How to Calculate Trading Volume in Forex: Practical Formulas, Examples, and Strategies

Author: Jameson Richman Expert

Published On: 2025-11-11

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

How to calculate trading volume in forex is a common question among both new and experienced traders because volume is a key confirmation tool for price moves, breakouts, and reversals. This article explains the realities of forex volume (including tick volume vs. real volume), gives step-by-step formulas to compute notional and pip values, provides worked examples for common currency pairs, shows how to use volume-based indicators, and lists reliable data sources and platforms so you can apply volume analysis confidently.

Why trading volume matters in forex

Volume helps you measure market participation and conviction behind price moves. In equities and futures, high volume often confirms strong interest that supports a trend. In forex — a decentralized over-the-counter market — volume behaves differently, but it still provides valuable signals when interpreted correctly. Traders use volume to:

- Confirm breakouts or fakeouts

- Spot divergences between price and participation

- Identify liquidity clusters and potential reversals

- Time entries and exits with better risk management

The challenge: spot forex is decentralized

Unlike stocks traded on centralized exchanges, spot forex trades are executed across banks, ECNs, and brokers worldwide. That means there is no single "official" volume feed for the entire forex market. Instead, traders rely on proxies:

- Tick volume: number of price changes (ticks) observed on a broker or platform during a period (common in MT4/MT5 and TradingView).

- Broker/ECN volume: actual traded volumes available from specific platforms that aggregate client flows.

- Exchange volume (futures): currency futures traded on centralized exchanges (e.g., CME) show real contract volumes and are often used as an institutional proxy for spot forex liquidity.

For authoritative background on the forex market structure, see the Foreign exchange market page on Wikipedia and the Bank for International Settlements FX turnover report (BIS).

Key units, lot sizes, and formulas

To calculate volume in forex, you must understand standard contract sizes and conversions between currency units and account currency. Here are the basic definitions and formulas you'll use:

Common lot sizes

- Standard lot: 100,000 units of the base currency

- Mini lot: 10,000 units

- Micro lot: 1,000 units

Basic formulas

Notional volume (in base currency units):

Notional Units = Number of Lots × Contract Size

Value of the trade in quote currency (for a pair Base/Quote):

Notional Value (quote) = Notional Units × Price (Base/Quote)

Convert trade value to your account currency (if different):

Account Value = Notional Value (quote) × Conversion Rate (quote/account currency)

Pip value (approximate) when the quote currency is USD or account currency is USD:

Pip Value = (One Pip / Price) × Notional Units

(One Pip usually = 0.0001 for most pairs, 0.01 for JPY pairs)

Worked examples: calculate trading volume in forex step-by-step

Example 1 — EUR/USD, 1 standard lot

Assumptions:

- Pair: EUR/USD

- Price: 1.1200

- Position: 1 standard lot = 100,000 EUR

1) Notional units = 1 × 100,000 = 100,000 EUR

2) Notional value in USD = 100,000 × 1.1200 = 112,000 USD

So trading volume (notional) = 100,000 EUR (base) or 112,000 USD (quote).

To compute pip value (1 pip = 0.0001):

Pip value = (0.0001 / 1.1200) × 100,000 ≈ 8.93 USD per pip.

Example 2 — USD/JPY, 0.5 standard lot (50,000 USD)

Assumptions:

- Pair: USD/JPY

- Price: 150.25

- Position: 0.5 standard lot = 50,000 USD

Notional value in JPY = 50,000 × 150.25 = 7,512,500 JPY

For JPY pairs one pip = 0.01, so pip value in JPY = (0.01 / 150.25) × 50,000 ≈ 3.33 JPY per pip

Convert pip value to USD (if account in USD): 3.33 JPY ÷ 150.25 ≈ 0.0222 USD per pip — but typically one would calculate pip value directly in USD using alternative formula for USD-quoted pairs. Best practice: convert contract to account currency using current FX rate for accurate risk sizing.

Example 3 — GBP/JPY using micro lots

Assumptions:

- Pair: GBP/JPY

- Price: 182.50

- Position: 5 micro lots = 5 × 1,000 = 5,000 GBP

Notional JPY value = 5,000 × 182.50 = 912,500 JPY

Pip value (0.01): (0.01 / 182.50) × 5,000 ≈ 0.274 JPY per pip -> convert to account currency as required.

