Is Forex a Good Trading Platform? Pros, Risks, Strategies

Author: Jameson Richman Expert

Published On: 2025-11-08

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Is forex a good trading platform is a question many new and experienced traders ask when deciding where to allocate capital. This article examines what the forex market is, evaluates whether forex trading platforms are a good choice compared with other markets, outlines the advantages and risks, and gives actionable guidance on choosing platforms, managing risk, and optimizing strategies. You’ll also find practical examples, regulatory pointers, and curated resources to explore advanced topics like futures, AI forecasting, and market-making in crypto that intersect with FX trading.

What is the Forex Market?

The foreign exchange (forex or FX) market is a global decentralized marketplace where currencies are traded. According to the Bank for International Settlements (BIS), forex is the largest financial market in the world by daily turnover. For an overview of the market’s structure and history, see the Foreign exchange market - Wikipedia. For practical trading definitions and tutorials, Investopedia’s Forex trading guide is also helpful.

Is Forex a Good Trading Platform? Short Answer

In short, forex can be a good trading platform for traders who value high liquidity, 24-hour access, and diverse strategies (scalping, day trading, carry trades, algorithmic trading). However, it is not ideal for everyone—leverage, counterparty risk, and variable regulation mean that success requires education, risk management, and the right platform/broker.

Key Advantages of Forex Trading Platforms

- High liquidity — Major currency pairs (like EUR/USD, USD/JPY) offer tight spreads and deep liquidity, reducing slippage on large orders.

- 24-hour trading — FX markets operate nearly 24/5 across Asia, Europe, and North America, allowing flexible timeframes for traders.

- Low transaction costs — For major pairs, spreads and commissions can be very competitive compared to some equity or crypto markets.

- Leverage availability — Many brokers offer significant leverage, which magnifies both gains and losses. This can be beneficial for capital-constrained traders.

- Diverse strategies supported — From fundamental carry trades to high-frequency/algorithmic approaches, forex platforms accommodate many trading styles.

- Robust platform features — Reputable brokers provide advanced charting, automated trading (EA/MQL), VPS, and API access.

Main Drawbacks and Risks

- High leverage risk — While leverage can increase returns, it can produce rapid losses and wipe out accounts without strict risk controls.

- Counterparty risk and platform reliability — Depending on the broker model (ECN vs market maker), order execution and price feeds can vary. Understand the broker’s execution policy.

- Regulatory variance — Forex brokers are regulated differently across jurisdictions; choose one regulated by reputable authorities (CFTC/NFA, FCA, ASIC, etc.).

- Overnight risk and gaps — Events outside trading hours can produce price gaps; risk management and stop-loss placement remain essential.

- Learning curve — Effective forex trading requires understanding macroeconomics, interest rates, technical analysis, and platform mechanics.

Platform Types: Which One Is Right for You?

Not all forex platforms are the same. Choose based on your trading goals, technical needs, and regulatory comfort.

1. Retail Forex Brokers (MetaTrader, cTrader)

Retail brokers typically provide platforms like MetaTrader 4/5, cTrader, or proprietary platforms. These are ideal for:

- Retail traders using EAs/algorithmic strategies (MT4/MT5 support automated trading).

- Traders who need robust charting and order types.

- Those who prefer a regulated intermediary to handle order routing and account management.

2. ECN/STP Brokers

Electronic Communication Network (ECN) and Straight Through Processing (STP) brokers route orders to liquidity providers with tighter spreads and often charge commissions. These are better for:

- Scalpers and high-frequency traders who need raw spreads and predictable execution.

- Traders needing direct access to interbank liquidity.

3. Multi-Asset Exchanges and Crypto Exchanges

Many modern exchanges offer cross-asset trading: FX-like pairs, crypto spot, derivatives, and futures. If you want to trade FX and crypto side-by-side, consider multi-asset platforms. Examples include Binance (register link: Binance account), MEXC (MEXC registration), Bitget (Bitget referral), and Bybit (Bybit invite).

How to Evaluate If Forex Is a Good Platform for You

Use this checklist when deciding whether to trade forex and which platform to pick.

- Define your trading goals: short-term (scalping/day trading) vs long-term (swing, carry trades).

- Assess risk tolerance: how much drawdown can you accept? How will leverage be managed?

- Check regulation: Is the broker regulated by a reputable authority (e.g., U.S. CFTC/NFA, UK FCA, Australian ASIC)? For basics about regulation and investor protection, consult the U.S. Securities and Exchange Commission (SEC) investor resources.

- Examine execution policy: market maker vs ECN; average spreads; slippage statistics; requotes policy.

- Platform stability & tools: Does the platform support automated trading, APIs, VPS, backtesting?

