Mastering Crypto Signals: A Comprehensive Guide

Author: Jameson Richman Expert

Published On: 2025-04-12

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

Understanding crypto signals is essential for anyone looking to navigate the volatile world of cryptocurrencies successfully. As someone who has spent countless hours delving into the intricacies of crypto trading, I can attest to the importance of reliable signals in making informed investment decisions. Over the years, I’ve experienced both triumphs and setbacks, each shaping my understanding of how to leverage these signals effectively. This article will guide you through everything you need to know about crypto signals, drawing from my personal journey and highlighting resources that can enhance your trading strategies.

What Are Crypto Signals?

Crypto signals are essentially trade ideas or recommendations that suggest the best times to buy or sell a cryptocurrency. These signals are generated based on technical analysis, market trends, and sometimes even news events. As I began my journey in crypto trading, I often found myself overwhelmed by the sheer amount of data available online. It wasn’t until I started to follow specific signals from trusted sources that I began to see consistent results. Signals can be delivered via various channels, including social media, dedicated websites, and trading platforms, making them accessible to traders at different levels. Crypto signals can also vary significantly in terms of their accuracy and reliability, which is why it's crucial to identify and follow reputable sources. Understanding the difference between short-term and long-term signals is also important; while short-term signals may focus on immediate trading opportunities, long-term signals can help you build a more stable portfolio.

The Evolution of Crypto Signals

Originally, crypto signals were primarily shared through forums and social media platforms, where experienced traders would post their insights based on personal analysis. However, as the market matured, many companies began to emerge, offering paid subscription services that promised more sophisticated signals based on advanced algorithms and comprehensive market research. Today, traders can choose from a variety of services that provide real-time signals, complete with detailed analytics and personalized insights, catering to different trading strategies and risk appetites. Furthermore, the use of artificial intelligence (AI) and machine learning algorithms has revolutionized the way signals are generated, allowing for more accurate predictions and tailored suggestions based on individual trading habits. As a result, traders now have access to an unprecedented amount of data that can inform their decision-making processes. Additionally, as more users enter the crypto space, the need for accurate and timely signals has become increasingly crucial, leading to the rise of new tools and technologies designed to enhance trading efficiency.

My Early Days: Trials and Errors

When I first entered the cryptocurrency space, I made a lot of mistakes. I relied on my intuition and random tips from friends, which often led to poor decisions. I remember one instance where I invested heavily in a coin based solely on a social media post. It tanked, and I lost a significant amount of money. It was a tough lesson, but it taught me the value of research and the necessity of using well-founded crypto signals. This experience underscored the importance of a systematic approach to trading, emphasizing the need for due diligence and critical analysis. I learned to develop a disciplined trading routine, which included setting specific criteria for entering and exiting trades based on the signals I followed. These early challenges ultimately became valuable learning experiences that shaped my trading philosophy. I also realized that emotional trading could lead to impulsive decisions, further amplifying the importance of following a structured plan.

Finding Reliable Sources for Crypto Signals

After my initial losses, I started searching for reputable sources that provided crypto signals. This led me to various platforms and exchanges that offer trading signals. Some of the most notable ones include:

- Binance: One of the largest cryptocurrency exchanges in the world, Binance provides a robust trading platform where you can access market signals and analytics. It also features a user-friendly app for trading on the go, making it accessible for both novice and experienced traders. Binance also offers a comprehensive educational section to help new traders grasp the basics, including a dedicated area for understanding crypto signals.

- MEXC: This exchange has a user-friendly interface and offers various tools for crypto trading, including signals that can guide your investments. MEXC's community features allow traders to share insights and strategies, creating an environment of collaboration and learning. The platform also offers a demo trading environment where users can practice without financial risk, making it an excellent choice for beginners looking to hone their skills.

- Bitget: Known for its futures trading, Bitget also provides signals that can help traders maximize their profit potential. Their platform includes risk management tools and analysis resources that are invaluable for navigating volatile markets. Additionally, Bitget hosts various trading competitions, which can enhance trading skills through practical experience and foster a competitive spirit among traders.

