Navigating the Cryptocurrency Trading Platform Landscape

Author: Jameson Richman Expert

Published On: 2024-10-25

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Cryptocurrency trading has witnessed a meteoric rise in popularity over the past few years, drawing both seasoned investors and novice traders into the intricate world of digital currencies. As this trend continues to evolve, a myriad of cryptocurrency trading platforms has emerged, each vying for the attention of users with promises of convenience, security, and lucrative opportunities. This article aims to explore the various aspects of cryptocurrency trading platforms, offering insight into their functionality, key features, and the tools available to traders. Ultimately, our goal is to empower users to make informed decisions in an ever-changing market.

Understanding Cryptocurrency Trading Platforms

At its core, a cryptocurrency trading platform allows users to buy, sell, and exchange various cryptocurrencies. These platforms can be broadly categorized into two main types: centralized exchanges and decentralized exchanges. Each type has its unique benefits and drawbacks, making it essential to understand how they function.

Centralized Exchanges

Centralized exchanges (CEX) are platforms that act as intermediaries between buyers and sellers. Users create accounts on these platforms, depositing their funds to facilitate trading activities. Some notable centralized exchanges include Binance, Coinbase, and Kraken.

- Pros: Centralized exchanges tend to offer a user-friendly interface, high liquidity, and a variety of trading pairs.

- Cons: Users must trust these platforms with their funds, which makes them vulnerable to hacks or regulatory pressures.

Decentralized Exchanges

Decentralized exchanges (DEX) allow users to trade cryptocurrencies directly with one another without the need for an intermediary. This model operates on blockchain technology, promoting greater transparency and security. Popular DEX platforms include Uniswap, SushiSwap, and PancakeSwap.

- Pros: Users retain control over their funds and can trade anonymously.

- Cons: DEX platforms typically feature lower liquidity and less user-friendly interfaces.

Key Features of Cryptocurrency Trading Platforms

When selecting a cryptocurrency trading platform, several key features should be considered to ensure it meets the needs of the user.

Security Measures

Security is paramount when it comes to cryptocurrency trading. Users must ensure that their chosen platform implements robust security measures such as two-factor authentication (2FA), cold storage for funds, and rigorous KYC (Know Your Customer) protocols. Platforms that prioritize security tend to gain the trust of their user base and foster a safer trading environment.

User Interface and Experience

A user-friendly interface is essential, especially for those new to cryptocurrency trading. Platforms should provide intuitive navigation, comprehensive tutorials, and responsive customer support to assist users in their trading journeys. A well-designed platform can significantly enhance the overall trading experience.

Trading Tools and Features

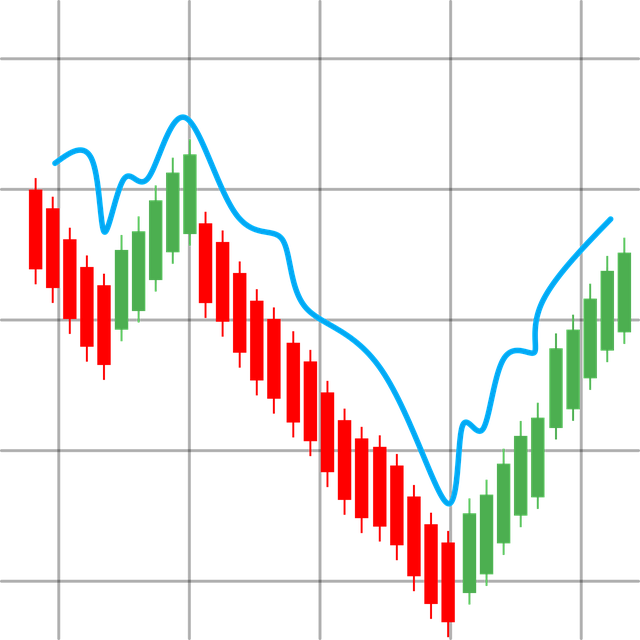

Advanced trading tools such as charts, indicators, and order types can give traders a competitive edge. Features like margin trading, futures trading, and trading bots can also be valuable, especially for more experienced traders. Automated trading solutions, in particular, can help reduce emotional decision-making by executing trades based on algorithms.

