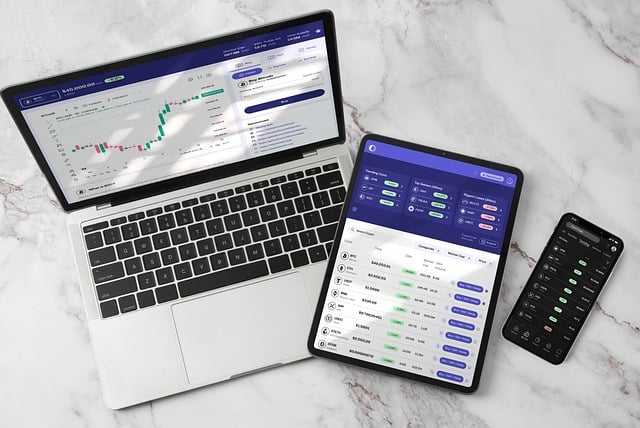

Maximize Your Profits with Binance Volatility Trading Bots

Author: Jameson Richman Expert

Published On: 2025-01-08

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

In today's rapidly changing cryptocurrency market, volatility can be both a friend and a foe. Savvy traders know that with volatility comes opportunity, but navigating those turbulent waters can be challenging. This is where Binance volatility trading bots come into play. These automated systems can help traders react swiftly to market changes, minimizing losses and maximizing potential profits. In this comprehensive guide, we'll delve into the functions, benefits, and strategies involved in using Binance volatility trading bots to enhance your trading experience.

What Are Binance Volatility Trading Bots?

A Binance volatility trading bot is automated software designed to execute trades on the Binance exchange based on predefined criteria. These bots continuously monitor market data 24/7, analyzing price movements and trends to make informed trading decisions. Their primary function is to exploit rapid price fluctuations, allowing traders to respond quickly to market changes and capitalize on profitable trades faster than human traders ever could.

Benefits of Using Binance Volatility Trading Bots

Implementing a volatility trading bot offers numerous advantages:

- 24/7 Monitoring: The cryptocurrency market never sleeps, and neither do trading bots. They continuously monitor price fluctuations to execute trades at any time.

- Speed of Execution: In a volatile market, having a bot that can execute trades almost instantaneously increases your chances of capitalizing on price changes.

- Emotionless Trading: Emotion can cloud judgment. Bots utilize algorithms, minimizing the emotional decision-making that can lead to costly mistakes.

- Backtesting Options: Many bots allow you to backtest trading strategies using historical data, helping you refine your approach without risking capital.

- Diversification: A trading bot can manage multiple trades across different cryptocurrencies, which allows for better risk management.

Choosing the Right Binance Volatility Trading Bot

With a plethora of trading bots on the market, it's essential to select the right one for your trading needs. Here are key factors to consider:

- User-Friendly Interface: A good trading bot should have an intuitive design to facilitate easy strategy setup.

- Customization Options: Look for bots that allow you to tailor your trading strategies to align with your risk tolerance and goals.

- Security Features: Ensure the bot employs strong security measures, including encryption and two-factor authentication, to protect your funds and data.

- Reliable Performance: Always check user reviews and testimonials to assess the reliability and effectiveness of the bot.

How to Set Up Your Binance Volatility Trading Bot

Once you've chosen a trading bot, follow these steps to set it up:

- Create a Binance Account: Sign up on the official Binance website and complete verification if you haven't yet.

- API Key Generation: Generate an API key from your Binance account settings, allowing the bot to execute trades on your behalf.

- Select Your Bot: Choose a bot that meets your requirements based on the factors mentioned earlier.

- Configure Your Trading Strategy: Set your trading parameters, including stop-loss levels and profit targets, based on your chosen strategy.

- Backtest Your Strategy: Use your bot’s backtesting feature to evaluate its potential effectiveness against historical data.

- Go Live: Once satisfied with your backtest results, enable live trading.

Trading Strategies for Volatility Bots

To effectively utilize a Binance volatility trading bot, consider adopting one or more of the following strategies:

- Trend Following: Analyze past price data to identify ongoing trends, allowing the bot to trade in the direction of these trends.

- Mean Reversion: Program your bot to buy when prices are unusually low and sell when they are high, based on historical averages.

- Scalping: Engage in high-frequency trading, where the bot executes numerous trades throughout the day to take advantage of small price changes.

- Arbitrage: Exploit price discrepancies between different exchanges, quickly buying low on one and selling high on another.

Challenges and Pitfalls to Avoid

While trading bots can offer significant benefits, they are not without challenges. Here are some common pitfalls to be aware of:

- Over-Reliance: While bots can automate trades, it's crucial to monitor their performance and adjust strategies as market conditions change.

- Neglecting Performance Review: Regularly assess your bot's performance; adjustments may be necessary based on recent market trends.

- Technical Issues: Like any software, trading bots can malfunction, leading to missed opportunities or unintended trades.

- Ignoring Market Conditions: Stay informed about market developments; sudden news can drastically alter volatility.

Conclusion

Maximizing profits with a Binance volatility trading bot requires a combination of effective strategies, diligent monitoring, and an understanding of the underlying market dynamics. By understanding the mechanics of these automated tools and employing sound trading practices, you can tap into the potential of cryptocurrency volatility. Embrace ongoing education, adapt to changing markets, and remember to use trading bots as an empowering supplementary tool rather than a complete substitute for your trading judgment.

For those keen on getting deeper insights into trading strategies and cryptocurrency news, I recommend checking out the following sources: