The Best Trading Bots for Binance in 2025

Author: Jameson Richman Expert

Published On: 2025-05-21

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

In the fast-evolving world of cryptocurrency, finding the right trading bot can significantly enhance your trading experience. As an avid trader myself, I've gone through numerous ups and downs trying to find the perfect solution. My journey was filled with failed attempts, learning experiences, and eventually finding success. This article serves as a comprehensive guide to understanding the best trading bots for Binance in 2025, focusing on Binance free trading bots, Telegram Binance bots, Python Binance bots, and Binance copy trading bots. You'll discover not only the technical aspects but also my personal experiences with these tools and how they can aid you in navigating the crypto market.

When I first entered the crypto trading scene, I was overwhelmed by the plethora of options available. I experimented with various trading strategies and tools, only to find myself struggling. Many trading bots promised quick riches but delivered frustration instead. It wasn't until I dedicated time to understanding how these bots function that I started to see the potential they held.

Understanding Trading Bots

Trading bots are automated software programs that buy and sell assets on behalf of traders. They utilize algorithms and predefined criteria to execute trades, allowing users to capitalize on market fluctuations without constant monitoring. My initial attempts at using trading bots were fraught with errors. I often selected bots based on flashy advertisements rather than thorough research. This approach led to disappointing results.

One of the key lessons I learned was the importance of choosing a bot that aligns with your trading strategy. For instance, if you're a day trader, a bot that executes rapid trades based on technical indicators is essential. Conversely, long-term investors might benefit more from bots designed for holding and reinvesting assets over time. By aligning the bot's capabilities with your personal trading style, you're more likely to achieve success.

Types of Binance Trading Bots

In 2025, the landscape of trading bots has expanded, with various types catering to different trading needs:

1. Binance Free Trading Bots

Free trading bots can be a great starting point for beginners. I initially tried a few free options, and while they were limited in features, they provided a solid foundation for understanding automated trading. These bots generally come with fewer customization options and may not have the advanced analytics that premium bots offer. However, they are excellent for those looking to dip their toes into automated trading without financial commitment. Some popular free options include Cryptohopper and 3Commas.

2. Telegram Binance Bots

Telegram trading bots offer a unique way to execute trades via messaging platforms. I found this approach particularly convenient as it allowed me to receive alerts and execute trades directly from my phone. These bots can pull in signals from various sources and execute trades on Binance with just a few clicks. However, it’s important to choose a reputable Telegram bot, as scams are prevalent in the crypto space. Popular Telegram bots include Binance Signal and Trading Signals Bot.

3. Python Binance Bots

For those with programming knowledge, Python Binance bots offer unparalleled flexibility. I dabbled with coding my own bot, which was both challenging and rewarding. The ability to customize strategies and backtest them against historical data was invaluable. However, I also realized that not everyone has the technical skills to create a bot from scratch. In such cases, utilizing open-source Python bots available online can save time and effort while still providing significant customization options. Some notable resources include Python-Binance and Binance Trading Bot.

4. Binance Copy Trading Bots

Copy trading bots have gained popularity for their ability to mimic the trades of successful traders. I experimented with this approach and was amazed at how quickly I could replicate profitable strategies. These bots often come with a subscription fee, but the investment can pay off if you choose to follow a consistently successful trader. It's crucial to perform due diligence on the trader you're copying to ensure their strategies align with your risk tolerance. Platforms like eToro and Zignaly facilitate this type of trading.

Choosing the Right Trading Bot

Selecting the right trading bot requires careful consideration. During my journey, I encountered numerous factors that influenced my choices:

- Reputation: Always research the bot's credibility. Read user reviews and check for any red flags. Websites like Trustpilot can be helpful.

- Features: Identify the specific features that are essential for your trading strategy, such as backtesting, signal integration, and risk management tools.

- Cost: Consider whether you’re willing to pay for a bot. Free bots may be limited, but they can still offer valuable insights. Weigh the cost against potential returns.

- Support: Look for bots that offer robust customer support in case you encounter issues. A responsive support team can save you from potentially costly mistakes.

I made the mistake of ignoring user feedback on a couple of bots, which led to losses that could have been avoided. Always take the time to evaluate other users' experiences before making a decision.

Getting Started with Binance Trading Bots

To get started with trading bots on Binance, you'll first need to create an account. You can sign up using this link: Binance Registration. Once you've set up your account, you can explore the various trading bots available. For instance, you might consider using a platform like MEXC, which offers several automated trading solutions.

Another great option is Bitget, known for its user-friendly interface and effective copy trading features. Lastly, Bybit also offers excellent trading capabilities with an array of tools for traders of all levels.

