Comprehensive Copy Trading Analysis for Traders

Author: Jameson Richman Expert

Published On: 2025-09-26

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Copy trading analysis has rapidly become a fundamental component of modern trading strategies, driven by the democratization of financial markets through digital platforms. Its core value lies in enabling less experienced traders to mirror the trades of seasoned investors, thereby gaining exposure to complex markets such as cryptocurrencies, forex, commodities, and indices without extensive personal expertise. However, success in copy trading does not rely solely on copying top performers; it requires a nuanced evaluation encompassing quantitative performance metrics, technical signals, social dynamics, behavioral insights, and technological innovations. This comprehensive guide aims to delve deeply into these aspects, providing traders with the knowledge to optimize their copy trading endeavors, mitigate risks, and adapt to evolving market conditions.

Understanding Copy Trading and Its Strategic Significance

Copy trading, also known as social trading or mirror trading, involves the automatic replication of trades executed by selected professional or experienced traders. This approach allows individuals to participate in high-level trading strategies without needing to master complex technical analysis or fundamental research. The strategic importance of copy trading extends beyond mere convenience; it democratizes access to expert knowledge, fosters diversification, and accelerates learning by observing real-time decision-making processes.

Platforms such as Binance, MEXC, Bitget, and Bybit have built comprehensive ecosystems that facilitate this process. They offer detailed trader profiles, real-time analytics, community feedback systems, and risk management tools—empowering traders to perform informed evaluations. These features enable users to analyze historical performance, trader consistency, and strategic approaches effectively. Yet, it is imperative to recognize that copy trading is not a guaranteed pathway to profits; it demands ongoing due diligence, continuous monitoring, and strategic flexibility, especially given the volatile nature of financial markets.

Key Performance Metrics for Effective Copy Trading Analysis

A thorough analysis of traders to emulate involves assessing a suite of performance metrics, each illuminating different facets of trading efficacy, resilience, and risk. Beyond surface-level indicators, in-depth metrics help differentiate genuinely skilled traders from those whose apparent success may be superficial or unsustainable. Here are essential metrics and their implications:

- Profitability Rate (%): Reflects the proportion of profitable trades relative to total trades. A high profitability rate suggests consistent success; however, it must be contextualized with average gains, drawdowns, and risk-reward ratios. For example, a trader with a 70% win rate but small average gains may be more desirable than one with a 90% win rate but minimal profits per trade.

- Maximum Drawdown (MDD): Indicates the largest peak-to-trough decline during a trading period, revealing the trader's capacity to withstand adverse conditions. Low MDD values are indicative of stability and prudent risk management, crucial for conservative investment approaches.

- Trading Frequency and Turnover Rate: The number of trades made within a specific period influences transaction costs, market impact, and strategy aggressiveness. High-frequency traders may exploit short-term inefficiencies but face increased costs and risk of overfitting, whereas lower-frequency traders typically follow longer-term trends, often providing more stability and predictability.

- Win-Loss Ratio: The ratio of winning trades to losing trades. While a high ratio indicates consistency, it needs to be combined with average profit and loss per trade; some traders might win frequently but with small gains, while others may have fewer wins but larger profits.

- Risk-Adjusted Metrics (Sharpe, Sortino, Profit Factor, Calmar Ratio): These advanced indicators account for volatility, downside risk, and drawdowns, offering a clearer picture of a trader’s risk-return profile. For example, a high Sharpe Ratio indicates that a trader is generating returns efficiently relative to risk taken, which is vital for aligning strategies with personal risk tolerance.

Modern platforms like Binance and MEXC integrate these metrics into user-friendly dashboards, allowing for comprehensive multi-metric assessments. Such tools prevent reliance on superficial success indicators and promote data-driven decision-making, fostering more robust portfolio construction.