- Bybit: This platform is popular for its leverage trading options and offers various signals for traders looking to enter or exit positions effectively. Bybit's educational resources are excellent for beginners, helping them build a solid foundation in crypto trading, including tutorials and strategy guides that explain the significance of each signal provided.

Each of these platforms not only facilitates trading but also provides valuable insights and signals that can make a difference in your trading performance. I found that joining these communities and utilizing their resources significantly improved my trading strategy. Additionally, many of these platforms offer educational resources, webinars, and forums that further enhance your understanding of crypto trading. Engaging with experienced traders and attending workshops can provide insights into advanced trading strategies that might not be readily available through typical online research. Moreover, many of these platforms have dedicated customer support teams that can assist you in understanding how to best utilize the signals they provide.

Types of Crypto Signals

Crypto signals can be categorized into several types, each serving a unique purpose:

- Buy Signals: Indicate a good time to purchase a cryptocurrency based on market analysis, often triggered by technical indicators like bullish patterns or support levels. These signals can help traders capitalize on upward price movements and maximize their gains. The timing and precision of buy signals can greatly influence your profit margins.

- Sell Signals: Suggest when to sell a cryptocurrency to maximize profits and minimize losses, typically indicated by bearish patterns or resistance levels. Understanding when to sell is as crucial as knowing when to buy; both are essential to a successful trading strategy. Sell signals can often be the make-or-break factor in a trader's ability to protect their profits.

- Stop-Loss Signals: Help mitigate losses by suggesting a point at which to sell if the market moves against you. These signals are crucial for risk management in volatile markets, acting as a safety net to protect your investments during downturns. Employing stop-loss signals can drastically improve a trader's risk-reward ratio.

- Take-Profit Signals: Indicate when to sell to secure profits from a favorable trade, ensuring that gains are realized before market volatility can erase them. These signals are vital for locking in profits on successful trades, providing a systematic approach to achieving financial goals. Setting take-profit levels can help avoid the emotional pitfalls of trading.

Understanding these signals and when to act on them is critical. I learned this the hard way when I ignored a stop-loss signal, leading to a substantial loss that could have been avoided. This experience taught me to respect the signals and the analysis behind them, rather than letting emotions dictate my trading decisions. Developing emotional discipline is just as important as understanding market signals; it can often be the differentiating factor between successful and unsuccessful traders. Additionally, recognizing the psychological triggers that can lead to impulsive trading decisions can help maintain a calm and calculated approach.

How to Analyze Crypto Signals

Analyzing crypto signals involves looking at various factors, including market trends, historical data, and indicators like moving averages, relative strength index (RSI), and trading volume. I remember spending hours trying to understand these metrics, and it wasn't until I started applying them in my trades that I began to see significant improvements. Familiarizing yourself with chart patterns and technical indicators can greatly enhance your ability to interpret signals accurately. Moreover, combining different indicators can help confirm signals, reducing the likelihood of false positives. Keeping a trading journal to note the effectiveness of specific signals can also provide valuable insights into your trading performance over time, allowing for continuous refinement of your strategies. Tracking your emotions and decisions in this journal can also help identify patterns that lead to successful trades versus failures.

