Is Forex Trading Halal in Islam? A Comprehensive Analysis

Author: Jameson Richman Expert

Published On: 2025-09-21

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Forex trading, also known as the foreign exchange market (Forex or FX), has experienced exponential growth over recent decades, establishing itself as one of the most liquid, dynamic, and accessible financial markets globally. Its decentralized nature allows traders—from individual retail investors to large institutional entities—to engage in currency transactions across borders with relative ease. While the market offers lucrative opportunities, it also raises significant ethical and religious questions within the Muslim community: Is engaging in forex trading permissible (halal) according to Islamic law (Shariah)? The answer is nuanced, depending on specific practices, structures, and operational methodologies employed during trading activities. In this article, we delve deeply into the core principles of Islamic finance, dissect the mechanics of the forex market, and explore scholarly perspectives, providing practical guidelines for Muslim traders to navigate forex trading in compliance with Shariah law. This comprehensive analysis aims to equip Muslim traders with the knowledge to participate in forex markets responsibly, ethically, and within the boundaries prescribed by Islamic teachings.

Understanding Fundamental Principles of Islamic Finance

Islamic finance operates within a moral and legal framework rooted in Shariah law, which emphasizes justice, fairness, transparency, social responsibility, and the avoidance of exploitation. These principles serve as benchmarks for assessing the permissibility of various financial activities, including forex trading. The primary prohibitions and guidelines include:

- Riba (Interest): Riba, often translated as usury or interest, is strictly forbidden in Islam. It involves the earning or paying of unearned income through interest, which is viewed as exploitative and unjust. This prohibition extends to any transaction that involves interest-bearing components, such as rollover or swap fees in forex trading, unless structured to be interest-free (swap-free accounts).

- Gharar (Excessive Uncertainty): Transactions characterized by excessive ambiguity, uncertainty, or speculation are prohibited. Gharar can lead to unjust enrichment or exploitation, especially when contractual terms are vague or when parties are unaware of the underlying risks or outcomes.

- Haram Activities: Investments or transactions that involve illegal, unethical, or morally objectionable sectors—such as alcohol, gambling (qimar), pork, weapons, or illicit drugs—are forbidden. This ensures profits originate from legitimate and socially responsible sources.

- Risk-Sharing and Asset-Backed Transactions: Islamic finance encourages equitable risk-sharing based on tangible assets or genuine economic activities. This discourages pure speculation, gambling, or derivative transactions that lack real economic backing and resemble gambling or unjust enrichment.

Fundamentally, Islamic finance aims to promote justice, prevent unjust enrichment, foster transparency, and uphold social justice. These principles are critical benchmarks for evaluating whether particular financial activities—such as forex trading—are compliant with Shariah law.

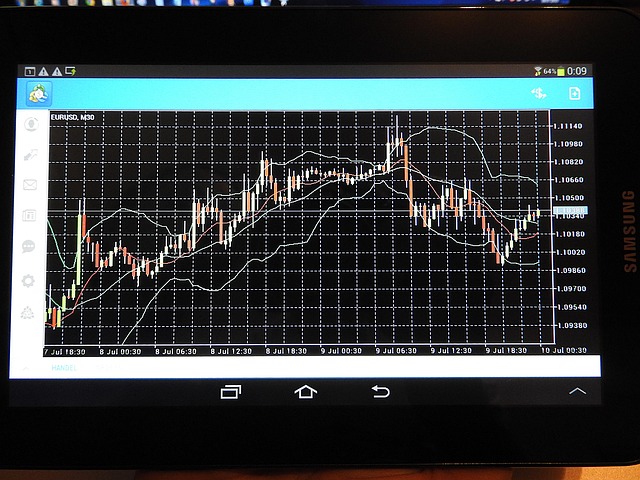

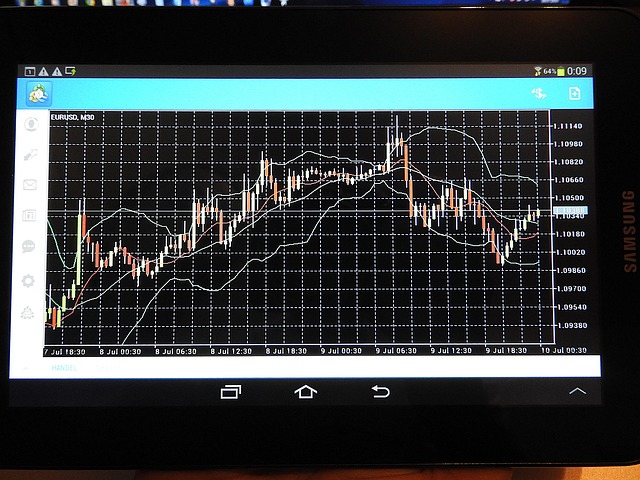

Mechanics of Forex Trading and the Islamic Perspective

Forex trading involves the exchange of one currency against another, with traders speculating on currency price movements to generate profits. Transactions are primarily conducted via online trading platforms, offering a variety of instruments including spot trades, forward contracts, futures, options, and leveraged positions. While the core idea of currency exchange seems simple, the intricacies involved pose specific concerns from an Islamic perspective:

- Interest (Riba) and Swap Fees: Many trades involve rollover or swap fees for holding positions overnight. These are often equivalent to interest payments, thereby contravening Islamic principles unless structured as swap-free (Islamic) accounts that explicitly exclude interest-based costs.

- Speculation and Gharar: Excessive speculative activity—such as trading without actual ownership or using highly leveraged short-term positions—can resemble gambling (maisir), which Islam strictly prohibits. The distinction between legitimate trading and gambling is often blurred in high-leverage, short-term strategies.

