The Evolution of Crypto Traders in 2024: A Human Perspective

The world of cryptocurrency trading has evolved significantly in recent years, with the rise of advanced technology and automation playing a major role in shaping the landscape. As we look ahead to 2024, it is clear that the role of crypto trading bots will continue to grow in importance, providing traders with new opportunities and challenges.

The Rise of Crypto Trading Bots

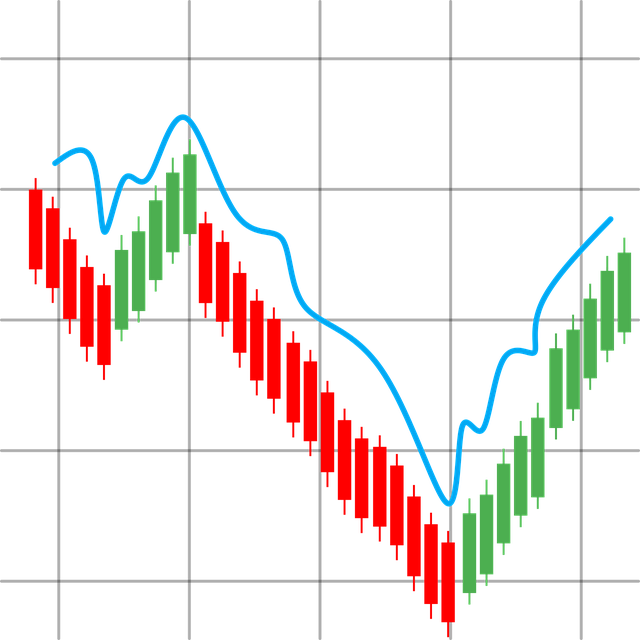

Crypto trading bots have become an essential tool for many traders, offering the ability to execute trades automatically based on pre-defined parameters. These bots can analyze market data at speeds far beyond human capability, allowing for quick decision-making and potentially higher profits. In 2024, we expect to see even more advanced bots entering the market, offering a wider range of features and customization options.

As a human trader, it is essential to understand how these bots work and how to use them effectively. While automation can be a powerful tool, it is important to remember that bots are only as good as the strategies they are programmed to follow. It is crucial to constantly monitor and adjust the settings of your bot to ensure it is performing optimally.

The Role of Emotions in Trading

One of the key advantages of using a trading bot is the removal of emotions from the trading process. Emotions such as fear and greed can often cloud our judgment and lead to poor decision-making. By using a bot, traders can eliminate these emotional factors and stick to a disciplined trading plan.

However, it is important to remember that while bots can remove emotions from the equation, they are not infallible. It is still crucial for traders to conduct thorough research and analysis before deploying a bot, to ensure that the strategies being used are sound and based on reliable data.

The Importance of Risk Management

Risk management is another crucial aspect of successful crypto trading, whether using a bot or trading manually. In 2024, it will be more important than ever for traders to have a solid risk management plan in place, to protect their capital and minimize potential losses.

When using a bot, it is important to set clear stop-loss and take-profit levels, to ensure that trades are automatically closed at the right time. Additionally, diversifying your portfolio and avoiding over-leveraging can help to spread risk and protect against catastrophic losses.

The Future of Crypto Trading

As we look ahead to 2024, the crypto trading landscape will continue to evolve, with new technologies and trends shaping the market. While the rise of trading bots presents new opportunities for traders, it is important to approach this technology with caution and a thorough understanding of its limitations.

By staying informed, conducting thorough research, and practicing sound risk management, traders can navigate the ever-changing world of crypto trading with confidence and success.