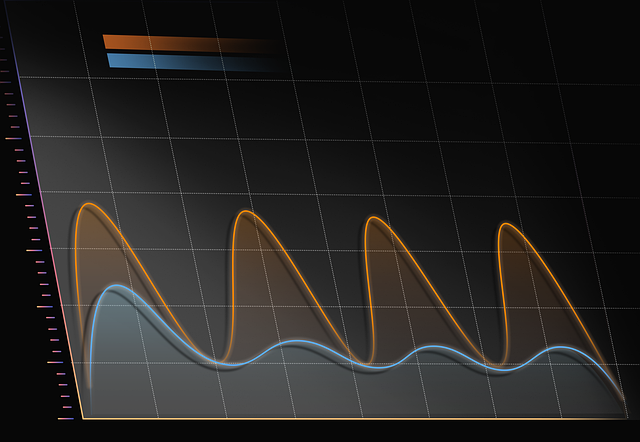

Using Technical Analysis for Better Signals

Technical analysis is a crucial component of trading signals. By studying price movements and trading volumes, traders can make informed decisions. I started using tools like TradingView to track these metrics, which allowed me to visualize trends more clearly. It was a game-changer for my trading approach. Additionally, mastering chart patterns such as head and shoulders, flags, and triangles can provide insights into potential price movements, making your trading decisions more robust. Furthermore, understanding Fibonacci retracement levels can help in identifying potential reversal points in the market, offering a strategic edge. A thorough grasp of candlestick patterns also enhances your ability to interpret market sentiment and anticipate price action. Continuous learning and adaptation to new technical analysis techniques can further bolster your trading skills. Exploring advanced topics like volume profile analysis and order flow can also enhance your understanding of market dynamics.

The Role of Sentiment Analysis

Market sentiment can greatly influence cryptocurrency prices. By gauging the general mood of the market, traders can better anticipate price movements. I often followed news outlets and social media channels to get a sense of what traders were feeling about certain coins. This additional layer of insight often complemented the signals I was receiving. Platforms like Twitter and Reddit can provide real-time updates and discussions, allowing traders to stay in tune with market sentiment. Additionally, tools like the Fear and Greed Index can help quantify market sentiment, offering insights into whether the market is overly optimistic or pessimistic. Participating in sentiment analysis can help you make more nuanced trading decisions, especially during volatile periods where emotions can lead to irrational market behavior. Understanding the psychology of market participants is critical for developing effective trading strategies. Engaging in discussions and debates with other traders can also provide fresh perspectives and insights that enhance your overall analysis.

Combining Signals with Fundamental Analysis

While signals are essential, they should not be the sole basis for trading decisions. I learned that combining signals with fundamental analysis—examining the underlying value of a cryptocurrency, its use case, the team behind it, and market demand—provides a more holistic view. This approach has helped me identify undervalued assets that I might have overlooked otherwise. Understanding the fundamentals of a cryptocurrency can give context to the signals you are following and help you make more informed decisions. Furthermore, keeping an eye on regulatory news and technological advancements in the crypto space can offer insights into long-term potential and risks. Analyzing the competition within the cryptocurrency space is also important, as it helps gauge the position of a particular asset within the market landscape. Fundamental analysis can often provide insights that technical analysis alone may not reveal, making it an invaluable part of your trading toolkit. Additionally, understanding macroeconomic factors, such as inflation rates and global economic trends, can also impact the performance of cryptocurrencies.

Developing Your Own Crypto Signal Strategy

As I gained more experience, I began to develop my own strategy for using crypto signals. I started by setting clear goals, such as defining my risk tolerance and understanding my investment horizon. I also kept a trading journal where I documented my trades, the signals I followed, and the outcomes. This practice helped me refine my strategy over time. Additionally, backtesting your strategy against historical data can help identify strengths and weaknesses, allowing for continuous improvement. Establishing clear entry and exit rules based on signals will also enhance discipline and consistency in your trading approach. Creating a checklist to evaluate potential trades against your established criteria can streamline your decision-making process and minimize emotional trading. This structured approach is vital for long-term success in the dynamic world of cryptocurrency trading. Periodically reviewing and adjusting your strategy based on performance metrics and market changes can also ensure ongoing relevance and effectiveness.

