Understanding Crypto Wallets: A Comprehensive Guide

Author: Jameson Richman Expert

Published On: 2025-04-24

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Crypto wallets are essential tools for anyone looking to manage digital currencies efficiently. Whether you are a seasoned trader or just starting your crypto journey, understanding how wallets work is crucial for safeguarding your assets and facilitating transactions. In this comprehensive guide, we will delve into the different types of crypto wallets, their functionalities, advantages, and tips for choosing the right one for your needs. We will also explore best practices for securing your wallet and the latest trends in the wallet landscape.

Crypto wallets serve as the bridge between users and the blockchain. A wallet allows you to send, receive, and store your cryptocurrencies securely. These wallets come in various forms, including hardware wallets, software wallets, and even paper wallets. Each type has its pros and cons, which we will explore in detail, along with the latest innovations in wallet technology that aim to enhance user experience and security.

Types of Crypto Wallets

Understanding the types of crypto wallets is fundamental for making informed decisions. Let's break down the most common types:

1. Hardware Wallets

Hardware wallets are physical devices that store your private keys offline. This makes them one of the most secure options available against online threats. Examples include the Ledger Nano S, Trezor, and the Ledger Nano X. These wallets are ideal for long-term investors who prioritize security over convenience. Hardware wallets often include features like recovery seed phrases and PIN codes, further enhancing their security. Additionally, many hardware wallets support multiple cryptocurrencies and integrate with software wallets for added flexibility.

Hardware wallets are designed to be resilient against various attack vectors, including malware and phishing attacks. They operate on the principle of cold storage, meaning your private keys are never exposed to the internet, thus significantly reducing the risk of hacking. For those who prioritize security, hardware wallets are often regarded as the gold standard in crypto storage. Recent advancements have also introduced features such as Bluetooth connectivity, allowing users to manage their assets on mobile devices without sacrificing security. It's crucial to keep the firmware of hardware wallets updated, as manufacturers often release patches to protect against newly discovered vulnerabilities.

2. Software Wallets

Software wallets can be further divided into desktop, mobile, and web wallets. Desktop wallets are installed on your computer, offering a balance between security and convenience. Mobile wallets, on the other hand, are apps on your smartphone, making them accessible for everyday transactions. Web wallets are hosted online, providing ease of access but potentially exposing users to security risks. Popular software wallets include Exodus, Electrum, and Atomic Wallet, each offering unique features such as multi-currency support and built-in exchange capabilities.

Software wallets typically require users to manage their private keys, which can be a double-edged sword; while it gives users control, it also means they are responsible for their security. Users should be cautious about which software wallets they choose, as vulnerabilities can arise from outdated software or poor development practices. Additionally, many software wallets now offer features such as decentralized finance (DeFi) integrations, which allow users to lend or stake their crypto directly from their wallets, enhancing utility. As the DeFi landscape expands, software wallets have become increasingly versatile, incorporating features that cater to active traders and investors. Regularly reviewing wallet security practices is essential, as the software landscape is constantly evolving.

3. Paper Wallets

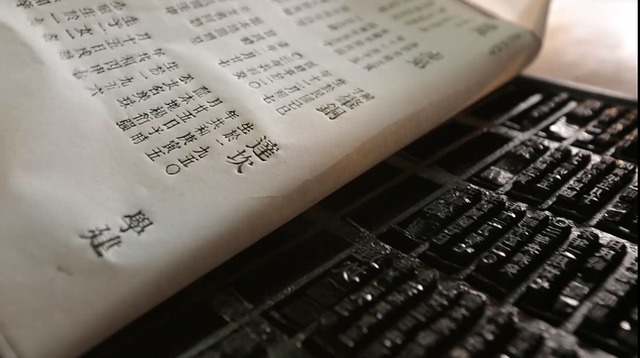

A paper wallet is a physical printout of your public and private keys. While they can be incredibly secure from hacking, they are susceptible to physical damage or loss. Hence, it’s essential to keep them in a safe place. Using tools like WalletGenerator.net can help create secure paper wallets, but users must ensure they are generated in a secure environment to avoid compromising their keys. Additionally, individuals should consider how they will access their cryptocurrencies if they opt for this method, as recovering funds from a paper wallet can be cumbersome without the proper procedures in place.

It's advisable to create a paper wallet only if you are confident in your ability to keep it safe. The process should ideally be done offline to prevent any digital interference. Furthermore, since paper wallets lack any user interface, users must be diligent in keeping track of their keys and understanding how to import them back into a digital wallet if needed. One critical aspect of using paper wallets is ensuring you have a secure method of backup, as losing access to your keys means losing access to your funds permanently. Additionally, consider using tamper-proof methods to store your paper wallet, such as encasing it in a protective sleeve.

