Is Margin Trading Halal? An In-Depth Analysis

Author: Jameson Richman Expert

Published On: 2025-09-22

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Understanding whether margin trading aligns with Islamic law (Shariah) requires a comprehensive exploration of core Islamic finance principles, the structural components of modern trading practices, and the mechanics of leverage. As an individual with both academic expertise in Islamic jurisprudence and practical experience in financial markets, I aim to provide an in-depth, nuanced analysis that addresses the legal, ethical, and practical considerations surrounding margin trading. This discourse is particularly pertinent for Muslim traders who wish to participate in contemporary financial markets while safeguarding their religious and ethical integrity.

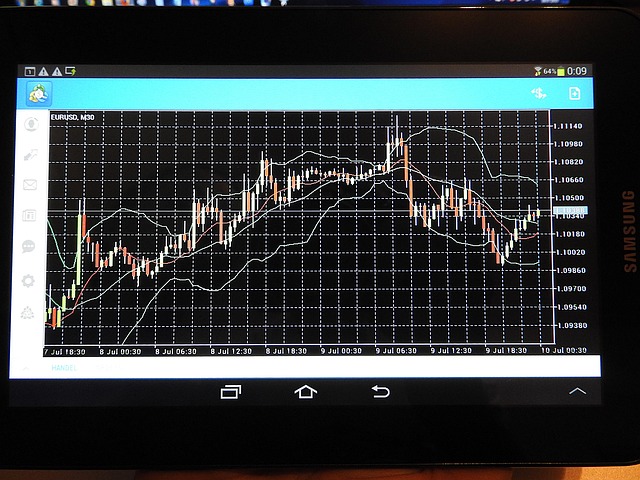

Margin trading involves borrowing funds to amplify trading positions, which can lead to higher profits but also significantly increase the risk of substantial losses. It spans various asset classes—cryptocurrencies, forex, stocks—and is facilitated by numerous platforms like Binance, MEXC, and Bitget. However, the permissibility of margin trading within Islamic finance depends on several critical factors: the nature of the borrowed funds, the presence or absence of interest (riba), transaction transparency, and the avoidance of excessive uncertainty (gharar) and gambling (maysir). My journey from initial skepticism to a balanced understanding has involved scholarly consultations, practical experimentation, and ongoing reflection on Islamic ethical standards and jurisprudence.

The Concept of Margin Trading in Financial Markets

At its core, margin trading enables traders to leverage borrowed capital to control larger positions than their own funds would permit. For example, a leverage ratio of 10:1 allows a trader with $1,000 to control a position worth $10,000. This leverage is typically provided through the trading platform or broker via margin accounts, which require depositing collateral (margin). The primary appeal is the potential for amplified gains in a rising market; however, the risks are equally magnified—margin calls, forced liquidation, and losses that can exceed initial investments if risk management strategies are not diligently applied. To mitigate these risks, traders often employ tools like stop-loss orders, position sizing, and diversification. Nonetheless, the inherent complexity and risk associated with leverage necessitate a thorough understanding of its mechanics and implications.

The Shariah Perspective on Margin Trading

From an Islamic jurisprudential standpoint, several concerns arise regarding margin trading. The foremost issue is riba (interest), since conventional borrowing arrangements often involve paying or earning interest—an unequivocally prohibited element in Islam. Most traditional margin trading models rely on interest-based financing, rendering such practices inherently unlawful (haram). Moreover, the high volatility and inherent unpredictability associated with leveraged trading introduce gharar—excessive uncertainty—which can lead to unjust outcomes or exploitation. The speculative nature of margin trading may also resemble maysir—gambling—particularly when traders engage recklessly, betting wealth on chance rather than informed analysis.

Contemporary Islamic scholars are actively debating whether margin trading can be permissible if structured without interest. Alternative models include employing Shariah-compliant financing mechanisms such as profit-sharing (Mudarabah), leasing (Ijarah), or agency contracts (Wakalah). These methods aim to eliminate interest and reduce excessive uncertainty by grounding transactions in tangible assets, profit-and-loss sharing, or leasing agreements. Ensuring transparency, adhering to ethical standards, and avoiding speculative practices are essential for such structures to be considered compliant. Several Islamic financial institutions have begun developing models for margin trading that incorporate these alternative contracts, seeking to harmonize modern trading practices with Shariah principles.