- Ownership and Delivery: A fundamental Islamic requirement is that traders possess or have the right to possess the currencies they trade at the time of transaction. Transactions based solely on price speculation, without actual transfer of possession or ownership, may violate this principle.

- Leverage and Margin Trading: High leverage amplifies both potential gains and losses. Excessive leverage can encourage reckless behavior akin to gambling, which is incompatible with Islamic ethics of responsible trading and risk-sharing.

Can Forex Trading Be Considered Halal? Conditions for Permissibility

Scholars and jurists have extensively debated the permissibility of forex trading, and consensus indicates that it can be permissible if strict conditions are met to ensure compliance with Shariah principles:

- No Riba or Interest Components: The trade should be free from interest charges or rollover fees. Islamic (swap-free) accounts are designed for this purpose, eliminating the element of riba, and thus making trades more compliant.

- Actual Ownership (Qabd): Traders must demonstrate genuine ownership or possession of the currencies involved at the time of trade. This involves either physical transfer or contractual transfer of currencies, ensuring that the transaction is not merely speculative but involves real economic activity.

- Immediate and Spot Settlement: Trades should be settled immediately—preferably within the same day—ensuring tangible delivery of currencies. This approach aligns with the Islamic requirement for real exchange and prevents speculative, delayed, or future-based transactions that resemble gambling.

- Transparency and Fair Dealings: The process must be transparent, with clear contractual terms and no deception or market manipulation. Fair pricing and market integrity are crucial for ensuring the transaction's permissibility.

- Minimal Gharar and Uncertainty: The terms of the contract should be explicit and unambiguous, reducing uncertainty. The trading activity should involve actual, tangible transactions rather than speculative bets on future price movements, which resemble gambling.

In practice, this emphasizes favoring spot trading over forward or futures contracts, which often involve interest components or speculative leverage. Some scholars also endorse the use of Islamic banking principles in forex trading, emphasizing real ownership, transparency, and immediate settlement.

Practical Guidelines for Engaging in Shariah-Compliant Forex Trading

Muslim traders eager to participate in forex markets ethically can adopt several practical steps to align their activities with Islamic law:

- Opt for Islamic (Swap-Free) Accounts: Choose brokers that offer Islamic accounts explicitly designed to exclude rollover interest, thereby removing the riba element.

- Focus on Spot Transactions: Engage in immediate delivery trades with real currency exchange, avoiding forward contracts, futures, or options that involve interest or speculative risks.

- Ensure Actual Ownership (Qabd): Confirm that transactions involve legal transfer or possession of currencies at the time of trade, not just contractual speculation on future prices.

- Use Moderate Leverage: Employ leverage responsibly, avoiding excessive ratios that turn trading into gambling. Moderate leverage promotes responsible risk management aligned with Islamic ethical standards.

- Seek Scholarly Guidance and Certification: Regularly consult qualified Islamic scholars or Shariah advisory boards for rulings on specific trading practices, broker offerings, and evolving financial products.

- Stay Educated and Informed: Keep abreast of developments in Islamic finance, market practices, and new Shariah-compliant trading tools to adapt accordingly.

Supporting Platforms and Resources for Islamic Forex Trading

Numerous online trading platforms now recognize the importance of Shariah compliance and offer Islamic accounts tailored for Muslim traders. Notable examples include:

- Binance: Provides Islamic accounts with transparent fee structures and no rollover interest, suitable for forex, cryptocurrencies, and other assets.

- MEXC: Offers swap-free accounts aligned with Islamic principles.

- Bitget: Focuses on transparent trading and provides Islamic options for responsible trading.

- Bybit: Known for educational resources and ethical trading options suitable for Muslim traders.

Scholarly Perspectives and Fiqh Opinions

Leading Islamic scholars, including Sheikh Taqi Usmani, Sheikh Yusuf al-Qaradawi, and others, have issued detailed rulings on forex trading. Their consensus underscores that:

- Transactions must avoid interest, rollover charges, and elements resembling gambling (maisir).

- Actual transfer or possession of currencies (Qabd) should occur during the trade to meet Islamic requirements.

- Excessive leverage and speculative positions should be approached with caution, as they pose risks of gambling.

- Transparency, honesty, and ethical conduct are essential for permissible trading.

Scholars warn against engaging in highly leveraged or purely speculative trading strategies, equating such practices with gambling and prohibiting them. Continuous consultation with qualified Islamic scholars and adherence to evolving rulings are vital for maintaining halal compliance.

Personal Reflection and Final Recommendations

From an extensive review of Islamic jurisprudence and market practices, it is evident that with diligent effort—such as choosing Islamic accounts, engaging in spot trading, ensuring genuine ownership, and avoiding interest—Muslim traders can participate in the forex markets ethically. Success depends on ongoing education, disciplined risk management, and aligning trading strategies with Shariah principles. Opting for reputable, Shariah-compliant platforms and seeking regular scholarly advice ensure that trading activities remain within the bounds of Islamic law. As financial markets evolve, so do the tools and options available for Muslims to trade responsibly without compromising their faith.

Conclusion

In conclusion, the permissibility of forex trading in Islam fundamentally hinges on how the activity is conducted. When traders adhere strictly to Islamic principles—avoiding interest, ensuring actual ownership and immediate settlement, minimizing uncertainty, and engaging in real economic activities—forex trading can be considered halal. Conversely, engaging in interest-based transactions, excessive speculation, or contracts lacking genuine ownership renders the activity haram. It is incumbent upon Muslim traders to continuously seek scholarly guidance, choose Shariah-compliant platforms, and uphold ethical standards. Responsible and informed participation in forex markets allows Muslims to align their financial pursuits with their faith—promoting justice, social responsibility, and integrity in all their trading endeavors.