The Future of Trading: Exploring Cryptocurrency Trading Bots

Author: Jameson Richman Expert

Published On: 2024-12-06

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

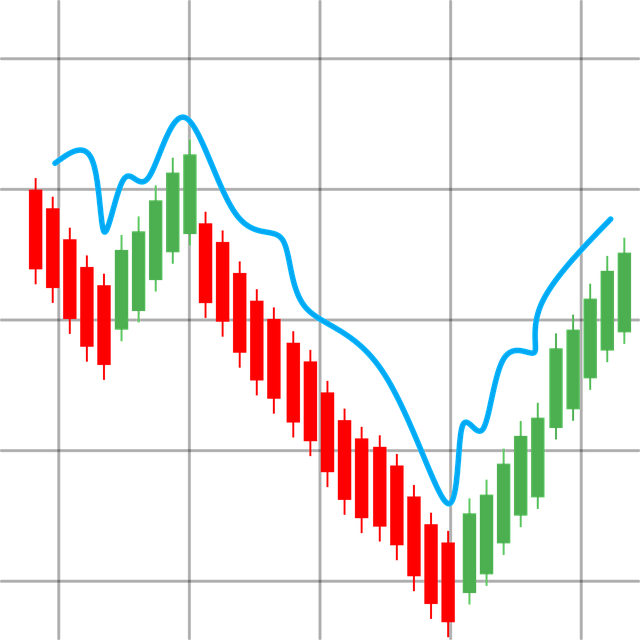

In the world of cryptocurrency trading, staying ahead of the market is essential for success. With the rise of automated solutions, trading bots have emerged as powerful tools for traders seeking to enhance their strategies and maximize profits. In this article, we’ll delve into what trading bots are, how they work, their advantages and disadvantages, and explore some of the most popular options available, including a look at resources such as 3Commas Grid Bot Review: The Automated Trading Solution, How to Use the Binance Bot: A 2024 Guide, and Mastering Crypto Trading with Santa Bot: A Comprehensive Guide to 3Commas.

What is a Trading Bot?

A trading bot is a software program that interacts with financial exchanges to automate trading decisions. The primary function of these bots is to analyze market data, execute trades, and manage portfolios based on predefined criteria. This automation allows traders to respond more swiftly to market changes than they could manually.

How Trading Bots Work

Trading bots operate using algorithms designed to monitor market trends and execute trades. Generally, these bots have several components:

- Market Data Analysis: Bots gather information from the market, analyzing price movements and historical data.

- Decision Making: Based on the analysis, they make decisions on buying or selling assets.

- Execution: Once a decision is made, the bot automatically executes the trade on the exchange.

Types of Trading Bots

While there are several types of trading bots available, the most popular include:

- Market Making Bots: These create liquidity by placing buy and sell orders, profiting from the spread.

- Trend Following Bots: They track market trends to make educated trades based on price direction.

- Arbitrage Bots: These take advantage of price discrepancies across different exchanges.

Advantages of Trading Bots

Trading bots offer numerous advantages that make them appealing to both novice and experienced traders.

1. Increased Efficiency

Trading bots can execute trades 24/7, eliminating the need for traders to be tethered to their screens. This can significantly increase trading efficiency and opportunities.

2. Reduced Emotions

One of the biggest challenges in trading is managing emotions, which can lead to impulsive decisions. Trading bots operate based on logic and algorithms, reducing the chance of emotional trading.

3. Backtesting Capabilities

Most trading bots allow users to backtest their strategies on historical data to gauge effectiveness before implementing in real-time market conditions.

4. Diversification

Bots can manage multiple accounts and execution strategies, enabling traders to diversify their portfolio without manual intervention.

Disadvantages of Trading Bots

Despite their benefits, trading bots also have some drawbacks that experienced traders should consider.

1. Technical Issues

Like any software, trading bots are susceptible to glitches, bugs, or network issues that can potentially lead to financial losses.

2. Market Dependency

Trading bots rely on established algorithms which may not perform well in unpredictable market conditions, particularly during high volatility.

3. Initial Learning Curve

Setting up and configuring the bots can be complex, requiring a certain level of expertise and understanding of trading strategies.

Popular Cryptocurrency Trading Bots

Numerous cryptocurrency trading bots are available today. Below are some of the most well-regarded options:

1. 3Commas

3Commas is a popular platform that provides a range of trading tools, including automated trading bots. Their 3Commas Grid Bot Review: The Automated Trading Solution outlines how the Grid Bot operates by capitalizing on the price fluctuations within a set grid. This method stabilizes returns in volatile markets by strategically executing trades at various price levels.

2. Binance Bot

Utilizing Binance for trading automation provides numerous advantages. The How to Use the Binance Bot: A 2024 Guide serves as a comprehensive resource for traders interested in leveraging Binance’s API to enhance their trading strategies through automation. It emphasizes the steps needed to connect your account and the various tools available for optimal trading performance.

3. Santa Bot

Santa Bot is gaining traction for its customizable features and ease of use. The guide titled Mastering Crypto Trading with Santa Bot: A Comprehensive Guide to 3Commas outlines how to navigate its functionalities and maximize profitability. It’s particularly focused on how Santa Bot can help traders implement effective strategies while automating their trading tasks.

How to Choose the Right Bot for Your Trading Needs

When selecting a trading bot, you should consider several factors:

- Trading Goals: Determine what you aim to achieve, whether it's day trading, swing trading, or long-term investments.

- Supported Exchanges: Ensure the bot is compatible with your preferred trading platform.

- Customization Options: The ability to tailor the bot’s strategy to suit your specific needs can be a significant advantage.

- User Reviews: Research user feedback to get a sense of the effectiveness and reliability of the bot.

Final Thoughts

As cryptocurrency trading continues to evolve, trading bots are becoming essential tools for success in a highly competitive market. By automating trades, reducing emotional decision-making, and leveraging backtesting capabilities, traders can position themselves strategically to capitalize on market opportunities.

However, selecting the right bot requires careful consideration, and understanding the potential drawbacks is equally important. With the right approach and the right tools, the world of cryptocurrency trading can be made more accessible and profitable.

In my opinion, the future of trading is leaning heavily towards automation. Whether you are a beginner or an experienced trader, embracing trading bots is crucial to staying competitive. Experimenting with tools such as 3Commas, Binance Bot, or Santa Bot can provide valuable insights and boost your trading strategies.