The Allure of Free Binance Trading Bots: A Comprehensive Exploration

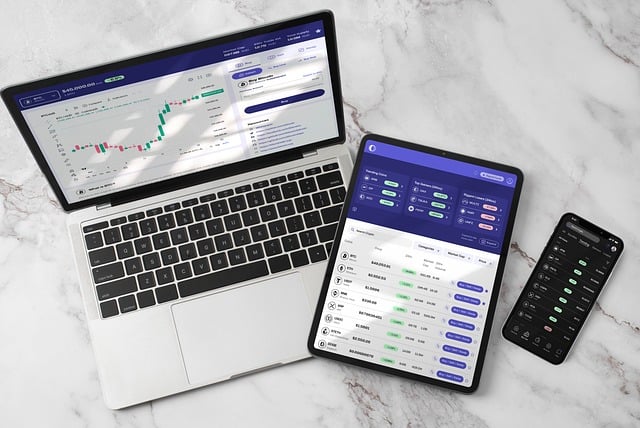

In the fast-paced world of cryptocurrency trading, individuals and institutions alike are constantly seeking strategies to optimize their trading performance. One such strategy gaining traction is the utilization of trading bots—automated software designed to execute trades on behalf of investors. Among the myriad of trading platforms available, Binance stands out as a leader, which raises the question: Are there effective free trading bots for Binance? This article explores the ins and outs of Binance trading bots, particularly focusing on their availability, efficacy, and the broader implications for both novice and seasoned traders.

What are Trading Bots?

Trading bots are sophisticated algorithms that employ various strategies to facilitate the buying and selling of cryptocurrencies. These bots operate on existing market data and execute trades at speeds and frequencies that far exceed human capabilities. The fundamental allure of trading bots, particularly for cryptocurrencies, lies in their ability to manage trades around the clock without the emotional influences that can often cloud human judgment.

How Do Binance Trading Bots Work?

At its core, a Binance trading bot utilizes the Binance API (Application Programming Interface) to interface with the platform and access market data. Traders can configure these bots to carry out specific trading strategies, such as:

By setting parameters such as entry and exit points, the bots ensure that trades are executed efficiently without the need for continuous human oversight.

The Appeal of Free Binance Trading Bots

While there are numerous trading bots available—ranging from paid subscriptions with advanced features to entirely free options—many traders are naturally drawn to free offerings. **In my opinion, however, one must exercise caution when utilizing free trading bots, as their effectiveness can vary significantly**.

Limitations of Free Trading Bots

Free trading bots often come with several limitations:

Thus, while they can be a good introduction for beginners, free bots might not be suitable for serious traders aiming for long-term profitability. **It’s essential to conduct thorough research and consider investing in reputable solutions for more robust trading strategies**.

Exploring the Efficacy of Trading Bots for Cryptocurrency: A Deep Dive

The exploration of trading bots ties closely with an article titled "Exploring the Efficacy of Trading Bots for Cryptocurrency: A Deep Dive." This article delves into the performance metrics of various trading bots, offering insights into how automated trading systems compare to traditional manual trading approaches.

**I believe that understanding these metrics is crucial for anyone navigating the crypto space. After all, knowledge is power, and making informed decisions can significantly improve trading outcomes.**

Balancing Automation and Human Insight

One key takeaway from the article is the importance of balancing automation with human insight. While bots excel at executing trades based on pre-defined algorithms, they lack the nuanced understanding that a human trader can offer, especially during volatile market conditions.

Adoption of Binance Trading Bots: Trends and Insights

The New Frontier: DeFi and Trading Bots

As the decentralized finance (DeFi) ecosystem continues to evolve, traders are exploring innovative platforms that integrate trading bots with DeFi protocols. A notable mention is the piece titled "Trader Joe's Crypto: A Deep Dive into the New Frontier of DeFi." This article investigates the intersection of DeFi platforms and automated trading, providing an intriguing perspective on how these technologies could reshape trading paradigms.

**As someone intrigued by the possibilities of DeFi, I find the merging of traditional trading techniques with decentralized solutions to be a forward-thinking approach that could democratize access to sophisticated trading strategies**.

The Benefit of Human Traders

Another critical consideration discussed in the DeFi piece is the growing trend of hiring dedicated crypto traders. The article "The Emerging Trend: Hiring a Crypto Trader in 2023" elaborates on how the increasing complexity of cryptocurrency markets and trading strategies has led many investors to seek out professionals who can navigate these challenges.

In my view, employing a skilled trader can complement the use of trading bots, allowing for a more holistic trading strategy that leverages both automation and expert analysis.

Technological Revolution: The Role of AI

AI-Driven Trading Bots

As technology continues to evolve, the role of artificial intelligence in trading is becoming increasingly significant. The article "Best AI Crypto Trading Bots: A Comprehensive Guide" offers a detailed overview of how artificial intelligence is influencing trading bots and improving their performance metrics.

**AI presents unprecedented opportunities in trading by analyzing vast datasets and identifying complex patterns that human traders might overlook. I firmly believe that the integration of AI will transform the landscape of cryptocurrency trading in the years to come**.

Navigating Through Signal Platforms

Another significant aspect of trading bot efficacy is the effectiveness of signal platforms. In this context, the piece "Cryptosignal: Navigating the Future of Digital Trading" explores how signal providers can enhance bot trading effectiveness by offering timely data orchestration, which can be incredibly valuable for traders relying on automated systems.

The insights shared in this article indicate that both trading bots and signal providers can work synergistically to improve trading outcomes. **Leveraging both resources can provide traders with an edge in the crowded and competitive crypto market**.

Conclusion: The Future of Trading Bots in Cryptocurrency

In summary, the world of cryptocurrency trading bots, particularly those available on platforms like Binance, offers a compelling avenue for optimizing trading strategies. **While free trading bots might provide an entry point, they should ideally be part of a more comprehensive trading framework that acknowledges the limitations and risks involved**.

As the market continues to evolve, traders must embrace a multifaceted approach that marries algorithmic trading with human insight and advanced technological implementations, such as AI. The articles highlighted throughout this discussion pave the way for deeper insights and trends, allowing traders to make more informed decisions as they navigate this dynamic market.

To really make the most out of cryptocurrency trading, staying informed through articles such as "The Three Commas: A New Era in Cryptocurrency Trading" becomes essential. As the landscape of trading bots and cryptocurrency evolves, so must the strategies we employ.

In conclusion, while the influx of trading bots offers unparalleled advantages in executing trades, a balanced approach that includes human oversight and cutting-edge technologies will likely yield the best results in the intriguing world of cryptocurrency trading.