How Crypto Wallets Work

At the core of a crypto wallet is the ability to generate and store cryptographic keys. A public key is like your bank account number, while your private key is akin to your PIN. Without the private key, you cannot access your funds. This is why keeping your private key secure is paramount.

Transactions made from a wallet involve signing with the private key, which proves ownership of the crypto assets. Once signed, the transaction is broadcast to the network, where it is confirmed by miners and added to the blockchain. This decentralized verification process enhances the security and integrity of transactions. Understanding this process can help you appreciate the importance of using reputable wallets, as well as the implications of blockchain technology in broader financial ecosystems. Furthermore, users should familiarize themselves with transaction fees associated with different wallets, as they can vary significantly based on network congestion and wallet choice. Being aware of these fees can help you make more cost-effective decisions when transferring assets.

Choosing the Right Crypto Wallet

When selecting a crypto wallet, consider factors such as security, ease of use, and supported cryptocurrencies. Here are some key points to keep in mind:

- Security Features: Look for wallets with two-factor authentication (2FA), multi-signature capabilities, and backup options. Regular security audits by third parties can also indicate a wallet's reliability. It's essential to assess how the wallet provider handles user data and their policies regarding privacy. Be wary of wallets that do not have transparent security protocols or a history of breaches. You may also want to check if the wallet offers features like biometric authentication for added security.

- User Experience: A good wallet should be easy to navigate, especially for beginners. Intuitive interfaces and customer support can greatly enhance your experience. Additionally, consider wallets that offer educational resources to help users understand their functionalities better. User-friendly wallets often include tutorials and FAQs that can assist new users in managing their assets more effectively. Additionally, mobile compatibility is crucial for users who prefer managing their assets on-the-go.

- Supported Coins: Ensure the wallet supports the cryptocurrencies you intend to hold. Some wallets focus on specific coins, while others provide a broad range of options. It's also beneficial to choose wallets that regularly update their supported currencies to keep up with the ever-evolving crypto landscape. This flexibility can be particularly advantageous for traders looking to diversify their portfolios, especially with the rise of new tokens and altcoins.

- Community and Reviews: Research the wallet’s community and user reviews to gauge its reliability and performance. Active user communities often provide real-time insights into issues and updates. Look for forums or social media groups where users share their experiences and tips for using specific wallets. Engaging with the community can also provide valuable insights into wallet features and potential issues. Pay attention to user feedback on customer support responsiveness and the wallet's update frequency.

Popular Crypto Wallets

Several reputable wallets are widely used in the crypto community. Below are some options to consider:

- Exodus: A user-friendly software wallet that supports multiple cryptocurrencies and offers an in-built exchange feature, allowing for easy trading between assets. It is known for its attractive interface and ease of use, making it suitable for beginners. Additionally, Exodus has a mobile app that mirrors its desktop functionality, enhancing accessibility. Recent updates have also improved security features and expanded the range of supported assets.

- Coinbase Wallet: Integrated with the popular exchange, this wallet provides a seamless experience for buying and selling, along with robust security measures. It also allows users to explore decentralized applications (dApps) directly from the wallet. Coinbase Wallet supports a wide range of ERC-20 tokens, making it a versatile choice for Ethereum users. Furthermore, Coinbase frequently updates its wallet features to enhance user experience and security.

- Ledger Nano X: A hardware wallet that supports a wide range of cryptocurrencies while maintaining high-security standards, with Bluetooth capability for mobile access. This feature allows users to manage their assets on-the-go without compromising security. Ledger Live, the accompanying app, also offers features like portfolio tracking and crypto staking. The Ledger ecosystem continuously evolves to include support for new tokens and integration with other DeFi platforms.

- Trezor Model T: A high-end hardware wallet known for its touchscreen interface and advanced security features, making it suitable for both new and experienced users. It supports numerous cryptocurrencies and offers unique features like password management and advanced recovery options. Trezor also emphasizes security through regular firmware updates and extensive community support.

How to Use a Crypto Wallet

Using a crypto wallet involves a few straightforward steps:

- Download or Purchase: Depending on your choice, either download the wallet software or purchase a hardware wallet. Ensure you are downloading from official sources to avoid scams. For hardware wallets, buy directly from the manufacturer or authorized retailers to minimize the risk of tampering.