Practical Experiences and Lessons Learned

My personal journey in trading highlights the importance of ethical caution, ongoing education, and scholarly guidance. Initially, I engaged in leverage-based trading without fully understanding or considering Islamic ethics, which resulted in losses and disillusionment. Through scholarly research, consulting qualified Islamic jurists, and reflecting on Islamic finance principles, I realized that responsible trading—grounded in transparency, risk-sharing, and interest avoidance—can potentially align with Islamic ethics. Leverage, when structured within ethical boundaries, should serve as a tool for prudent risk management rather than a shortcut to gambling. This experience underscores the necessity of continuous learning, disciplined risk management, and seeking scholarly advice to navigate complex financial products responsibly and ethically.

Best Practices for Islamic Traders Interested in Margin Trading

For Muslims considering margin trading within a Shariah-compliant framework, the following best practices are recommended:

- Choose Shariah-compliant platforms: Opt for trading platforms that offer Islamic accounts or explicitly adhere to Islamic finance principles, preferably overseen by reputable Shariah scholars or fatwa councils. Verify their compliance status through scholarly certifications.

- Avoid interest-based financing: Ensure that the funding method involves fee-based arrangements, profit-sharing, or leasing contracts—such as Murabaha or Ijarah—that are compliant with Islamic law. This minimizes the risk of engaging in riba.

- Prioritize transparency and minimize speculation: Fully understand all trading terms, leverage ratios, and risk management strategies. Avoid strategies that resemble gambling or involve highly uncertain outcomes that could lead to unjust enrichment or impoverishment.

- Implement robust risk management: Use tools like stop-loss orders, limit leverage levels, diversify investments, and set clear risk thresholds to prevent unjust gains or losses.

- Engage scholarly consultation: Regularly consult with qualified Islamic finance scholars, fatwa collections, and authoritative resources to stay aligned with evolving jurisprudential standards and rulings, especially as financial products evolve rapidly.

The Mechanics of Leverage and Its Implications in Islamic Context

Leverage amplifies both potential gains and losses by borrowing capital to increase the size of trading positions. To operate responsibly within an Islamic framework, traders must understand the mechanics—such as margin requirements, margin calls, and liquidation procedures. Brokers extend credit based on collateral, and margin calls occur when the trader’s equity drops below the maintenance margin level, potentially leading to forced liquidation. If the borrowing arrangement involves interest, it becomes non-permissible according to Islamic law. Therefore, traders should seek platforms that offer Shariah-compliant leverage options, such as profit-sharing arrangements or leasing-based credit mechanisms. For in-depth insights, refer to comprehensive guides on leverage management that emphasize ethical and Islamic compliance, such as this detailed explanation of leverage mechanics.

The Future of Margin Trading in Islamic Finance

Islamic finance is undergoing rapid innovation, especially with the emergence of digital assets, cryptocurrencies, and blockchain technology. New structures—such as Shariah-compliant derivatives, leasing contracts, and profit-sharing products—are being developed to enable margin trading that aligns with Islamic principles. Several platforms and financial institutions are actively working toward creating genuine Shariah-compliant margin and derivative offerings, with oversight from reputable scholars and regulators. The integration of blockchain technology and smart contracts promises enhanced transparency, automation, and adherence to Islamic standards, potentially transforming the landscape of Islamic margin trading. As these innovations mature, Muslim traders will have more ethically sound options to participate responsibly in leveraged trading without compromising their religious principles.

Additional Resources and References

To deepen your understanding of Islamic finance and margin trading, consider exploring these authoritative resources:

- In-depth analysis of Bitcoin’s price history — exploring the role of digital assets within Islamic finance and their compliance considerations.

- Comprehensive guide on leverage mechanics — emphasizing responsible trading aligned with Islamic ethics.

- Future outlook of financial service providers in Singapore — insights into global trends and Islamic financial innovation.

Conclusion

In conclusion, the permissibility of margin trading in Islam hinges on its structural features and adherence to Shariah principles. My personal experience demonstrates that, with careful planning, ethical risk management, and the use of Shariah-compliant instruments, participation in margin trading can be justified within Islamic ethics. Nonetheless, continuous learning, scholarly consultation, and platform selection that aligns with Islamic standards are essential. The overarching goal is to balance the pursuit of financial growth with a firm commitment to Islamic values—avoiding interest, excessive uncertainty, and gambling. As Islamic finance continues to evolve, especially with technological advancements, innovative solutions are emerging that may better accommodate compliant margin trading. For further guidance, I recommend exploring detailed resources such as this comprehensive guide on crypto trading.