Is Crypto Triangular Arbitrage Profitable? An In-Depth Analysis

Author: Jameson Richman Expert

Published On: 2025-10-05

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

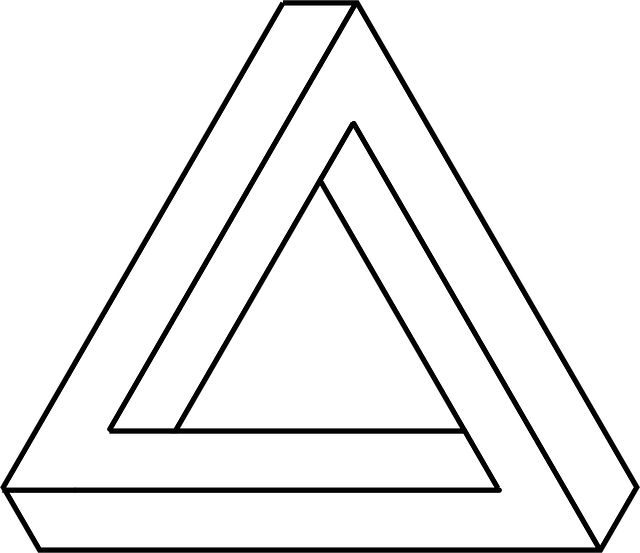

Crypto triangular arbitrage represents one of the most sophisticated and potentially lucrative trading strategies within the rapidly evolving digital asset markets. It involves exploiting temporary pricing inefficiencies among three different cryptocurrencies, often across various exchanges or within different trading pairs of a single platform. While the fundamental principle—buy low, sell high—is straightforward in theory, practical implementation requires navigating complexities such as market microstructure nuances, technological constraints, and the fast-paced nature of crypto markets. As market conditions continue to shift due to technological advancements, regulatory changes, macroeconomic influences, and increased competition, a pressing question arises: Is triangular arbitrage still a profitable strategy in 2024? Drawing on extensive industry insights, current market data, and practical experience, this article explores the profitability potential, key challenges, and strategic considerations critical for success in crypto triangular arbitrage today and in the near future.

Understanding the Core Principles of Crypto Triangular Arbitrage

At its core, crypto triangular arbitrage involves executing a sequence of three trades that cycle through three different cryptocurrencies, aiming to end up with a larger amount of the original currency than initially invested. This process is based on identifying fleeting discrepancies where the implied cross-exchange rates differ from the actual market prices, creating arbitrage windows. These discrepancies can manifest due to fragmented liquidity pools, asynchronous price feeds, varying fee structures, and blockchain network delays. The process typically involves converting one cryptocurrency into a second, then into a third, and finally back into the original to realize a profit from the price inefficiency.

For example, a trader might notice that BTC, ETH, and LTC are mispriced relative to each other across multiple exchanges. The trader could convert BTC to ETH, ETH to LTC, and then LTC back to BTC. If after accounting for all transaction costs—including fees and network charges—the final amount of BTC exceeds the initial investment, the arbitrage is profitable. However, these opportunities tend to be extremely short-lived—often just milliseconds—necessitating highly sophisticated infrastructure and execution speed. The profitability hinges on several interconnected factors:

- Transaction Fees: Each trade incurs costs—maker/taker fees, withdrawal charges, and blockchain network fees. These can cumulatively eat into or eliminate potential profits, especially when arbitrage gaps are narrow, often less than 1%.

- Market Liquidity: High liquidity ensures rapid execution at expected prices, minimizing slippage. Illiquid markets can cause significant price slippage, turning profitable opportunities into losses.

- Price Volatility and Timing: While volatility generates arbitrage opportunities, it also introduces risks. Price discrepancies tend to be corrected swiftly, sometimes within milliseconds, demanding rapid response times.

- Execution Speed and Infrastructure: Success depends on executing trades within milliseconds. This often involves deploying high-frequency trading systems, colocated servers near exchange data centers, and optimized APIs to reduce latency.

Market Microstructure and Its Impact on Profitability

A deep understanding of market microstructure—the mechanisms governing how orders are processed, how prices are formed, and how liquidity is distributed—is essential for effective arbitrage. Crypto markets are highly fragmented across numerous exchanges, each with distinct liquidity profiles, order book depths, fee structures, and transaction confirmation times. These disparities create arbitrage opportunities but also pose execution risks.

For instance, major platforms like Binance, Coinbase Pro, and Kraken typically feature deep liquidity and stable order books, making them ideal for arbitrage. Conversely, smaller or regional exchanges with wider spreads and lower liquidity can lead to higher slippage and partial fills. Blockchain confirmation times - for Bitcoin, often several minutes; for Ethereum, faster but sometimes congested - further complicate timing strategies. These delays, combined with network fees, influence the effective arbitrage margin and necessitate precise planning. Traders must account for transfer delays, potential blockchain congestion, and fluctuating network fees, all of which can significantly impact profitability.

Challenges and Limitations in Crypto Arbitrage

Despite its theoretical appeal, real-world constraints often diminish or neutralize arbitrage opportunities. My early experiences in crypto arbitrage confirmed that apparent opportunities spotted via scanners often vanish once transaction costs are factored in. For example, a 1% price discrepancy may seem attractive, but after deducting trading fees (which can range from 0.05% to 0.2% per trade), withdrawal fees, and blockchain network charges, the net profit may turn negative.

Slippage—particularly in less liquid markets—can distort execution prices. Market orders tend to consume existing liquidity, pushing prices away from initial quotes, while limit orders mitigate slippage but risk not being filled immediately, leading to missed opportunities. Additionally, exchange-specific factors like API stability, withdrawal timeframes, and fee structures need continuous monitoring. Arbitrage opportunities are often short-lived, and delays in execution can turn a profitable trade into a loss rapidly.