- Set Up Your Wallet: Follow the instructions to create a new wallet. Make sure to back up your seed phrase securely, as this is essential for recovering your wallet if needed. Write it down and store it in a secure location away from your wallet. Consider using a fireproof safe or a safety deposit box for added protection. It's also wise to test the recovery process with a small transaction to ensure you understand how to restore your wallet.

- Add Funds: Transfer cryptocurrencies from an exchange or another wallet. Familiarize yourself with the wallet's interface to understand how to send and receive funds. Check for any transaction fees before proceeding with transfers, and be aware of network congestion that could affect transaction times. It's beneficial to conduct smaller test transactions to ensure everything works smoothly before moving larger amounts.

- Manage Your Assets: You can now send, receive, or trade your assets directly from the wallet. Take advantage of any advanced features your wallet may offer, such as transaction tracking and analytics. Regularly monitor your wallet for any unauthorized activity, and consider setting up alerts for large transactions. Staying informed about market trends can also help you make timely decisions regarding asset management.

Staying Safe with Crypto Wallets

While crypto wallets offer convenience, they also come with risks. Here are some tips to ensure your assets remain safe:

- Use Strong Passwords: Always create complex passwords and change them regularly. Consider using a password manager to keep track of your passwords securely. Avoid using easily guessable information such as birthdays or common words. Implementing a password policy can help reinforce security practices.

- Enable 2FA: Add an extra layer of security by enabling two-factor authentication whenever possible. This can significantly reduce the risk of unauthorized access to your wallet. Opt for authenticator apps over SMS for better security, as SMS can be vulnerable to interception.

- Keep Software Updated: Regularly update your wallet software to protect against vulnerabilities. Enable automatic updates if available to ensure you are using the latest security features. Being proactive about updates can safeguard you from potential exploits.

- Be Wary of Phishing: Always double-check URLs and emails for authenticity. Avoid clicking on links from unknown sources that could lead to phishing attempts. Educate yourself on common phishing tactics to better protect your assets, and consider using browser extensions that warn against malicious sites.

- Consider Cold Storage: For long-term holdings, consider using cold storage methods, such as hardware wallets or paper wallets, to keep your assets offline and away from potential online threats. Diversifying your storage methods can enhance security and reduce risk. Regularly review your storage practices to ensure they align with the current security landscape.

Conclusion

In conclusion, understanding crypto wallets is essential for anyone looking to invest or transact in cryptocurrencies. With the right knowledge and tools, you can protect your digital assets effectively. Explore various wallets, assess their features, and choose one that suits your needs best. As the crypto landscape continues to evolve, staying informed about wallet developments and best practices is crucial for your security and success.

If you are considering starting your crypto journey, platforms like Binance, MEXC, Bitget, and Bybit offer secure and reliable services for buying and managing cryptocurrencies. Each of these platforms has unique features and benefits, which can enhance your overall experience in the crypto space.

For further reading, you can explore resources like Investopedia for a deeper understanding of how crypto wallets function and their importance in the digital economy. Additionally, staying updated with industry news from sources like CoinDesk and The Block can provide valuable insights into emerging trends and technologies in the cryptocurrency space. Joining crypto communities on platforms like Reddit or Discord can also enhance your knowledge and keep you informed about the latest developments.

Future of Crypto Wallets

As the cryptocurrency ecosystem continues to evolve, so too will the technology surrounding crypto wallets. Key trends shaping the future of crypto wallets include:

- Integration with Decentralized Finance (DeFi): The rise of DeFi applications is pushing wallet providers to enhance their offerings. Users are looking for wallets that can seamlessly integrate with DeFi protocols for lending, borrowing, and yield farming without needing to transfer assets to exchanges.

- Enhanced User Experience: Wallet providers are focusing on simplifying interfaces and enhancing user onboarding processes, making it easier for newcomers to navigate the complexities of cryptocurrency management.

- Greater Interoperability: As the blockchain landscape diversifies, the demand for wallets that support multiple blockchains and cross-chain transactions is increasing. This will allow users to manage a diverse range of assets from a single interface.

- Security Innovations: As cyber threats evolve, wallet providers are expected to implement more advanced security features, including biometric authentication, hardware security modules, and AI-driven fraud detection systems.

- Regulatory Compliance: With governments worldwide tightening regulations on cryptocurrencies, wallet providers may need to incorporate compliance features to adhere to local laws while maintaining user privacy.

Staying abreast of these trends will be essential for users looking to optimize their crypto management strategies. By adopting wallets that align with these advancements, users can ensure they remain ahead in the rapidly changing cryptocurrency landscape.