Complete crypto trading guide e book 2025: Practical Strategies for Traders

Author: Jameson Richman Expert

Published On: 2025-10-31

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

This comprehensive crypto trading guide e book style article brings together essential knowledge, practical strategies, and up-to-date 2025 insights to help beginners and intermediate traders make smarter cryptocurrency decisions. You’ll get step-by-step tactics, risk-management rules, exchange selection tips, sample trade walkthroughs, and vetted resources — plus links to detailed perspectives on regulation, price outlooks, and signal services to deepen your learning.

Why this crypto trading guide e book matters in 2025

Cryptocurrency markets continue to evolve rapidly: institutional participation, evolving regulations, and new derivatives products make trader education more important than ever. This article functions like a modern e-book — organized, actionable, and reference-ready — so you can learn, test, and trade with discipline. It also links to expert resources that address religious, regulatory, and market-structure questions relevant in 2025.

What you’ll learn (quick overview)

- Core crypto concepts and terminology

- How to choose exchanges and avoid jurisdictional pitfalls

- Proven strategies for spot, margin, and derivatives trading

- Risk management rules and position-sizing formulas

- Indicator combinations and trade examples

- How to vet trading e-books, signal providers, and Telegram groups

- Regulatory and tax resources to stay compliant

Start here: fundamentals every trader must know

Before trading live, understand these essentials:

- What is cryptocurrency? A useful primer is the Cryptocurrency page on Wikipedia, which explains the basics of decentralization, blockchain, and tokens.

- Market types: spot, margin, perpetual futures, options, and on-chain yield products.

- Order types: market, limit, stop-loss, OCO (one cancels the other).

- Fees and slippage: trading costs affect profitability — factor taker/maker fees and expected slippage into plan.

- Custody: non-custodial wallets vs exchange custody; learn wallet basics and seed phrase security.

Choosing an exchange: safety, access, and fees

Select exchanges based on security, liquidity, supported products, and jurisdictional access. Because regulations vary worldwide, availability differs by country — for example, know where Bybit can be accessed (and where it may be restricted) when selecting a derivatives platform: Where is Bybit not restricted — comprehensive guide.

If you want to try large, liquid platforms, you can register at major exchanges (use referral links below if you choose):

How to vet a crypto trading e book (and why it matters)

Not all e-books are equal. Use this checklist to evaluate any crypto trading e-book before you commit time or money:

- Author credentials: Look for verifiable trading experience, public track record, or audited backtests.

- Publication date and updates: Crypto markets change rapidly; ensure the e-book is updated for 2025 market structure.

- Strategy transparency: Good guides show entry/exit logic, position-sizing, and historical performance with drawdowns.

- Risk management focus: Avoid books that emphasize “guaranteed wins.” Quality resources teach how to limit losses.

- Community reviews: Search for independent reviews or mentions on reputable forums.

Core strategies explained — from spot to derivatives

Below are practical strategies you can learn from a well-constructed crypto trading guide e book. Each includes when to use it, the core setup, and risk rules.

1) Trend-following (moving average crossover)

Best for: trending markets, swing trading. Tools: EMA(50), EMA(200), higher timeframe confirmation.

- Entry: Price closes above EMA(50) while EMA(50) crosses above EMA(200) on a daily/4H chart.

- Stop-loss: below recent swing low. Risk 1–2% of account.

- Exit: trailing stop or EMA(50) crossing back below EMA(200).

2) Mean-reversion (RSI and support zones)

Best for: range-bound markets, shorter timeframes. Tools: RSI(14), horizontal support/resistance, volume.

- Entry: Price tests a strong support level with RSI < 30 and bullish divergence on volume.

- Stop-loss: below the support; tight sizing due to potential strong moves against range plays.

- Exit: set profit targets at the range midpoint and resistance levels.

3) Breakout trading (volatility breakout)

Best for: high-volatility cryptocurrencies after consolidation. Tools: Bollinger Bands, volume breakout, consolidation range.

- Entry: Break and close above consolidation high with above-average volume.

- Stop-loss: below breakout candle low or halfway into the range.

- Exit: set multiple targets (1x, 2x risk) or use trailing stops to capture extended moves.

4) Leverage and derivatives (perpetual futures)

Perpetuals allow amplified returns but amplify losses and liquidation risk. If using leverage:

- Use very conservative leverage (1.5x–5x for most traders).

- Set hard stop-loss orders and calculate liquidation price before entry.

- Understand funding rates and how they affect long/short costs.

