Exploring the Intersection of Crypto, AI Trading, and Day Trading Platforms

Author: Jameson Richman Expert

Published On: 2024-11-12

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

As the world continues to evolve technologically, the financial landscape is experiencing a seismic shift, particularly in the realm of cryptocurrencies. With AI trading platforms gaining traction, and online brokerage firms like Robinhood offering more features, investors are left pondering the dynamics of day trading crypto. In this article, we will delve into the concept of a crypto AI trader, discuss whether Robinhood allows for day trading of cryptocurrencies, share insight on the best crypto trade signals, and examine optimal crypto trade times.

What is a Crypto AI Trader?

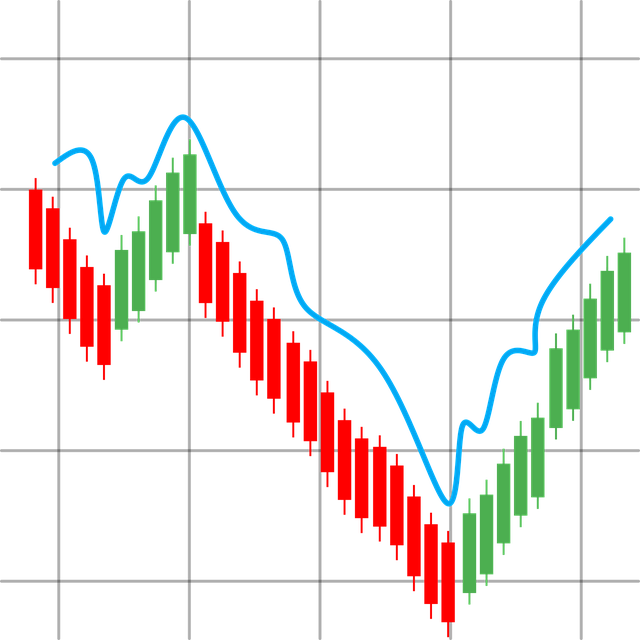

The rise of cryptocurrencies has not only changed how we view money and investment, but it has also given birth to innovative trading technologies. One of the most intriguing advancements in this space is the integration of artificial intelligence into trading strategies.

Defining AI-Driven Trading

A crypto AI trader employs machine learning algorithms and data analysis to make informed trading decisions. These systems can analyze vast amounts of market data at incredible speeds, thereby identifying patterns that are often invisible to the naked eye. Investors increasingly turn to AI-driven trading strategies to enhance their decision-making processes and potentially increase profitability.

Advantages of Using AI in Crypto Trading

- Faster Data Analysis: AI systems can process large datasets in real-time, allowing for quicker reactions to market fluctuations.

- Emotional Detachment: Unlike human traders, AI does not experience emotions, leading to more rational decision-making.

- Predictive Analytics: With sufficient historical data, AI algorithms can generate predictions on market trends, providing traders with potential entry and exit points.

In my opinion, the incorporation of AI into crypto trading can be a game-changer, but investors should approach it with reasonable skepticism and ensure they remain informed about the market dynamics.

Robinhood: Can You Day Trade Crypto?

Robinhood has grown to become one of the most recognizable names in online trading, especially among younger investors. Its commission-free trading model has attracted a massive user base eager to tap into the growing world of cryptocurrencies.

Understanding Day Trading

Day trading refers to the practice of buying and selling financial instruments, such as cryptocurrencies, within the same trading day. Traders aim to capitalize on short-term price movements, requiring a keen understanding of market timing and trends.

Robinhood's Policies on Crypto Trading

As of now, Robinhood offers a limited selection of cryptocurrencies for trading, including popular tokens like Bitcoin, Ethereum, and Dogecoin. However, the platform does not allow day trading for crypto in the same way it does for stocks. Although you can buy and sell crypto at any time, the absence of specialized features for day trading limits the platform's capability to accommodate active trading strategies.

From my perspective, Robinhood is an excellent entry point for novice traders, but those looking to engage in serious day trading may want to explore more specialized platforms designed for that purpose.

Best Crypto Trade Signals

Successful trading often hinges on having access to effective trade signals. These signals can indicate when to buy or sell specific assets and are crucial for both beginners and seasoned traders.

What are Crypto Trade Signals?

Crypto trade signals are essentially suggestions or recommendations that traders can use to inform their trading strategies. These signals are generated based on various market indicators, including price movements, trading volume, and market sentiment. Many platforms and tools provide these signals, helping traders make informed decisions.

Channels for Obtaining Crypto Trade Signals

- Signal Providers: There are dedicated services that offer trade signals for various cryptocurrencies, often for a subscription fee.

- Social Trading Platforms: Many trading platforms allow users to copy trades from successful traders, offering a form of algorithm-generated signals.

- Crypto Bots: Many automated trading bots come with integrated signals that can execute trades based on pre-configured parameters.

In my view, while using trade signals can significantly enhance a trader’s strategy, it’s vital to commit to only those signals that come from reputable sources.

Top Platforms for Crypto Trade Signals

- CryptoSignals.org: Known for its high accuracy rate and reliable signals.

- CoinSignals: Offers a blend of free and premium signal services tailored to various trader needs.

- TradingView: While primarily a charting platform, it has social features where traders share their own signals and insights.

In my opinion, finding the best platform for trade signals is crucial. Always test these platforms with a demo account first to avoid significant losses.

Understanding Crypto Trade Times

Timing is pivotal in the world of trading, especially in the fast-paced crypto markets. Understanding the optimal times to trade can have a significant impact on profitability.

Why Crypto Trade Times Matter

The cryptocurrency market operates 24/7, which presents unique challenges and opportunities. Unlike traditional stock trading that has specific hours, crypto trading is constant. This means that market sentiment can shift quickly, requiring traders to act fast based on both short-term trends and long-term projections.

Best Times to Trade Cryptocurrency

- Overlap of Major Markets: Trading during periods when two major exchanges are open can lead to increased volatility, often resulting in better trading opportunities.

- Market Sentiment: Monitoring peak trading activity can provide insights into when price movements may be more pronounced.

- Specific Days of the Week: Historical data suggests that specific days, like Wednesdays and Thursdays, often show increased market activities.

In my opinion, while it is important to understand trade times, traders should also monitor market news and sentiment to adapt their strategies accordingly.

Final Thoughts: Navigating the Rapidly Evolving Crypto Landscape

As the crypto market continues to develop, technologies like AI trading and platforms like Robinhood are reshaping how we engage with finance. Whether you are considering using a crypto AI trader, day trading on platforms like Robinhood, seeking reliable trade signals, or looking to optimize your trading times, staying informed is essential.

In conclusion, navigating the complexities of cryptocurrency trading requires strategy, research, and an understanding of market dynamics. By leveraging advanced technologies and staying active in the crypto trading community, investors can strive for success in this volatile yet rewarding market.

Don’t forget to conduct your own research and practice caution while diving into the world of crypto trading!