The Evolution of Crypto Trading Bots in 2024

Author: Jameson Richman Expert

Published On: 2024-10-24

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

In the rapidly evolving landscape of cryptocurrency, trading bots have emerged as transformative tools employed by both novice and seasoned traders. These automated programs have fundamentally changed the way individuals participate in the market, making it more accessible and efficient. The year 2024 is poised to witness further advancements in crypto trading bots, reflecting an increasing sophistication in trading algorithms and a broader adoption across various platforms.

Understanding Crypto Trading Bots

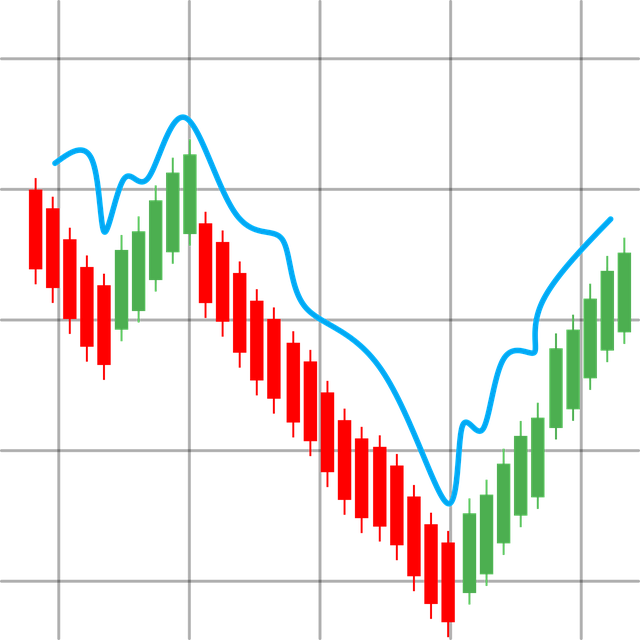

Crypto trading bots are automated software that execute buy and sell orders on behalf of traders, leveraging algorithms to analyze market data and identify profitable trading opportunities. As the cryptocurrency market is characterized by its volatility, the ability to automate trades provides a significant advantage. Traders can set specific parameters and strategies, allowing the bot to operate independently, thus working around the clock.

Key Features of Trading Bots

- 24/7 Trading: Bots can execute trades at any time, ensuring that traders do not miss out on potential opportunities due to time constraints.

- Emotionless Trading: Bots operate based on data and logic, eliminating the emotional stress that can cloud human judgment.

- Backtesting Capabilities: Traders can test their strategies using historical data before deploying them in live trading, enhancing confidence in their approach.

- Diverse Strategy Implementation: Bots can be configured to follow a variety of trading strategies, from market-making to arbitrage.

The Surge in Popularity of Crypto Trading Bots

The increasing popularity of crypto trading bots can be attributed to several factors. Firstly, as more individuals become interested in cryptocurrency, the need for user-friendly tools that simplify trading has risen. Additionally, the market's inherent volatility attracts those looking to capitalize on price fluctuations, making the use of trading bots an appealing option.

In 2024, many platforms are likely to enhance their offerings by integrating sophisticated algorithms, leveraging machine learning, and utilizing data analytics to create smarter bots capable of adapting to market changes in real-time.

Creating Your Own Crypto Bot

Creating Your Crypto Bot in 2024: A Step-by-Step Guide is an essential resource for individuals looking to dive into the crypto trading bot arena. It offers comprehensive insights into the process of developing personalized trading bots tailored to specific strategies and market conditions. As the landscape continues to evolve, having custom solutions allows traders to maintain an edge in the competitive market.

Exploring the Mechanisms Behind Trading Bots

Understanding how trading bots function is crucial for effectively utilizing them. At their core, these bots rely on algorithms that analyze various indicators and data points to make informed decisions.

Algorithmic Trading

Algorithmic trading involves the use of complex mathematical formulas to determine trade entries and exits. Bots gather data from multiple sources, including market news, historical performance, and trading volumes, to formulate strategies based on defined parameters.

Types of Trading Strategies

- Scalping: This strategy focuses on making numerous small profits from minor price changes throughout the day.

- Trend Following: Bots identify and follow established trends, buying during upward momentum and selling when trends reverse.

- Arbitrage: This involves exploiting price discrepancies between different exchanges to secure profits quickly.