- Cost structure: spreads, commissions, swap/overnight charges, inactivity fees.

- Customer support & education: quality of onboarding resources, responsiveness of live support.

Regulation and Safety: Your Shield

Regulated brokers must adhere to capital requirements, segregation of client funds, and certain conduct rules. If you are in the United States, the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) oversee forex brokers. In the UK, the Financial Conduct Authority (FCA) regulates many firms. Always verify a broker’s license and read regulator warnings.

Leverage: Powerful but Dangerous

Leverage is a defining feature of forex platforms. Retail leverage can be very high (e.g., 30:1 in some jurisdictions for major currency pairs), while institutional traders use customized leverage. Always consider:

- Using stop-losses and position-sizing techniques to limit downside.

- Lowering leverage as you learn or during high-volatility events.

- Understanding overnight swap rates and margin call mechanics on your platform.

Execution Quality and Slippage

Execution quality can determine whether a trading edge yields consistent profits. Key metrics to test during a broker trial:

- Average spread during active sessions (London/New York overlap).

- Frequency and average magnitude of negative slippage.

- Order rejection and requote rates.

Run a demo or micro account and monitor these metrics over time to see if the platform meets your latency and execution expectations.

Technology & Charting: Tools That Matter

Modern forex platforms offer advanced charting, integrated news, economic calendars, and API access. Criteria to evaluate:

- Does the platform support 1-click trading and hotkeys for fast reaction?

- Are custom indicators, automated strategies, and backtesting available?

- Is there low-latency connectivity (VPS options) for algorithmic traders?

Strategies That Work on Forex Platforms

FX supports many trading styles. Here are examples and when they can be effective:

- Scalping — Requires low spreads, fast execution, and discipline. Best on ECN/STP platforms during liquid hours.

- Day Trading — Leverages intraday volatility, often around macro news and session overlaps.

- Swing Trading — Targets larger moves over days/weeks using technical patterns and macro catalysts.

- Carry Trade — Long-duration strategy benefiting from interest-rate differentials between currencies.

- Algorithmic & Quant — Uses systematic rules and backtesting; requires API/VPS and tick data.

Examples: Putting Theory Into Practice

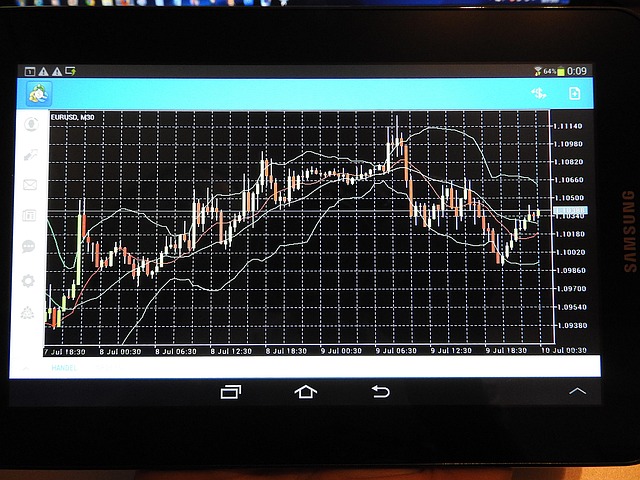

Example 1 — Day trade EUR/USD:

- Trade during London/New York overlap for highest liquidity.

- Use a 15-minute + 1-hour chart confluence: moving averages, RSI divergence, and support/resistance.

- Place stop-loss a few pips beyond support with a risk-to-reward ratio of 1:2 or better.

Example 2 — Carry trade (long-term):

- Identify a high-yield currency relative to a low-yield funding currency.

- Assess interest rate outlook and economic fundamentals via central bank releases.

- Manage rollover/swap costs and hedge during crisis events.

Forex vs Crypto vs Futures: Comparing Platforms

Each market has different characteristics:

- Forex — Mature, highly liquid, regulated in many markets, lower volatility on majors.

- Crypto — High volatility, 24/7 market, emerging regulation, growing derivatives market. If you trade XRP or crypto derivatives, consider reading deep-dive analyses such as this XRP future price prediction and market outlook, or the guide on XRP futures trading in 2025.

- Futures — Centralized clearing, exchange-traded, standardized contracts. For a primer on market-making and the roles in crypto/futures, see this explanation of market makers: what is a market maker – crypto.

If you are exploring cross-market strategies (FX + crypto futures), learning from advanced AI forecasting and signal approaches can help; for instance, see techniques in AI to predict XRP: techniques and strategy. These resources show how AI models and market-maker behavior intersect with trading decisions, and they may inspire multi-asset approaches that complement forex strategies.

