Unlocking Potential: A Deep Dive Into Cryptocurrency Trading Bots

Author: Jameson Richman Expert

Published On: 2024-08-27

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

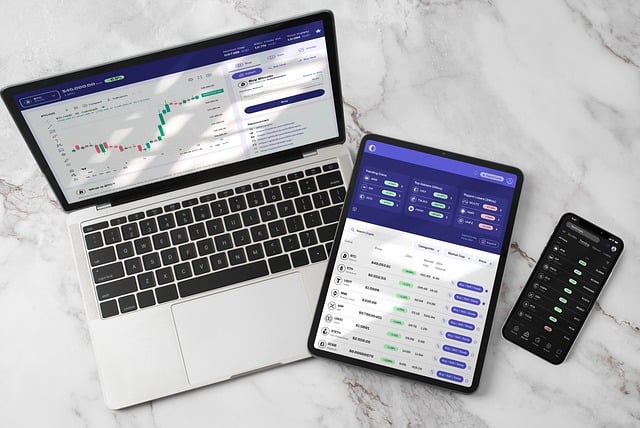

Cryptocurrency trading has become a prevalent choice for many investors seeking high returns amidst the digital asset revolution. The dynamic landscape of the crypto market has prompted traders to optimize their strategies to keep pace. Among these strategies, cryptocurrency trading bots have surged in popularity, acting as automated tools to assist traders in managing their portfolios. This comprehensive article examines the functionality, advantages, and implications of utilizing trading bots, while also providing relevant resources for further insights into cryptocurrency trading.

What are Cryptocurrency Trading Bots?

Cryptocurrency trading bots are automated software programs that execute trades on behalf of users based on predefined algorithms and strategies. These bots analyze market data and trends to make informed trading decisions without the need for human intervention. This level of automation allows traders to capitalize on market opportunities 24/7, which is essential in highly volatile markets like cryptocurrency.

How Trading Bots Work

Trading bots operate by connecting to a cryptocurrency exchange via an API (Application Programming Interface) to place buy and sell orders on behalf of the user. Typically, users set parameters for the bot, including stop-loss limits, market indicators, and risk management tools. The bot is then left to execute trades according to these specifications.

- 1. **Signal Processing**: Bots utilize algorithms to process trading signals derived from market analysis.

- 2. **Trade Execution**: Once trading signals meet specific criteria, the bot executes trades without human involvement.

- 3. **Portfolio Management**: Bots can manage and rebalance portfolios to optimize performance based on set parameters.

Advantages of Cryptocurrency Trading Bots

In the world of cryptocurrency trading, time can be as volatile as the market itself. Here are some benefits of using trading bots:

- 1. **Enhanced Trading Speed**: Bots can analyze multiple markets and execute trades within milliseconds, which is crucial in the fast-paced crypto environment.

- 2. **Emotionless Trading**: Bots operate free of emotions, which often leads to more rational and disciplined trading decisions.

- 3. **24/7 Trading**: Cryptocurrency markets never sleep, and trading bots can exploit opportunities around the clock without any breaks.

- 4. **Diverse Strategies**: Bots can implement a variety of trading strategies, from arbitrage to market-making, tailored to the user's preferences.

Types of Cryptocurrency Trading Bots

There are several types of trading bots that traders can utilize based on their trading styles and requirements:

1. Arbitrage Bots

These bots exploit price discrepancies across different exchanges, buying low on one platform and selling high on another. This type of bot relies on speed and efficiency to profit from tiny price differentials.

2. Market-Making Bots

Market-making bots provide liquidity to the market by placing buy and sell orders simultaneously, earning profit from the spread. This helps maintain a healthy market environment.

3. Trend-Following Bots

These are designed to capitalize on existing market trends. Trend-following bots utilize technical indicators to determine the market’s direction and execute trades accordingly.

4. Portfolio Management Bots

These bots efficiently manage your cryptocurrency portfolio by reallocating assets and diversifying holdings based on user-specified strategies.

How to Choose a Trading Bot

Selecting the right cryptocurrency trading bot is crucial to successful trading. Here are some factors to consider:

1. User Interface and Usability

A user-friendly interface will make it easier for you to navigate the bot’s features and functionalities, ensuring you can adapt it to your trading style.

2. Security Features

Ensure the bot employs top-tier security measures to protect your funds and personal information. Look for bots utilizing two-factor authentication (2FA) and encryption protocols.

3. Trading Strategies

Evaluate whether the bot performs well with your chosen strategies. Certain bots may offer multiple strategies while others may provide more specialized approaches.

4. Customer Support

Access to responsive customer support is essential, especially if you encounter any technical issues or have questions regarding your trades.

5. Reviews and Reputation

Research user reviews and the broader reputation of the bot. A well-established trading bot with positive testimonials usually indicates reliability.

Combining Bots with Trading Signals

While trading bots can operate autonomously, combining them with trading signals may further enhance effectiveness. Trading signals are alerts that indicate potentially profitable trading opportunities based on market analysis. They can serve to supplement a trading bot by providing strategic insights for its automated operations.

Best Crypto Trading Signals: A Resource for Smarter Trading

For those looking to further inform their trading practices, one resource worth exploring is Best Crypto Trading Signals: Your Comprehensive Guide to Smarter Trading. This comprehensive guide delves into various aspects of using trading signals and integrates them into your trading bot functionalities. It discusses various types of signals, their reliability, and strategies for interpreting signals effectively.

TradeSanta: A Comprehensive Overview of Automated Trading in Cryptocurrency

Another essential resource is TradeSanta: A Comprehensive Overview of Automated Trading in Cryptocurrency. This article provides in-depth information on how platforms like TradeSanta facilitate automated trading with user-friendly features. It outlines strategies and scenarios where automated trading can yield optimal results for both novice and experienced traders.

Day Trading Cryptocurrencies: A Comprehensive Guide to Strategies and Insights

For traders who lean towards day trading, understanding the nuances of this style is vital. The article Day Trading Cryptocurrencies: A Comprehensive Guide to Strategies and Insights offers significant insights. It explores various day trading strategies and emphasizes the importance of swift decision-making, making it a valuable read for those intending to combine knowledge with automated trading systems.

The Best Cryptocurrencies for Day Trading in 2023

Additionally, understanding which cryptocurrencies to day trade can make a considerable difference in your strategies. The article The Best Cryptocurrencies for Day Trading in 2023 outlines the top coins that are ideal for day trading, based on volatility, liquidity, and trading volume. A solid understanding of which assets to target can help you better instruct your trading bot.

The Rise of Crypto Signals Telegram: A New Frontier in Cryptocurrency Trading

As cryptocurrency trading evolves, so too do the tools traders employ. The platform The Rise of Crypto Signals Telegram: A New Frontier in Cryptocurrency Trading discusses how Telegram signals can play a crucial role in trading decision-making. This platform offers real-time signals, fostering community engagement among traders. The immediacy and collaborative nature of Telegram channels are invaluable, particularly when leveraged alongside trading bots.

Conclusion: The Future of Trading with Bots

In conclusion, cryptocurrency trading bots represent a potential game-changer for both novice traders and seasoned investors. They allow for faster, data-driven decision-making while reducing the emotional toll of trading. However, it is essential to remain vigilant and continuously educate oneself about market changes, risks, and evolving strategies.

**As the world of cryptocurrency advances, integrating trading bots and signals will likely become a necessity rather than an option for traders looking to stay competitive. Those who embrace these innovations will be better equipped to navigate the complexities of a technology-driven market.**