The Importance of Community and Mentorship

Another lesson I learned was the value of community and mentorship. Joining online forums and groups where traders share insights and signals has been incredibly beneficial. I found mentors who guided me and offered valuable advice, which was instrumental in my growth as a trader. Platforms like Telegram and Discord host active communities that can be a goldmine for aspiring traders. Engaging with experienced traders can provide invaluable lessons and diverse perspectives that enhance your trading journey. Additionally, participating in webinars and live trading sessions can offer practical insights that are difficult to gain from reading alone. Being part of a trading community can also help keep you motivated and accountable to your trading goals, providing a support network during both successes and failures. Building relationships with other traders can also facilitate knowledge-sharing and collaboration, further enriching your trading experience. Consider finding a mentor who resonates with your trading style and values, as personalized guidance can significantly accelerate your learning curve.

Staying Updated with Market Trends

The cryptocurrency market is constantly evolving. Staying updated with the latest trends is vital. I make it a point to follow reputable news sites and subscribe to newsletters that offer insights into market dynamics. This not only helps me anticipate potential market shifts but also informs the signals I choose to follow. Utilizing tools like Google Alerts and following influential figures in the crypto space on social media can also help you stay informed about relevant developments. Moreover, utilizing market analysis reports and podcasts can provide a well-rounded understanding of ongoing trends and expert opinions in the industry. Regularly reviewing market performance indicators and economic events can further inform your trading strategies, allowing for timely adjustments to your approach. Engaging with various analytical tools and software can also help streamline the process of staying updated and making data-driven decisions.

Conclusion: Your Path to Success with Crypto Signals

Mastering crypto signals requires patience, continuous learning, and a willingness to adapt. Through my journey filled with ups and downs, I have come to appreciate the importance of utilizing well-researched signals and developing a comprehensive trading strategy. I encourage you to explore the platforms mentioned earlier, engage with trading communities, and continually educate yourself. Remember, every trader's journey is unique, but with the right tools, mindset, and a disciplined approach, success in crypto trading is achievable. As you embark on this journey, maintain a learner's mindset and be prepared to adjust your strategies as the market evolves. Always remember, the crypto market is highly speculative, and risk management should be at the forefront of your trading strategy. By staying informed, adaptable, and committed to continuous improvement, you can navigate the complexities of crypto trading with greater confidence. Embrace the learning process, and don’t hesitate to revisit your strategies as new information and experiences come to light.

Appendix: Additional Resources

To further enhance your understanding of crypto signals and trading strategies, consider exploring the following resources:

- Books: Titles such as "Technical Analysis of the Financial Markets" by John J. Murphy and "The Intelligent Investor" by Benjamin Graham provide foundational knowledge essential for any trader. Additionally, "Mastering Bitcoin" by Andreas M. Antonopoulos offers insights into the technical aspects of Bitcoin that can be beneficial for traders. Other recommended reads include "The Little Book of Common Sense Investing" by John C. Bogle, which provides timeless investment principles.

- Online Courses: Websites like Coursera, Udemy, and Khan Academy offer courses on cryptocurrency trading, technical analysis, and market psychology that can deepen your expertise. Consider specialized courses focused on algorithmic trading or market psychology to gain a competitive edge. Platforms like Investopedia also offer free resources that can complement your learning.

- YouTube Channels: Channels like DataDash and Coin Bureau provide valuable insights into market trends, trading strategies, and the latest news in the crypto space. Following technical analysts and market experts can help you gain diverse perspectives on trading. Additionally, channels that focus on live trading sessions can offer real-time insights into market behavior.

- Podcasts: Listening to podcasts such as "Unchained" and "The Pomp Podcast" can keep you informed about industry developments and expert opinions. Engaging with various podcast formats, including interviews and roundtable discussions, can broaden your understanding of the crypto ecosystem. Exploring niche podcasts focused on specific cryptocurrencies or trading strategies can also enhance your knowledge.

By utilizing these additional resources, you can expand your knowledge base, refine your trading strategies, and ultimately improve your performance in the cryptocurrency market. Continuous education and networking with other traders will keep you ahead of the curve in this rapidly changing industry. Remember that the journey of a trader is ongoing, and the most successful traders are those who remain curious and adaptable.