Advanced Technical Analysis Tools in Copy Trading

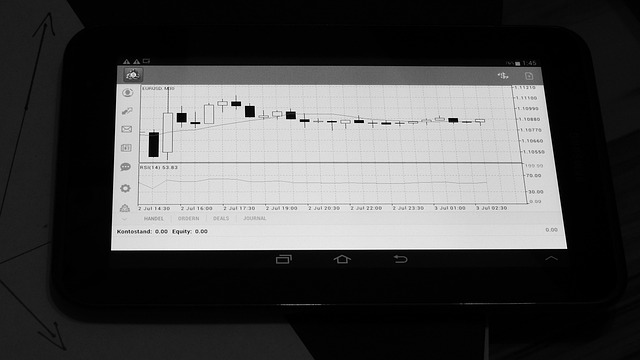

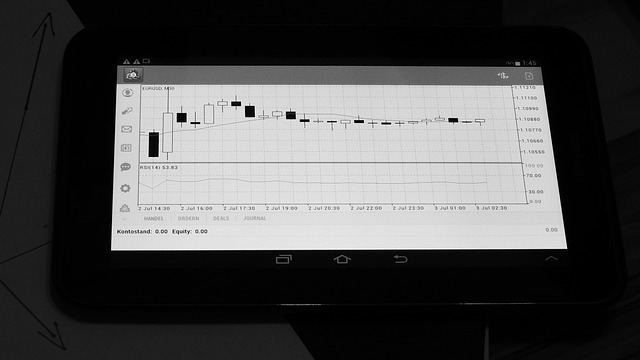

Integrating advanced technical analysis (TA) tools enhances the depth of trader evaluation, enabling a more precise understanding of strategy robustness. Key indicators such as Moving Averages (MA), Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands, Fibonacci retracements, and volume analysis are instrumental in deciphering market momentum, trend strength, reversal points, and volatility patterns.

Most cutting-edge platforms embed sophisticated charting features. For instance, MEXC’s platform (https://www.mexc.co/invite/customer-register?inviteCode=mexc-1bE4c) offers dynamic overlays, customizable indicators, and backtesting functionalities that allow traders to validate whether a trader’s decisions are grounded in technical signals or are coincidental responses to market noise. Applying technical analysis alongside performance metrics enables traders to adopt a multi-dimensional evaluation approach. For example, confirming that a trader consistently enters trades aligned with RSI oversold/overbought signals coupled with bullish MACD crossovers demonstrates disciplined technical strategy rather than impulsive reactions to volatility.

Social Sentiment and Behavioral Factors in Copy Trading

Beyond quantitative data, social sentiment analysis provides crucial qualitative insights. Platforms like Bitget (https://www.bitget.com/referral/register?clacCode=WSVEGD6H) and Bybit (https://www.bybit.com/invite?ref=Q8QKORN) foster vibrant communities where traders share insights, reviews, and feedback. Analyzing trader reputation, transparency, engagement levels, comment histories, and responsiveness helps evaluate discipline, honesty, and adaptability.

Behavioral factors such as consistency in communication, openness about past results, and responsiveness to community feedback are indicative of trader professionalism and risk management discipline. Incorporating social sentiment analysis, empowered by natural language processing (NLP), enables traders to gauge macroeconomic news, community mood, and market chatter—thus reducing risks associated with inflated claims or strategic opacity. This holistic, socially aware approach helps build resilient portfolios less vulnerable to manipulation or herd behavior.

Risks, Challenges, and Best Practices in Copy Trading Analysis

Despite its advantages, copy trading analysis faces inherent limitations. Past performance does not guarantee future results; traders may alter strategies unexpectedly, markets can reverse abruptly, and unforeseen geopolitical or economic events can override historical patterns. Relying solely on historical data without considering macroeconomic, political, and sector-specific developments can lead to misguided decisions.

To mitigate these risks, diversification remains vital—copying multiple traders across different assets, sectors, and strategies diminishes the impact of individual trader failure or strategy-specific vulnerabilities. Implementing strict risk controls such as setting stop-loss and take-profit levels, limiting capital allocation per trader, and establishing maximum drawdown thresholds are essential to protect capital. Continuous portfolio monitoring, periodic performance reevaluation, and dynamic reallocation based on current market conditions enhance resilience. Automated alerts and risk management tools further empower proactive decision-making, enabling traders to respond swiftly to changing scenarios.

Emerging Trends and Future Innovations in Copy Trading Analysis

The future of copy trading analysis is poised for transformation through automation, artificial intelligence (AI), machine learning, and blockchain transparency. AI-driven systems can process vast datasets—including social sentiment, technical indicators, macroeconomic data, and trader behavior—to generate predictive models of performance and market movements with higher accuracy. Real-time risk assessments, automated alerts for strategy shifts, and intelligent asset allocation recommendations will enable traders to adapt swiftly and effectively.

Blockchain technology promises to enhance transparency and trust by providing immutable records of trading activities and performance claims, reducing fraud and manipulation risks. Integration with decentralized finance (DeFi) protocols can lower trading costs, improve security, and broaden accessibility. Moreover, emerging innovations such as personalized AI trading assistants—designed to recommend traders aligned with individual risk profiles, investment horizons, and goals—will make copy trading more tailored, trustworthy, and user-centric.

Conclusion

In summary, effective copy trading analysis demands a multi-layered approach that synergizes quantitative performance metrics, advanced technical analysis, social sentiment insights, and disciplined risk management. Leveraging features from platforms like Binance, MEXC, Bitget, and Bybit enables traders to make well-informed decisions and optimize their portfolios. Looking ahead, technological advancements—particularly automation, blockchain transparency, and AI analytics—promise to elevate copy trading to new levels of sophistication, safety, and accessibility. Success hinges on ongoing education, rigorous evaluation, and adaptive strategies that respond to dynamic market environments. Embracing these principles will empower traders to navigate the complexities of copy trading with confidence and resilience.