Maximizing Cryptocurrency Trading with Binance Scalping Bots: A Comprehensive Guide

Author: Jameson Richman Expert

Published On: 2025-01-06

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

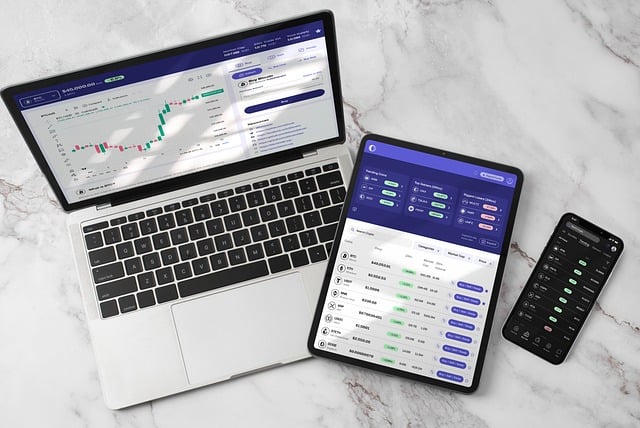

The cryptocurrency trading landscape is rapidly evolving, and tools like the Binance scalping bot are becoming essential for traders looking to maximize their profits efficiently. This comprehensive guide delves into what these bots are, how they work, their advantages, and the implications they hold for both novice and experienced traders.

What is a Binance Scalping Bot?

A Binance scalping bot is an automated trading software designed for traders engaged in scalping, a strategy that involves executing numerous trades within short timeframes to accumulate small profits. By capitalizing on minor price fluctuations, these bots are programmed to execute buy and sell orders based on current market conditions and predefined parameters, allowing for extremely fast trading.

How Does a Binance Scalping Bot Work?

These bots continuously monitor price movements, market volume, and trends in real-time. When specific conditions are met—such as the price hitting a predetermined level—the bot executes trades automatically. This rapid execution is crucial, as seconds can significantly impact profitability.

Advantages of Using a Binance Scalping Bot

- Speed and Efficiency: Bots can execute trades faster than human traders, allowing for quicker responses to market changes.

- Emotion-Free Trading: Automated systems remove emotional decision-making, promoting more rational trading choices.

- 24/7 Market Monitoring: Bots can analyze the market around the clock, ensuring no opportunities are missed due to personal schedules.

- Backtesting Capabilities: Many bots allow traders to backtest their strategies using historical data, refining their methods before live trading.

Challenges of Using a Scalping Bot

While there are significant benefits, it’s important to recognize potential risks:

- Market Volatility: The crypto market is known for erratic price swings that can lead to unexpected losses.

- Technical Issues: Connectivity problems, software bugs, or incorrect configurations can result in missed opportunities or losses.

- Over-Optimization: Excessively tuning a bot based on historical performance can lead to poor live trading outcomes.

Considerations for Effective Scalping

Simply deploying a Binance scalping bot isn't enough. Successful traders need a clear strategy that includes:

- Specific entry and exit points

- Risk management techniques

- Market conditions to monitor

Continuously analyzing performance and refining strategies is essential for success in this intricate market.

Exploring Additional Trading Tools: Signal and Arbitrage Bots

As the cryptocurrency market evolves, other trading tools like crypto signal bots and arbitrage bots are becoming increasingly popular. These tools help traders capitalize on price discrepancies across exchanges, offering new avenues for profit.

The Shift to Cryptocurrency Trading

More people are leaving traditional jobs to embrace trading cryptocurrency full-time. The article The Shift to Cryptocurrency: More People Quit Their Jobs for Trading explores this trend, showcasing the growing recognition of cryptocurrency as a legitimate income source.

The Future of Crypto Bots Trading in 2024

As technology progresses, the future of crypto bot trading appears promising. The anticipated advancements in AI and machine learning will enhance trading efficiency. For a detailed look at these developments, see The Future of Crypto Bots Trading in 2024.

Opportunities for Young Investors

Curious about the possibilities for young traders? The article Can You Trade Crypto at 16? Exploring Young Investors' Options discusses age-related challenges and opportunities for young investors in the crypto space.

Embracing AI Technology in Trading

The integration of AI and advanced algorithms is revolutionizing cryptocurrency trading. Check out Revolutionizing Cryptocurrency Trading: The New Breed of AI Bots and Tools to understand how AI-driven tools can enhance trading strategies.

Conclusion

In summary, employing a Binance scalping bot can significantly increase your cryptocurrency trading efficiency. However, traders must remain vigilant, embracing continual learning and adapting strategies that align with market behavior. As we approach 2024, those who effectively leverage these advanced tools will find themselves at a competitive advantage in the thriving and volatile world of cryptocurrency trading.