Position sizing and risk management (actionable formulas)

Discipline in sizing is the difference between surviving and blowing up. Use this standard formula:

Position size (units) = (Account equity × Risk per trade) / (Entry price − Stop-loss price)

Example:

- Account equity: $10,000

- Risk per trade: 1% ($100)

- Entry: $20.00, Stop-loss: $18.00 (risk = $2.00)

- Position size = $100 / $2 = 50 units → position value = 50 × $20 = $1,000 (10% of equity)

General rules of thumb:

- Risk no more than 1–2% per trade (conservative traders may use 0.5%).

- Use a maximum portfolio risk cap (e.g., total exposure to correlated holdings no greater than 20–30% of account).

- Plan for drawdowns; a robust system expects drawdowns and has rules to reduce risk during losing streaks.

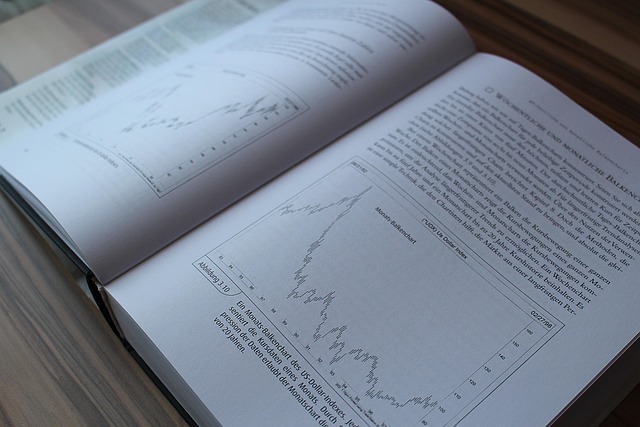

Indicators and combinations that work in practice

Indicators are tools, not truths. Combine price action, volume, and one or two indicators to avoid conflicting signals. Popular, practical pairs:

- EMA + RSI: trend alignment with momentum confirmation.

- MACD + Volume: trend strength and confirmation of momentum changes.

- VWAP (intraday) + support/resistance: institutional flow reference for day trading.

Sample trade walkthrough (practice before risking capital)

Scenario: You spot BTC consolidating above $40,000 on the daily chart. EMA(50) is above EMA(200) and RSI sits at 52. Volume spikes on a bullish daily close.

- Identify entry zone on pullback to $41,000 (preferred entry at retest of support level).

- Set stop-loss below $39,000 (risk per unit = $2,000 on a 1 BTC position — clearly too much for a small account).

- Calculate position size using the formula: if you risk 1% of $20,000 ($200), and stop-loss risk per BTC is $2,000, you buy 0.1 BTC (position size = $200 / $2,000 = 0.1 BTC).

- Set targets at $45,000 (first take-profit) and $50,000 (second target), or trail stop using EMA(21) on the 4H chart.

Always paper-trade this setup to validate execution and slippage assumptions before trading live.

On-chain, macro, and fundamental analysis

For mid-to-long-term traders, incorporate on-chain metrics and macro drivers:

- On-chain indicators: active addresses, exchange flows, realized cap, supply distribution (Glassnode, CoinMetrics).

- Macro: interest rates, dollar strength, geopolitical risks, ETF flows, and regulatory news.

- Project fundamentals: token utility, roadmap progress, developer activity, and partnerships.

For example, long-term Bitcoin outlooks and scenarios for India and global markets can change market structure; read expert forecasts like a 2030 price forecast with drivers and scenario analysis here: Bitcoin price in 2030 — India 2025 forecast, drivers, and scenarios.

Signals, Telegram groups, and subscription services — how to evaluate

Many traders use signal services or Telegram groups. Some are high quality; many are not. Use this vetting process:

- Prefer services that show timestamped historical performance and verifiable track records.

- Beware of unrealistic win-rate claims without drawdown data.

- Assess transparency: do they publish entry, stop, target, and trade management rules?

- Test on a demo account before funding trades based on signals.

If you want a structured guide to Telegram-based signals in 2025, this resource provides steps for finding reliable sources and red flags to watch: Crypto & Forex Signals Telegram Guide 2025 — Find Reliable Signals.

Regulation, taxation, and ethical considerations

Regulatory regimes and tax treatments vary by country. If you’re in the U.S., consult the IRS guidance on virtual currencies: IRS — Virtual Currencies. For investor protection advice and alerts, refer to the SEC’s investor resources: SEC Investor Alerts and Bulletins. UK readers can reference the Financial Conduct Authority (FCA) for domestic regulation updates.

Religious and ethical considerations matter for some traders. For example, if you are considering whether crypto trading is permissible under Islamic law, read perspectives and analyses such as Mufti Taqi Usmani’s view in 2025: Is crypto trading halal? Mufti Taqi Usmani’s perspective in 2025. This can inform how you structure trades (spot vs derivatives) to align with your beliefs.