Strategies for Successful Trading

Having a robust trading strategy is essential for success. Through trial and error, I've learned several strategies that work well with trading bots:

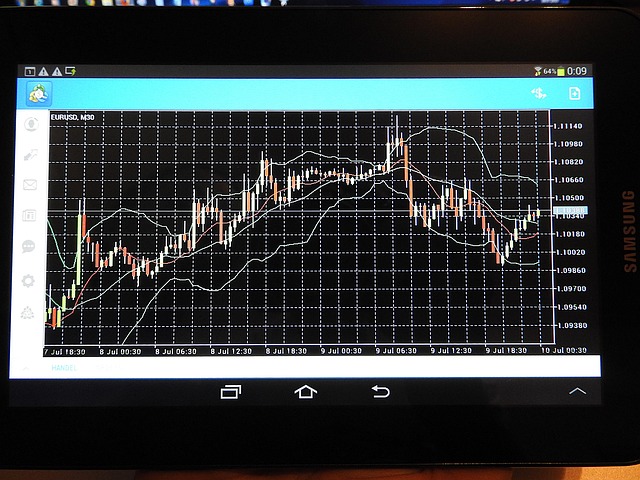

- Trend Following: This strategy involves identifying upward or downward trends and trading accordingly. Utilizing indicators like moving averages can help identify these trends. I found that combining trend-following with volume analysis often leads to more profitable trades.

- Mean Reversion: This strategy bets on the price returning to its average after significant fluctuations. It's important to understand market cycles to effectively implement this strategy, especially in volatile markets. Using Bollinger Bands and Relative Strength Index (RSI) can help identify overbought or oversold conditions.

- Arbitrage: Taking advantage of price differences between different exchanges can lead to quick profits. This requires quick execution and low transaction costs to be effective. I recommend using bots that can monitor multiple exchanges simultaneously to capitalize on these opportunities.

Each of these strategies has its pros and cons, and it’s important to test them using a demo account or with small amounts before fully committing. During my experimentation, I often faced setbacks, but each failure taught me valuable lessons.

Risk Management

Understanding risk management is crucial in trading. I learned the hard way that even the best strategies can lead to losses without proper risk management. Key aspects to consider include:

- Setting Stop-Loss Orders: This ensures that you limit potential losses on trades. Adjusting your stop-loss as your position becomes profitable can help lock in gains. I found that using trailing stop-loss orders can provide additional protection against market reversals.

- Diversification: Don’t put all your funds into one asset. Spread your investments across different coins and trading pairs to mitigate risk. This not only protects your capital but can also enhance your overall returns.

- Position Sizing: Only risk a small percentage of your total capital on any single trade. Many traders recommend risking no more than 1-2% of your total portfolio on a single trade. This approach can help you withstand a series of losses without depleting your capital.

By implementing these risk management strategies, I was able to significantly reduce my losses and protect my trading capital. Regularly reviewing your portfolio and adjusting your strategies based on market conditions is also critical for long-term success.

Final Thoughts

The world of cryptocurrency trading is filled with opportunities and challenges. My experiences with various trading bots have taught me that success doesn't come overnight. It requires patience, research, and a willingness to learn from failures. As you explore the different options available for Binance trading bots in 2025, remember to choose a bot that aligns with your trading goals and risk tolerance.

For more information on choosing the best crypto exchange, check out this guide. If you're interested in unlocking the secrets of crypto wallets, visit this article. Lastly, to understand more about crypto coins, click on this resource.

With the right trading bot and strategies, you can navigate the exciting world of cryptocurrency trading. Embrace the journey, learn from your mistakes, and always be ready to adapt to the ever-changing market.

FAQs About Binance Trading Bots

As a trader, you may have some common questions regarding Binance trading bots. Here are a few frequently asked questions that might help clarify any doubts:

1. Are trading bots safe to use?

While many trading bots are legitimate, it's crucial to do thorough research before using any bot. Look for bots with positive user reviews, solid security measures, and transparent operating practices. Remember that using a bot does not eliminate trading risks; it merely automates the process.

2. Can I use multiple trading bots simultaneously?

Yes, many traders choose to use multiple trading bots to diversify their strategies and manage risks better. However, ensure that the bots do not overlap in strategies to avoid unintentional losses.

3. How can I monitor my trading bot's performance?

Most trading platforms offer dashboards that allow you to track the performance of your trading bots in real-time. Regularly reviewing the analytics and metrics provided will help you make informed decisions about your trading strategies.

4. What is the average cost of premium trading bots?

The cost of premium trading bots can vary widely, ranging from $10 to several hundred dollars per month, depending on the features and services offered. It's essential to weigh the potential returns against the costs before making a commitment.

5. Can trading bots guarantee profits?

No, trading bots cannot guarantee profits. They operate based on algorithms and market data, and while they can enhance trading efficiency, market conditions can still lead to losses. It’s essential to continuously monitor performance and adjust strategies accordingly.

Understanding these aspects will empower you to make informed decisions and utilize trading bots to their full potential.