Understanding Signals in Crypto Trading: A Comprehensive Exploration

Author: Jameson Richman Expert

Published On: 2024-10-29

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

In recent years, the world of cryptocurrency trading has gained immense traction, attracting both seasoned investors and novices alike. Among the most critical aspects of navigating this volatile market are signals—essentially indicators that help traders make informed decisions about buying and selling cryptocurrencies. In this article, we will explore what crypto trading signals are, their types, benefits, and how they can be effectively utilized in your trading journey.

What Are Crypto Trading Signals?

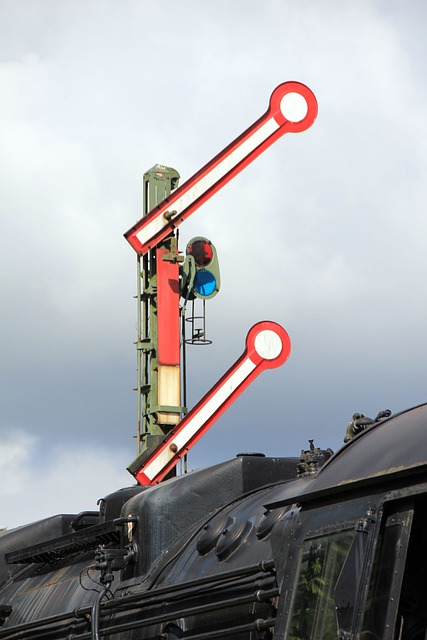

Crypto trading signals are data-driven indicators that suggest when traders should enter or exit a trade. These signals can be generated through technical analysis, fundamental analysis, or by employing automated trading algorithms that evaluate market patterns. In the most straightforward terms, trading signals act as navigational tools, guiding traders through the often turbulent waters of cryptocurrency markets.

The Importance of Trading Signals

Utilizing signals in crypto trading can significantly minimize risk and maximize profit opportunities. For traders who may not have the time or expertise to conduct extensive market analyses, signals serve as a valuable resource for informed decision-making. Here are some compelling reasons why trading signals are essential:

- Speed and Efficiency: Crypto markets operate 24/7, making timely decisions crucial. Trading signals help traders react quickly to market changes.

- Risk Management: Effective use of signals can aid in setting stop-loss and take-profit points, thereby controlling potential losses.

- Data-Driven Decisions: Instead of relying solely on gut feelings, signals offer data-backed insights, fostering more rational trading strategies.

Types of Crypto Trading Signals

Trading signals generally fall into two primary categories: manual and automated signals. Each type has its own advantages and can be used based on individual trading strategies.

1. Manual Trading Signals

Manual signals are typically generated through in-depth analysis conducted by experienced traders or analysts. Here are some common sources for manual signals:

- Chart Analysis: Many traders analyze various charts and technical indicators, such as Moving Averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence), to identify potential entry and exit points.

- Fundamental Analysis: This involves examining market news, trends, and developments related to specific cryptocurrencies, which can influence trading decisions.

- Social Sentiment: Monitoring social media platforms and forums can help gauge public sentiment and sentiment-driven signals.

2. Automated Trading Signals

Automated trading signals are generated by algorithms that analyze vast amounts of market data within milliseconds. These signals can be derived from various sources, including:

- Trading Bots: These programs automatically place trades based on predefined criteria, ensuring timely execution of signals.

- AI and Machine Learning: Advanced technologies are now being utilized to predict market movements based on historical data.

- API Integrations: Many trading platforms provide APIs that allow users to access real-time trading signals and execute trades directly.

How to Use Crypto Trading Signals Effectively

To get the most out of trading signals, traders should consider the following strategies:

1. Choose a Reliable Source

With so many providers offering trading signals, not all of them are trustworthy. Extensive research is vital to find reputable sources that have a proven track record. For instance, platforms that provide signals based on in-depth analysis or reliable algorithms, such as Understanding Crypto Whale Signals: The Game Changers in the Cryptocurrency Market, which educates traders about whale activity and its impact on market trends.

2. Develop a Trading Strategy

Always incorporate signals into a broader trading strategy rather than acting on them in isolation. Maintaining a consistent approach will help mitigate risks and increase the chances of success.

3. Monitor Your Trades

Keeping a detailed record of your trades can assist in understanding what works for you. By refining your strategies based on experience and signal performance, you increase the likelihood of successful trading.

The Potential of Advanced Signal Generation

The world of crypto trading signals is constantly evolving, particularly with advancements in technology. Two noteworthy resources include:

3Commas Exchanges: A Comprehensive Overview of 2024

This resource offers insights into 3Commas, a sophisticated trading platform that automates trading strategies efficiently. With the potential to integrate various exchanges, the platform enables users to set up robust trading bots that can generate signals based on comprehensive market analysis.

Binance Bot Review: The Future of Automated Trading

The Binance Bot review delves into the user-friendly interface and powerful algorithms used to optimize trading strategies. It emphasizes the bot’s capability to generate real-time trading signals, ensuring that trades are executed swiftly without the need for constant supervision.

How to Use Binance Trading Bot: A Detailed Guide

This comprehensive guide provides step-by-step instructions for setting up and utilizing the Binance bot. Given the competitive edge it can offer, using trading bots intelligently could enhance a trader’s ability to respond to market signals.

The Future of Crypto Trading Signals

As the cryptocurrency market continues to mature, the development of trading signals will likely follow suit. The integration of blockchain technology, AI, and advanced technical indicators suggests a future where trading signals will become more precise and reliable.

In my opinion, the future of crypto trading signals not only lies in their predictive capabilities but also in their usefulness as a tool for risk management. As newcomers flock to the market, educational resources associated with signals will become increasingly imperative. As highlighted in Understanding Crypto Whale Signals, several factors influence trading outcomes, and educating traders on these dynamics will be crucial.

Moreover, with the rise of automated trading systems that use a combination of technical analysis and human oversight, it will become easier for traders to navigate this complex environment. Consequently, those who adapt quickly and leverage available tools will likely thrive in the evolving landscape of crypto trading.

Conclusion

In conclusion, understanding crypto trading signals is essential for anyone looking to succeed in the market. From manual analysis to automated systems and everything in between, there's a wealth of information available to assist traders in making better decisions.

As we have discussed, the effective use of signals can significantly impact trading outcomes, making such knowledge invaluable for both new and experienced traders. By adopting a comprehensive approach to trading signals and utilizing technology smartly, traders can elevate their trading strategies and potentially enjoy substantial profits in the fast-paced world of cryptocurrency.

Ultimately, staying updated and informed through reputable educational resources and communities is crucial for every trader. The cryptocurrency market is dynamic and ever-changing; thus, continuous learning and adaptation are the keys to success.