Choosing the right exchange partnerships is critical. Low-fee, high-liquidity platforms such as MEXC, Bitget, and Bybit offer reliable infrastructure, competitive fee structures, and liquidity pools conducive to arbitrage. Nonetheless, traders must stay vigilant regarding each platform’s fee policies, withdrawal constraints, and API performance, which can influence the feasibility and profitability of arbitrage strategies.

Leveraging Technology and Automation

Performing manual arbitrage at scale is impractical due to human limitations in speed, accuracy, and emotional discipline. The advent of automation—via trading bots, APIs, and sophisticated algorithms—has revolutionized crypto arbitrage. Modern traders deploy automated systems that continuously monitor multiple exchanges and currency pairs for arbitrage signals, executing trades within milliseconds—something human traders cannot match.

Automation enables dynamic risk management, such as implementing stop-loss and take-profit orders, adjusting trade sizes based on liquidity and volatility, and prioritizing trade execution based on real-time market data. Many arbitrageurs utilize low-latency colocated servers situated near major exchange data centers to minimize response times, which is often the difference between capturing and missing fleeting arbitrage opportunities. Incorporating third-party analysis tools—like Telegram trading signals, macroeconomic indicators, and blockchain network analytics—further enhances decision-making and execution efficiency.

Additionally, incorporating blockchain-specific variables—such as network congestion levels, recent confirmation times, and fluctuating transaction fees—can optimize execution timing to maximize arbitrage margins and reduce transaction costs, ensuring sustained profitability.

Market Dynamics and Strategic Considerations

Market conditions significantly influence the viability of arbitrage strategies. During periods of heightened volatility, such as market shocks or sudden news events, price gaps often widen, creating more frequent and substantial arbitrage opportunities. Conversely, in stable or trending markets, discrepancies tend to narrow or disappear, making arbitrage less profitable.

External macroeconomic factors also impact arbitrage profitability. Regulatory actions—such as bans, restrictions on cross-border transfers, or crackdowns on specific exchanges—can create temporary price disparities that, if identified and acted upon swiftly, generate profits before the market stabilizes. For example, during regulatory crackdowns, prices on exchanges in less-regulated jurisdictions may diverge significantly from those in heavily regulated markets.

Furthermore, macro trends like Bitcoin’s long-term trend, macro liquidity conditions, and geopolitical tensions influence overall market dynamics. For instance, during Bitcoin rallies or macroeconomic crises, increased volatility and trading volume often expand arbitrage margins, albeit with increased risk. Conversely, during prolonged bear markets, opportunities may diminish as prices become more correlated across exchanges and pairs.

Risk Management and Practical Advice

Crypto arbitrage is inherently risky. Market swings, technical failures, API outages, blockchain network issues, and regulatory changes can all lead to significant losses. Effective risk management—such as setting strict stop-loss orders, diversifying across multiple exchanges and pairs, and continuously monitoring network health—is essential.

Start small: test strategies with minimal capital or in demo environments to refine execution and risk controls. Employ diversification to spread risk across different exchanges, assets, and arbitrage pathways. Constantly monitor network congestion, fee structures, and blockchain confirmation times, adjusting strategies as needed. Staying informed about exchange policies, withdrawal limits, and potential regulatory developments is crucial for avoiding costly mistakes.

Is Arbitrage Still Worth Pursuing in 2024?

While crypto triangular arbitrage remains a profitable strategy in certain niches, it no longer offers the "low-hanging fruit" opportunities that existed a few years ago. The proliferation of high-frequency trading bots, arbitrage aggregators, and sophisticated infrastructure has rapidly exploited many arbitrage windows, causing discrepancies to disappear within seconds or milliseconds.

Today, success in arbitrage often depends on deploying advanced automation, maintaining a highly optimized infrastructure, and executing rapid, informed trades. Profitable arbitrage tends to be concentrated in less liquid or emerging markets, during periods of market stress, or in response to regulatory shifts. Traders with deep technical expertise, real-time macroeconomic awareness, and disciplined risk management can still generate consistent profits by identifying niche opportunities and acting swiftly.

Final Thoughts and Strategic Recommendations

Crypto triangular arbitrage offers compelling profit potential but demands a high level of technical knowledge, discipline, and vigilance. Success hinges on ultra-fast execution, meticulous cost and risk management, and adaptability to evolving market conditions. Building a robust trading infrastructure—leveraging high-frequency algorithms, choosing low-fee and high-liquidity exchanges, and staying informed of macroeconomic developments—can turn transient inefficiencies into sustainable income streams.

Remember, consistent arbitrage profitability is a marathon requiring persistent effort, continuous learning, and strategic refinement. The competitive landscape intensifies as technology advances; thus, remaining ahead necessitates innovation and discipline. By staying vigilant to macro trends, technological upgrades, and regulatory changes, traders can capitalize on residual arbitrage opportunities in the complex crypto ecosystem.

For those seeking to deepen their expertise or maintain a competitive edge, consider exploring the following resources:

- Crypto.com Fee & Strategic Positioning Analysis

- Bitcoin Price Forecast 2025

- Top Telegram Trading Signal Channels

- Crypto Community Insights on Reddit

- Bitcoin Bot Price and Setup Guide

In conclusion, while crypto triangular arbitrage in 2024 faces heightened competition and technological hurdles, it remains a viable and potentially lucrative strategy for well-informed, technologically adept traders. Success depends on continuous innovation, disciplined execution, and a keen understanding of both micro- and macroeconomic factors. With persistent effort, strategic planning, and adaptive tactics, traders can exploit residual market inefficiencies and sustain profitable arbitrage operations in the complex crypto landscape.