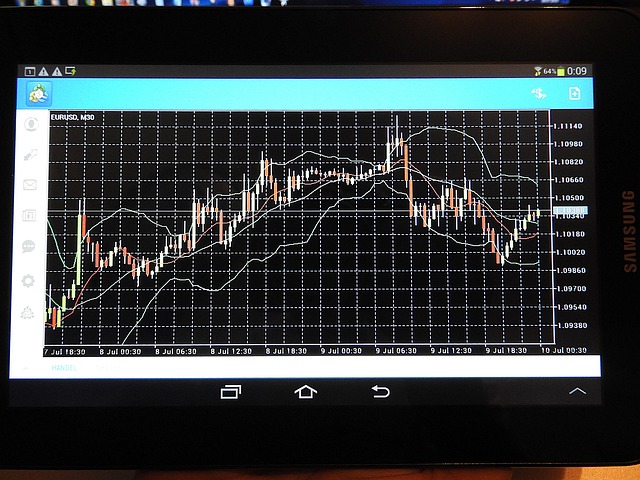

Using tick volume as a practical proxy

Most retail platforms (MT4, MT5, TradingView) provide tick volume — the number of times price changed during a bar. While tick count is not the same as the number of traded units, empirical studies show tick volume correlates well with real volume, especially on liquid pairs and timeframes above one minute.

How to use tick volume:

- Look for increased tick volume on breakouts — higher ticks suggest stronger participation.

- Compare volume across similar sessions (e.g., London open vs New York open).

- Use volume divergence: price makes new high but tick volume declines → possible exhaustion.

For methodology and definitions, review Investopedia’s overview of volume.

Implementing OBV and VWAP with tick volume

On-Balance Volume (OBV) can be adapted to tick volume: treat tick counts as the “volume” component in the OBV calculation. VWAP (volume-weighted average price) is less precise with tick volume but still helpful for intraday support/resistance if you use a consistent volume proxy.

Using futures volume (CME) as a proxy for institutional activity

Currency futures traded on centralized exchanges like the CME have real traded volumes and open interest. Institutional flows often show up first in futures, and futures volume can be a useful high-quality proxy for spot forex liquidity and sentiment.

Access CME FX futures data and educational material: CME Group FX futures.

Step-by-step: How to calculate trading volume in forex (practical checklist)

- Decide on a source: tick volume from your broker, broker-reported lots, or exchange futures data.

- Define the contract size: standard = 100,000 units, mini = 10,000, micro = 1,000.

- Compute notional units: Lots × Contract Size.

- Convert to quote currency: Notional Units × price (base/quote).

- Convert to account currency: If needed, use the current FX rate to convert the quote currency to your account currency.

- Compute pip value: (One Pip / Price) × Notional Units or use broker pip calculators for exact values.

- Interpret volume: Compare relative increases/decreases, look for divergences, and use with other confirmations (price action, indicators, liquidity zones).

Volume-based strategies and actionable rules

Below are practical, actionable rules that apply volume calculations and tick data into trading strategies.

Breakout confirmation

- Rule: Accept breakout if volume (tick volume or futures volume) during breakout is at least 30–50% higher than the average volume of the previous n bars (n = 20 is common).

- Action: Enter on pullback to breakout level if volume remains supportive; place stop below the breakout candle low (or a fixed ATR multiple).

Volume divergence

- Rule: If price makes a new high/lower low but volume weakens for 3–5 bars, suspect exhaustion.

- Action: Look for reversal patterns (engulfing, pin bar) with supportive volume change before taking a contrarian trade.

Volume clusters & liquidity pools

- Rule: Identify high-volume nodes (HVN) on a volume profile — price tends to respect HVNs as support/resistance.

- Action: Trade re-tests of HVNs with tight risk and clear stop-loss placement.

Using VWAP for intraday trades

- Rule: Use VWAP as a fair-value guide. Price above VWAP with rising volume = intraday bullish bias.

- Action: Use VWAP crossovers combined with volume spikes to enter momentum trades (lower timeframes for intraday traders).

Tools, platforms, and data sources

To calculate and act on volume, you need good charting and data. Consider these options:

- MT4 / MT5: Provides tick volume from your broker and volume indicators.

- TradingView: Excellent charting and community scripts. For setting up alerts tied to volume conditions, see this TradingView alerts guide: TradingView 2.0 Price Alerts — Ultimate Setup Guide.

- Futures exchanges: Use CME data for high-quality FX futures volume (CME Group FX futures).

- Broker/ECN volume feeds: For real traded lot volumes, choose a broker or ECN that provides volume data transparency.

