Binance Trading Chart Today: A Comprehensive Guide to Informed Cryptocurrency Trading

Author: Jameson Richman Expert

Published On: 2025-09-26

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Understanding the Binance trading chart today is essential for traders seeking to navigate the inherently volatile and complex cryptocurrency markets with precision and confidence. From my extensive experience, mastering live trading charts on Binance involves a multi-layered approach that integrates technical analysis, fundamental context, and psychological discipline. This detailed guide explores the myriad features, advanced tools, and sophisticated strategies available on Binance’s platform to help traders interpret market signals accurately. Whether you are analyzing flagship cryptocurrencies like Bitcoin and Ethereum or diving into the vast universe of altcoins, developing proficiency in Binance’s charting capabilities can dramatically enhance your trading accuracy, risk management, and profitability.

Introduction to Binance Trading Chart Today

When I first began analyzing Binance’s trading charts, I was quickly overwhelmed by the volume of data—candlesticks, volume profiles, technical indicators, multiple timeframes, and more. Early on, I relied on basic line charts, which failed to provide sufficient insights into market momentum or potential reversals. Over time, I realized that Binance offers a highly customizable and robust array of charting tools suited to various trading styles, from rapid scalping to long-term investing.

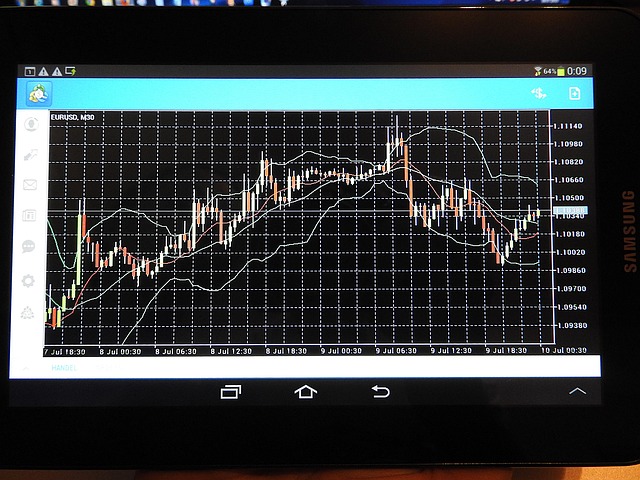

The choice of chart types—candlestick, Heikin Ashi, OHLC—plays a pivotal role in visualizing price action. Candlestick charts, for instance, reveal market psychology through patterns like Doji, Engulfing, or Shooting Stars, which often precede significant reversals. Combining these visualizations with volume analysis and technical indicators creates a layered analytical approach that improves predictive accuracy and helps manage risk effectively. Additionally, understanding the interplay of different timeframes—such as confirming a daily trend with lower timeframe entries—is crucial for executing precise, high-probability trades.

Key Features of Binance Trading Chart Today

Binance’s trading chart platform is equipped with a comprehensive suite of features designed for in-depth technical analysis and strategic decision-making:

- Extensive Customizable Technical Indicators: Binance supports a vast selection of overlays including Moving Averages (SMA, EMA), Bollinger Bands, RSI, MACD, Fibonacci levels, Ichimoku Clouds, and VWAP. These tools assist in identifying trend directions, momentum shifts, overbought/oversold conditions, and prospective reversal zones. For example, Fibonacci retracements are invaluable during correction phases, projecting potential support/resistance levels based on prior swings. RSI divergence can warn of weakening trend strength, while MACD crossovers confirm momentum shifts. Effective traders understand each indicator’s calculation basis and how to combine multiple signals for confirmation, minimizing false positives and enhancing trade confidence.

- Multiple Chart Types and Visualizations: Flexibility in switching between candlestick, Heikin Ashi, line, Renko, or Kagi charts allows traders to analyze price action from diverse perspectives. Heikin Ashi, in particular, smooths out noise, making clear trend directions and potential reversals easier to identify—especially useful during sideways or choppy markets. Advanced traders may also utilize third-party plugins to incorporate additional chart styles that better suit their analysis, such as Point & Figure charts or P&F with volume overlay.

- Multi-Timeframe Analysis and Multi-Chart Layouts: Binance enables viewing from 1-minute to weekly charts, facilitating a multi-layered approach. Shorter timeframes (e.g., 5-minute, 15-minute) are ideal for scalping and intraday trades, whereas daily and weekly charts provide the macro view necessary for swing or position trades. Overlaying multiple assets or creating synchronized multi-chart layouts helps in evaluating correlations—like Bitcoin’s influence on altcoins—and understanding overall market cycles and sector rotations.

- Drawing Tools and Pattern Recognition: Advanced drawing functionalities include trend lines, horizontal support/resistance, Fibonacci arcs, channels, and pattern tools—triangles, head & shoulders, flags, wedges. Recognizing these formations in real-time affords early signals for entries and exits. Automating pattern detection through custom scripts or third-party plugins enhances efficiency, allowing for quicker identification of complex formations such as cups and handles, pennants, or double tops/bottoms, which are critical for timing trades precisely.

- Real-time Data, Alerts, and Automated Notifications: Setting alerts based on price levels, indicator thresholds, or pattern formations ensures that traders stay informed of significant market movements without constant screen monitoring. These alerts can be integrated with mobile devices or trading bots to facilitate rapid responses—crucial in the fast-moving crypto environment. Binance’s API also supports custom scripting for automated analysis and order execution, enabling algorithmic trading based on predefined chart signals.