The Rise of Trading Bots in Cryptocurrency: Revolutionizing the Market

The Rise of Trading Bots in Cryptocurrency: Revolutionizing the Market encapsulates the broader implications of bots in the crypto marketplace. This resource outlines how these automated systems have not only democratized trading by making it accessible to anyone with an internet connection, but they have also introduced new standards in speed and efficiency. In 2024, the evolution of such technologies is expected to deepen, creating an even more dynamic trading environment.

Arbitrage Trading: A Strategic Advantage

Arbitrage trading, which leverages differences in the price of the same asset across various exchanges, is a prominent strategy employed by many crypto traders. With the proliferation of trading bots, this strategy has seen significant advancements.

The Role of Bots in Arbitrage Trading

Trading bots can quickly analyze multiple exchanges, executing trades in a matter of milliseconds. This speed gives traders a competitive advantage, making it possible to capitalize on fleeting opportunities that manual traders might miss.

Robot Arbitrage in the Crypto Market: An In-Depth Exploration

Robot Arbitrage in the Crypto Market: An In-Depth Exploration delves into the technicalities of creating and optimizing arbitrage bots. It highlights the mathematical models and algorithms used to identify and act on price discrepancies swiftly. Given the dynamic nature of cryptocurrency prices, such exploration is invaluable for traders seeking to leverage this strategy effectively in 2024.

Assessing the Risks and Challenges of Trading Bots

While trading bots offer numerous advantages, they are not without their risks. Understanding these challenges is essential for traders considering the automating of their trading activities.

Market Volatility

The cryptocurrency market is notoriously volatile, and while bots can react quickly to price changes, they can also incur significant losses if not configured correctly or if market conditions change unexpectedly. Risk management strategies are imperative for any automated trading approach.

Technical Failures

Software glitches, server outages, and internet connection issues can hinder a trading bot's performance. Traders must ensure that they have contingency plans in place to mitigate risks associated with technical failures.

The Future of Crypto Trading Bots

As we progress through 2024, the future of crypto trading bots appears promising. Innovations in artificial intelligence and machine learning are set to revolutionize the capabilities of these bots, enabling them to adapt and evolve with market trends more effectively.

The Rise of Crypto Robot Trading: An In-Depth Analysis

The Rise of Crypto Robot Trading: An In-Depth Analysis provides insights into what traders can expect in the coming years. As trading algorithms become more sophisticated, the barriers to entry for aspiring traders will continue to diminish, allowing more individuals to participate in the cryptocurrency market.

Regulatory Implications

The regulatory landscape surrounding cryptocurrency trading bots is also evolving. In 2024, investors must remain aware of legal requirements and compliance issues related to automated trading to avoid potential pitfalls.

Integrating Bots with Popular Exchanges

To maximize the effectiveness of trading bots, integration with popular cryptocurrency exchanges is crucial. This ensures that trades can be executed promptly based on the analysis and signals generated by the bot.

How to Make a Binance Trading Bot: A Comprehensive Guide

How to Make a Binance Trading Bot: A Comprehensive Guide is an excellent resource for users looking to harness the power of one of the largest cryptocurrency exchanges in the world. It elucidates the steps and considerations involved in creating a trading bot tailored specifically for the Binance platform, focusing on key functionalities and integrations that can enhance trading outcomes.

The Impact of Bot Crypto Coin on the Market

New cryptocurrencies have emerged synchronously with the rise of automated trading technologies. Bot Crypto Coin is one such example that deserves attention.

The Rise of Bot Crypto Coin: A Game Changer in the Cryptocurrency Landscape

The Rise of Bot Crypto Coin: A Game Changer in the Cryptocurrency Landscape discusses how this new asset aims to integrate seamlessly with automated trading platforms, enhancing its utility for traders. By combining the functionality of trading bots with a digital asset, it is positioned to become a cornerstone in the ecosystem of automated trading.

Conclusion

As we navigate through 2024, the landscape of cryptocurrency trading continues to evolve at an unprecedented pace. The rise of trading bots has redefined how individuals approach trading, providing innovative solutions to capitalize on market opportunities. Given the complexity and potential profitability of these automated systems, it is essential for traders to remain informed, adapt to changes, and continually enhance their understanding of the tools available at their disposal.

It is my opinion that while trading bots present remarkable opportunities, the key to success lies in the trader's ability to develop sound strategies and continuously monitor and adjust them based on market conditions.