Investing Bots: The Future of Auto Crypto Trading

Author: Jameson Richman Expert

Published On: 2024-12-07

Prepared by Jameson Richman and our team of experts with over a decade of experience in cryptocurrency and digital asset analysis. Learn more about us.

In the world of cryptocurrency, time is money, and technology is evolving faster than ever. Enter investing bots, the innovative software tools designed to automate the trading processes. This article will explore the ins and outs of investing bots, their benefits, challenges, and how they fit into the rapidly changing landscape of auto crypto trading.

What are Investing Bots?

Investing bots are automated software programs that perform trades on behalf of users. By utilizing algorithms and predefined trading strategies, these bots analyze market conditions and execute buy or sell orders without human intervention. They can operate 24/7, taking advantage of the volatile crypto market’s round-the-clock fluctuations.

How Do Investing Bots Work?

At their core, investing bots rely on various algorithms and trading strategies. The process generally involves:

- Market Analysis: Bots gather and analyze real-time data from multiple exchanges to identify trends and trading opportunities.

- Trade Execution: Once a potential opportunity is identified, the bot executes trades quickly and efficiently, often much faster than a human trader.

- Risk Management: Many bots come with risk management tools like stop-loss settings to limit potential losses during a downturn.

Types of Investing Bots

Investing bots come in various forms, each designed with specific purposes in mind. Some of the most common types include:

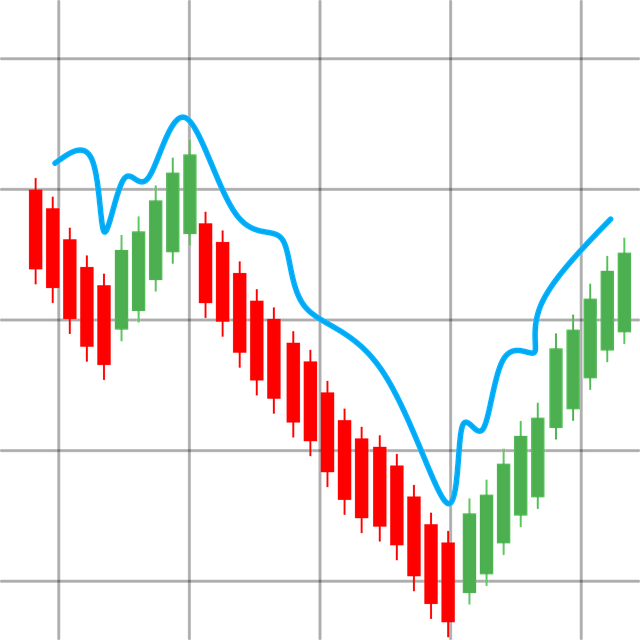

1. Trend Following Bots

These bots identify and capitalize on rising or falling market trends. They usually generate signals based on moving averages and other indicators.

2. Arbitrage Bots

Arbitrage bots take advantage of price discrepancies between different exchanges. They buy low on one exchange and sell high on another, pocketing the difference.

3. Market Making Bots

Market-making bots provide liquidity to various trading pairs by placing both buy and sell orders. They earn a profit from the spread between buy and sell prices.

4. Portfolio Automation Bots

These bots autonomously manage and rebalance your investment portfolio, ensuring optimal asset allocation based on predetermined criteria.

Benefits of Using Investing Bots

Investing bots offer numerous advantages, including:

1. 24/7 Trading

Unlike human traders, bots can operate continuously, capturing trading opportunities that arise at any hour. This constant vigilance enables traders to capitalize on market volatility, enhancing the potential for profit.

2. Speed and Efficiency

Bots execute trades at lightning speed, often within milliseconds. This rapid execution can be critical in a fast-paced market where prices can change dramatically in moments.

3. Emotionless Trading

One of the significant pitfalls of trading is emotional decision-making. Bots operate based solely on data, removing feelings like fear or greed from the equation. This objectivity can lead to more rational, disciplined trading strategies.

4. Backtesting Capabilities

Investing bots allow traders to test their strategies against historical data. This backtesting can provide insights into how a strategy could perform under varying conditions, helping traders refine their approaches.

Challenges with Investing Bots

Despite the myriad benefits, there are challenges associated with using investing bots:

1. Technical Issues

Bugs, server downtimes, and other technical glitches can hinder performance. Traders are often at the mercy of technology, and technical failures can lead to missed opportunities or losses.

2. Over-Optimization

While backtesting is valuable, over-optimization can lead to strategies that only perform well on historical data but fail in live markets. Traders must strike a balance between fine-tuning their bots and ensuring their strategies remain robust against real-world scenarios.

3. Market Changes

The cryptocurrency landscape is continually evolving, influenced by regulations, technological advancements, and market sentiment. Investing bots may struggle to adapt to sudden changes if their algorithms aren’t updated regularly.

Getting Started with Investing Bots

If you're considering using an investing bot, here are some practical steps to help you get started:

1. Research and Select a Reliable Bot

Choose a bot with positive reviews, a track record of success, and robust security features. Thoroughly investigate user feedback and explore forums for trustworthy recommendations.

2. Define Your Trading Strategy

Before launching any bot, establish your trading preferences and risk tolerance. Define your goals and the type of trades you'd like the bot to execute.

3. Start Small

When you first implement a bot, start with a minimal investment to gauge its performance. This cautious approach allows you to learn how the bot operates without exposing too much capital.

4. Monitor Performance

Regularly check your bot’s performance and make necessary adjustments. Ignoring your bot’s operations can lead to unexpected losses, so ongoing monitoring is crucial.

The Future of Auto Crypto Trading and Investing Bots

The rise of investing bots is just the tip of the iceberg in the world of auto crypto trading. As technology progresses, we can anticipate even more sophisticated algorithms that utilize artificial intelligence and machine learning to enhance trading decisions.

Integration with Decentralized Finance (DeFi)

The evolution of decentralized finance introduces new opportunities for investing bots. By connecting with various DeFi platforms, bots will be able to lend, borrow, and provide liquidity automatically, increasing their utility for traders.

Enhanced User Interfaces

User-friendly interfaces are likely to emerge, making investing bots more accessible to novice traders. The simplification of these technologies will invite a broader audience into the world of automated trading.

Focus on Security

As investing bots grow in popularity, so will concerns regarding security. Developers will need to prioritize security protocols to protect users' assets from hacks and breaches.

Conclusion

Investing bots represent a compelling innovation in the realm of cryptocurrency trading, offering advantages that can enhance profitability and efficiency. However, as with any financial tool, they come with their unique set of challenges. By understanding both the potential and the pitfalls of investing bots, traders can make informed decisions that align with their financial goals.

Ultimately, the most effective use of investing bots lies in their ability to complement the trader's strategy. Harnessing the capabilities of these automated tools while maintaining human oversight may prove to be the best approach for success in the rapidly evolving landscape of crypto trading.