If you trade crypto or want cross-market comparison (crypto volume vs FX), check these related strategy and signals guides: Bitcoin price indicators and strategies and XRP trendline breakout analysis. If you need to understand exchange fees when using crypto platforms for FX/crypto comparisons, read Is Binance free to trade in 2025?

Where to get real-time liquidity and why platforms matter

If you want actual order book depth and traded volume for FX/crypto hybrids or futures, consider centralized exchange accounts or ECNs. For crypto and some FX-related products you can sign up here:

- Register on Binance — large order book for crypto and some FX-related pairs.

- Register on MEXC — another exchange for crypto liquidity and volume analysis.

- Register on Bitget — derivatives and futures with volume data.

- Register on Bybit — deep order books for derivative volume analytics.

For algorithmic traders, paid data feeds and VPS-hosted strategies that capture tick volume across multiple brokers help build a more representative volume picture.

Advanced considerations: order flow, liquidity, and institutional volume

Institutional traders analyze order flow (time & sales), depth-of-market (DOM), and aggregated futures open interest to understand who is moving the market. While retail traders may not have direct access to aggregated global order flow, you can get a lot of insight by:

- Monitoring futures volume and open interest (CME) for directional bias

- Using broker-provided DOM or Level II data where available

- Watching for surprise volume spikes during news events (higher probability of stop runs and rapid moves)

Common mistakes when using volume in forex

- Assuming tick volume equals traded units — it’s a proxy, not identical.

- Ignoring session context — a high volume in Asian hours means different things than a high volume in London or New York.

- Relying solely on volume without price confirmation — volume is a filter, not the whole strategy.

- Using inconsistent volume sources — compare apples to apples (same broker or same type of feed) when measuring relative changes.

Frequently Asked Questions (FAQs)

Q: Can I calculate “real” volume for spot forex?

A: Not for the entire global market. You can calculate exact volume for your broker or ECN feed (if it reports traded units), or use futures (CME) for exchange-verified volume. For most retail traders, tick volume is a reliable and practical proxy.

Q: How many lots equal $1,000,000 notional exposure on EUR/USD?

A: For EUR/USD at 1.1200, 1 standard lot = 100,000 EUR ≈ 112,000 USD. To reach $1,000,000 USD notional, you need roughly 8.928 standard lots (1,000,000 ÷ 112,000 ≈ 8.928). You’d typically round to 8.9 or 9 lots, accounting for precise live rates.

Q: Should I use volume indicators or raw tick counts?

A: Use both. Raw tick counts give immediate clues; indicators (OBV, VWAP, Volume Profile) aggregate information and reduce noise. Customize indicator parameters to your timeframe and instrument.

Practical checklist: implement volume analysis today

- Decide which volume feed you will trust: your broker’s tick volume, a consolidated feed, or futures data.

- Set up your charting platform (MT4/MT5 or TradingView) with a volume indicator and OBV adapted to tick volume.

- Create a rule for breakout confirmation (e.g., volume ≥ average volume of past 20 bars × 1.3).

- Practice on a demo account for at least 30 trades to validate the signals against actual outcomes.

- For deeper analysis, compare futures volume (CME) with spot tick volume to identify institutional alignment.

Further reading and resources

- Foreign exchange market — Wikipedia

- Volume — Investopedia

- CME Group — FX products and volume

- TradingView volume alerts and setup: TradingView 2.0 Price Alerts

- Practical strategy examples and crypto/FX crossover guides: Bitcoin indicators and strategies, XRP trendline breakout analysis

- Exchange fee considerations and platform choices: Is Binance free to trade in 2025?

- Algorithmic tools and bots (cost vs value): NURP trading bot pricing and costs

Conclusion

How to calculate trading volume in forex depends on what you want to measure: notional exposure (lots × contract size), tick volume (price change counts), or exchange futures volume (real contracts). Use the formulas above to calculate notional units and pip value, adopt tick volume indicators as practical proxies on MT4/MT5 or TradingView, and validate signals with futures data when possible. Combine volume analysis with price action and risk management for the best results.

Ready to practice? Open a demo or funded account on your preferred platform, set up volume indicators, and start collecting data. If you trade across crypto/FX or want deep order book visibility, you can register on major platforms here: Binance, MEXC, Bitget, and Bybit.

Use the methods here to quantify participation, validate setups, and improve your timing. Volume is not a magic bullet, but measured and combined with sound strategy it becomes a powerful tool in any trader’s toolkit.