on crypto automation. Remember, integrating multiple analysis techniques and maintaining disciplined execution enhances trading outcomes.

Exploring Diversified Earning Strategies in Crypto

Beyond active trading, I explored passive income avenues like staking, yield farming, liquidity mining, and participating in airdrops. Each method involves distinct risks and reward profiles:

- Staking: Locking tokens in proof-of-stake (PoS) networks such as Ethereum 2.0, Cardano, and Polkadot to support network security and earn staking rewards. Ensuring staking protocols are audited and understanding lock-up periods are vital.

- Yield Farming & Liquidity Provision: Supplying tokens to DeFi protocols like Aave, Compound, Uniswap, and Curve to earn interest, governance tokens, or trading fees. Be aware of risks like impermanent loss, smart contract bugs, and market volatility.

- Airdrops & Forks: Receiving free tokens from project distributions or network forks—an effective way to acquire new assets without significant capital outlay. Staying updated on project announcements and participating early can maximize benefits.

- Emerging Sectors: NFTs, metaverse projects, decentralized autonomous organizations (DAOs), and blockchain gaming are creating new earning opportunities through investments, staking, and participation in community governance.

Due diligence, security best practices, and portfolio diversification are crucial. I recommend reviewing this article on future crypto trends for insights into upcoming earning opportunities and technological shifts.

Leveraging Platforms, Community Resources & Education

Active engagement with community platforms accelerates learning and provides timely insights. Platforms like Binance, MEXC, Bitget, Bybit, and KuCoin offer advanced trading features, educational resources, and community support. Participating in forums like Reddit’s r/CryptoCurrency, Telegram groups, Discord servers, and following influencers on Twitter exposes you to diverse perspectives, early alerts, and trading tips. Additionally, attending webinars, AMAs, and conferences—virtual or in-person—enhances networking and industry understanding. These interactions help you stay ahead of regulatory changes, technological innovations, and emerging projects. To facilitate your journey, consider registering on these platforms via my referral links, which sometimes include incentives:

Active community participation not only provides shared knowledge but also early access to new projects and trading opportunities, crucial for strategic decision-making.

Continuous Education & Staying Ahead with Technological Advancements

The crypto market is a constantly evolving landscape. To remain competitive, continuous education is essential. I follow reputable news outlets such as CoinDesk, CoinTelegraph, The Block, and Messari, which provide up-to-date news, analysis, and regulatory developments. Deepening understanding of blockchain innovations—like proof-of-stake vs. proof-of-work, Layer 2 solutions (e.g., zk-Rollups, Optimistic Rollups), interoperability protocols (Polkadot, Cosmos, Avalanche), and cross-chain bridges—expands strategic options. Enrolling in structured courses from platforms like Crypto Academy, Coursera, and edX has provided comprehensive knowledge, certifications, and credibility. Staying informed about emerging trends such as decentralized identity, zero-knowledge proofs, and decentralized finance (DeFi) protocols enhances risk assessment and opportunity identification. Regular participation in webinars, developer meetups, and conferences fosters innovation and industry connections, ensuring you are prepared for regulatory shifts and technological breakthroughs.

Final Reflections: Patience, Discipline, and Strategic Growth

My crypto trading journey has been marked by both setbacks and successes. The key to long-term sustainability lies in practicing patience, disciplined trading, and continuous learning. Avoid impulsive decisions driven by market hype; instead, focus on building a resilient, research-backed strategy. Market and technological landscapes are highly volatile; adaptability is crucial. By maintaining discipline, staying informed on trends, and implementing robust risk controls, you can substantially improve your chances of consistent growth. Remember, sustainable success is a marathon, not a sprint. For a comprehensive recount of my experiences, lessons learned, and insights, read the full story here. Building your knowledge step-by-step will position you for steady, informed growth over time—patience and persistence are your greatest allies in the crypto space.