Understanding Cryptocurrency Trading Bots: Revolutionizing Digital Asset Trading

Author: Jameson Richman Expert

Published On: 2024-08-24

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

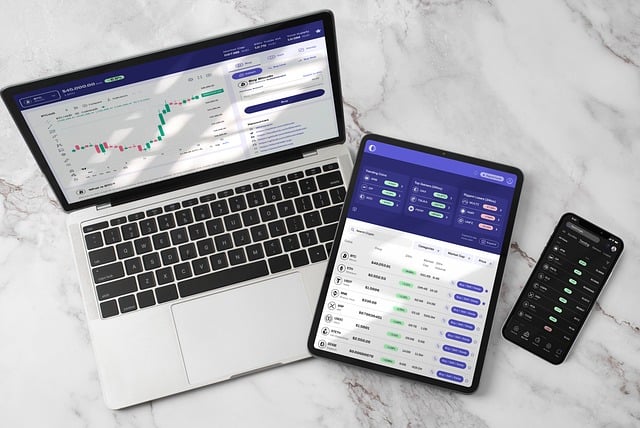

In recent years, the world of cryptocurrency has burgeoned into a billion-dollar industry, attracting investors from various walks of life. As the market grows, so too does the complexity of trading strategies. One technological advancement that is rapidly gaining traction is the cryptocurrency trading bot. These sophisticated automated systems promise to enhance profitability and streamline trading processes. In this article, we delve deep into the functionalities, advantages, limitations, and future prospects of cryptocurrency trading bots.

What is a Cryptocurrency Trading Bot?

At its core, a cryptocurrency trading bot is an automated software application that executes trades on behalf of the user. These bots leverage algorithms to analyze market conditions and price fluctuations, making buy or sell decisions based on predetermined criteria. The goal is to eliminate emotional trading and capitalize on market inefficiencies. In the volatile world of cryptocurrencies, where price swings can occur within moments, having a bot can be advantageous.

Types of Cryptocurrency Trading Bots

Cryptocurrency trading bots can be broadly classified into several types, each designed to serve specific purposes:

- Trend Following Bots: These bots analyze market trends and make trades based on upward or downward trends. They aim to buy low and sell high over a specific period.

- Arbitrage Bots: These bots exploit the price differences of the same asset across different exchanges, buying at the lower price and selling at a higher one for profit.

- Market Making Bots: Such bots provide liquidity to the market by placing both buy and sell orders. They profit from the spread between the bid and ask prices.

- Portfolio Management Bots: These bots help traders optimize their investment portfolios by rebalancing assets based on market conditions and risk tolerance.

How Do Trading Bots Work?

The operation of cryptocurrency trading bots involves several components, each vital for their effectiveness:

1. Market Analysis

Most trading bots utilize technical indicators to analyze market data. They may implement strategies such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands to gauge market conditions. By continuously analyzing data, bots can spot trading opportunities that a human trader might overlook.

2. Trading Strategy Implementation

A successful trading strategy is crucial for a bot's effectiveness. Once the market parameters are established, bots can execute trades autonomously. This includes setting entry and exit points, stop-loss levels, and the size of trades based on capital allocation.

3. High-Speed Execution

One of the significant advantages of trading bots is their ability to execute trades at high speed. In the fast-moving cryptocurrency market, where seconds can mean the difference between profit and loss, this speed is a game-changer.

Advantages of Using Cryptocurrency Trading Bots

The use of cryptocurrency trading bots presents numerous benefits that make them an attractive option for both novice and experienced traders. Below are some of these advantages:

1. Emotionless Trading

One of the greatest challenges that traders face is the emotional aspect of trading. Fear and greed can cloud judgment and lead to poor decision-making. Trading bots follow predetermined strategies without emotional interference, allowing for rational and calculated trades.

2. 24/7 Market Monitoring

Unlike humans, trading bots can operate around the clock, monitoring multiple markets simultaneously. This capability allows them to capitalize on opportunities whenever they arise, irrespective of time.

3. Enhanced Profitability

By exploiting price discrepancies and other trading opportunities, bots can potentially generate higher returns compared to manual trading. Moreover, they can execute trades faster than any human trader, maximizing profit potential.

4. Backtesting Capability

Most trading bots come with built-in backtesting features, allowing traders to test their strategies against historical data. This feature is invaluable for refining trading strategies before implementing them in live markets.

Limitations of Cryptocurrency Trading Bots

Although cryptocurrency trading bots offer several advantages, they are not without limitations. Understanding these is crucial for traders looking to incorporate bots into their strategy:

1. Market Volatility

The cryptocurrency market is notably volatile, which can lead to unforeseen losses. Bots may fail to adapt to sudden market changes, particularly during significant events or announcements that cause erratic price movements.

2. Technical Glitches

Trading bots rely on software and connectivity. Any technical failures, server outages, or connectivity issues can result in missed trading opportunities or erroneous trades, leading to potential financial losses.

3. Over-optimization

Traders sometimes over-optimize their strategies based on historical data, leading to poor performance in real-world trading conditions. What worked in the past may not be effective in the present or future.

4. Lack of Intuition

While bots can execute trades based on data, they lack the human intuition and understanding of market sentiment. Certain decisions require a nuanced understanding that algorithms may not capture.

Selecting the Right Trading Bot

Choosing the right trading bot involves careful consideration of several factors:

1. Reputation and Security

Prioritize bots that have positive user reviews and a track record of security. It’s essential to use reputable service providers to avoid scams or fraudulent platforms.

2. User Interface

A user-friendly interface can make a significant difference, especially for beginners. The simpler it is to navigate, the more effective your trading experience will be.

3. Customization Options

Look for bots that offer various customizable options and strategies. The flexibility to tailor a bot’s approach to your specific trading style is essential.

4. Support and Community

Strong customer support and an active user community can enhance your experience. Engaging with other users can provide insights and troubleshooting answers.

The Future of Cryptocurrency Trading Bots

As technology continues to evolve, so too will the capabilities of cryptocurrency trading bots. Future developments may include advanced artificial intelligence, machine learning algorithms, and enhanced features that improve decision-making efficiency. Furthermore, the integration of blockchain technology could lead to increased transparency and security.

In my opinion, the future of cryptocurrency trading bots looks promising. With the right strategies and technology, they could become indispensable tools for traders looking to navigate the complex world of digital currencies.

Conclusion

Cryptocurrency trading bots represent a significant innovation in the trading landscape, offering automation and efficiency that manual trading often lacks. While they come with their own set of limitations and challenges, their potential for enhancing profitability makes them worth considering for traders at any level. As the cryptocurrency market continues to mature, embracing technology, including trading bots, will undoubtedly be a key factor in staying competitive.

In conclusion, for traders willing to learn and adapt, cryptocurrency trading bots can serve as powerful allies in the pursuit of success in the fast-paced world of digital assets.