Practical checklist: use this before each trade

- Why am I entering this trade? (thesis)

- What timeframe is this trade? (day, swing, position)

- Entry level, stop-loss, and take-profit(s) set

- Position size calculated and verified

- Know fees and expected slippage

- Regulatory or news events in the next 24–72 hours checked

- Trade logged in the journal after execution

How to build your own crypto trading guide e book

Creating your personal e-book (a living document you update) is an excellent way to consolidate learning. Include:

- Glossary of terms and your chosen indicators

- Standard operating procedures (SOPs) for trade setup, sizing, and exit

- Past trade journal entries with lessons learned

- Backtests and forward-test summary for each strategy

- Resource links and contacts (trusted exchanges, tax advisors, signal services)

Keep the e-book version-controlled (e.g., Google Docs or a private markdown repo) and update quarterly.

Resources section — tools, data, and learning platforms

- Charting: TradingView — for visual charts and strategy backtesting.

- On-chain data: Glassnode, CoinMetrics.

- Prices and market data: CoinMarketCap, CoinGecko.

- Regulatory reading: SEC, FCA.

- Educational platforms: Coursera, edX, and university resources for blockchain fundamentals.

Common mistakes new crypto traders make (and how to avoid them)

- Overleveraging: Use leverage only after mastering position sizing and stop discipline.

- Chasing noisy signals: Wait for confirmed setups and volume confirmation.

- Poor record-keeping: Keep a trade journal and periodically review performance metrics.

- Ignoring fees and taxes: Model fees and expected tax impacts into your return calculations.

- Following unvetted paid signals: Verify real performance and start with small sizes on new services.

Advanced topics briefly explained

Derivatives greeks and funding rates

Perpetual futures have a funding rate that periodically transfers value between longs and shorts. Positive funding means longs pay shorts and can be a cost of holding. Understand how funding interacts with your carry strategy.

Algorithmic trading basics

If you plan to automate strategies, start with low-frequency rules (daily rebalancing, trend-following) before intraday automation. Simulate strategy on historical data using platforms like TradingView Pine Script or Python backtesting libraries.

DeFi and yield strategies

Decentralized Finance (DeFi) opens yield opportunities (liquidity provision, staking). These carry smart contract risk — evaluate audits, TVL, and protocol economic models before allocating significant capital.

How to use the links and resources provided in this guide

This guide references specific content that deepens selected topics:

- Religious perspective on trading and permissible instruments: Is crypto trading halal — Mufti Taqi Usmani’s perspective in 2025.

- Long-term Bitcoin price scenarios and India-specific considerations: Bitcoin price in 2030 — India 2025 forecast.

- Global exchange accessibility and regulatory compliance (Bybit example): Where is Bybit not restricted?.

- Guidance on evaluating signal services and Telegram groups: Crypto & Forex Signals Telegram Guide 2025.

Recommended practice plan (30/60/90 days)

Turn the e-book-style lessons into an actionable training schedule:

- Days 1–30: Learn basics, set up accounts (practice on testnet or small-size trades), build a one-page trading plan.

- Days 31–60: Backtest 2–3 strategies, journal every trade, refine position sizing, practice risk control.

- Days 61–90: Transition to a consistent live approach with strict risk rules, review results weekly, adjust strategy parameters only after statistical significance is reached.

Where to open accounts safely (links)

When you’re ready to trade live, choose exchanges with strong security, liquidity, and clear compliance practices. Use these registration pages if you want to start with industry leaders:

- Binance registration (affiliate) — large order book liquidity for many markets.

- MEXC registration (affiliate) — altcoin listings and derivatives access.

- Bitget registration (affiliate) — derivatives and copy-trading features.

- Bybit registration (affiliate) — strong derivatives offering (check regional availability first).

Note: Some exchanges restrict services in certain jurisdictions — read their compliance pages and the earlier Bybit access guide linked above to confirm availability.

Keeping your learning current in 2025

The crypto ecosystem is dynamic. Subscribe to reliable sources, follow protocol governance updates, and periodically update your guide with new strategies or regulatory changes. Good sources include official project blogs, established research firms, and government regulator announcements.

Final checklist before you go live

- Complete paper-trading period and verify positive expectancy over at least 100 trades or multiple market regimes.

- Confirm exchange KYC and withdrawal security settings (2FA, withdrawal whitelist).

- Have tax and legal compliance plan: consult a professional where required.

- Start small and scale position sizes only as you prove consistent performance and emotional control.

Conclusion

This crypto trading guide e book style article equips you with a structured path from fundamentals to live trading in 2025. Use the resources and links provided to deepen specific areas — whether you’re investigating halal compliance, long-term price scenarios, exchange access rules, or signal providers. Above all, make risk management and continuous testing the foundation of your trading practice.

Further reading and references:

Disclaimer: This article is educational and not financial advice. Always perform your own due diligence and consult licensed professionals for tax or legal matters.