Practical Steps to Get Started

- Open a demo account: Practice order execution, platform tools, and strategy testing without risking capital.

- Start small on live accounts: Use small position sizes and reasonable leverage until you verify performance under live conditions.

- Track performance and journal: Keep a trading journal with entries for market conditions, rationale, and outcome to refine edge over time.

- Use proper risk management: Risk no more than 1–2% of capital per trade and use stop-loss orders.

- Choose the right broker/platform: Consider ECN/STP for scalping, or regulated retail brokers for a balanced approach. Multi-asset traders may prefer platforms that combine FX with crypto and futures.

Choosing Between Brokers and Multi-Asset Exchanges

If your focus is pure FX, an FCA/CFTC-regulated broker with MT4/MT5 and ECN access may be best. If you also trade crypto or derivatives, multi-asset exchanges like Binance, MEXC, Bitget, and Bybit provide cross-margin accounts, futures, and spot trading in one place. Sign-up links (use responsibly and verify compliance in your jurisdiction): Binance (register with Binance), MEXC (MEXC registration), Bitget (Bitget referral), Bybit (Bybit invite).

Common Mistakes New Traders Make

- Overleveraging — Using maximum leverage without considering volatility and correlation risks.

- Poor position sizing — Risking too much on single trades breaches sound money management.

- Lack of plan — Trading without defined entry, exit, or contingency rules leads to emotional decisions.

- Ignoring execution metrics — Not testing slippage and spreads can erode profitability.

Advanced Considerations: Algorithmic Trading, AI, and Market Makers

Algorithmic trading is prominent in FX because of the market’s liquidity. Traders using algorithms should consider backtesting rigorously and ensuring low-latency execution via VPS and co-location when necessary.

AI models are increasingly used for forecasting in adjacent markets like crypto and can be adapted to FX signals. For a detailed exploration of AI techniques applied to a specific asset, see this analysis on AI predicting XRP: AI to predict XRP. While AI can help generate signals, successful deployment requires robust feature engineering, continuous retraining, and stress testing across regimes.

Understanding market makers is also useful. Market makers provide liquidity but can influence short-term price dynamics. Learn more about market-maker roles and strategies here: what is a market maker – crypto. Although the article addresses crypto market makers, many concepts (spread capture, inventory management) apply to FX liquidity providers as well.

When Forex Might Not Be the Best Option

Forex may be less suitable if:

- You prefer low-leverage, long-term buy-and-hold equity investing tied to company fundamentals.

- You can’t dedicate time to monitor economic calendars and news that affect currency pairs.

- Your jurisdiction restricts leverage or access to desired instruments, affecting strategy viability.

Measuring Success: Metrics and KPIs

Track these performance metrics to judge whether forex platforms and strategies are delivering:

- Net profit and annualized return

- Max drawdown and recovery time

- Win rate vs. average win/loss ratio

- Sharpe ratio to understand risk-adjusted returns

- Slippage and execution quality logged per trade

Resources to Learn More

- Investopedia Forex Guide — Fundamental and technical primer for beginners.

- Bank for International Settlements FX Turnover Data — Data and analysis on global FX activity.

- Foreign exchange market - Wikipedia — Historical and structural overview.

- Advanced crypto/derivatives resources relevant to cross-asset traders: XRP futures trading guide and XRP future price prediction and market outlook.

Final Verdict: Is Forex a Good Trading Platform?

So, is forex a good trading platform? The answer depends on the trader:

- Yes, if you value liquidity, flexible trading hours, a variety of strategies, and access to leveraged products—and you commit to solid risk management and education.

- No, if you cannot manage leverage, dislike frequent monitoring, or prefer unleveraged, long-term equity investing tied to corporate fundamentals.

For those exploring multi-asset approaches, combining FX knowledge with emerging tools (AI forecasting and futures/crypto strategies) can create diversified opportunities. Explore AI and market-making concepts further to expand your toolkit: AI to predict XRP, market maker roles, and specialized asset guides like XRP futures trading. For a speculative market outlook on a specific crypto that some FX/crypto traders watch, see this XRP price prediction and market outlook.

Next Steps

- Decide your focus: pure FX or multi-asset trading.

- Open demo accounts with 2–3 brokers/platforms to compare execution, fees, and tools. If you want multi-asset platforms, consider Binance (register), MEXC (sign up), Bitget (referral), or Bybit (invite).

- Create a trading plan, test strategies extensively, and maintain a journal to measure performance.

Forex is a powerful and legitimate trading platform for many traders, but success depends on the right platform choice, disciplined risk management, and continual learning. Use the resources and steps in this article to evaluate whether forex aligns with your goals and to build a robust trading approach that fits your risk profile.