Exploring Trading Bots

The emergence of trading bots has transformed the landscape of cryptocurrency trading. These automated systems execute trades based on predetermined strategies and algorithms, providing an edge in the highly volatile cryptocurrency market.

The Best AI for Trading Cryptocurrency

For those interested in leveraging artificial intelligence in their trading strategies, The Best AI for Trading Cryptocurrency: A Comprehensive Guide serves as an invaluable resource. This guide explores various AI models and their application in predicting market trends, enhancing decision-making, and optimizing trading strategies. With the fast-paced nature of crypto markets, utilizing AI technology can help traders gain a significant competitive advantage.

Understanding Arbitrage Crypto Bots

Another innovative approach for crypto traders is through the use of arbitrage bots. These bots exploit price discrepancies across different trading platforms to secure profitable trades. For a deeper understanding of how these bots function, check out Understanding Arbitrage Crypto Bots: A Comprehensive Guide.

The guide delves into the mechanics of arbitrage trading, the type of market inefficiencies these bots capitalize on, and tips for selecting a reliable arbitrage bot. With the right approach, traders can potentially profit from the swift price changes that characterize the cryptocurrency market.

The Best Crypto Trading Bots

If you're looking to explore automated trading further, be sure to read The Best Crypto Trading Bots: Your Essential Guide to Automated Trading. This essential guide evaluates various crypto trading bots based on functionality, ease of use, and relevant features.

The article offers insights into top-performing trading bots and how they can cater to different trading styles, whether day trading, swing trading, or long-term investing. Automated trading has become more prevalent and can significantly enhance traders' overall efficiency.

The Arrival of Crypto AI Bots on Coinbase

In a groundbreaking development, cryptocurrency exchange platform Coinbase has announced the integration of AI trading bots. This move is explored in the article titled The Arrival of Crypto AI Bots on Coinbase: A Revolutionary Step in 2024.

The introduction of AI bots to a platform as robust as Coinbase signifies a shift toward more advanced trading options. These AI bots are designed to enhance user trading experiences, offering real-time analysis, predictive modeling, and automated execution of trades. For those who are serious about cryptocurrency trading, the integration of AI in such platforms could define the future of trading dynamics.

Choosing the Right Trading Platform for You

Given the multitude of options available in the cryptocurrency trading landscape, selecting the right platform requires careful consideration of several factors:

Your Trading Goals

Identify your primary trading objectives. Are you a long-term investor looking to buy and hold or a day trader aiming to capitalize on short-term price movements? Understanding your goals will help you choose a platform that aligns with your trading style.

Volume and Liquidity

Choose a platform that offers sufficient liquidity for the cryptocurrencies you wish to trade. High trading volumes typically equate to better price stability and reduced slippage, making it easier to execute trades at desired prices.

Costs and Fees

Different platforms have varying fee structures, including trading fees, withdrawal fees, and deposit fees. Be sure to evaluate these costs as they can eat into your profits over time.

Conclusion

As the world of cryptocurrency trading continues to innovate and expand, identifying the right trading platform becomes increasingly critical. By understanding the different types of exchanges, evaluating key features, and exploring the potential of automated trading tools, traders can position themselves for success. Implementing advanced technologies such as AI and trading bots can offer an edge in navigating the complexities of the cryptocurrency market.

With the proper knowledge and tools, you can embark on your cryptocurrency trading journey with confidence, prepared to seize the opportunities that arise in this dynamic market.

As a final note, I'd like to emphasize that while cryptocurrency trading has immense potential rewards, it bears significant risks. Users should conduct thorough research and consider their risk tolerance before engaging in trading activities.