A powerful yet often underused feature is the ability to compare multiple assets or synchronize multiple charts, which aids in understanding market cycles, sector rotations, or crypto correlations—key elements for diversification, hedging, or arbitrage strategies. Additionally, Binance’s API enables traders to develop personalized automated trading systems based on chart signals, further enhancing operational efficiency and reaction speed in volatile conditions.

My Personal Trading Journey with Binance Chart

My journey with Binance’s trading chart started with enthusiasm, but it quickly exposed the pitfalls of superficial analysis. Initially, I relied heavily on observing live price movements without considering external factors like macroeconomic developments, news catalysts, or on-chain data, which often led to impulsive trades and losses. Over years of experience, I learned to integrate technical analysis with multiple layers of fundamental insights—such as macroeconomic shifts, regulatory news, on-chain metrics, and sentiment indicators—to craft a more holistic trading approach.

As I refined my skills, I adopted systematic risk management practices—using strategic stop-loss orders at key support levels, trailing stops to lock in profits, and position sizing based on volatility assessments. For example, spotting a double bottom pattern with strong volume confirmation on Binance’s chart provided high-confidence entries while minimizing emotional reaction. This multi-dimensional approach helped filter out false signals, improve consistency, and build confidence in my trades.

Furthermore, I began monitoring sentiment and external market factors—social media trends, news outlets, and community discussions—to anticipate market shifts that purely technical analysis might not reveal immediately. Combining pattern recognition with external sentiment analysis allowed me to better anticipate market turns and manage volatility more effectively, increasing my overall trading resilience.

Strategies for Using Binance Trading Chart Today

Building on my experience, here are advanced strategies to leverage Binance’s charting tools for maximum advantage:

- Trend Following and Moving Average Crossovers: Use the 50-day and 200-day EMA/SMA for identifying primary trend directions. A bullish crossover (golden cross) suggests a buy signal, while a bearish crossover (death cross) indicates potential short positions. Confirm these signals with volume trends and momentum indicators like RSI or MACD to improve reliability.

- Pattern Recognition and Candlestick Signal Analysis: Master key candlestick patterns—such as Doji, Hammer, Engulfing, Morning/Evening Stars, and Head & Shoulders—as these often precede significant reversals. Recognize consolidation patterns like triangles, flags, and pennants to anticipate breakouts. Combining candlestick signals with trend lines and volume confirmation greatly enhances trade accuracy.

- Volume and Breakout Confirmation: Confirm breakouts through resistance or support levels with high volume; this validates the move and reduces false signals. Watch for divergences, such as decreasing volume on rising prices, signaling potential exhaustion or reversal.

- Multi-Timeframe Confluence: Always confirm signals on higher timeframes (daily, weekly) before executing trades on lower timeframes (15-minute, 1-hour). This layered confirmation reduces whipsaw risk and enhances the robustness of your trading decisions.

- Oscillator Divergence and Momentum Analysis: Use RSI, MACD, and stochastic oscillators to identify divergences—like price reaching new highs while RSI fails to do so—indicating weakening momentum and potential reversals. Divergences serve as early warning signs for trend exhaustion and opportunity points.

Understanding Market Sentiment and External Influences

While Binance’s trading chart offers invaluable technical insights, external factors—such as regulatory news, macroeconomic shifts, security incidents, or social sentiment—can trigger rapid, unpredictable price movements. Cryptocurrency markets are highly reactive; for instance, a sudden regulatory crackdown or a major exchange hack can cause sharp declines that technical signals may not predict immediately.

To stay ahead, I recommend integrating sentiment analysis tools—such as Twitter trending topics, Reddit discussions, and Google Trends—alongside monitoring mainstream news outlets. Platforms like Santiment, LunarCrush, and TheTIE aggregate social sentiment data, providing early clues about market shifts. Blending external insights with on-chart analysis creates a comprehensive framework, allowing traders to adapt swiftly and mitigate risks more effectively.

Useful Resources and Referral Links

To support and optimize your trading journey, consider signing up through reputable platforms using trusted referral links:

- Binance Registration – Features extensive trading pairs, advanced charting, high liquidity, margin, futures, and staking options, making it a versatile platform for all trader levels.

- MEXC Exchange – Offers a broad selection of assets, competitive fees, and innovative trading tools, including margin and staking functionalities.

- Bitget – Known for derivatives and leverage trading, with integrated advanced charting for seasoned traders.

- Bybit – Specializes in margin trading and derivatives with professional-grade charting tools to execute sophisticated strategies.

Additional resources include detailed market analysis portals, fee structure guides, and legal compliance updates. For instance, explore XRP Price Prediction 2035 or stay informed with Binance Fee Analysis. Staying aware of regional regulations—such as Islamic finance considerations in Islamic Finance—ensures compliant and ethical trading practices.

Conclusion

Mastering the Binance trading chart today requires a blend of technical expertise, fundamental awareness, and external market understanding. It’s both an art and a science—demanding continuous learning, disciplined execution, and strategic adaptation. From my personal experience, combining technical mastery with macro insights and sentiment analysis significantly improves trading outcomes. Leverage Binance’s versatile tools—such as multi-timeframe analysis, pattern recognition, volume confirmation, and custom alerts—and supplement your knowledge through trusted resources and active community engagement. Remember, consistent success in crypto trading hinges on solid risk management, emotional discipline, and ongoing education. Embrace the challenges, remain adaptable, and utilize Binance’s powerful charting features to navigate the dynamic world of cryptocurrency trading successfully.