Maximizing Profits with Crypto Trading Bots: The Future is Here

Author: Jameson Richman Expert

Published On: 2025-01-19

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

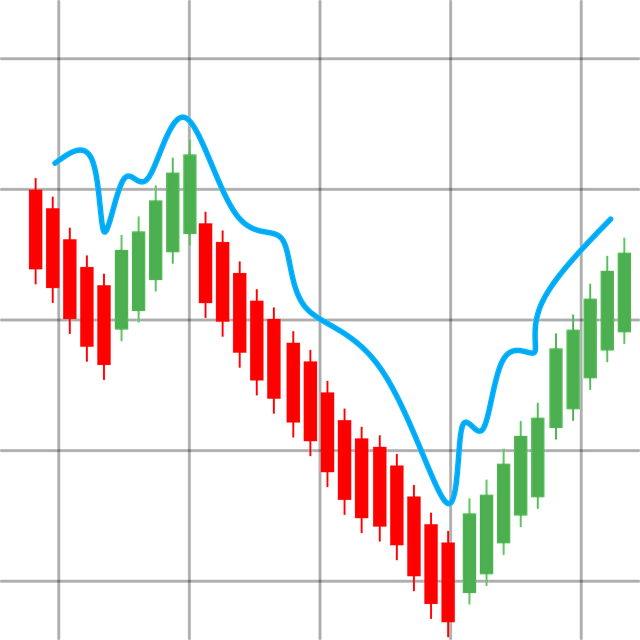

In the rapidly evolving world of cryptocurrency, traders are always on the lookout for tools that can give them an edge. One such tool that has gained immense popularity is the crypto trading bot. These automated systems can execute trades on behalf of users, allowing them to navigate complex markets more efficiently. In this article, we will explore various aspects of crypto trading bots, including their functionalities, advantages, and how they integrate with popular platforms like Binance and crypto exchanges.

What are Crypto Trading Bots?

Crypto trading bots are software programs that interact with financial exchanges to trade cryptocurrencies on behalf of the user. They utilize various strategies and algorithms to analyze market data, execute trades, and manage portfolios. The essence of trading bots lies in their ability to operate without human intervention, providing a significant advantage in the fast-paced crypto market.

Types of Crypto Trading Bots

There are several types of trading bots, each designed for different trading strategies:

- **Arbitrage Bots:** These bots exploit price differences between exchanges. They buy a coin at a lower price on one exchange and sell it at a higher price on another.

- **Market-Making Bots:** These bots provide liquidity to the market by placing buy and sell orders for a particular asset, profiting from the spread between the two.

- **Trend-Following Bots:** These bots analyze market trends and execute trades based on specific indicators, following the market momentum.

- **Mean-Reversion Bots:** These bots operate on the concept that prices will revert to their average over time, placing trades to capitalize on price fluctuations.

Benefits of Using Crypto Trading Bots

Implementing a crypto trading bot can offer numerous advantages:

- Emotionless Trading: Bots execute trades based on algorithms, eliminating emotional decision-making that often leads to poor outcomes.

- 24/7 Market Monitoring: Trading bots can operate round the clock, ensuring you don’t miss any trading opportunities.

- Quick Execution: Bots can execute trades significantly faster than humans, capturing opportunities before they vanish.

- Backtesting Capabilities: Many bots allow you to backtest strategies against historical data, enabling you to refine your approach before risking real capital.

Integrating Crypto Trading Bots with Crypto Exchanges

One of the most popular exchanges among crypto traders is Binance. To effectively use a crypto trading bot, it often requires integration with these platforms. For instance, using a The Ultimate Guide to Binance Day Trading Bots: Supercharge Your Trading Experience, traders can learn how to maximize their trading efficiency on Binance with specialized bots designed for day trading activities. These bots often support multiple trading strategies that may assist in capitalizing on market movements.

Understanding Crypto Signals and Their Importance

Crypto signals are suggestions for entering a trade, typically accompanied by specific entry and exit points. These signals can be generated by experienced traders or through advanced algorithms analyzing market data. By utilizing crypto signals, traders can make more informed decisions, improving their chances of profitable trades. This integration of signals with trading bots enhances the effectiveness of automated trading. For instance, traders can utilize Exploring the World of Crypto Coin Bot Trading and Coin Flip Bots for Discord to understand how they can leverage signals within Discord communities to get real-time updates and trade recommendations.

The Role of Metamask Wallet in Crypto Trading

Security is paramount in cryptocurrency trading, and wallets play a critical role in safeguarding funds. Metamask is a popular digital wallet that allows users to manage their assets securely while interacting with decentralized applications (dApps). Trading bots can be integrated with Metamask to streamline the trading process, enabling users to trade seamlessly while ensuring their assets remain secure. Understanding how wallets like Metamask function is crucial for any trader looking to utilize crypto trading bots.

Common Misconceptions About Trading Bots

Despite the advantages that trading bots offer, there are several misconceptions that can hinder their use:

- Trading Bots Guarantee Profits: While bots can optimize trading strategies, they do not guarantee profits. Market conditions can change rapidly, and losses are always a possibility.

- Trading Bots Eliminate Risk: Risk management remains crucial. Bots can help automate trading but do not eliminate risk.

- Technical Expertise is Necessary: While some knowledge can enhance a trader’s experience, many user-friendly bots require little to no technical background.

The Future of Automated Trading

As the cryptocurrency market continues to grow, the role of trading bots is expected to expand further. According to The Future of Automated Trading: Understanding Crypto Trading Bots in 2024, advancements in artificial intelligence and machine learning will lead to even more sophisticated trading bots capable of adapting to market conditions in real-time. This evolution will likely drive higher accuracy, allowing traders to enter and exit positions with greater confidence.

Conclusion

The integration and use of crypto trading bots can significantly transform the way traders interact with the cryptocurrency market. By harnessing the capabilities of automated trading, enhanced security measures offered by wallets like Metamask, and utilizing crypto signals, traders can take their trading strategies to new heights. Whether you are a seasoned trader or just starting, understanding these tools and leveraging platforms such as Binance can optimize your trading experience and potentially increase profits.

To stay updated with the latest in the world of trading bots, it's essential to keep exploring resources that delve into operational tactics and market insights.