Crypto Trading Bot Review: Your Ultimate Guide to Automated Trading

Author: Jameson Richman Expert

Published On: 2025-01-13

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

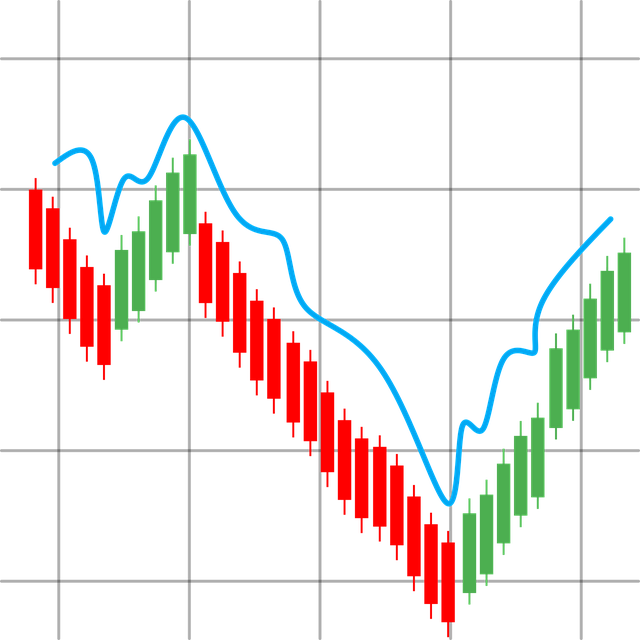

The world of cryptocurrency trading can be overwhelming, especially for new entrants. With thousands of tokens available and the volatility dominating the market, deciding on the best approach is crucial. Enter crypto trading bots—automated software that can execute trades on your behalf, optimizing your strategy based on market conditions. This article delves into various aspects of crypto trading bots, including reviews of C++ crypto trading bots, how to create your own, and the advancements in AI automated trading software.

Understanding Crypto Trading Bots

Crypto trading bots are programs that use algorithms to analyze market data and execute trades based on predefined criteria. They can take advantage of market trends, react faster than human traders, and operate continuously, 24/7, without emotions clouding their judgment. For anyone interested in diving into crypto trading, understanding how these bots work is essential.

Crypto Trading Bot Review: Pros and Cons

The effectiveness of crypto trading bots can vary significantly based on the type and the user's trading strategy. Here’s a breakdown of the advantages and disadvantages:

Pros:- 24/7 Trading: Bots can operate around the clock, taking advantage of market opportunities at any time.

- Speed: Bots can execute trades much faster than humans, allowing them to capitalize on fleeting opportunities.

- Emotionless Trading: Since they operate based on algorithms, bots remove emotional bias, leading to more rational trading decisions.

- Market Volatility: Bots can struggle to adapt to sudden market changes and may incur losses.

- Technical Issues: Like any software, trading bots can fail or malfunction.

- Reliance on Programming: The success of a trading bot heavily depends on the algorithms programmed into it.

C++ Crypto Trading Bots: High Performance Meets Scalability

C++ is a powerful programming language often used in developing high-performance applications, including trading bots. When evaluating C++ crypto trading bots, consider the following:

Benefits of C++ Trading Bots:- Execution Speed: C++ bots can execute trades faster due to their compiled nature, suitable for high-frequency trading strategies.

- Efficiency: Being a lower-level language, C++ programs can be highly optimized in terms of performance.

- Compatibility: C++ can easily interact with other languages and APIs, making it a versatile choice for bot development.

For traders who prioritize performance and require precision in their strategies, C++ crypto trading bots could be the ideal choice. However, they may require more programming expertise compared to more user-friendly platforms.

How to Create Your Own Crypto Trading Bot

Building a crypto trading bot can be a rewarding experience that allows you to customize trading strategies to fit your personal trading profile. Here’s a simplified guide on how to create your own:

Step 1: Define Your StrategyBefore coding, outline a clear trading strategy, including risk management rules and asset allocation.

Step 2: Choose a Programming LanguageDecide whether to use C++, Python, JavaScript, or another language based on your expertise and performance requirements.

Step 3: Get Access to APIsRegister on a crypto exchange that supports API access (like Binance, Kraken, etc.) to allow your bot to execute trades.

Step 4: Develop and Test Your BotStart coding and implement a backtesting phase to assess how your bot would have performed in past market conditions.

Step 5: Launch and MonitorDeploy your bot in a live trading environment but keep an eye on its performance and be ready to make adjustments as necessary.

AI Automated Trading Software: The Future of Trading

The rise of AI technology has revolutionized trading, particularly in the cryptocurrency space. AI automated trading software is designed to analyze vast amounts of data to recognize patterns and predict market movements. Here are some advantages:

Benefits of AI Trading Software:- Advanced Analysis: AI can continuously learn and adjust to new data, enabling it to optimize trading decisions.

- Risk Management: Advanced risk management features can be integrated into AI bots to minimize losses.

- Real-Time Insights: AI software can provide traders with real-time analytics and predictions, enhancing decision-making.

AI-driven trading tools are quickly becoming essential for serious traders, providing a competitive edge in a fast-paced market.

Emerging Trends in Crypto Trading Bots

As the cryptocurrency market continues to evolve, several trends are shaping the future of crypto trading bots:

1. Increasing Adoption of Copy Trading:- Copy trading allows users to mimic the trades of successful traders automatically, making it easier for newcomers to participate in the market.

- As crypto trading becomes mainstream, prominent exchanges like Binance are enhancing their trading capabilities, often offering automated tools and bots.

- Learn more about trends in exchanges with The Rise of Crypto Exchanges: Binance Leads the Charge, which discusses how Binance is setting new standards in the crypto trading ecosystem.

- As technology advances, the capabilities of trading bots will continue to grow, incorporating more sophisticated AI and machine learning algorithms.

- Explore future trends in automated trading by reading Bots for Crypto Trading: The Future of Trading in 2024, which outlines what traders should expect in the near future.

Final Thoughts

Whether you are a seasoned trader or a newcomer to the world of cryptocurrencies, understanding crypto trading bots is essential for maximizing and optimizing your investment strategy. From developing your trading bot to taking advantage of AI-driven software, the tools available today can help you succeed amidst market volatility. Embrace the future of trading and harness the power of automation to enhance your trading experience.

As we look toward 2024 and beyond, the integration of more advanced technology will continue to shape how we trade. Investigate different software options, define your risk strategy, and consider leveraging bots for a more efficient trading experience.