Mastering Crypto Trading Bots: A Comprehensive Guide

Author: Jameson Richman Expert

Published On: 2025-01-26

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

As the world of cryptocurrency trading continues to expand, trading bots have emerged as vital tools for both novice and experienced traders alike. These automated programs can execute trades on behalf of users, analyzing market trends, and responding to price movements 24/7. In this article, we’ll dive deep into how you can leverage a crypto trading bot, why you should consider using one, and how to get started—even if you’re a beginner.

What are Crypto Trading Bots?

Crypto trading bots are software applications that use algorithms to automate trading strategies in the cryptocurrency market. These bots can manage trades based on predetermined criteria, eliminating the need for manual trading. They can execute buys and sells in fractions of a second, providing an edge that can be hard to achieve manually.

Why Use a Crypto Trading Bot?

There are several reasons why traders choose to utilize bots in their trading strategies:

- 24/7 Availability: The cryptocurrency market operates around the clock. Bots do not need to sleep or take breaks, ensuring opportunities for trading are always met.

- Emotionless Trading: Bots adhere strictly to business logic, which means emotional decisions—such as panic selling or exuberant buying—are completely eliminated.

- Backtesting Capabilities: Many trading bots allow users to backtest their strategies against historical data, optimizing performance before real capital is at risk.

- Diverse Strategies: Users can implement multiple trading strategies simultaneously, diversifying their approach and reducing the risk associated with any single investment.

How to Choose the Right Crypto Trading Bot

When selecting a crypto trading bot, you’ll want to consider several key factors:

- Security: Ensure the bot incorporates top-notch security measures to protect your funds and personal data.

- User Reviews: Look for feedback from other users to gauge the reliability and effectiveness of the bot.

- Supported Exchanges: Make sure the bot supports the exchanges you plan to trade on, such as Binance, Coinbase, or Kraken.

- Customization Options: The ability to customize trading strategies is crucial for adapting to changing market conditions.

- Pricing: Consider the cost of using the bot and whether its features justify the expense.

Popular Crypto Trading Bots

Here are a few popular crypto trading bots that you might want to explore:

- 3Commas: A user-friendly platform offering features like trailing stops, take profit, and bots for various strategies.

- Cryptohopper: A versatile bot that offers a wide range of indicators and templates, suitable for both beginners and advanced traders.

- HaasOnline: This bot is known for its advanced technical analysis tools, including a backtesting engine and a range of trading strategies.

- Binance Trading Bot: Directly integrated with the Binance exchange, this option allows users to automate their trades efficiently. To start trading, click here.

Creating Your Own Python Crypto Trading Bot

For developers and those with a programming background, creating a custom crypto trading bot using Python can be a rewarding endeavor. Below, we’ll outline the basic steps involved in developing your bot:

Step 1: Set Up Your Python Environment

Install the necessary packages using pip:

pip install ccxt pandas numpy

Step 2: Connect to a Cryptocurrency Exchange

Use the CCXT library to connect to the exchange of your choice:

import ccxt

exchange = ccxt.binance({

'apiKey': 'YOUR_API_KEY',

'secret': 'YOUR_API_SECRET',

})

Step 3: Define Your Trading Strategy

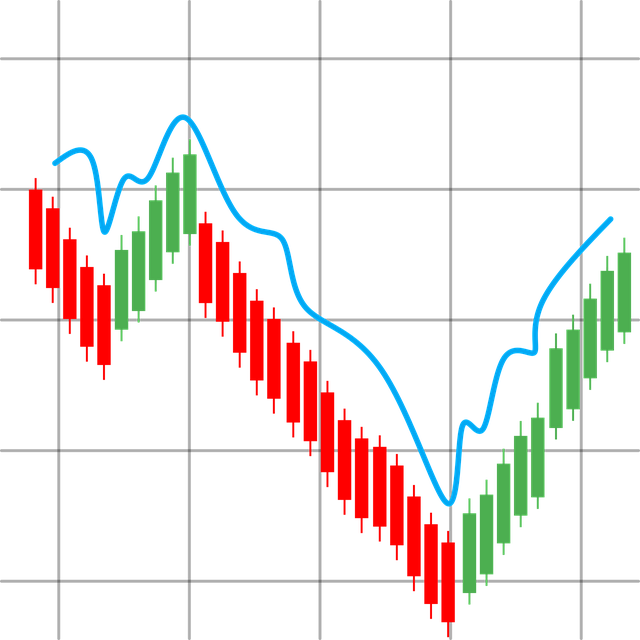

Outline your trading strategy. For example, you might choose to implement a simple moving average (SMA) strategy where the bot buys when the short-term moving average crosses above the long-term moving average and sells when the opposite occurs.

def signal_generator(data):

if data['sma_short'] > data['sma_long']:

return 'buy'

elif data['sma_short'] < data['sma_long']:

return 'sell'

else:

return 'hold'

Step 4: Implement the Trading Logic

Use the trading signals to execute buy and sell orders on the exchange:

if signal == 'buy':

exchange.create_market_order('BTC/USDT', 'buy', amount)

elif signal == 'sell':

exchange.create_market_order('BTC/USDT', 'sell', amount)

Step 5: Backtesting

Before deploying your bot, backtest your strategy using historical data to assess its performance.

Step 6: Deployment

Once satisfied with your bot’s performance, you can deploy it to trade live on the market.

Best Practices for Operating a Crypto Trading Bot

Operating a crypto trading bot comes with its own set of best practices to ensure optimal performance and security:

- Start Small: Begin with a small amount of capital until you become comfortable with the bot's performance.

- Continuous Monitoring: Regularly monitor your bot’s performance and adjust strategies as necessary based on market conditions.

- Stay Updated: Keep up with changes in the cryptocurrency market, as trends can shift rapidly.

- Use Security Measures: Enable two-factor authentication (2FA) and use strong, unique passwords for your trading accounts.

Conclusion

Crypto trading bots represent a powerful means of gaining an edge in the ever-evolving world of cryptocurrency trading. Whether you're a beginner exploring the idea of automating your trades or an experienced trader looking to refine your strategy, a trading bot could be just the tool you need. By following the steps outlined above, anyone can dive into the realm of automated trading with confidence.

If you’re ready to get started or are looking for a robust platform to begin your trading journey, consider signing up on Binance. Click here to create your account today!