Global Crypto FX Trade: A Comprehensive Guide to Crypto Coins for Day Trading

Author: Jameson Richman Expert

Published On: 2024-12-26

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

The world of cryptocurrency has exploded in popularity over the last few years, attracting traders and investors alike. This explosive growth has led to the emergence of the global crypto FX trade, a marketplace that offers vast opportunities for those looking to capitalize on price fluctuations. In this article, we will explore the fundamentals of day trading in the crypto space, the most popular cryptocurrency options for day trading, and effective strategies to enhance your trading performance. Let's dive in!

Understanding Global Crypto FX Trade

Global Crypto FX trade represents the buying and selling of cryptocurrencies in various markets worldwide. As an asset class, cryptocurrencies are known for their extreme volatility, which presents both opportunities and risks. The Forex market, traditionally dominated by fiat currencies, has seen an increase in crypto pair offerings, allowing traders to leverage skills and strategies from conventional FX trading to this new and dynamic market.

The market operates 24/7, providing traders with the unique opportunity to trade at any time. This non-stop nature can be both exhilarating and overwhelming, making it crucial for day traders to stay informed and equipped with effective strategies.

Highly Recommended Crypto Coins for Day Trading

Not all cryptocurrencies are created equal, especially when it comes to day trading. Below are several popular crypto coins that many traders favor due to their liquidity, volatility, and trading volume:

1. Bitcoin (BTC)

As the original cryptocurrency, Bitcoin remains a staple in the global crypto FX trade. Its liquidity and trading volume are unrivaled, making it a preferred choice for many day traders. Traders often use BTC as a benchmark to gauge the broader market trend.

2. Ethereum (ETH)

Ethereum is not only a cryptocurrency but a platform for creating decentralized applications (dApps). Its broad use case and high trading volume have established it as a reliable option for day traders.

3. Binance Coin (BNB)

Initially created as a utility token for the Binance exchange, BNB has built momentum over the years. With a sizable trading volume and a growing number of applications, it ranks high among the favorite coins for day trading.

4. Ripple (XRP)

XRP has made a name for itself by facilitating fast and low-cost international transactions. Its unique selling proposition gives it distinctive appeal in the day trading arena.

5. Cardano (ADA)

Cardano has gained significant traction due to its scalable and sustainable blockchain technology. Its price trends and movements have made it a prime candidate for day trading.

Effective Strategies for Day Trading Cryptocurrencies

Trading in the crypto market involves various strategies tailored to different market conditions. Below are several effective strategies for day trading cryptocurrencies:

1. Scalping

Scalping is a quick trading strategy aimed at exploiting small price movements. Traders can make many trades throughout the day, banking on minimal gains from each. This method demands quick decision-making and precise execution.

2. Momentum Trading

This strategy relies on the trend of substantial price movement in either direction. Traders look for cryptocurrencies that show significant upward or downward momentum and attempt to ride that wave for profits.

3. Swing Trading

Although slightly longer-term than day trading, swing trading capitalizes on price "swings." Traders hold positions for a few days or weeks, taking advantage of the volatility that often accompanies cryptocurrency price fluctuations.

4. Arbitrage

Arbitrage involves buying and selling a currency on different exchanges to exploit price disparities. Traders must be quick and vigilant as these opportunities can vanish rapidly!

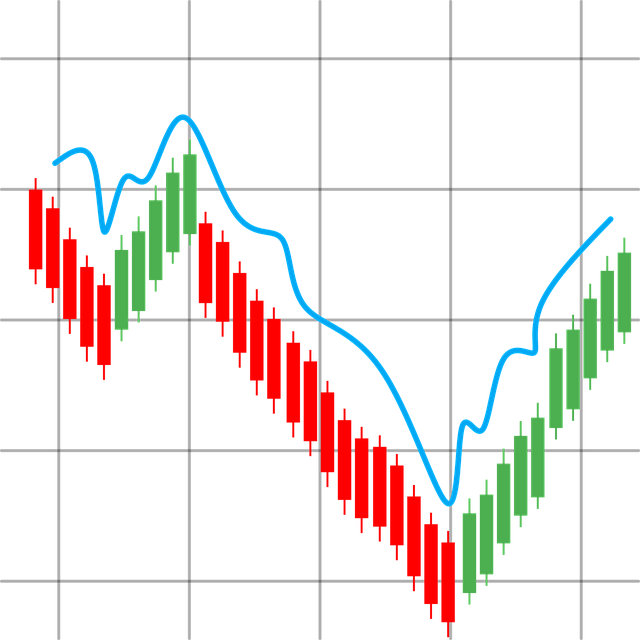

5. Technical Analysis

Technical analysis is the practice of evaluating cryptocurrencies using statistics and chart patterns. Tools such as moving averages, RSI, and volume indicators can help traders identify potential entry and exit points.

The Importance of Risk Management in Day Trading

While the potential for profit is appealing, day trading comes with its risks. Engaging in proper risk management can make a significant difference in a trader's success. It's essential to know your risk tolerance and set stop-loss orders to minimize potential losses.

Risk management strategies may include:

- Setting stop-loss orders to limit losses.

- Diversifying your portfolio to spread risk across various assets.

- Using position sizing to determine how much capital to risk on a single trade.

The Role of Sentiment Analysis in Crypto Trading

In the volatile world of cryptocurrencies, market sentiment can dramatically affect price movements. Social media platforms, news outlets, and trading forums can provide insights into how traders feel about a specific coin or the market as a whole.

Monitoring sentiment can help you predict price movements and make more informed trading decisions. Various tools and platforms allow traders to gauge market sentiment, making it easier to act in accordance with prevailing trends.

The Future of Crypto FX Trade: Trends to Watch

The global crypto FX trade is evolving, and several trends may shape its future:

1. Increased Regulation

As the market matures, governments worldwide are beginning to implement regulations to stabilize the ecosystem. While regulations can introduce new challenges, they can also enhance investor confidence and market stability.

2. Enhanced Technology

As blockchain technology advances, we will likely witness enhanced trading platforms that offer user-friendly interfaces, faster trading options, and improved security measures.

3. Growing Acceptance of Cryptocurrencies

As more businesses begin to accept cryptocurrencies as a form of payment, the utility and demand for these digital assets will likely increase, creating more trading opportunities.

Conclusion

Trading cryptocurrencies globally can be an exhilarating and potentially profitable endeavor. By understanding market dynamics, utilizing effective strategies, and employing robust risk management practices, traders can position themselves for success in the fast-paced world of crypto FX trade.

As always, a prudent approach and continuous learning can lead to improved trading outcomes. Remember, the crypto market is highly volatile; hence vigilance is the key.

Overall, crypto trading is not just about profits; it’s about understanding the market and making informed decisions.

Additional Resources for Crypto Trading

If you're interested in further enhancing your knowledge about crypto trading, consider visiting some of these popular betting tips or sports news websites: